The cost of equity is the expected return on an investment in a business by an investor. The cost of equity is used by a company to evaluate the relative attractiveness of various investments, including both internal and external acquisition options. Organizations normally utilize a mix of value and obligation financing, with value capital being more costly. The conventional recipe for the expense of value is the profit capitalization model and the capital asset pricing model (CAPM).

To operate and grow, businesses must obtain capital from people. Individuals and organizations who are willing to donate money to others have a natural desire to be compensated. The dividend capitalization model, which focuses the cost of equity primarily on a company’s payouts, is one technique to calculate the cost of equity. The formula is:

(Dividends per share for next year ÷ Current market value of the stock) + Dividend growth rate

CAPM (Capital Asset Pricing Model) –

The CAPM considers the riskiness of an investment in relation to the market. Because of the calculations’ approximations, the model is less precise (because it uses historical information).

CAPM Formula:

E(Ri) = Rf + βi × (E(Rm) – Rf)

Where:

E(Ri) = Expected return on asset i

Rf = Risk-free rate of return

βi = Beta of asset i

E(Rm) = Expected market return

The cost of equity refers to two separate ideas relying upon the gathering in question. Similarly, as landowners look for rents on their property, capital suppliers look for returns on their assets, which should be proportionate with the danger attempted. Firms get capital from two sorts of sources: banks and value financial backers. Although equity does not have to be returned, the tax benefits of interest payments make it more expensive than borrowed capital. Because the cost of equity is higher than the cost of debt, it offers a higher rate of return.

The expected return on a risk-free investment; the asset’s systematic risk (volatility) in comparison to the market. Beta can be discovered online or computed using regression, which involves dividing the asset and market returns’ covariance by the market’s variance.

βi < 1: Asset i is less volatile (relative to the market)

βi = 1: Asset i’s volatility is the same rate as the market

βi > 1: Asset i is more volatile (relative to the market)

An alternate method to figure the cost of equity is to see it as the stock value that should be kept everything under control to hold financial backers back from selling the stock. The cost of equity formula in this technique is made up of three sorts of returns: a risk-free return, an average rate of return expected from a typical broad-based group of stocks, and a differential return based on the risk of a given stock in relation to the wider group of companies. From the point of view of capital suppliers, loan specialists look to be remunerated with revenue and value financial backers look for profits or potentially appreciation in the worth of their venture (capital increase).

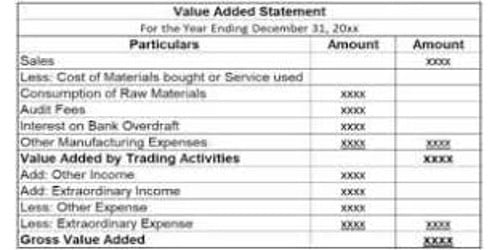

From the standpoint of a company, it must pay for the capital it acquires from others, which is referred to as its cost of capital. These costs are divided into two categories: debt and equity, and attributable to these two types of capital sources. The profit capitalization model can be utilized to ascertain the cost of equity, yet it necessitates that an organization delivers profits. The computation depends on future profits.

The Dividend Capitalization Model only applies to dividend-paying corporations and assumes that dividends will grow at a steady rate. The model does not take into consideration investment risk in the same way as the CAPM model does (since CAPM requires beta). The hypothesis behind the condition is the organization’s commitment to deliver profits is the expense of paying investors and along these lines the expense of value. This is a restricted model in its understanding of expenses.

While a company’s current cost of debt may be determined reasonably easily by looking at interest rates in the capital markets, its current cost of equity cannot be observed and must be inferred. However, the capital asset pricing model can be applied to any stock, even if it does not pay dividends. All things considered, the hypothesis behind CAPM is more muddled. Money hypothesis and practice offers different models for assessing a specific association’s expense of value, for example, the capital resource evaluating model, or CAPM.

According to the theory, the cost of equity is determined by the stock’s volatility and risk level in comparison to the overall market. The Gordon Model, which is a discounted cash flow model based on dividend returns and eventual capital returns from the sale of the investment, is another technique. Another straightforward strategy is the Bond Yield Plus Risk Premium (BYPRP), where an abstract danger premium is added to the company’s drawn out obligation loan cost. Organizations normally report profits far ahead of the circulation. The data can be found in the company’s filings. If the information isn’t available, a guess can be formed.

A corporation with a high beta, or a high degree of risk, will have a higher cost of equity in general. In addition, the cost of equity can be estimated by estimating the market implied cost-of-capital using the discounted residual income model. Depending on who uses it, it might indicate two distinct things. Investors use it as a benchmark for a value venture, while organizations use it for projects or related speculations. As indicated by money hypothesis, as an association’s danger expands/diminishes, its expense of capital builds/diminishes. This hypothesis is based on human behavior and logic: capital providers expect to be compensated for lending their money to others.

The cost of equity solely pertains to equity investments, whereas the WACC (Weighted Average Cost of Capital) considers both equity and debt investments. If the company does not have any debt, it can be used to calculate the relative cost of an investment (i.e., the firm only raises money through issuing stock). At the point when an organization chooses whether it takes on another financing, for example, the expense of value decides the return the organization should accomplish to warrant the new drive. Cost of value can be utilized as a markdown rate if financial backers utilize levered free cash flow (FCFE).

Companies often raise capital in one of two ways: through debt or through equity. Each has its own set of expenses and returns. Since FCFE is the cash accessible to equity investors, the cost of equity indicates the cost of raising money from equity investors, and it is the proper rate to discount FCFE by. An alternate method to figure the expense of value is to see it as the stock value that should be kept everything under control to hold financial backers back from selling the stock. The cost of equity formula in this technique is made up of three sorts of returns: a risk-free return, an average rate of return expected from a typical broad-based group of stocks, and a differential return based on the risk of a given stock in relation to the wider group of companies.

Information Sources: