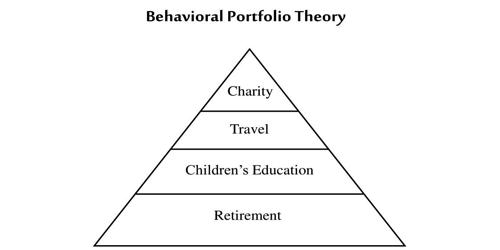

The Behavioral Portfolio Theory (BPT) developed by Shefrin and Statman (2000) is often set against Markowitz’s (1952) Mean-Variance Theory (MVT). Behavioral portfolio theory put forth in 2000 by Shefrin and Statman, provides an alternative to the assumption that the ultimate motivation for investors is the maximization of the value of their portfolios. Even if the asset allocations may coincide, typical MV investors will not usually select the BPT optimal portfolios. It suggests that investors have varied aims and create an investment portfolio that meets a broad range of goals. It does not follow the same principles as the capital asset pricing model, modern portfolio theory, and the arbitrage pricing theory. These results underline that MVT and BPT cannot be used interchangeably. A central feature in behavioral portfolio theory rests on the observation that investors view their portfolios as sets of distinct mental account layers in a portfolio pyramid.

A behavioral portfolio bears a strong resemblance to a pyramid with distinct layers. Each layer has well-defined goals. The base layer is devised in a way that it is meant to prevent financial disaster, whereas, the upper layer is devised to attempt to maximize returns, an attempt to provide a shot at becoming rich. The optimal portfolios of BPT investors are different from those of CAPM investors as well. Modern portfolio theory (MPT) and behavioral finance represent differing schools of thought that attempt to explain investor behavior. The optimal portfolios of CAPM investors combine the market portfolio and the risk-free security. In contrast, the optimal portfolios of BPT investors resemble combinations of bonds and lottery tickets.

BPT is a descriptive theory based on the SP/A theory of Lola Lopes (1987) and closely related to Roy’s safety-first criterion. Lopes developed SP/A theory, a psychological theory of choice under uncertainty. The theory is described as a single account version: BPT-SA, which is very closely related to the SP/A theory. SP/A theory is a general choice framework rather than a theory of portfolio choice. However, SP/A theory can be regarded as an extension of Arzac’s version of the safety-first portfolio model. Behavioral finance instead focuses on correcting for the cognitive and emotional biases that prevent people from acting rationally in the real world.

Behavioral portfolio theory describes portfolios on behavioral-wants frontiers and prescribes them to investors whose wants extend beyond the utilitarian benefits of high expected returns and low risk, to expressive and emotional benefits such as those of demonstrating sincere social responsibility, high social-status, hope for riches, and protection from poverty. In this multiple account version, investors can have fragmented portfolios, just as we observe among investors. They even propose in their initial article a Cobb–Douglas utility function that shows how money is allocated in the two mental accounts.