Credit policy for Corporate Clients of Mercantile Bank Limited

This report is based on ‘Credit Policy for Corporate Clients of Mercantile Bank Limited’ which is prepared from the experiences gained by working in Credit Department at MBL. At the present time, Banks and Financial Institutions are becoming very competitive and various kinds of services and products provided by financial institution are increasing with rapid growth. People need money to accommodate their livelihoods as well as updating with the present world of living, therefore people take ‘Credit/Loan’ from the bank. For this reason different organizations require credit facilities from the bank to run their business so that they can meet the need of people by their various types of products and services. This report focuses on different credit facilities provided to the Corporate Clients by Mercantile Bank Limited and the procedure of lending such.

With the clear mission to provide efficient banking services and to contribute socio-economic development of the country, Mercantile Bank Ltd emerged as a new commercial bank and inaugurated its operation on 2nd June, 1999. The bank has 86 branches all over the country up to 2014. There are 30 sponsors involved in creating Mercantile Bank Limited. The sponsors of the bank have a long heritage of trade, commerce and industry. They are highly regarded for their entrepreneurial competence.

The major task for a bank is to survive in the competitive environment of credit service by managing its assets and liabilities in an efficient way. And Mercantile Bank Limited manages the assets and liabilities effectively. Consequently it is achieving success and prosperity. It operates in a disciplined and prudent manner with a focus on driving productivity initiatives with delivering sustainable improvements in business practices.

Introduction

Mercantile Bank Limited is considered as one of the leading banks in Bangladesh. This is a blend of development and commercial bank. It has been established to promote banking activities in the country. It is committed to provide high quality services to its clients through different financial products and profitable utilization of fund and contribute to the growth of GDP of the country by financing trade and commerce, helping industrialization, boosting export, creating employment opportunities for the educated youth and encouraging agriculture and micro- credit leading to poverty alleviation and improving the quality of life of the people and thereby contributing to the overall socio- economic development of the country.

Historical Background of Mercantile Bank Ltd:

Mercantile Bank Ltd was established on May 20, 1999 and started its operation on June 02 on the same year. It was founded as banking company under the companies Act 1913. The bank is governed by the bank companies Act 1991. According to CAMELS (Capital adequacy, Assets, Management capability, Earnings, Liquidity, Sensitivity) rating, it was given the top ranking after applying all the ten creation that are required to judge a bank’s overall performance.

The first branch of MBL was opened at Dilkusha commercial area in Dhaka. It became as a public limited company on May 20, 1999. MBL enlisted in Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) on February 16, 2004 respectively. It has two subsidiaries namely Mercantile Bank Securities Ltd. (MBSL) and Mercantile Exchange House (UK) Limited.

On June 2010, MBSL was created to deal with stock dealing and brokering. After obtaining stock dealer and broker license from appropriate authority it started commercial operation on September 14, 2011. Another subsidiary of MBL that is Mercantile Exchange House (UK) Limited was incorporated as private limited company on December 06, 2010, whereas it started its business operation on December 06 2011.

Product/ Service Offerings of MBL

The bank is continuously differentiating itself from other banks through its products and services. Their service is only for their target customers to fulfill their needs so that their needs and demands can be met accurately. The bank is proud to have exemplified the true concept as “Bungler Bank”. Therefore it launched several financial products and services. These are as follows

Deposit Products:

- Current Deposit (CD) Accounts

- Savings Bank Deposit (SB) Account

- Fixed Deposit Receipt (FDR)

- Scheme Deposit

- Monthly Saving Scheme (MSS)

- Double benefit deposit scheme (DBDS)

- Family maintenance deposit scheme (FMDS)

- Quarterly benefit deposit scheme (QBDS)

- Special saving scheme (SSS)

- Education planning deposit scheme (EPDS)

- Super benefit deposit scheme (SBDS)

- School Banking

Loan & Advances:

Mercantile Bank Ltd. provides following types of loans to their clients

Retail Loan:

- Consumer credit scheme

- Lease finance

- Car loan scheme

- Home loan scheme

- Doctors’ credit scheme

- Any purpose loan ( personal loan scheme)

- House furnishing loan

- Overseas employment loan scheme

- Cottage Loan

- Education Loan

- Rural Development scheme

Corporate Loan:

- Short Term Finance

- Long Term Finance

- Real Estate Finance

- Import Finance

- Construction Business

- Export Finance

- Structured Finance

- Loan Syndication

SME Financing:

- Chaka (Term Loan)

- Samriddhi (Continuous loan)

- Mousumi (Short term seasonal loan)

- Anannya (Women entrepreneur’s loan)

Agriculture Loan:

- Nabanno (Polli loan)

- Sakti (Solar energy loan/Bio gas)

MBL Card:

- Debit Card

- Credit card (Local card, international card, Duel currency card)

- MBL pre- paid card (Student card, hajj card, travel card)

E-banking Services:

- Online Banking

- Mobile financial services (My Cash)

NRB Banking

Locker Services

Credit Policy for Corporate Clients of Mercantile Bank Ltd

Summary

The credit policy of any banking institution is a combination of certain accepted, time tested standards and other dynamic factors dictated by the realities of changing situations in different market places.

The accepted standards relate to safety, liquidity and profitability of the advance whereas the dynamic factors relates to aspects such as the nature and extent of risk, interest or margin, credit spread and credit disposal. In all business dealings, officers and employees must be guided by the principles of honesty, integrality, and safe-guard the interest of the depositors & shareholders of the bank. They should strictly adhere to the Banking Laws, Rules, and Regulations of the Govt. of Bangladesh and the guidelines issued by the Bangladesh Bank/ Head Office from time to time which affect the business practices of the Bank. However, the key to safe, liquid, healthy, and profitable credit operations lies in the quality of judgment used by the executives/ officers making lending decisions and knowledge of the borrower and the market place.

At present, the bank has wide branch network coverage in both rural and urban areas of the country and every new branch is added with the task force. Credit portfolio of the bank has been growing at a constant pace every year.

Asset quality of the bank was never compromise under any circumstances. As the lion’s share of the total revenue comes from credit operation and the existence of the bank depends on quality of asset portfolio, efficient management.

Description of the Project

Objective of the Project

The report is prepared on “Credit Policy for Corporate Clients of Mercantile Bank LTD.” with thought of getting in depth of credit management process.

Broad Objective is to analyze properly the credit policy of Mercantile Bank Ltd for their corporate clients.

Specific Objectives:

- Evaluate the credit risk management tools for better effectiveness.

- To get the knowledge of Mercantile Bank Ltd overall credit policy and the real scenario of their recovery process whether it is really matching with the rules and regulations or not.

- To acquire practical experience in different credit policy in Mercantile Bank Ltd.

- To find out the weakness and strengthens of the current credit policy.

Methodology

Sources of Data

Both primary and secondary data were used to complete the report. The main primary source of data is the information collected from employees of the Credit Department by taking interviews several time. Secondary data is most important for providing information properly. The secondary source of data is the documents and rules book of Credit Department of Mercantile Bank Ltd.

Primary Data:

- Direct conversation with respective officers and clients

- Personal observation

Secondary Data:

- Credit rules of Mercantile Bank

- Data from Annual report of MBL.

- Relevant files provided by the officers.

Lending Guidelines

Basics of Lending:

Before selecting a corporate client and subsequent recommendation for financing, the credit officer / relationship manager must observe the following basics of lending:

Portfolio Management Analysis:

Portfolio management may be defined as the allocation of funds amongst investment alternatives to maximize the profit and minimize the risks. In this regard bank’s policy is to deliver the business and allocate the fund in different sectors in consideration of the followings;

- Maximum concentration to a single sector should be maximum 25% of investable fund.

- Prospect of the business and thrust sectors

- Economic trend

- Historical growth and performance of the products

- Ensure maximum return keeping the risk at minimum level

- Government incentive policies

Corporate Banking Division, SME Division, Retail Banking Division, and Agriculture Credit Dept. prepare sector wise budget annually and provide it to Research and Planning (R&P) Division for placing to the competent authority of the bank for information, guidance, and approval.

Industry and Business Segment Focus:

As a general practice, Mercantile Bank Ltd. definitely concentrate its business in Trade Finance / Export- Import business and all types of commercial loan, industrial / project finance/syndication and structured finance/ SME Financing / Agricultural/ Rural and other specialized programs except otherwise restrict by the government.

The bank gives emphasize to diversity its business portfolio matching with economical cycle order, business trend, life cycle of the products, demand supply gap, social and national obligation etc.

Lending Caps

- The bank management establishes a specific industry sector exposure cap to avoid over concentration in any one industry sector. Considering the cycle aspect of the economical growth for each sector, sector- wise allocation of credit with growth is made annually with the approval of the executive Committee of the Board.

- Diversification of the Credit portfolio is encouraged so as to reduce the risk of dependence on a particular sector for balanced socio-economic development of the country.

- Branches submit a report outlining trend and outstanding loan portfolio of each sector to the head of credit risk management division on quarterly basis for submission to the board of directors for information guidance.

Discouraged Business Types:

The bank will discourage lending to following areas of business

- Military equipment or weapons finance

- Tobacco sector

- Companies listed on CIB black list or known defaulters

- Highly leveraged transactions

- Finance of speculative investments

- Logging, mineral extraction or other activity that is ethically or environmentally sensitive

- Counter parties in countries subject to UN sanctions

- Taking an equity stake in borrowers

- Lending to holding companies

Loan Facility Parameters:

The loan facility parameters for the bank have been set as following

- The bank in general approves or renews short periodic trade finance or working capital facility for the period of one year from the date of approval, disbursement or last expiry date.

- The bank will extend short term loan for up to 12 months and medium term loan for above one year up to five years period.

- The bank will extend long term loan for maximum period of ten years including grace period up to eighteen months ( depending on the nature of the project0 for project finance but in case of need, in syndication or club financing, the bank may extend the period as per agreement of the syndicated members.

- In case of house building loan (commercial), the repayment period will be maximum of five years for developers.

- Besides above, the bank will extend credit facilities for special program like SME Financing, Agriculture / Rural Credit, Women Entrepreneurship development Project, Refinance Scheme for Solar Energy, Bio Gas and ETP, Green Finance etc to be set by the ban under the policy guidelines of the specific scheme.

- The rate of interest, commission, charges, fees etc would be as per the approved circular of charges as per Bangladesh Bank guidelines and with the approval of competent authority.

- The interest rate would be charged and to be paid out on quarterly basis except the special schemes.

- Repayment of term loan would be fixed preferably on monthly or quarterly basis.

- Margin for L/C preferably in cash should be on the basis of banker- customer relationship subject to minimum requirement of Bangladesh Bank.

- For import of capital machinery, margin for L/C would be preferably 5%- 30% or on the basis of banker- customer relationship subject to minimum requirement of Bangladesh Bank.

- Security accepted against credit facilities will properly be valued and will be effective in accordance with laws of the country. An appropriate margin of security will be taken to reflect such factors as the disposal costs or potential price changes of the underlying assets.

- Accepted securities are cash / cash equivalent like FDR, balance on CD ( Current Account), STD account etc, land and building (in the form of registered mortgage with registered IGPA), ownership of plant, machinery, stock of goods, assignments of bills / receivables, book debts, pledge of shares, guarantee / corporate guarantee etc.

- Valuation of the above mentioned securities will be done by the bank’s enlisted professional surveyors. Branch also will make valuation on the offered securities duly endorsed by the Head of Branch. However, revaluation of the property will not be done within three years.

- The value of the mortgage property will preferably be doubled of the facility to be extended depending on other security coverage. The Managing Director may relax the security conditions depending on banker-customer relationship and potentiality of the business of the client.

Any other exception of the loan parameters mentioned above is subject to be approved by the Executive Committee of the Board of Directors.

Types of Credit Facilities for Corporate Clients:

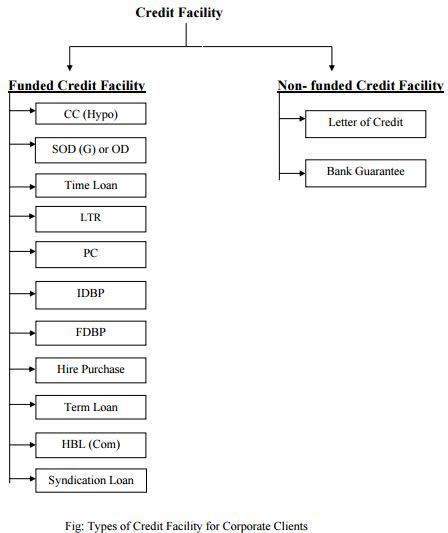

Depending on the various nature of financing all the credit facilities are divided into two major groups. One is Funded Credit and another one is Non-funded Credit.

Funded Credit Facilities:

Any type of credit facility which involves direct outflow of bank’s fund on account of borrower refers to funded credit facility. The followings are the funded credit facilities which are practiced in the Mercantile Bank Ltd.

Cash Credit (Hypothecation):

This is a continuous credit limit allowed for trading as well as manufacturing, assembling, other value adding units to procure and maintain the stock in trade for trading units and stock of raw material (RM), work in process (WIP) and finished goods (FG) for manufacturing, assembling and other value adding units.

Feature:

- This is a continuous loan

- Continuous drawing and adjustment is possible

- Validity of the limit may be one year or less

- It is adjusted through crediting sale proceeds in the account on regular basis. Desired yearly credit turnover in the account in four times of the credit limit.

- Stock in trade remain under customer’s lock and key

- Pricing mode: Interest

- Primary security is hypothecation of stock in trade or stock of RM, WIP and FG.

From the above graph it can be noticed that the amount of CC (Hypo) loan has been increased in the last year and it is the highest amount among the last three years. So it indicates that the bank attracts new clients through this facility.

In MBL Anwar Ispat Ltd. got this facility for purchasing raw materials in order to manufacture their products. On the other hand, to meet the requirement of working capital Arrival Fashion Ltd. got this facility from MBL as well. Additionally, Enam Motors had this credit facility from the bank to purchase car tire, IPS battery etc. Therefore, it is clear that organization can have this facility according to meet their different conceded purpose.

Secured Over Draft (General) or Over Draft:

This continuous credit limit is allowed for different business purposes specially service oriented business enterprise who does not maintain stock including meeting working capital requirement. The facility also allowed for payment of duty, tax, VAT against import business.

Features:

- This is a continuous loan

- Continuous drawing and adjustment is possible

- Validity of the limit may be one year or less

- Pricing mode: Interest

- Primary security may not be available but in case of SOD (Gen) or OD against other bank’s deposit, lien on underlying deposit

From the above graph it can be seen that the amount of SOD (gen) has been increased at a satisfactory level in the last year which indicates the existence of positive reputation regarding the bank among the clients. As a result, new clients are taking this loan from the bank. A travel agency named Al-rafi Travel Trade had this facility from this bank in order to provide their service. Additionally, Faria’s Fashion Ltd. received this facility from MBL to pay their duty, tax, VAT etc.

iii. Time loan:

This is a very specific purpose of short time. The facility is allowed to favouring the customer usually for the following reasons:

- To meet emergency/ seasonal fund requirement in the business

- The facility is allowed in some forced circumstances such as encashment of bank guarantee, against letter of credit and other commitment of the bank where customer fails to pay.

- This loan is also allowed as a post import facility against sight L/C (local)

Features:

- It is a short term demand loan. Maximum validity can be 180 days.

- It is a single time disbursement loan with specific purpose and validity.

- Pricing mode: Interest

- Primary security is hypothecation of stock in trade, work in process, finished goods

Time loan has been increased in last three years. It means that the bank continuously attracts new clients through this service. In 2014, Benhid Apparel Bangladesh Ltd. got this credit facility from Mercantile Bank Ltd. Another name of organization that got this facility from this bank is Masud Enterprise.

Non-Funded Credit Facility:

Any type of credit facility which involves commitment of bank on behalf of customer for payment to third party in some agreed conditions refers to non-funded credit facility. The followings are the non-funded credit facilities practiced in Mercantile Bank Ltd.

Letter of Credit (L/C): This is an obligation to the exporter’s bank the importer for import of any permissible item from both local and foreign sources. The Authorized Dealer (AD) branches are allowed to operate the L/C business.

Features:

- L/C governed by the UCPDC-600

- An L/C transaction is guided by foreign exchange guidelines of central bank, Foreign Exchange Regulation (FER) and import policy

- Bank is obliged to pay the beneficiary (exporter) on complied presentation of documents

- L/C is of different types. They are sight L/C, Deferred L/C, Back to Back L/C. MBL is providing this facility in a regular basis to Arrival Fashion Ltd, Reytex Fashion Wears Ltd. and many other organizations.

Bank Guarantee: A bank guarantee is an unconditional undertaking of the bank on account of its customer in favour of the beneficiary to pay a specified amount of money if the customer (on account of which guarantee is issued) fails to fulfill the contractual obligation.

Features:

- The guarantee is unconditional and irrevocable

- Bank is obliged to pay the beneficiary on lodgment of claim by the beneficiary

- Pricing mode: Commission usually on quarterly basis.

- Primary Security: Counter guarantee of the customer.

General Covenants:

While sanctioning credit facility Mercantile Bank Ltd. will set some covenants. Some of these are general and others are specific to a particular credit facility and/ or customer. These are as follows

- The customer cannot sell or transfer the ownership of the business, factory, shop and vehicle etc until bank dues are fully paid or without NOC of the bank.

- Nature of business cannot be changed without prior approval of the bank

- Capital in the business of the borrower cannot be reduced without prior approval of the bank

- The borrower cannot make any amendment or alteration in Memorandum & Article of association without prior approval of the bank

- The customer is not allowed to borrow from any other source without prior approval of the bank

- The customer need to submit financial statements within 30 days after year end

- Bank will have the authority to debit client’s account to keep insurance policy with other charges, commissions, interest including stamps cost etc in force.

Credit Risk Assessment, Credit Risk Grading

Credit Risk Assessment process of MBL:

A thorough credit and risk assessment need to be conducted for all types of credit proposals. That’s why credit risk assessment is being done properly in Mercantile Bank Ltd. Therefore, the results of assessment are presented in the approved credit appraisal form originated from the branches and zonal office of this bank and forwarded to corporate banking division along with their recommendation. Then the Relationship Managers (RM) of the corporate banking division conducts assessment with due diligence on new borrowers, existing borrowers for renewal/enhancement of existing credit line or sanction of new credit facility, principals, and guarantors. After proper analysis, that division forwards it to the Credit Risk Management (CRM) Division with their proper recommendation. After getting recommendation on the proposal, CRM Division places the proposal to the Credit Committee. According to the decision of the credit committee, CRM Division places the credit proposal as per standard format with their necessary observation, recommendation before the management for consideration to approve and to place the same before the board for approval.

Credit Appraisal summarizes the results of Credit Officers/ RMs risks assessment and includes the following details

- Amount and type of loan(s) proposed

- Purpose of loan(s)

- Results of financial analysis

- Up to date and clean CIB (Credit Information Bureau) Report of the borrower as per Bangladesh Bank’s guideline

- Borrower’s credit report

- Loan structure ( tenor, covenants, repayment schedule, rate of interest)

- Security arrangements

In addition, the following risk areas should be addressed

Borrower Analysis: The majority shareholders, management team and group or associate companies should be assessed. Any issues regarding lack of management depth, complicated ownership structures or inter group transactions should be addressed and risks mitigated.

Industry Analysis: The key risk factors of borrower’s industry should be assessed. Any issues regarding the borrower’s position in the industry, overall industry concern or competitive forces should be assessed and the strengths and weakness of the borrower relative to its competitors should be identified.

Supplier/ Buyer Analysis: Any customer or supplier concentration should be addressed, as these could have a significant impact on the future viability of the borrower.

Historical Financial Analysis: An analysis of a minimum of three years historical financial statements of the borrower should be presented. Where reliance is placed on a corporate guarantor, guarantor financial statements should also be analyzed. The analysis should address the quality and sustainability of earnings, cash flow and the strength of the borrower’s balance sheet. Specially, cash flow, leverage and profitability must be analyzed.

Projected Financial Performance: When term facilities (tenor >1 year) are being proposed, a projection of the borrower’s future financial performance are provided, indicating an analysis of the sufficiency of cash flow to service debt repayments. Loans are not granted if projected cash flow is insufficient to repay debts.

Account Conduct: For existing borrowers, the historic performance in meeting repayment obligations (trade payments, cheques, interest and principal payments etc) areassessed.

Mitigating Factors: Mitigating factors for risks identified in the credit assessment need to be identified. Possible risks include, but are not limited to: margin sustainability and volatility, high debt load (leverage), overstocking or debtor issues, rapid growth, acquisition or expansion; new business line/ product expansion, management changes or succession issues, customer or supplier concentration and lack of transparency or industry issues.

Loan structure: The amounts and tenors of financing proposed should be justified based on the projected repayment ability and loan purpose. Excessive tenor or amount relative to business needs increases the risk of fund diversion and may adversely impact the borrower’s repayment ability. Before granting loan managers of MBL estimate all these aspects properly.

Security: A current valuation of collateral should be obtained and the quality and priority of security being proposed should be assessed. However, loans are not granted based only on security. Adequacy and the extent of the insurance coverage are also assessed.

KYC Concept:

The credit officers/ RM must know their customers and conduct due diligence on new borrowers, principals and guarantors to ensure such parties are in fact who they represent themselves to be i.e. Know Your Customer (KYC). The banker-customer relationship would be established first through opening of CD/ SND/ SB accounts. Proper introduction, photographs of the account holders/ signatories, passport/National ID, trade license, memorandum, Articles of the company, certificate of incorporation, certificate of commencement of business, list of Directors, board resolution papers as per bank’s policy and regulatory requirements are to be obtained at the time of opening of the account. Information regarding business pattern, nature of business, volume of business etc. are ascertained. Any suspicious transaction must be timely addressed and brought down to the notice of head office or Bangladesh Bank as required and also appropriate measures is taken as per the director of bank management and Bangladesh Bank from time to time.

Credit Approval Authority

Credit Approval Authority:

Mercantile Bank Ltd. believes in decentralization of powers. In order to implement the system of delegation of powers effectively, and to derive the desired benefit for the bank, the bank has developed a system to ensure that the delegated authority exercised by the executives can be evaluated realistically and qualitatively. For that purpose, the bank has developed a Management Information System (MIS) so that the Board of Directors gets prompt and systematic feedback about how effectively and efficiently the delegated authority is being exercised by the executives. For the purpose of investment of bank’s fund, the fundamental principle is ‘Safety first, Business next’.

Credit Approval Authority is delegated to the following body/ Executive

i. The Board of Directors

ii. The Executive Committee of the Board

iii. Different tier of the management

The Board of Directors:

The Board of Directors has the authority to sanction any loan for the amount not exceeding the regulatory limit the bank can provide to a single customer.

- All proposals for the waiver of interest, commission, charges etc must be approved by the Board of Directors.

- Any proposal for reduction rate of interest as per agreeable range of the rate set by central bank from time to time.

- All large loan of the bank must be approved by the Board of Directors.

- If the consolidated result against Environment Risk is high, in that case any credit proposal loan (irrespective of amount) will be needed approval from the Board of Directors.

The Executive Committee of the Board:

The executive committee of the board of Directors may sanction any loan for the amount not exceeding the regulatory limit. However, it will not have the authority to approve any proposal for waiver of principal. Any proposal beyond the delegated authority of the Managing Director will be placed before the executive committee of the board for approval.

The Management:

Different tier of the management can delegate credit approval authority to ensure timely disposal of the credit proposals at root level. In the Management, the following executives can do so

- The Managing Director & CEO can execute all the powers provided to other executives/officers of the bank.

- The Managing Director & CEO can delegate the business power (as approval by the Board of Directors) to Additional Managing Director/ Deputy Managing Director/ Executives/ Officers of the bank by a separate letter issued by him or under his order.

- Executives and officers authorize to exercise delegated powers only when posted as InCharge of branch/ Zonal Office/ Division.

- The Managing Director may suspend or reduce delegated powers of any executive / officer through specific or general order at his discretion by the prior/ post fact approval of the Board.

- The sanctioning authority exercises their discretion and judgment at the time of applying delegated business powers.

General Principles for Credit Approval Authorities:

In exercising the powers, authorized officials abide by credit restrictions, CIB clearance, CRG restriction, margin restrictions, stipulation regarding period of repayment in force from time to time etc. followings are some general principles for credit approval authorities

- The credit approval function has been excluded from the corporate/ relationship management function.

- If there is any requirement for better functioning of the delegation of business power, then the Managing Director will be empowered in line with the judicial guidelines of Bangladesh Bank to assign any executives with that power for credit approval of all cases from higher authority to lower authority within the approved structure.

- Any limit approved by the executives should be within his/her delegated power as consulted to them by Managing Director and CEO. Pooling or combining of delegation powers of the executives is not permitted.

- Any credit proposal that does not comply with lending guidelines, regardless of amount should be identified in the applications and a justification for approval must be referred to Head Office for approval by the competent authority.

- Any branches of lending authority must report to Managing Director & CEO, Head of Internal Control and Head of CRM.

- The schedule of business powers lay down in delegation of business power is the maximum power against per customer. A customer means Individual, Proprietorship firm, partnership firm, duly registered, Private Limited Company, Public Limited Company, joint venture, Co-operative Society duly registered, Trustee Board operating private education/ health institutions, Micro financing Institution duly registered.

- While determining sanctioning power for each customer against different types of credit facilities, the existing limit and the proposed amount of limit are taken together and the total amount of a particular facility must not exceed the delegated power of sanctioning authority of the specific type.

- A customer should not be allowed credit facilities in different natures or types from branches without the approval of Head Office. However, L/C facilities with eventual liquidation facility such as LTR, HP, Lease Finance can be allowed within business delegation.

- A party should not be allowed credit facilities in different names or from different branches without the authority of Head Office. A party means any one person/ firm/ company/ concern and includes his/ its sister concerns.

- No business power will be applied to accommodate customers to whom Head Office has already sanctioned limit or proposals of which have already declined by head Office. However, the above mentioned credit facility will be renewed if it falls within the revised business power or business power of concerned authority is increased due to change in post or designation.

- Authority beyond delegated power will be exercised by the Executive Committee or the Board of Directors.

- There is no power to sanction any clean advance without any security (primary, collateral, guarantee). If for any reason, clean advance needs to be approved, are placed before the Board/ the Executive Committee of the Board for consideration.

- The customer to whom credit is allowed should be as far as possible within the command area meaning area of operation of the branch.

- Sanctioning authority cannot involve in the sanctioning process of any credit to any of his/ her near relations and to any firm/ company where his/ her relations have financial interest. Such cases are sent to Head Office for consideration.

- No loan or advances are sanctioned to any Director of the bank or any firm or company where they have interest as Proprietor / Partner/ Director or to their family members as defined in the Bank Companies Act, 1991.

- There is Credit Committee at Head Office and branch. In case of any disagreement between the committee and the concerned Executive, the matter is referred to the Managing Director for disposal for the greater interest of the bank.

- Above mentioned rules containing schedule of powers are treated as strictly confidential and are always in the custody of the executive/ officer to whom it has been issued.

Loan Recovery process of Mercantile Bank LTD.

Credit Monitoring Policy

Credit monitoring process starts immediately after disbursement of the facility. Steps involved in monitoring process are as follows

Step-1: The customer starts repayment of the loan. At the same time, branch relationship officer starts monitoring the loan on on-site basis. If he/she finds any inconsistency to the terms and conditions of the sanction or borrowers financial health, then he/she prepares an Early Alert Report and sends it to the Monitoring, Recovery and Compliance Division, Head Office.

Step-2: Simultaneously, Monitoring, Recovery & Compliance Division monitors the loan on an off-site basis and reports its findings to the Credit Risk Management Division. It may propose revising the customer’s risk grading. Credit Risk Management Division ultimately decided on the customer and directs Corporate Banking Division to take necessary action.

Step-3: The relationship officer regularly reminds the customer as per decision of the Credit Risk Management Division about the irregular repayment, if any breach of contract through letter or phone call or visit in person.

Classification of Loans & Provisioning system

In order to strengthen credit discipline and improve the recovery position of loans and advances by the bank, Bangladesh Bank introduced a system covering loan classification which is completely followed by MBL. In this system if bank suspense any interest due then will make provisions against potential loan loss. For loan classification and provisioning system, the bank follows Bangladesh Bank guidelines.

Non-Performing Loan (NPL) monitoring:

On a quarterly basis, a Classified Loan Review (CLR) will be prepared by the Monitoring Recovery & Compliance Division’s (MRCD) account manager to update the status of the action or recovery plan, review and assess the adequacy of provisions and if required then modify the bank’s strategy. The Head of Chief Risk Officer (CRO) approves the CLR for NPLs up to 15% of the bank’s capital. In excess of 15% of the bank’s capital, MD’s approval will be required.

The CLR’s for NPLs above 25% of capital should be approved by the MD/CEO with a copy presented before the Board of Directors.

Findings and Recommendation

Findings

During writing this report I have gone through different aspects of Credit policies and procedures of Mercantile Bank Limited. By analyzing, I have identified the following findings as importantly

- Political and Social Pressure on granting loans: Often the bank faces pressures from different political, social persons to make consideration in granting loan to their recommended applicant. Though the applicant might fail to satisfy conditions in some cases, for example the collateral security offered by the applicant is not matched with demanded loan amount (under-valued) or Credit Officer can guess the chance of being default of the sanctioned loan. Still they grant loan to such customer because of continuous pressures from respective political person sometimes from the Director of the bank as well.

- Fund Diversion by the Borrower: Sometimes it happens that the bank provides loan to a client for business purpose which might be used in personal uses by that client. In such cases the bank faces problem of getting periodical installments from that particular client within specific time. By investing the loan amount in other purposes the clients violate the conditions of credit policy. Ultimately, the bank confronts with difficulties to have periodical repayment if the client fails to pay the installment within the specific time.

Recommendation:

For effective Credit policy for Corporate Clients there are some recommendations which are as follows:

- Bottlenecks or barriers should be removed by taking advanced steps in mode of disbursement, charge documents and approval process.

- Business Delegation Power for sanctioning and approving loans and advances can be increased at branch level. Meaning centralization of credit approval policy should be made decentralized to reduce time and complexity of sanctioning loans

- The Bank should organize more conference in overseas, work shop and seminar for more expansion of corporate loan. It means they should increase their promotional activities to attract new corporate clients.

- The sectors where the bank is investing should need much more concern and need a revision so that desired outcome can be obtained from every investment. Also should try to overcome the pressures for granting loan to particular clients.

- Industry wise integrated Credit Risk Grading systems should be developed by the bank. So that risk can be measured for different industry of business.

- Training is the key factor for development of the risk managers´ skills. Mercantile Bank Ltd. should provide a regular training and development program so that risk managers are able to know every risk matters and assessment techniques.

- Team effort helps a bank to obtain its goal perfectly and systematically. So existence of strong co-ordination with the related divisions and departments is very much required.

Insurance coverage should be obtained immediately for every funded and non funded credit facility. So that in case of uncertainty and damage like fire, strike, riot etc. bank and borrower can save themselves form financial losses.