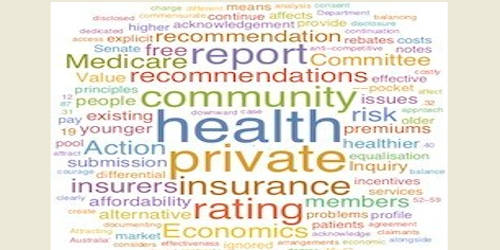

Community Rating is a rule that prevents health insurers from varying premiums within a geographic area based on age, gender, health status or other factors. It is a concept usually associated with health insurance, which requires health insurance providers to offer health insurance policies within a given territory at the same price to all persons without medical underwriting, regardless of their health status. It refers to an insurance pricing system that prohibits medical underwriting and requires that all of a carrier’s insureds in the same geographical area pay the same premiums, regardless of their health status. Most insurance companies have stopped using this in favor of the experience rating.

Community rating is a method for pricing insurance that pools policyholders within a geographic area into a single risk pool (a “community”) and charges them the same premium regardless of health, gender or other factors. Pure community rating prohibits insurance rate variations based on demographic characteristics such as age or gender, whereas adjusted or modified community rating allows insurance rate variations based on demographic characteristics such as age or gender.

Concept

Community rating, as a basis for premium calculation, is fundamentally different from the usual method of determining insurance premiums, i.e. risk rating. In a risk-rated insurance market, an insurer calculates the premium payable by a potential policyholder in order to enter into an insurance contract on the basis of various factors particular to that individual, such as the risk of a claim occurring, and the value of any such claims during the term of an insurance policy. If community rating were not in place, individual insurance premiums could progressively increase until it became unaffordable for those who need it most.

In a community rated market, the insurer may not calculate premium on the basis of the risk factors attaching to the particular person wishing to purchase an insurance contract, but rather the risk factors applying to all persons within the market as a whole. Thus, in a community-rated market, the insurer evaluates the risk factors of the market population, and not those of anyone person when calculating premiums. Some form of risk equalization also often exists in a community-rated system.