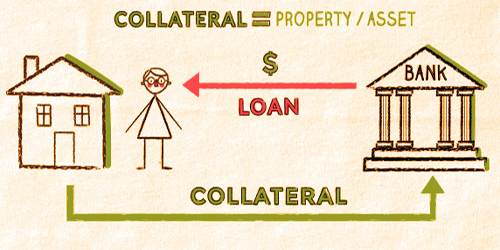

The term collateral is an asset or property that is provided as protection for a loan by a person or organization to a lender. The collateral acts as a lender’s security against the default of a borrower and may thus be used to cover the loan if, under the terms of the loan agreement, the borrower fails to pay the principal and interest satisfactorily. In the event that the borrower winds up not making the settled upon head and intrigue installments on the credit on account of indebtedness or for some other explanation that is, in the event that the borrower defaults on the advance the loan specialist, at that point turns into the proprietor of the guarantee that swore. The moneylender would then be able to offer the collateral to cover any misfortune.

In such a case, to compensate for the unreturned lent capital, the collateral becomes the lender’s house. The insurance offered by collateral usually enables lenders to pay lower interest rates on loans that have collateral. The lender will seize the collateral and sell it to recoup its losses if a borrower defaults on the loan. The decrease in loan fees can be up to a few rate focuses, contingent upon the sort and estimation of the security. For instance, the interest rate (APR) on an unstable advance is regularly a lot higher than on a made sure about credit or logbook advance.

Example of Collateral

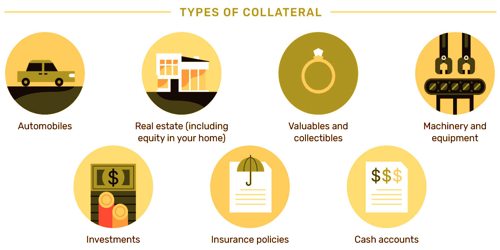

As previously described, collateral can take several forms. It usually relates to the essence of the loan, so the house collateralizes a mortgage, while the vehicle in question is the collateral for a car loan. Other private, non-specific loans may be collateralized with other properties. For instance, if an individual needs to apply for a line of credit from the bank, he/she may utilize his/her vehicle or the title of a bit of property as insurance. On the off chance that he/she neglects to reimburse the credit, the guarantee might be seized by the bank, in light of the two gatherings’ understanding. On the off chance that the borrower has got done with taking care of his/her advance, at that point the security is gotten back to his/her ownership.

The type of collateral may be limited on the basis of the type of loan (as in the case of car loans and mortgages); it may also be versatile, as in the case of personal loans dependent on collateral. For a loan, several different items can serve as collateral. In a commonplace home-purchasing exchange, for instance, the property is utilized as insurance to make sure about a home loan advance from a bank. In the event that the purchaser can’t make the home loan installments and defaults on the credit, the responsibility for property is then moved to the bank through a legitimate cycle called abandonment. The bank at that point offers the dispossessed property to recuperate its misfortunes.

Usually, loans secured by collateral are available at slightly lower interest rates than unsecured loans. Any business owner or individual should know the various forms of collateral that can be used when borrowing in order to be able to take out a loan successfully.

Types of Collateral

- Real estate – The most well-known sort of guarantee utilized by borrowers is real estate, for example, one’s home or a bundle of land. Such properties accompany a high worth and low devaluation. Notwithstanding, it can likewise be unsafe supposing that the property is sequestered because of a default, it can’t any more extended be reclaimed.

- Cash secured loan – Another common form of collateral is cash because it works very quickly. A person can take a loan from the bank where he holds active accounts, and the bank can liquidate his accounts in the event of a default in order to recover the borrowed money.

- Inventory financing – This includes stock that acts as the collateral for a loan. The goods listed in the inventory can be sold by the lender to recover its loss if a default occurs.

- Invoice collateral – Solicitations are one of the kinds of collateral utilized by private ventures, wherein solicitations to clients of the business that are as yet extraordinary unpaid are utilized as collateral.

- Blanket liens – This requires the use of a lien, which allows a lender to dispose of the assets of a company that is in default on a loan via a legal argument.

Traditionally, collateral, especially in banking, refers to secured lending (also known as asset-based lending). To secure trade transactions (also known as capital market collateralization), more complex collateralization structures can be used. The collateralized personal loan, in which the borrower provides an object of value as protection for a loan, is another form of borrowing. The value of the collateral must match the amount to be loaned or surpass it. The previous regularly presents one-sided commitments made sure about as property, guarantee, ensure or other insurance (initially meant by the term security), though the last frequently presents respective commitments made sure about by more-fluid resources, for example, money or protection, frequently known as the edge.

Collateral and security are two concepts that sometimes confuse individuals who feel the concepts are entirely interchangeable with each other. The two definitions, in reality, are different. Marketable collateral is the exchange of financial assets between a financial institution and a borrower, such as stocks and bonds, for a loan. In order to be considered marketable, assets must be capable of being sold with acceptable promptness at current fair market value under normal market conditions. Collateralized advances are likewise a factor in edge exchanging. A decrease of guarantee esteem is an essential danger when protecting advances with attractive insurance. A speculator obtains cash from an agent to purchase shares, utilizing the equalization in the financial specialist’s money market fund as insurance.

Information Sources: