The capital market risk usually defines the risk involved in the investments. The stark potential of experiencing losses following a fluctuation in security prices is the reason behind the capital market risk. The capital market risk cannot be diversified. Capital markets such as the stock, bond, foreign currency and derivatives markets are considered risky because of the constantly changing prices of the securities that are traded.

In other words, security prices are volatile. Securities prices are not influenced just by their fundamentals, but also by broader market influences such as economic news, political developments, currency movements, or even “black-swan” unexpected events such as a massive earthquake, tsunami or general market panic. While debatable, some consider price volatility to be a proxy for risk. The risk of financial loss associated with either choosing to or being forced to sell a security when prices have declined is what is meant by capital market risk.

The capital market risk can also be referred to as the capital market systematic risk. While an individual is investing on a security, the risk and return cannot be separated. The risk is the integrated part of the investment. The higher the potential of return, the higher is the risk associated with it. The systematic risk is also common to the entire class of liabilities or assets. Depending on the economic changes the value of investments can fall enormously. There may be some other financial events also impacting the investment markets. In order to give a check to the capital market risk, the asset allocation can be fruitful in some cases.

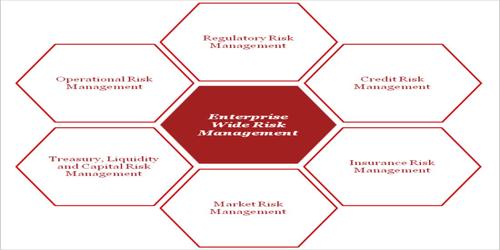

Any investment in stocks or bonds comes with the following types of risks.

- Market Risk

- Industry Risk

- Regulatory Risk

- Business Risk

The market risk defines the overall risk involved in the capital market investments. The stock market rises and falls depending on a number of issues. The collective view of the investors to invest in a particular stock or bond plays a significant role in the stock market rise and fall. Even if the company is going through a bad phase, the stock price may go up due to a rising stock market. While conversely, the stock price may fall because the market is not steady even if the investor’s company is doing well. Hence, these are the market risks that the stocks investors generally face.

The industry risk affects all the companies of a certain industry. Hence the investors if the investor’s company comes under the obligation of government implement the stocks within an industry fall under the industry risk. The regulatory risk may affect tend new regulations and laws. The business risk may affect the investors if the company goes through some convulsion depending on management, strategies, market share and labor force.

Capital Market Risk in the Stock Market

Stock prices keep fluctuating over a wide range unlike the bank deposits or government bonds. This has a considerable effect on not only the individual investors or the household but the entire economy.The efficient market hypothesis shows the effect of fundamental factors in changing the price of the stock market.

Capital Market Risk in the Bond Market

There are market participants who own the bond, collect the coupon and hold it till the expiry of the maturity date. These market participants do not face any capital market risk. Capital market risk is faced by individuals who buy or sell the bonds before it expires. Capital market risk in the bond market arise due to interest rate changes. There is an inverse relationship existing between the interest rate and the price of the bonds.

Information Source: