Bottom-up forecasting is a technique for estimating a company’s future performance by starting with low-level data and moving up to revenue. It is the forecast of a company’s micro-level inputs to achieve sales and profitability for a specific year. Nonetheless, assessment of these miniature factors that prompts the income is hard to figure as it is organization explicit and relies upon different components. This methodology begins with nitty-gritty client or item data and afterward expands up to income.

Budget estimates are commissioned from each division, department, or business unit independently then pooled to arrive at the overall budget amount for the entire organization, as in bottom-up budgeting. Top-down forecasting is the polar opposite of bottom-up forecasting, and it starts with broad assumptions like Total Addressable Market (TAM) and market share before working “down” to revenue. Bottom-up forecasting, for example, starts with a particular product or customer data set and works its way up to company-wide revenue.

Economists, econometricians, management scientists, financial analysts, budget analysts, securities analysts, chief financial officers (CFOs), and controllers, among others, may utilize bottom-up techniques. It is the forecasting of micro-level inputs in order to get at an accurate revenue estimate for a particular year or group of years. For instance, a monetary expert might start making a 5-year deals estimate layout by laying out the entirety of the orders that are relied upon to be put for every one of the association’s business channels. This is a standard method to start a base up the investigation; nonetheless, granular perspective administration can begin further down with something like publicizing change rates, or even the exhibition of a solitary group or worker.

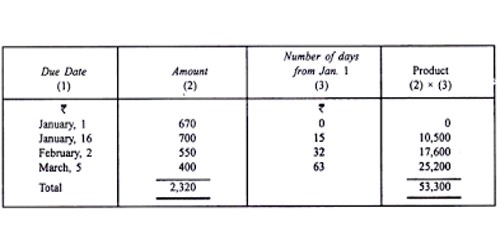

In addition to top-down and bottom-up forecasting, other forecasting approaches include regression analysis and year-over-year (YoY) analysis. In the creation of corporate cost spending plans, income spending plans, and capital spending plans, a granular perspective would include first setting them at the most point by point level of every administration revealing detail for every unit or division inside the administration announcing progression. In bottom-up forecasting, a company’s actual sales are anticipated by comparing the demand for its products in the market from the previous year to the current year.

The most basic technique of forecasting is year-over-year analysis, in which an analyst examines past growth rates and applies a growth rate percentage to historical revenue. A granular perspective to deals guaging produces gauges for every particular item or segment, and perhaps at the same time for different measurements, for example, deals channel, geographic district, client type, or explicit client. It’s like examining the health of a body by first examining the health of a cell or an organ and then extrapolating that health to the entire creature.

We may build organization-wide forecasts utilizing this method by just using the data that is there in front of us. Because this method is based on the company’s data, it is reliable. To forecast, a Financial Analyst will not need to rely on third-party data. Real data strengthens forecasting since patterns can be verified using the company’s historical data. Predictions for wider classes of items or components, as well as aggregates of sales channels, geographic areas, client types, and customer categories, would be created by integrating forecasts provided at more detailed levels.

Taking a bottom-up approach to problem-solving and changing course on the fly is a wonderful strategy to improve your capacity to adapt to challenges and changes in the business environment. Different segments may exist inside a company. Bottom-Up identifies each segment’s demand, allowing businesses to better allocate resources. It makes the organization more proficient while settling on capital planning choices. Since the cycle is started at the base, a particularly granular methodology will in general be exact in regards to every office’s necessities.

A bottom-up approach requires attention to detail in terms of expenditure, production, and income, which is essential for planning and managing business unit operations. Because the choice is based on micro variables, it provides a clear image of the firm to upper management. The board knows about the consumption being led by each portion and regardless of whether it will be feasible to decrease the use to further develop usefulness. At the point when offices are asked, not told, what the spending plan ought to be, obviously their suppositions are considered, which can further develop resolve.

The study takes a long time to complete since it involves numerous micro variables. For this strategy, all micro variables must be adequately anticipated. In certain situations, prediction mistakes made at a higher level might compound when the more precise projections and estimations are added together. This is especially true if the projection mistakes at higher levels tend to be in one direction. Because the bottom-up technique might suffer from what is known as the “fog of war,” doing it from a single point of reference is always sub-optimal.

Some line directors might enlist needs for additional assets that are needed while focusing on less income and benefit age than they ought to have the option to create. In will require a group to be committed to social occasion information from singular divisions to complete the methodology. As a result, forecasting is costly. While an individual, worker’s viewpoint is valuable, his or her ideas will be hampered by a lack of knowledge about related functions, teams, or business components.

Information Sources: