BRAC Bank SME Loan Poverty Alleviation in Bangladesh

Advanced expansion of the Small and Medium Enterprises (SMEs) can help to cut poverty to a satisfactory level by eliminating various prejudices against labour intensive industry and creating jobs for the skilled manpower in the SME sector. However, the access to financing is still recognized as the leading obstacle to SME growth in Bangladesh, alike most other developing and under-developed countries. Small and medium entrepreneurship have a tremendous potential in empowering potential entrepreneurs and transforming society. To target this sector with huge potentiality BRAC Bank Ltd introduced SME Banking Division in 2001.

Being the fastest growing bank of the country currently BRAC Bank is operating all over the country having 166 Branches and Krishi Branches, 22 SME Sales and Service Centers, 400+ ATMs, 464 SME Unit offices. This fastest growing bank works on 3P- People, Planet and Profit; ensures sustainable growth and largely focuses on SME financing sector.

BRAC Bank SME division was set up to capture “Missing Middle” and to create socioeconomic impact in the country. Within 11 years of establishing it has proved its success through becoming country‟s largest SME finance provider and 4th large SME provider in the world in terms of lending volume.

For the inheriting business risk, SME sector is facing several constrains in terms of growth. Policy level complexity, financial constraints, legal bindings and industry structure are hindering financial institutions to support SME sector. Lack of SME supporters, poor infrastructure of the country, lack of entrepreneur‟s skills, lender-borrower gap, huge market competitions are the major drawbacks for both borrowers and lenders. Again SME sector has tremendously contributed in the economy. Today it has been considered as the engine of country‟s economy.

Being country‟s largest SME provider, BRAC Bank is facing several challenges which are identified in analytical part of the report. Business risk, high interest rate, high defaulter rate, certain government policy change etc are the major challenges facing by BRAC Bank. At the same time BRAC Bank has a large number of defaulters. Even though strict loan approval system is maintained, due to some unavoidable reason “bad-losses” sometimes occur. In order to reduce credit risk BRAC Bank follows consistent monitoring system upon borrower‟s activities. Again if someone turns in to defaulter special wing called SAM works to enforce law.

Introduction

Banks lie at the heart of the world‟s financial system. Banking system plays a significant and commendable role in the growth and development of economy and its components. A wellbuilt banking sector is significant for a prosperous economy. For any nation, banking system plays a vital role in the development of its sound economy. And commercial banks are the major player to develop the economy.

Bangladesh banking system has undergone unprecedented changes over the last twenty five years. The country moved away from state control to a relatively market-based open economy by adopting a major stabilization, liberalization and deregulation program under the influence of the World Bank and the IMF against the backdrop of serious macroeconomic imbalances in the early 1980s. After the initiation of Financial Sector Reforms Program (FSRP) in 1990, the sector was opened to greater competition by the entry of new private banks and more liberal entry of foreign banks in line with the recommendations of this program.

Where increased adoption of the internet as a delivery channel contributes to a gradual reduction in overhead expenses (Marketing, IT and Staff) of the banks by providing a high level of quality services through ATM, POS (Point of Sale), Online, Internet, Tele-banking, SWIFT and Reuter. These have changed the market structure of Bangladesh banking industry significantly. As a result, in recent years, the state-owned public banks have lost market share to the private commercial banks.

These changes will have vast implications for concentration and competition in the banking and financial sectors. However, increased concentration can intensify the market power of the large banks by fostering collusive behaviour among them and therefore hinder both competition and efficiency. In order to judge the implications of these structural changes and developments, it is imperative to examine current market structure of the banking sector to understand the impact the changes are likely to have on the market structure and the behaviour of banks.

Background

Dedicated to the people of Bangladesh because we believe in faith and hope cemented by Our Unshakable trust on the dreams of 160 million, it is not just a place for transactions – BRAC Bank is a place where potentials are realized. Traditionally, banking in Bangladesh has been for the mid to large sized businesses or the professionals in jobs. Ironically, more than ¾th of the economy is out of the reach of formal banking. BRAC Bank took a step to break this tradition of banking and tapped into the true suburb entrepreneurial initiatives.

More than half of BRAC Bank‟s lending is for this small and medium enterprises – popularly known as „SME‟. These businesses are the dreams and achievements of individual Bangladeshis

What BRAC Bank has been doing?

BRAC Bank is one of the country largest and world‟s 4th largest SME Bank. In a market where traditional banking support was inadequate, these SMEs could find a partner. Since BRAC Bank inception served around 471,618 SME borrowers by lending BDT 291,871 Million through 624 customer touch points (SME unit offices, SME sales and service centers, SME Krishi Branches and Branches)! While we are a SME-heavy bank, we also render a fullarray of banking services, not only SME financing. The bank is considered a leading one in retail services with the largest plastic-base (over half a million customers of the bank carry a debit or credit card to access their everyday banking needs), the 3rd largest private-sector remittance distributor, and the 7th largest bank in terms of fund management, 2nd highest issuer of home loans and 3rd largest distributer of car loans in the country.

Business model of BRAC Bank

The Business Model innovated was simple: mobilize funds from the urban market towards lending at semi-urban and rural. The bank had to break away from traditional banking, had to develop new ways to assess credit proposals and to reach these people who rarely accesses a bank outside metro areas, but the journey proved a success.

Structure

Capital Structure

BRAC Bank has started with an initial capital of amount BDT 250 million, while the authorized capital is BDT 1,000 million. Over time the bank has increased its capital base because of its steady growth and within three years of operations, it has doubled its capital base to BDT 500 million. The Bank has planned to go public by the last quarter of this year (2006) and raise it‟s paid up capital to BDT 1000 million. BRAC Bank originated with Local and International Institutional shareholding including BRAC as promoter with IFC.

Capital Fund

The authorized and paid up capital of BBL is TK.1000 million and TK.500 million respectively. The paid up capital is one of the strongest in the banking industry. The bank is going to raise its paid up capital in the month September, 2006 by TK.500 million with issuing public share of 5, 00,000 of TK.100 each.

Retail Banking Division

Retail Division offers a wide array of lucrative and competitive banking products to the individual customers of the bank. It offers different types of term deposit scheme and attractive STD & Savings deposit schemes giving interest on daily balance. Retail Banking

Division has the following departments:

- Branch Banking

- Alternative Delivery Channels (ATM, AponSomoy, Cash deposit machine (CDM), Phone banking, e-statement)

- Ca000rds Department

- Retail Risk

- Products and Marketing

- Value Centers

Currently BRAC Bank has re-organized its retail business according to customer profile. This segmentation has been done to deliver more standardized services and reduce operating costs as well. The segments are as follows

- Premium

- Banking

- Supreme Banking

- Excel Banking

- Easy Banking

Premium Banking:

Guest who maintains at least BDT 50 lacs (6 month average) is called premium customers. They are highly prioritized. They also enjoy different gift and discount through BRAC Bank. Currently BRAC Bank has around 1000 premium customers.

Supreme Banking:

Guests who maintain a balance between BDT 10 lacs to below 50 lacs (6month average) are treated as supreme clients. They enjoy separate service booth and cash deposit booth in the branch along with many other services.

Excel Banking:

Client who maintains a balance between BDT 50 thousand to below 10 lacs in an average of 6 months are called excel group of guest.

Easy Banking:

These are the general customers who do day to day and traditional banking with the bank. They only require a minimum balance in the account (up to BDT 50 thousand).

Corporate Banking Division

Corporate Division provides full range of commercial banking products and services to any potential corporate clients including multinationals, large or medium local corporate, NGOs, institutional bodies.

The Corporate Banking Division has a centralized structure through on-line banking system. Any credit facility is processed at the Corporate Banking Division, Head office. After sanctioning of the facility, the limit is put on line and the customer can enjoy the facility from any of the BRAC Bank branches. Strict adherence to internal control guidelines and other legal and statutory compliance are followed. The Credit approval process involves separate Credit Division, the Managing Director and finally the Board.

Other departments like Foreign Trade, Treasury, and Credit Administration etc. play the support role for a comprehensive range of service to the Corporate Banking Division.

Treasury Division is one of the major divisions of BRAC Bank. Treasury Division deals with money market. All treasury related products are processed in conformity with the Bank’s Operational, Trading, Money market, Overnight, Term placing, Deal settlement, Commercial position keeping, Treasury, Credit, Finance & other applicable policies.

Treasury Operations calculates investment figure, prepares the auction application, forwards the application to Bangladesh Bank for Bid and Treasury Operations maintains and reconciles all accounts with foreign and local banks.

Cash Management & Custodial Services

Corporate Cash management provides a wide range of corporate fund management solutions. Tailored cash management solutions are provided to different Government organizations, autonomous bodies, and large local conglomerates to MNC‟s.

Treasury & Financial Institution

Treasury department is vested with the responsibility to measure and minimize the risk associated with Bank‟s liquidity, foreign exchange exposure and asset liability management. Treasury continuously monitors price movement of foreign exchange and uses various hedging technique to manage its open position in such a way that minimize risk and maximum return.

The FI wing work as trigger point of establishing new relationship with correspondent bank as well as to maintain the existing relationship to provide a smooth funding channel for all business units. BRAC Bank Ltd has a strong worldwide corresponded network with the world‟s leading 20+ banks to facilitate trade, remittance and other services to its client efficiently and profitably.

Money Market Desk

BRAC Bank has a strong presence in the Treasury Market in Bangladesh. The Money Market Desk of the Treasury Division mainly deals in Bangladeshi Taka transactions. The basic activities undertaken by the Money Market Desk are:

- Management of Statutory Reserves viz. Cash Reserve Ratio (CRR) & Statutory

- Liquidity Ratio (SLR)

- Daily Funds & Liquidity Management

- Investment Management

- Treasury Services

- Call/Overnight Lending & Borrowing

- Term Money Borrowing & Lending

- Repurchase Agreement

- Treasury Bills (T-Bills)

Description of the Project

The report has been prepared in order to provide a brief idea about the SME financing scenario of Bangladesh from the perspective of BRAC Bank Ltd. The broad objective and specific objectives of the report are given bellow-

Broad Objective

Broad objective of this study is to analysis the SME scenario of Bangladesh and to assess the performance of BRAC Bank Ltd in context of highly competitive market. Along with that the report will justify how SME is contributing in socio-economic development of the country and its challenges.

Specific Objectives

The report will work on some specific objectives. Those are as follows-

- To present an overview of SME division of BRAC Bank Detail description of SME division of BRAC Bank Operation Process of SME Loan Disbursement of BRAC Bank Risk management process and collection process of BRAC Bank Ltd.

- To find out the problems, if any, that BRAC Bank Ltd. as well as clients is facing inSME financing for small and medium entrepreneurs and to suggest remedies for the problems encountered.

Methodology

Both the primary and secondary data are used to make the report more rich and informative.

Primary Sources

Face to face communication with the on-site supervisor and employees of the BRAC Bank Ltd. Open ended and closes ended questions with borrowers.

Secondary Sources

- Official Website of the Bank and bank records

- Different books, training papers, manuals etc. related to the topic.

- Different websites and publications, newspapers

Small & Medium Enterprises (SME)

SME is defined as, “A firm managed in a personalized way by its owners or partners, which has only a small share of its market and is not sufficiently large to have access to the stock exchange for raising capital”. SME ordinarily have few accesses to formal channels of finance and depends primarily upon savings of their owners, their families & friends.

Consequently, most SMEs are sole proprietorships & partnerships. As with all definitions, this one is not perfect. Depending on context therefore definition of SME will vary.

Despite the common features globally, countries do not use the same definition for classifying their SME sector. Also, a universal definition does not appear feasible or desirable. SMEs have been defined against various criteria. The three parameters that are generally applied by the Governments to define SMEs are:

- Capital investment in plant and machinery

- Number of workers employed

- Volume of production or turnover of business

Other definitions are based on whether the owner of the enterprise works alongside the workers, the degree of sophistication in management, and whether or not an enterprise lies in the “formal” sector. The definitions in use depend on the purposes these are required to serve according to the policies of the respective countries/Governments According to Bangladesh Bank‟s Small and Medium Enterprise (SME) Credit Policies and Programs.

Pre-Operation

Before undertaking small enterprise financing, bank/financial institutions are required to follow some specific guidelines. Firms that have already established SME financing are required to compliance with the guidelines by six month of the date of issuance of Small Enterprise Financing Prudential Regulations. Pre-operation guidelines are

- For the purpose of undertaken SME financing, banks are required to set up own separate risk management capacity which will be properly staffed in combined with sufficient expertise and experienced person in the field o consumer finance/business

- The bank shell develops comprehensive credit policies suitably approved by Board of Directors. The policy will cover loan administration combined with documentations process, disbursement systems and appropriate monitoring mechanism. The policy will also revise with job description and job specification of different layer staffs. Along with it, policy shall specify powers/authority relating to approval/sanction of consumer finance facility.

- The bank shall develop specific Product Program Guide (PPG) for every type of SME activities. The program shall describe the eligibility of the borrower in terms of objectives or quantitative parameters. It shall also determine the maximum permissible loan limit of each borrower. Along with that, PPG shall indicate the maximum permissible exposure banks will take against each product

- The SME undertaking bank shall have computer based Management Information‟s System (MIS) which will cater the need of small and medium enterprise financing portfolio and should be flexible enough to generate necessary information regarding various clients and their payments behaviours. This periodical report are expected to help in generating new policies, effectively implementation of current policies and facilities appropriate modifications of existing policy.

- The bank shall prepare product wise profit and loss account quarterly which will adjusted with the provision on account of classified account as expected. The profit and loss account should be present to the Board of Directors in the immediate next board meeting. In case of foreign banks, the report should be place before committee combined with Chief Executive Officer, Chief Financial Officer and Head of Small enterprise.

- The bank shall have comprehensive recovery procedures for the delinquent loan. There must have a constructive procedure to recover loan defaulters. That recovery procedure my very product to product, but the distinct should be prescribed in such manner so that pre-planned enforcement measures could be taken immediately.

- All the institutions starting/undertaken small and medium enterprise financing are instructed to gone through some training on an ongoing basis to their capabilities related with various aspects of SMEs. The bank shall prepare standardized set of borrowing and recourse documents for each types of SME financing.

Operations

Like other financing institutions, small and medium enterprise financing institutions are subject to set up own credit risk management process. The process includes information about borrower past dealing with banks, assessing the clients ability to repayment, sources of repayment, net worth and information obtained from Credit Information Bureau approved by Bangladesh Bank.

While granting loan to the borrowers, bank shall obtain written declaration from the borrower reviling the details of various facilities he/she already obtained from other financial institutions. The bank shall carefully gone through the declaration detail and find out whether the customer exceeds the resemble limits as laid down in the approved policies of the banks. Additionally this declaration helps the bank to avoid exposure against an enterprise having multiple facilities from different financial institutions.

Bank should establish its own internal audit and control system in order to review its activities. For its inheriting nature, SME portfolios are subject to high risk and various weaknesses. The internal audit review managerial decisions in order to rectify the weaknesses of SME financing and reduce the level of risk. Another function of the internal audit is to look after the delinquency of internal control. It also figured out whether standardized policies are developed and practiced in reality.

The bank shall ensure that their accounting and computer systems are properly equipped so that bank can avoid mark up. Even if it marked –up, bank must ensure that the marked-up charge on the outstanding amount is kept separate from the principal. The banks shall also ensure that any repayment made by the borrower is accounted for before applying mark-up on the outstanding amount

Discloser/Ethics

Bank shell disclose all necessary terms and conditions regarding fees-charges; interest rate and penalties. It should also reveal internal information to some extend because sometimes it contains conditions related with interest rate and pre-payments penalties. In order to make it hassle free and keep update with clients, banks are encourage to published brochures regarding their different mood of products, eligibility to apply and frequent asked questions.

BRAC Bank SME Loan Poverty Alleviation in Bangladesh

Small and Medium size Enterprises (SMEs) in Bangladesh did not have access to banks and financial institutions like the big multinational & local corporate. But SMEs have a significant role in employment generation, poverty alleviation and overall economic growth, especially for a developing economy like that of Bangladesh‟s.SME banking was a young and dynamic industry in Bangladesh as 25% people of its overall workforce are involved in SME sector, which has 25% contribution to the country‟s Gross Domestic Product (GDP).

To serve the “Missing Middle” and to work as a catalyst for the vibrant yet unbanked SME sector of Bangladesh, The Chairperson of BRAC, Sir FazleHasn Abed founded BRAC Bank in 2001 with institutional shareholding of BRAC, Shore Bank & IFC.

Financial Industry’s contribution to SMEs in Bangladesh

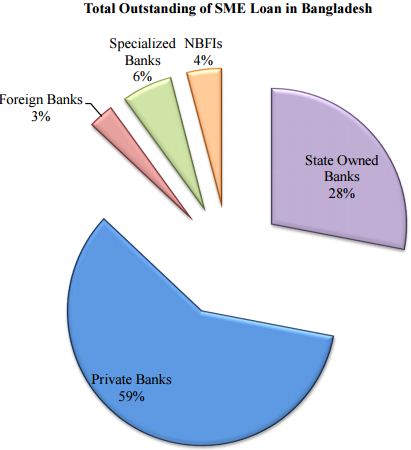

The SME loan growth of the private banks was 73.65% in December 2013 while the growth of the national commercial banks was only 13.32% and the foreign banks 7.99%. Total Outstanding of SME Loans in the industry is more than USD 10,000 Million

BRAC Bank holds:

- 9% SME Portfolio of Private Banks

- 29% SME Portfolio of Entire Industry

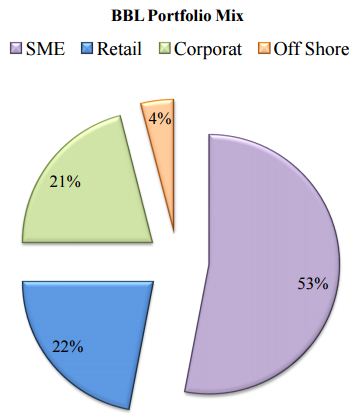

BRAC Bank’s Portfolio Mix:

BRAC Bank started its journey in 2001 with a mandate to serve the SMEs of Bangladesh & to realize dreams and aspirations of SMEs especially in remote areas of the country. In-line with the mandate BRAC Bank continued to grow its SME portfolio, which is 53% of Bank‟s total portfolio. And always maintain a minimum of 51% SME portfolio which is commitment with Bangladesh Bank.

BBL is the first bank to launch SME division, but BBL now a financial tree that offers financial solution to all branches- be it retail, SME, wholesale banking, capital market, or remittance, but it has a special focus on SME.

Challenges of BBL SME loan and Analysis

Key Challenges – Small Business in BBL

- Adept with the current economic condition & achieve the desired growth in SMEb Segment

- Maintain the competitive edge over other players & retain the No 1 position in SME lending in an environment where there will be increased competition among existing players as well as new entrants (new banks/FIs) focusing the SME segment.

- Improve/maintain the Quality of the Portfolio

- Higher customer & quality staff attrition due to competition

- Greater regulatory intervention in SME lending which may impact pricing and bring down revenue

- Declining Net Interest Margin due to increase in cost of liquidity

- Containing costs of acquisition through enhancing staff productivity and efficiency

Findings

BRAC Bank, as we know, is one of the fastest growing banks in Bangladesh. SME banking which has made the performance of this bank so enlightened is its core product to offer to the small and mediocre business entrepreneurs. In fact no businessman could think ever before that they could take loan so easily, without any collateral and without going to bank. But BRAC Bank has made this improbable process so successfully through SME banking.

However from the analysis of BBL SME Loan Poverty Alleviation in Bangladesh and It‟s Challenges, I can make the following findings especially on Non-Performing Loan creation in SME loan of BRAC Bank.

Causes for Creation of Non-Performing Loans in SME

i. Pre-approval phase:

Factors influencing pre approval phase mainly include the followings:

- Poor selection process of potential borrower

- Mistake in selection of business where to finance/ not to finance

- Poor overhead appraisal technique on viability of the project

- End use/ purpose not properly tracked

- Defective structuring of credit

- Under/ over financing

- Lack of proper pre-inquiry

- Absence of observing of cash flows tatement

ii. Disbursement phase:

Defect in filing and signing of charge documents

Improper obtaining of legal document:

- Improper obtaining instruments/ documents

- Lack of proper stamping

- Lack of appropriate execution & registration

- Improper line

- Poor quality of collateral

- Poor quality of hypothecation

III. Post disbursement phase:

Major factors influencing post approval phase:

- Poor recovery drive and absence of monitoring

- Poor MIS

- Irregular or delinquent loan payments

- Frequent alterations in loan terms

- Poor loan renewal records

- Verification of projected cash flow with actual cash flow

- Customer‟s reliance on non-recurring sources of funds to meet loan repayments

- Covenants not complied and monitored

- Improper internal control and audit

- Absence of competent successors

- Disasters and calamities

- Political unrest

- Wilful default

- Economic recession

- Change in govt. policy

At present SME loan of BRAC Bank is also facing some others barrier in financing. The major constraints are:

Inadequate fund:

BRAC Bank SME loan products have set a specified limit for SME financing. If big amount financing require for the expansion of existing business or pursuing new venture then it is difficult to collect require fund from the bank

Project Preparation and Evaluation:

Regardless of Bangladesh bank instruction, Loan application process for SMEs financing in BBL is still lengthy. On the other hand, it is quiet difficult to the entrepreneur to prepare a formal project proposal.

High interest on SME loan:

BRAC Bank charge highest interest rate on SME financing with compare peer banks interest rate. The rate is almost 14% to 24% and this high rate is on the prime hitch in the competitive market. Where peer banks are in below 20%.

Collateral requirement:

BRAC Banks demand good collateral as a safeguard and reduce risk exposure from the small and medium enterprises financing. But most of the SMEs fail to comply with this requirement of the banks and deprived of SME loan facility

Recommendations

Strategies for managing SME NPL of BBL

Two types of strategies should be taken for the management of SME NPL in BRAC Bank: Preventive strategy

Curative strategy

(A) Preventive Strategy

(I) Formulation of well-structure NPL management strategy covering following areas:

- No compromise with due diligence in the sanctioning process. Keeping in mind “prevention is better than cure.”

- Prepare loan recovery policy, strategies and techniques for reducing NPL

- Fix targets of recovery and draw time bound action program

- Identification of highly risk sensitive borrowers in the credit portfolio

- Identification of geographical area-wise risk sensitivity

- Targeting high value end NPL accounts

- Proper action on credit reports

- Developing capacity of officers and executives on recovery at all levels

(II) Supervising:

- Off-site monitoring.

- Periodic reports on the risk sensitive clients/ borrowers

- Ascertaining and grading risks

- Analysis of financial statement to find out the weakness in the vusiness

- On-site monitoring

- Physical visits to the business venue of the clients.

- Direct interaction/ discussion meeting

- Understand clients business

- Analyze clients financial position

- Frequent visit to client

- Ensuring perfection of legal documentation

- Investigation on market rumours

- Use credit bureau checking

(III) Monitoring and follow up:

- To see that the terms and condition are complied with

- To ensure that funds are utilized for the purpose for which they were sanctioned.

- To monitor the project implementation for avoiding time lag and consequential cost over runs

- To evaluate the performance in terms of production, sales, profits on a periodic basis for ensuring that the borrower is keeping to the original plan and is having sufficient profits to repay the debts

- To assess the impact of negative externalities on the performance of the company.

- To detect the symptom of sickness at the early stage

- To keep check on the movement of financial position

- Monitoring implementation status of the time bound action plan

- Take corrective steps whenever found necessary while monitoring the action plan and make changes in the original plan if necessary

(IV) Requiring awareness of the bankers:

- Bankers are required to remain vigilant over the status of their credit portfolio and if any indication of deterioration of performance of borrowers is found, in that case immediate retrieval measure should be initiated

- Apparent stagnation in the business as reflected by slow/ negligible turnover in the account

- Frequent request for overdrawing or issue of cheques without ensuring availability of funds in the account

- In case of term loan, no payment of overdue instalment

- Unexplained delays in submission of stock reports.

- Slow movement/ stagnation of stocks observed during inspection.

- Persistent delay in compliance or non-compliance with vital requirements like execution of documents

- Diversion of fund to sister units/ acquiring capital assets not relevant to the business

(V) Features common to NPL which should warn a banker:

- Unusual or unexplained delay in receiving promised repayments.

- Adverse changes in the price of a borrowing customer‟s stock

- Adverse changes in the borrower‟s capital structure (equity/ debt ratio), liquidity (current ratio or activity levels), and ratio of sales to inventory.

- Deviation of actual sales or cash flow from those projects when the loan was sanctioned.

- Sudden unexpected and unexplained changes in deposit balance maintained by the customer.