Options are contracts that offer a buyer the right to buy or sell the underlying asset, or the security on which a derivative contract is based, at a specified price, by specified expiration date. A call option, also known as a “call,” is a type of derivatives contract that gives the buyer the right, but not the obligation, to buy a stock or other financial instrument at a certain strike price within a given time frame. It addresses a commitment to sell the basic security at the strike cost if the alternative is worked out.

A put option, on the other hand, grants the buyer the right to sell the underlying asset at a predetermined price on or before the expiration date. If the buyer wishes to exercise their option to buy, the seller of the option is obliged to sell the protection to them. The buyer of the contract has the option to exercise it at any point before the expiration date. It could be three months, six months, or even a year before the expiration date. For choices on stocks, call alternatives give the holder the option to purchase 100 portions of an organization at a particular cost, known as the strike cost, up until a predefined date, known as the termination date.

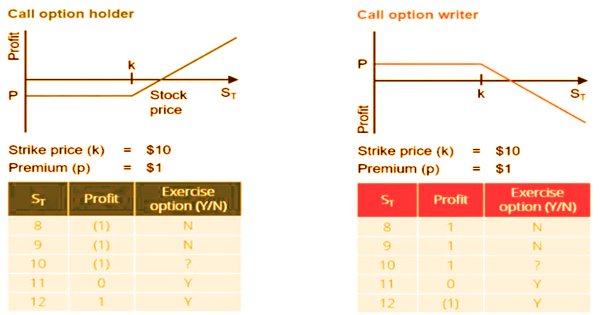

The seller of a call option, on the other hand, hopes that the asset’s price will fall, or at the very least never increase above the option strike/exercise price, before the option expires, in which case the money earned for selling the option will be a pure benefit. In the event that the cost of the fundamental security doesn’t increment past the strike value preceding termination, at that point it won’t be productive for the choice purchaser to practice the choice, and the alternative will lapse useless or “out-of-the-money”. The buyer would lose the same amount as they paid for the call option.

For a fixed period of time, the call buyer has the right to purchase a stock at the strike price. The call buyer pays a premium for that right. The choice would be profitable if the underlying price rises above the strike price. The choice may be sold for a profit or exercised by the buyer. Buying call options empowers financial backers to contribute a limited quantity of cash-flow to possibly benefit from a value ascend in the basic security, or to fence away from positional dangers. Small investors use options to try to turn small sums of capital into large profits, while corporate and institutional investors use options to boost their marginal earnings and hedge their equity portfolios.

100 shares of the underlying stock are represented by a single stock call option contract. Call options may be in, at, or out of the money; stock call prices are usually quoted per share:

- In the money means the underlying asset price is above the call strike price.

- Out of the money means the underlying price is below the strike price.

- At the money means the underlying price and the strike price are the same.

The premium is the market price of the call option. It is the price charged for the rights given by the call option. The call buyer loses the premium paid if the underlying asset is below the strike price at expiration. This is the greatest misfortune. On the off chance that the hidden’s cost is over the strike cost at expiry, the benefit is the current stock value, short the strike cost and the premium. This is then multiplied by the number of shares held by the option buyer. Call options are used by investors for the following reasons:

- Speculation: Call options allow their investors to benefit from an increase in the price of an underlying stock for a fraction of the cost of purchasing actual stock shares. They’re a leveraged investment that can yield infinite gains while limiting losses (the price paid for the option). Call options are considered high-risk assets due to their high leverage.

- Hedging: Call options are used as hedging tools by investment banks and other institutions. Hedging with an option opposite your position, like insurance, helps to minimize the amount of damage on the underlying instrument in the case of an unexpected event. Call options may be purchased and used to hedge short stock portfolios, or sold to hedge long stock portfolios against a pullback.

A few financial backers use call options to create pay through a covered call technique. The financial backer gathers the alternative premium and expectations the choice lapses useless (below strike price). This strategy provides the investor with incremental profits, but it can also reduce profit opportunities if the underlying stock price increases rapidly.

Buying Call Options: The best way to trade call options is to buy them. Buying calls is a popular way for new traders to begin trading options, not only because of its convenience, but also because of the high return on investment created by successful trades. A holder is the person who buys a call option. The holder buys a consider alternative with the expectation that the cost will ascend past the strike cost and before the lapse date. The benefit acquired equivalents the deal continues, less strike value, premium, and any conditional expenses related with the deal. The buyer will not exercise the option if the price does not rise above the strike price. The customer would incur a loss equal to the call option premium.

Selling a Call Option: Call option traders, also referred to as authors, sell call options in the hopes that they will expire worthless. They profit by pocketing the premiums (price) that have been paid to them. Their benefit will be discounted, or may even bring about a total deficit if the choice purchaser practices their choice beneficially when the basic security value transcends the choice strike cost. Call options are sold in the following two ways:

- Covered Calls: If the call option writer owns the obligated quantity of the underlying defense, the short call is secured. The covered call is a common option strategy that allows stockholders to earn additional income from their stock holdings by selling call options on a regular basis.

- Naked (Uncovered) Calls: When an option trader writes calls without owning the underlying security’s obligated stake, he is naked shorting the calls. Naked call shorting is a high-risk option strategy that is not recommended for inexperienced traders.

options contracts offer purchasers the chance to get huge openness to a stock at a generally little cost. Financial backers may likewise purchase and sell distinctive call alternatives at the same time, making a call spread. This can limit the strategy’s possible profit and loss, but they are often more cost-effective than a single call option because the premium received from one option’s sale offsets the premium charged for the other. A call and a put alternative are diametrically opposed.

A call option is the right to purchase a fundamental stock at a foreordained cost up until predefined termination date. Unexpectedly, a put alternative is the option to sell the basic stock at a foreordained cost until a fixed expiry date. A put option buyer has the right (but not the obligation) to sell shares at the strike price before or on the expiry date, while a call option buyer has the right (but not the obligation) to purchase shares at the strike price before or on the expiry date. Options trading allows investors to alter portfolio allocations without having to buy or sell the underlying security.

Information Sources: