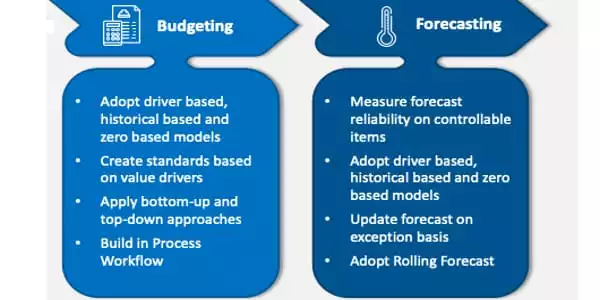

Budgeting describes how the plan will be carried out from month to month and includes information such as revenue, expenses, potential cash flow, and debt reduction. Traditionally, a company will establish a fiscal year and develop a budget for the year. It may adjust the budget based on actual revenues or compare actual financial statements to determine how close to meeting or exceeding the budget they are.

Forecasting uses historical data and current market conditions to predict how much revenue an organization can expect to generate in the coming months or years. Forecasts are typically updated as new data becomes available.

Once you’ve created your first budget, started using it, and gotten a sense of how it can keep your finances on track, you might want to map out your spending plan or budget for the next 6 months to a year. This allows you to easily predict which months your finances will be tight and which ones you will have extra money. You can then look for ways to smooth out the highs and lows in your finances so that they are more manageable and enjoyable.

The main distinction between a budget and a forecast is that a budget lays out the plan for what a company wants to achieve, whereas a forecast states the company’s actual expectations for results, usually in a much more summarized format. To put it another way, a budget is a plan for where a company wants to go, whereas a forecast is an indication of where it is actually going.

In reality, the forecast is the most useful of these tools because it provides a short-term representation of the actual circumstances in which a business finds itself. A forecast’s information can be used to take immediate action. A budget, on the other hand, may include targets that are simply unattainable, or for which market conditions have changed so drastically that it is not prudent to attempt to achieve. If a budget is to be used, it should be updated more frequently than once a year to ensure that it is relevant to current market realities. The last point is of particular importance in a rapidly-changing market, where the assumptions used to create a budget may be rendered obsolete within a few months.

Extending your budget allows you to forecast how much money you will be able to save for important things like a vacation, a new vehicle, your first home or home renovations, an emergency savings account, or retirement. Using a realistic budget to forecast your spending for the year can be extremely beneficial to your long-term financial planning. You can then make reasonable assumptions about your annual income and expenses and plan for long-term financial objectives such as starting your own business, purchasing an investment or recreational property, or retiring.

A budget is a quantified expectation for what a business wants to achieve. Its characteristics are:

- A budget is a detailed representation of the future results, financial position, and cash flows that management expects the company to achieve over a specific time period.

- Depending on how frequently senior management wants to revise information, the budget may only be updated once a year.

- Actual results are compared to the budget to determine deviations from expected performance.

- Management takes corrective action to bring actual results back in line with budget.

- The budget-to-actual comparison may cause changes in employee performance-based compensation.

A forecast is an estimate of what will actually be achieved. Its characteristics are:

- Typically, the forecast is limited to major revenue and expense line items. The financial position is usually not forecasted, but cash flows may be.

- The forecast is updated on a regular basis, possibly monthly or quarterly.

- The forecast can be used for short-term operational considerations like staffing, inventory levels, and production planning.

- There is no variance analysis comparing the forecast to the actual results.

- Forecast changes have no effect on employee performance-based compensation.