A collateralized debt obligation (CDO) is a type of credit subordinate and a type of organized structured asset-backed security (ABS). The CDO is a synthetic investment commodity representing various loans that are bundled together and sold on the market by the lender. A bank keeps a loan on an asset with a daily mortgage commitment and gets monthly payments. A CDO is a specific kind of subsidiary in light of the fact that, as its name infers, it’s worth is gotten from another basic resource. These benefits become the guarantee if the advance defaults.

The form of derivative security is a collateralized debt obligation since its price (at least notionally) depends on the price of some other asset. The bank will repossess the asset used as collateral on the loan if the borrower does not pay as agreed upon. But when a CDO is placed together by a bank, such loans are bundled together and sold as a tranche or split loan unit to investors. Like other private name protections upheld by resources, a CDO can be thought of as a guarantee to pay speculators in an endorsed grouping, in light of the income the CDO gathers from the pool of bonds or different resources it claims.

Functions of Collateralized Debt Obligation

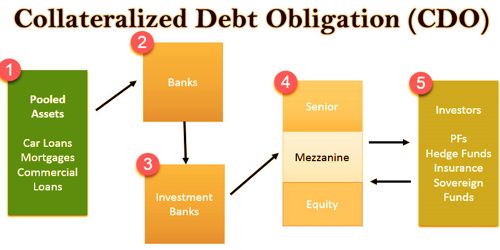

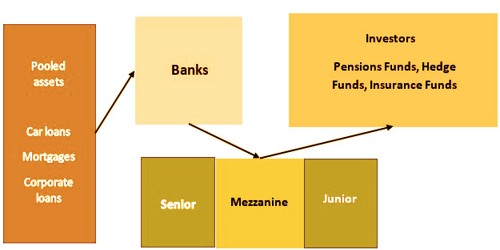

Investment banks accumulate cash flow-generating assets such as mortgages, bonds, and other forms of debt in order to construct a CDO and repackage them into different groups or tranches depending on the amount of credit risk that the lender assumes. Corporate bonds, sovereign bonds, and bank loans have historically contained the underlying assets of collateralized debt obligations. The CDO is “sliced” into “tranches”, which “catch” the income of intrigue and head installments in succession dependent on status. A CDO accumulates pay from an assortment of collateralized obligation instruments and designates the gathered pay to an organized arrangement of CDO protections.

Similar tranches have different scores for credit. Higher-level tranches have a higher credit ranking with first preference and low default risk for investor payments. The downside is that they give a lower coupon or interest rate for these tranches. Those in the lowest, most “junior” tranches incur losses first if any loans default, and the cash received by the CDO is inadequate to pay all of its investors. The last to lose installment from default are the most secure, most senior tranches. The first CDOs included income CDOs, i.e., not exposed to dynamic administration by a store supervisor.

Early CDOs were diversified and could include anything from debt for aircraft leasing equipment, loans for manufactured homes, student loans, and debt for credit cards. The final investment products are these tranches of securities: bonds whose names can reflect their particular underlying assets. For instance, contract supported protections (MBS) are included home loan advances, and resource upheld protections (ABS) contain corporate obligation, vehicle advances, or Visa obligation. CDOs are classified “collateralized” in light of the fact that the guaranteed reimbursements of the fundamental resources are the insurance that gives the CDOs their worth.

Structure of Collateralized Debt Obligation (CDO)

CDOs were funded with debt, including mortgage-backed securities, raising their earnings but also rising losses if the market changed course. Other types of CDOs include investment-grade collateralized bond obligations (CBOs) backed by a pool of high-yield but lower-rated bonds, and single securities backed by collateralized loan obligations (CLOs) backed by a pool of debt, often including low-rated corporate loans. CDO permits banks to decrease the measure of the danger they hang on their asset report. Most of the banks are needed to hold a specific extent of their benefits for possible later use. This boosts the securitization and offers of advantages, as holding resources available for later is exorbitant for the banks.

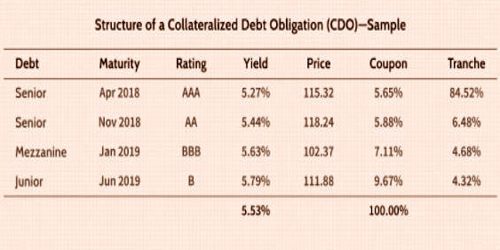

CDO tranches are named to reflect their risk profiles, such as senior debt, mezzanine debt, and junior debt, along with their Standard and Poor’s (S&P) credit scores, as seen in the sample below. But depending on the specific product, the actual structure varies. Collateralized debt obligations allow banks to turn relatively illiquid security into a relatively liquid security (a single bond or loan). The CDO can guarantee speculators a pace of profit for their venture that is supported by the money streaming in every month from the credit installments. The guarantee of income is the fundamental resource that financial specialists depend on to produce returns.

The former investment bank, Drexel Burnham Lambert, founded the earliest CDOs in 1987, where Michael Milken, then called the “junk bond king”, reigned. Historically, houses have been seen to be inherently distinct from other properties, such as company bonds and shares. Therefore, in contrast with the demand for other investment instruments, the housing industry has been evaluated differently. The Drexel bankers made these early CDOs by amassing the arrangement of garbage bonds, given by various organizations. Exchanges in the lodging market are normally high-esteem exchanges including people, and the general recurrence of such exchanges is low contrasted with security or offer, which may change hands on different occasions during a day’s exchange.

In structure and underlying properties, CDOs differ, but the fundamental concept remains the same. Sections in many individual mortgage bonds are owned by a mortgage-backed CDO. Thus, by diversification through multiple mortgage bonds, a mortgage-backed CDO is seen to reduce the possibility of a small-scale housing crisis. For some of the biggest financial services institutions, the bursting of the CDO bubble triggered losses of hundreds of billions of dollars. These misfortunes brought about the speculation banks either failing or being rescued through government intercession and assisted with raising the worldwide money related emergency, the Great Recession, during this period.

Information Sources: