A calendar spread also referred to as a time spread or horizontal spread, is a spread of options or futures generated by simultaneously entering a long and short position at the same strike price but with different settlement months on the same underlying commodity. In the case of futures contracts in commodity markets, it is most commonly done, especially for grains such as wheat, corn, rice, etc. It is sometimes referred to as an intra-market, time, or horizontal spread, inter-delivery. A future exchanging is an extremely unstable movement, as most costs are influenced because of various outside macroeconomic conditions that can’t be controlled. The schedule spread can be utilized to endeavor to exploit a distinction in the suggested volatilities between two unique months’ choices. When the options they purchase have a distinctly lower implied volatility than the options they write, the trader will typically follow this strategy (selling).

If the underlying asset does not make any major movements in either direction until after the close-month option expires, a calendar spread is most profitable. The currency of a nation is in most situations, tied to the value of the goods it produces. In spread trading, the market costs of the products apply little impact on the benefit made by speculators. It is on the grounds that there are two distinct legs of the exchange, purchasing an agreement, and selling another. An increase in the overall implied volatility of the options of a market during trading in the traditional variant of this strategy will tend very strongly to be to the benefit of the trader, and a decrease in implied volatility will tend strongly to work to the disadvantage of the trader.

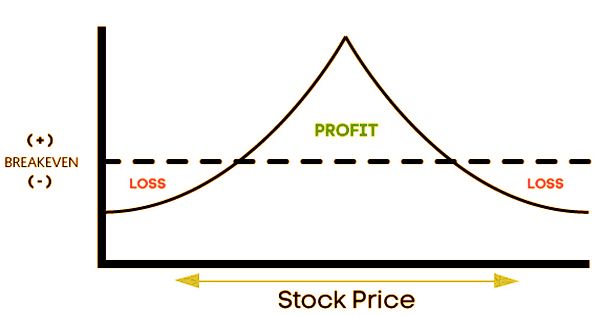

(Example of Calendar Spread)

Profitability, therefore, lies in the relationship between the two distributions. The standard calendar spread trade includes the sale with a near-term expiration date of an option (either a call or a put) and the simultaneous purchase with a longer-term expiration of an option (call or put). Both options are of the same form and the same strike price is usually used.

- Sell near-term put/call

- Buy longer-term put/call

- Preferable but not required that implied volatility is low

A financial specialist may bring in cash in one leg of the arrangement and lose cash in the other. A fruitful spread is one where the benefit from one leg exceeds the misfortune from the other, subsequently turning a general benefit for the speculator. The motivation behind the exchange is to benefit from the progression of time as well as an expansion in suggested unpredictability in a directionally impartial system. Instead, if the trader buys options for a nearby month in some underlying market and sells additional options for the same underlying market at the same striking price, this is known as a reverse calendar spread. This strategy would have a strong propensity to benefit from a decrease in the average implied volatility of the options of that market over time.

Since the objective is to benefit from time and instability, the strike cost should be as approachable as conceivable to the hidden resource’s cost. The exchange exploits how close and since quite a while ago dated choices act when time and unpredictability change. The schedule spread is generally nonpartisan with respect to the cost of the fundamental. Net negative theta is the short calendar spread. The difference is regarded as the cost of carrying between the futures contracts of the same commodity over a two-month span. For the period between the two months in question, it involves the expense of keeping the product. An expansion in suggested instability, any remaining things held the equivalent, would positively affect this technique since longer-term alternatives are more delicate to changes in unpredictability (higher vega).

The price difference between the two positions of the contracts is tracked in future spread charts. It allows investors to control the trading margins of a specific grain. Calendar spreads or switches are most commonly used to ‘rollover’ a position for delivery from one month to another month in the futures markets. The ideal market move for benefit would be a consistent to marginally declining fundamental resource cost during the life of the close term alternative followed by a solid move higher during the life of the far-term choice, or a sharp move upward in suggested instability. It is also helpful to track future spreads to forecast future market directions for commodities as positions may offer indications of future shortage or surplus (due to bumper crops).

Try to think of this policy as a covered call when selling a calendar spread. However, it is good practice to always sell the shortest dated option available when choosing the short strike. These options lose value the quickest and can be rolled out over the life of the trade month-to-month. On the other hand, when the item is exchanged at a value lower than its spot value, the market is supposed to be in backwardation. Close by months are the months wherein the fates contract is set to terminate or the month where the conveyance date lies. The later component of the same is the deferred months. As follows, the two distinct forms of spread positions are:

- Bull spread: When the nearby month is purchased by a seller and the deferred month is sold.

- Bear spread: At the point when a dealer sells the close by month and purchases the conceded month. It occurs in instances of foreseen market unpredictability. Value swings are consistently higher in close-by months and will in general get settled around conceded months.

The maximum benefit will occur at the expiration of the near-term option when the underlying asset is at or slightly below the expiring option’s strike price. The expiring option would have intrinsic value if the asset were higher. When the close term alternative lapses useless, the dealer is left with a straightforward long call position, which has no maximum breaking point on its possible benefit. In grain markets, there are three significant sorts of spreads:

- Intra-market spreads/Calendar spreads: Buying a futures contract in one month for a certain grain and selling another contract in a different month for the same grain.

- Inter-market spreads: Simultaneously buying and selling futures contracts of associated grains. Corn and soybeans, for example, are similar commodities, and their price ratios are taken into consideration when agreeing to exchange.

- Commodity-product spreads: Buying and selling futures for raw and refined goods, respectively (using the same raw commodity). For instance, if soybeans are the product, the product is soy milk.

In synopsis, recollect that a long schedule spread is an impartial and in certain cases a directional exchanging procedure that is utilized when a dealer anticipates a slow or sideways development for the time being and has more bearing predisposition over the life of the more drawn outdated alternative. Basically, the risk of buying a longer-term call option can be lowered by an investor with a bullish longer-term outlook. By selling a short-dated option and purchasing a longer-dated option, this trade is built, resulting in a net debit. This spread can be made with either calls or puts, and subsequently can be a bullish or bearish methodology. The dealer needs to see the short-dated alternative rot at a quicker rate than the more drawn outdated choice.

Information Sources: