Origin of the Study:

This report is originated as the post graduation requirement of MBA program of International Islamic University Chittagong (Dhaka Campus). This report is Assigned by Dr. Md. Jahirul Islam , Professor & Head, Department of Business Administration, International Islamic University Chittagong (Dhaka Campus).

Objective of the Study:

The premier objectives of this study are:

- To get an overall idea of banking functions of PBL as a financial institution

- To know the overall performance of Premier Bank Limited

- To determine the size of the import & export business in Premier Bank Limited.

- To analyze the economic benefits accrued by Premier Bank Limited providing general banking and promoting foreign trade business

- To know the various banking functions of PBL

- To identify the causes of customer dissatisfaction

Suggesting strategies to improve the Banking functions of Premier Bank Ltd. Mohakhali Branch.

3 Scope of the Study:

Scope means the area of operations. This study has covered operational, financial, structural, functional and overall performance of Premier Bank Ltd. Karwan bazar Branch.

4 Methodology:

The report has been prepared on the basis of the experience gained during the period of the internship. The important features of the report are the use of both primary and secondary data.

Source of Information:

The data was collected from two sources:

Primary Source:

- Personal experiences gained by the visiting different desk.

- Personal investigation with bankers.

Secondary Source:

- Different “Procedure Manual” published by The Premier Bank Ltd.

- Publications of Newspaper.

- Publication of Journal.

- Internet.

- Annual Report 2007-2008.

Limitations of the Study:

During my internship in Premier Bank Ltd. Karwan bazar Branch, I have faced same Problems. These are as follows:

- Time allocation (3 Months) was too short to learn the overall banking functions and performance of Premier Bank Limited.

- Due to the shortages of time, I have not gone to branches outside of Dhaka. As a result, the performance is only measured on the basis of Dhaka-based.

- I can not consult with PBL officials because of their excessive busy.

In spite of all the limitations, that I have faced in conducting the study and making the internship report, everything has been managed well at the hand. I believe that it is a qualify report on banking functions of Premier Bank Ltd.

The Premier Bank Limited- At a Glance:

The banks play an important role in the economy of the country. After liberation expects the foreign banks all banks were nationalized. These banks were merged and grouped into six commercial banks. Of the total six commercial banks Uttara and Pubali were transferred to private bank on 1985. The financial system of Bangladesh consists of Bangladesh bank (BB) as the central bank, 4 nationalized commercial banks (NCB’s), 5 government own specialized banks, 30 domestic private, 10 foreign banks and 28 non-bank financial institutions are existing in our economy.

Profile of the Premier Bank Ltd:

The Premier Bank Limited (PBL) is incorporated in Bangladesh as banking company on 10th June 1999 under Companies Act 1994. Bangladesh Bank, the central bank of Bangladesh, issued banking license on 17th June 1999 under Banking Companies Act.1991. The Head Office of The Premier Bank Limited is located at 42 Kemal Ataturk Avenue, Banani, Dhaka, one of the fast growing commercial and business areas of Dhaka city. Now It is operating with twenty two Branches all over the country. The Premier Bank also incorporated Islamic Banking division along with normal banking facilities to meet the demand of all types’ customers in Bangladesh. The Premier Bank also introduced on line banking facilities to enhance customers’ facilities all over the country. People can draw and deposit money from any part of the country. Visa Credit Card facilities also a fascinating product of PBL. It has both local and international credit facilities for the customers. PBL came in the banking sector in Bangladesh with complete service. It is the most successful and fastest growing third generation in Bangladesh. Service is the first priority for Premier Bank Limited.

Corporate information:

The Premier Bank Limited is managed by a group of dynamic Board of Directors drawn from different segments. They hold very respectable positions in the society and are fro highly successful group of business and Industries in Bangladesh. The bank has a very competent Management Team who has enough knowledge and experience in domestic and international banking. The bank uploads and strictly abides by good corporate governance practices and is subject to the regulatory supervision of Bangladesh bank.

The Authorized Capital of the Bank is: BDT 6000.00 Million

Capital Funds is: BDT 3994.50 Million including

Paid-up Capital is: BDT 2242.30Million

The Capital Adequacy ratio is 14.63% as against required 11.30%. The bank is full fledged Commercial Bank and licensed by Bangladesh Bank. The bank has a strong capital base, with no insider lending and low non-performing loans (0.43%).

Board of Directors:

The Board consist of 15 (Fifteen) Directors. The members of the Board of Directors of the Bank hold very respectable positions in the society. They are from highly successful group of Business and Industries in Bangladesh. Out of 15 members one is from Taiwan. Each member of the Board of Directors plays a significant role in the socio-economic domain of the country.

PBL’s Value:

PBL’s value statement is “Service First’ PBL’s hold the following value:

Strong customers focus and build relationship based on integrity superior service and mutual benefits-

- Work as a team to serve the best interest of the group.

- Relentless in pursuit of business innovation and improvement and empowerment.

- Value and respect people and make decision based on bank interest.

- Recognitions and rewards based on performance.

- Open and honest communications.

- Responsible trust worthy and law abiding in every activity.

Vision of the Bank:

“To be the best amongst the top financial institutions”.

Mission of the Bank:

- To be the most caring and customer friendly provide of financial services, creating opportunities for more people in more places.

- To ensure stability ands sound growth whilst enhancing the value of shareholders investment.

- To aggressively adopt technology at all levels of operations and to improve efficiency and reduce cost per transactions.

- To ensure a high level of transparency and ethical standards in all business transacted by the bank.

- To provide congenial atmosphere which will attract competent work force who will be proud and eager to work for the bank.

- To be socially responsible and strive to uplift the quality of life by making effective contribution to national development.

Commitment of the Bank:

“Service First” – holds a prime and central focus in the Bank’s operation.

“Easier Banking” – provide our customers with a comfortable and friendly environment and up to date technology applications.

“Better Relationship” – view banking to be a long term relationship with our customers to fulfill their needs and satisfaction.

“Assured Confidentiality” – assure our customers with uncompromising commitment to transact their financial activities with strict confidentiality and professional manner.

Objectives of the bank:

- To ensure and motivate new entrepreneur to establish industries and business in line with development of the national economy.

- To boost up investment in private sector by financiering independently or under syndication arrangement.

- To financing foreign trade of the country both in export and import.

- To enhance savings tendency of the people by offerings attractive and lucrative new savings scheme.

- To develop the standard of living of the limited income group by offering consumer credit scheme.

- To boost up mobilization of savings both from urban and rural areas.

- To develop the model of participatory banking.

- To develop competitive most modern science and social welfare oriented banking institutions on the country.

- To finance the industry, trade and commerce through conventional way as well by offerings various customers’ friendly credit products.

Function of the bank:

The bank offers:

¨ Term loans and working capital loans to industries.

¨ Full-fledged commercial banking service including collection of deposit, short term trade finance, working capital finance in processing and manufacturing units and financing and facilities trade.

¨ Loans to small and medium enterprises (SME’s)

Micros credit to the urban poor through linkage with Non-Government Organizations (NGO’s) with a view to face-lifting their access to the formal financial market for mobilization of funds.

Future directions:

The objectives for the years ahead are to become a highly professional and profitable bank to contribute to the economic development of the country. Priorities have been identified for implementing in the near future. These include looking out for new business lines, developing more products & services, widening branch network and introducing newer banking technology.

Even through global and national economy offers no immediate sign of fast growth there is an apparent advantage to our bank in attracting business by offering better service at competitive terms. We believe the bank is well structured, well focused and in right platform to become a top ranking bank of the country within few years.

Business Philosophy of Premier Bank Limited:

The philosophy of the PBL is to develop the bank into an ideal and unique banking institution. The bank should be quite different from other privately owned one managed commercial bank operating in Bangladesh. PBL is to grow as a leader in the industry rather than a follower. The leadership will be the are of service constant effort being made to add new dimension so that clients can get additional value in the matter of service to commensurate with the needs and requirements of the country growing society and developing of the country.

Division of PBL:

The Managing Directors is the head of the operational area, of the bank and its chief executive. The Managing directors are appointed by the board of directors with prior permission of the Bangladesh bank. All the policy formulation and subsequent executions are done in the Head Office. It comprises the following divisions. Financial administration division which is mainly know as FAD and others departments are GSD, ID, ITD, Establishment, Accounts.

Products and service of the bank:

Premier bank always conscious of the changing needs of the customers and strive to develop new and improved services for its valued customers. Premiers Bank offers various Deposit and Lending Products and Service to meet all kinds of financial needs of their customers.

Deposit Products:

- Monthly Savings Scheme (MSS).

- Monthly Income Scheme (MIS).

- Education Savings Scheme (ESS).

- Special Deposit Scheme (SDS).

- Fixed Deposit

- Savings Account.

- Current Account.

- Corporate savings account.

- Short Term Deposit Account.

- RFCD/NFCD Account.

Premier Bank is paying interest on daily balance of the savings & corporate savings accounts.

Lending Products:

- Consumers Credit Scheme.

- Rural Credit Scheme.

- Student Credit Program.

- Special Credit Scheme on RMG.

- Doctors Loan.

- Lease Finance.

- SME Finance(Coming)

- Hire Purchase.

- Car Loan.

- Trade Finance.

- Working Capital Finance.

- Project Finance.

- Finance for Agro-processing Industry.

- Others commercial lending such as: cash credit, PAD,LIM and LTR.

Islamic banking operation:

In order to serve those customers who neither Receive or Pay Interest, PBL decided to open separate branches based on SHARIAH PRINCIPLES. The activities & book keeping will be kept separate from the Conventional Branch Operations.

Islamic Banking service now available at Mohakhali Branch of DhakaCity and Sylhet Branch. These two branches are run under Islamic Shariah Principles. Chairman of Islamic Bank Limited former Secretary of Government of Bangladesh and Former Deputy Governor of Bangladesh Bank- Mr. Shah Abdul Hannan is also the chairman of Islami Shariah Council of Premier Bank. The council also consists of renowned Islamic Scholars like Dr. A.R.M Ali Haider, Professor of Department of Islamic Studies, University of Dhaka, Moulana Ruhul Amin Khan, Executive Director of the Daily Inqilab and others two determine the guideline principles for operation of PBL Islamic Branches. The performance of PBL Islamic branches during the year 2008 deposits 876.53, investment 282.42, Profit 1.05

Service of the premier bank:

Lockers Service:

For safekeeping of customers’ valuables and important documents and goods like jewelries and gold ornaments, premier locker service is available in most of the branches of urban arrears.

| NATURE OF THE SERVICE | NATURE OF CHARGES | RATE OF THE CHARGES |

| Custody of locker/safe | Rent |

|

Online any Branch Banking:

Premier Bank Limited already been set up wide are network using Radio link, fiber optic and other available communication systems to provide any branch banking to its customers in really better, easy and modern way which is very significant in today’s banking.

Customers of one branch are now able to deposit and withdraw money at any of our branches. No TT/DD or cash carrying will be necessary. Online branch banking service is designed to serve its valued to clients. Under this system any one be able to do the followings type of transaction:

- Cash withdrawal from his or account from any branch of PBL.

- Deposit in account at any branch of the bank.

- Transfer of money from one account to another account at any of the branch of PBL.

- There is no limit of transaction so better to say unlimited transaction.

- No online transaction membership fee is required.

- No charges for online transactions.

ATM:

Premier bank Limited already buys numbers of ATM machines and set up will be start very soon around the country. It will help to the customers deposit and withdrawal of money any time any where in Bangladesh.

Banking Software:

Robust banking software which will integrate the Total Banking Operations and provide total solutions to the customers needs to under selections. Implementations are expected soon.

SWIFT:

The Premier Bank Limited is one of the first few in Bangladesh who have become a member of SWIFT (Society for Worldwide Inter-bank Financial Telecommunication) in 2002. SWIFT is members owned co-operative, which provides a fast and accurate communication network for financial transactions such as Letter of Credit (LC), Fund Transfer etc. by becoming a members of SWIFT the bank has opened up possibilities for uninterrupted connectivity with over 5,700 user institutions in 150 countries around the world.

SWIFT No: PRMRBDDH

Credit card:

The premier bank limited hold the principle members license from VISA International to Issue & acquire the world’s most widely used credit card. Premier bank is the first local bank offer VISA International credit card in the country. The Bank is offerings both local and international credit card which is known as Classic and Gold.

The Premier Bank Limited- Overview of Operating Outcome

The Premier Bank has completed five years of operations and it found the bank at the top slot in terms of growth, quality services and image building to the customers and value addition for the shareholders. The bank made tremendous growth progress in all spheres of business operations including profitability in 2008. the trademark “service first” associated with our Banks name is nota mere slogan any more, rather a practice and way of life in Premier Banks’ day-to-day operation. The Bank remained focused on customer service during the whole year and ensured delivery of “Total Quality Services” in the dealings with the customers. The bank closed the year under review with a number of achievements:

+ Registered significant growth (2.5 times over 2006)

+ Captured leading positions in the industry with capital adequacy ratio of 14.63 percent, assets quality (non-performing loan 0.43 percent), proactive management, earnings (ROA 4.63 percent) and liquidity maintenances (CRR 4.98 percent, SLR 16.54 percent, loan-deposit ratio 85.447 percent).

+ Issued 14200 Visa Credit Card last year, highest ever in the banking industry of the country.

The Bank further expanded and consolidated its customers base in both of its core business and retail banking. During the year the network of branches increased to 38 with four new branches – one in DhakaCity, one in Gajipur district, one Naryangonj and one Barisal. We have already planned to add few more branches to pour network, which will give the bank strategic advantages in terms of operations and business potentials.

In a challenging market conditions and also to fetch/explore post-MFA globalization effects, the Bank continued to provide more innovative products and best quality service to retain the market share. The best strategic direction for the bank has been clearly identified and laid down in the corporate plan and Budget for 2007. Priorities identified in the corporate plan include expansion of business loan, in new areas such as house building loan, investment & portfolio management, lease finance, overseas remittance business and acquisitions of other many more.

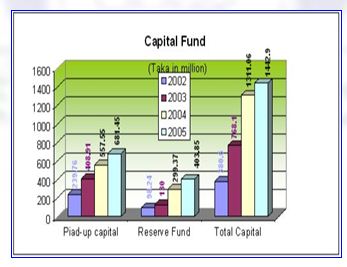

Capital Fund:

Authorized capital of the bank has been increased from Tk. 2000.00 million to Tk. 1000.00 during the year and Paid-up capital at Tk 1689.99 million as in December 2008. Reserve Fund of the Bank stood at Tk. 301.08 Million. Retained earnings 301.40 million, General Provision for unclassified advances at Tk. 152.60 million and this amount is also available for calculating capital adequacy requirement. Thus total capital funds stood at Tk. 1312.63 million as on December 31, 2004. The Capital Adequacy Ratio of the bank as on December 31, 2008 worked out at 14.63 percent as against the minimum requirement of 11.30 percent, which testifies to the sound capital base of the bank. The Capital Adequacy ratio in 2006 was 11.76.

Table:

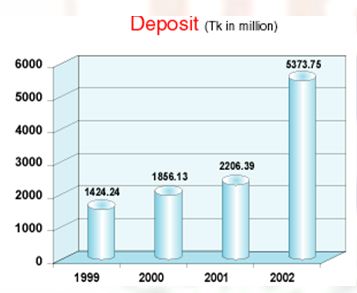

Deposit:

The deposit base of the bank registered a significant growth of 79.50 percent and stood at Tk. 18005.20 million at the end of 2004 as agonist Tk. 10030.52 million in preceding year. Deposit mix at the end of year 2004 is as follows:

Table:

Loans and Advance:

Loans and advances are focal point of all the activities of every bank and in Premier Bank this is even more seriously dealt with to uphold the “Zero Classification” policy of the bank. Credit activities of the bank are being administrated by the Management Committee(MANCOM) at the Head office by strict separation of the responsibilities between assessment of the risk, lending decisions and its monitoring functions.

At the end of 2008 total loans and advances stood at Tk. 15383.93 million, a 90.03 percent increase compared to tk. 8095.37 million from the preceding year. While growth in loans and advances were our major focus, under no circumstances there was any compromise on quality of advance. Total non-performing loans remained low at 0.43 percent in 2008. loan to deposit ratio as on December 31. 2008 was 875.44 percent which is within the acceptable tolerance of Bangladesh Bank.

Trade Finance:

Trade finance is an important constituent of the service portfolio Premier Bank ands enhanced capacity to handle even more volume of business. Premier bank played a landing role among the private sector banks in this area. The import and export positions of the bank stood at Tk. 20592.70 million and Tk. 13515.80 million respectively, compared to Tk. 12756.18 mullion and Tk. 8178.12 million in preceding years, which reflects an increase of 61.43 percent and 65.26 percent respectively.

Treasury:

Treasury operations had long been considered as an important avenue for income generation purpose within the Head Office guided by Assets and Liability Committee(ALCO). Treasury operation played a major role in raising the banks income and recorded an income of Tk. 203.00 million in 2008.

The bank ensures available funds to meet its obligations of maintaining Statutory liquidity Ratio(SLR) and investment of liquid assets in a profitable manner. We had liquid assets of Tk. 4449.30 million and as on 31 December 2008 our ratio of liquid assets to total asset was 22.14 percent.

Consumes Credit:

The bank is extending credit facilities through its Customers Credit Scheme to cater the credit needs of the fixed income group for household durables and cars/automobiles. Total outstanding in this segment stood at Tk. 196.94 million and recovery rate was 94 percent as December 31.2008.

Credit Card:

Premier Bank launched VISA Credit Card (Local & International) at the beginning of 2004 as New Year bonanza- first time in Bangladesh by local bank. PBL issued 14,200 cards just in 11 months with accumulated revenue of Tk. 78.10 million and profit of Tk. 35.00 Million by the end of the year under review. Card Division is now conducting its operation as an independent vital profit center of the bank as steps has been taken for extending merchant network for acquiring more business as well.

Operating Result:

The year under review was a successful year in terms of profits and turnover. The Bank made an operating profit of Tk. 930.93 million in 2004, compared to Tk 400.73 million in 200.3 registering a significant rise of 132.20 percent over the preceding year. After necessary provision net profit stood at Tk. 470.54 million as on December 31.2008. An amount of Tk. 385.35 million has been set aside for our tax contribution to the National Exchequer. PBL return on Assets(ROA) was 4.63 percent which was well above the industry average. As a dynamic institutions we always stressed on sustainable growth. During the year we have given more of consolidation in different segment of business and our relationship with customers. PBL introduce credit cards, Corporate Banking, Treasury and a separate Leasing Division as vital profit centers.

Islamic banking branch:

The Premier Bank Limited is operating two branches one at Mohakhali , Dhaka and another one in Lalclighirpar, Sylhet on Islamic Shariah base profit & loss sharing principles. Premier bank Shariah Council under the chairmanship of Mr. Shah Abdul Hannan determines the guiding principles for operation of those who brances. The bank is maintaining a sperate set of accounting system for Islamic banking branches which is completely different from conventional banking branches to confirm to the standards adopted by financial accounting & auditing organization for Islamic financial institutions.

The performance of PBL Islamic Banking during the year 2004-2005 is given bellow:

Deposits 876.53 ( corer )

Investments 282.42 “

Profit 1.05 “

Automation in banking operation:

The Bank continued to bring to all the branches under one network in order to facilitate “Real Time Online Banking” service to its customers. As a result customers are enjoying the advantage of any branch banking facility. Very soon the bank is going to provide internet banking and PBL already providing SMS banking facility allowing its customers to make query regarding account balance, cheque payment and deposit status and also delivery request for account statement.

Human Resources:

Premier Bank considers its employees as the most the most valued resources and the focal point of all its activities. The bank tried to assemble a pool of highly talented professionals coupled with fresh university graduates and built the finest the finest team in the industry and is providing them an environment in which team sprit, creativity and excellence thrives. As a service industry the bank is constantly trying to improve quality of its human resources where performance excellence is always encouraged by reward and recognition. The bank conducted comprehensive training sessions and workshops through is own Training Institutes and Bangladesh Institutes of Bank Management(BIBM) with the vision of developing Human Resources to the highest professional level and boosting productivity across the Bank Employees’ compensation package and other welfare schemes are kept in line with the prevailing market level. The total number of employees of the Bank as on December 31, 2008 stood at 554 corresponding to 435 in 2006. Net earning per employee was Tk. 1.67 million in 2008 reflecting a significantly high productivity.

Corresponding Relationship:

The bank has established corresponding relationship across the globe. The number of foreign corresponding its 297 as on December 31,2008. PBL is maintaining adequate number of nostril accounts in major convertible currencies to facilitate export and import payment needs of our valued customers.

Premier Social Activities:

As in the previous years, Premier Bank is involving its activities in social arena more vigorously. The bank extended financial assistance to the victims who were affected by natural disinters during the yar 2004, the premier bank donated Tk. 4.00 million to the Prime Minister a relief fund and Tk. 4.00 million to the relief fund of Bangladesh Awami League for rehabilitations of flood affected people. The Bank also donated 1.00 million to the Leader of Opposition of the Parliament for the Medicare and rehabilitations of August 21, 2004 grenade victims. Premier Bank Limited also sponsor Premier Football League of 2005 and they also associated with Royal UniversityBangladesh as well as sponsor to others social activities. The bank has set up “Premier Bank Foundation” for extending benevolent services to the society. The bank will contribute to foundation out of its operating profit each year.

Special Features of Premier Bank Limited:

¨ Real Time Banking Facility allowing transaction at any branches of the bank irrespective of the branch where a customer open his account.

¨ They pay interest on daily balance of the Saving Account that also operates like a currents account.

¨ They are one principal members of VISA International & offer VISA Credit Card both local and International ever first by local bank in Bangladesh.

Commitment of PBL:

¨ Service First:

“Service First” is not just motto, Premier Bank really mean it. Premier Bank know that, by responding to customer needs, one can provide better service. Bank train employees to use their own initiative to satisfy customers’ needs resolve problems quickly and make suggestion about how to serve them better.

¨ Easier Banking:

Providing customers with a comfortable environment and up to date technical facilities to do their banking is an important aspect of the customer’s service at premier bank. Goal is to make banking easier through one to one communications.

¨ Better Relationship:

Premier Bank view banks to be a long-term relationship with customers. The business they transact with bank help to understand their goals and expectations and bank respond proactively to their financial needs.

¨ Ensured Confidentiality:

At Premier Bank great care taken for customers to make sure that all banking transactions are done in a confidential & Professional manner.

Management of fund:

The two main function of a bank are borrowing money from public by accepting deposits and lending to others for development of trade, commerce, industry and agriculture. A bankers dealer in money and credit. It act as financial intermediaries between savers and investors. It is a profit seeking business concern as any other commercial on industrial organization. The bank resources are slightly different from other business concern as it depends upon the mobilization of deposits from the public. Their owned fund (share capital and reserves) constitute generally not more than 10 % of the total. A banks main source of fund is the deposits made by the customers. So, a bankers has to pay interest to depositors at prescribe rate and meet the demand of money when their require it.

Sources of fund of the premier bank.

Paid up share capital: Paid-up share capital indicates the contribution made by the shareholders of the bank.

Reserve fund and undistributed profits: Reserve Fund is the amount accumulated over the years out of undistributed profit. It actually belongs to the shareholders. The accumulation of such retained reserves is an essential condition for financial soundness, stability and growth of the banks to fulfill special roles assigned to them from time to time. Besides, such reserves provide a cushion for meeting unforeseen contingencies. The Reserve Fund operates as an additional security to the bank’s customers.

Deposits from the public in various accounts: Deposits from public represent by far the most powerful source of funds to a bank, accounting for over 90% of the total. These deposits are the key to a bank’s potential growth. These funds are liabilities of the bank, because these have to be returned to the owners on demand. The principal types of deposit offered traditionally by all the major banks are Current deposits, Savings bank deposit and Fixed or Term deposits.

Borrowings from the Bangladesh Bank and other banks: Borrowing from the Bangladesh Bank and other banks also source of fund. In the emergency situation The Premier Bank Limited like other local commercial bank borrows money from Bangladesh bank and other local banks with very high rate of interest. Though it is not a regular of option of fund, but it is also very important in crisis situation. It takes secured and unsecured loan from banks. Bangladesh plays as a last resort for all commercial bank as well as for The premier Bank also.

Uses of Fund

The banks cannot simply keep the resources with them without investing them profitably outside. Before a bank can plan intelligently for the employment of funds to advantage, he must be completely familiar with the nature 0 the funds with which he has to work.

The total working funds may vary from bank to bank depending upon the capital, reserves, deposits and borrowings of each bank; but the bank’s own funds, viz, paid- up share capital, reserves and unallocated profits as stated earlier, accounts for only a small percentage of working funds. The contributions coming from various deposits in Current, Savings, Fixed and other Accounts constitute the major part of bank’s funds. As these deposits from the public are payable on demand, or at a very short notice, banker cannot make advance whole of them. A part of the deposit is kept in cash to meet withdrawals of the depositors and a portion in the form of other liquid assets to maintain statutory cash reserve with the Central Bank, i.e., Bangladesh Bank.

The Premier Bank Limited do not lockup their funds for long periods. They usually grant short term advances which are utilized to meet the working capital requirements of the borrowers repayable at short notice. Only a small portion of a bank’s demand and time liabilities is advanced on a long term basis where the banker usually insists on a regular repayment by the borrower. Thus The PBL has to employ his funds wisely so that he is able to meet the obligations and at the same time make maximum profit.

Introduction:

The principal reason banks are chartered by state and federal authorities is to make loans to their customers. Banks are expected to support their local communities with an adequate supply of credit for all legitimate business and consumer financial needs and to price that credit reasonably in line with competitively determined interest rates. Indeed making loans is the principal economic function of banks – to fund consumption and investment spending by businesses, individuals, and units of government.

Credit Analysis:

The division of the bank responsible for analyzing and making recommendations on the fate of the most loan applications is the credit department. This department should satisfactory answer three major questions regarding each loan application:

- Is the borrower creditworthy? ( Appraisal of loan applications )

- Can the loan agreement be properly structured and documented?

- Can the bank perfect its claim against the assets or earnings of the customer so that, in the event of default, bank funds can be recovered rapidly at low cost and with low risk?

- Credit Standers.

- Credit Terms.

Written loan Policy:

One of the most important ways a bank can make sure its loans meet regulatory standards and are profitable is to establish a written loan policy. It should contain:

- A goal statement for the bank’s loan portfolio.

- Specification of the lending authority given to each loan officer and loan committee.

- Lines of responsibility in making assignments and reporting information within the local loan department.

- Operating procedures for soliciting, reviewing, evaluating, and making decision on customer loan application.

- The required documentation that is to accompany each loan application and what must be kept in the bank’s credit files.

- Lines of authority within the bank, detailing who is responsible for maintaining and reviewing g the bank’s credit files.

- Guidelines for taking, evaluating, and perfecting loan collateral.

- A statement of quality standards applicable to all loans.

- A statement of the preferred upper limit for total loans outstanding.

- A description of the bank’s principal trade area, from which most loans should come.

- A discussion of the preferred procedures for detecting, analyzing, and working out problem loan situations.

Objectives:

Every banks and financial organization trying to “Know Your Customers” because without knowing customers mind no banks or organization exist in the market too long. so here we have to find out the customers level of satisfaction in premier bank and if they are not satisfied then what should be done by the bank. To know PBL customers its need to talk with not only the account holders but also who taken loan from the bank and the company which are opening letter of credit (L/C) to their bank. From begging it was seems to me that customers are too satisfy with the bank service but it was not true because they are some customers who had very bad and negative impression on bank and its service specially on online banking and credit card because its too take to time some times.

Loan Agreement:

The typical loan agreement of the bank contain:

* The Note

* Loan Commitment Agreement

* Collateral

* Covenants

*Borrower Guaranties or Warranties

* Events of Default.

Credit Standards:

The guidelines issued by a bank that are used to determine if a potential borrower is creditworthy. Credit standards of a bank are often created after careful analysis of past borrowers and market conditions, and are designed to limit the risk of a borrower not making credit payments or defaulting on loaned money.

Collection Policy:

Definition: Guidelines that spell out how to decide which customers are sold on open account, the exact payment terms, the limits set on outstanding balances and how to deal with delinquent accounts

Though most consumers expect to pay cash or use a credit card when making a purchase, commercial customers typically want to be billed for any products and services they buy. You need to decide how much credit you’re willing to extend them and under what circumstances. There’s no one-size-fits-all credit policy–your policy will be based on your particular business and cash-flow circumstances, industry standards, current economic conditions, and the degree of risk involved.

As you create your policy, consider the link between credit and sales. Easy credit terms can be an excellent way to boost sales, but they can also increase losses if customers default. A typical credit policy will address the following points:

- Credit limits. You’ll establish Tk figures for the amount of credit you’re willing to extend and define the parameters or circumstances.

- Credit terms. If you agree to bill a customer, you need to decide when the payment will be due. Your terms may also include early-payment discounts and late-payment penalties.

- Deposits. You may require customers to pay a portion of the amount due in advance.

- Credit cards and personal checks. Bank is a good resource for credit card merchant status and for setting policies regarding the acceptance of personal checks.

- Customer information. This section should outline what you want to know about a customer before making a credit decision. Typical points include years in business, length of time at present location, financial data, credit rating with other vendors and credit reporting agencies, information about the individual principals of the company, and how much they expect to purchase from you.

- Documentation. This includes credit applications, sales agreements, contracts, purchase orders, bills of lading, delivery receipts, invoices, correspondence, and so on.

For assistance, ask your particular industry’s trade or professional association for guidelines. Part of your research should include finding out what your competitors’ terms are and taking them into consideration when determining your own requirements.

An often-overlooked element in setting a credit policy is the design of invoices and statements. The invoice is the document that describes what the customer is being billed for; the statement is the follow-up document that indicates the status of the account. One collection and creditor rights expert says that invoices and statements that

are clear, easy to read, and allow the customer to quickly identify what is being billed are likely to be paid faster.

Here are several points to include on the invoice:

- An invoice number

- An invoice date

- A customer number or other identifying code

- A complete and clear description of the product or service and item numbers, if appropriate. Avoid abbreviations your customer may not understand.

- The customer’s purchase order, job order or other reference information that will make identifying the invoice easier

- The total dollar amount due, clearly indicated

- Payment terms and due date (and specify any early-payment incentives or late-payment penalties).

How much time takes to open an account in PBL?

Open an account in premier bank there is some procedures like there must be an introducer who will introduce a new customer to open an account. Customers must

have 2 copies of passport size photo and 1 copy of nominee photo have to submit first 8(eight) page photocopy of passport. If the customer doesn’t have any passport then he/she must submit voter or national ID card, or national certificate issued by ward commissioner or union chairman. Customer can open an account with 1000/-taka only but they have to maintain minimum balance of 500/-. If the account became zero then bank has right to close the account at any time to inform the customers. The interest in saving account is 7.00% and Tk 200/- will deduct from customers account as annual excess fee. And for chque book bank take 25,50 and 100 taka for 10,25, and 50 pages.

So overall I can said it that customers satisfaction is not bad in to open new account in bank. But executives must provide proper training on it. And the customers who don’t have any introducer in bank or branch should help them to open an account at the same time rule must be change for the students also. And for students bank may start new concept of banking such as other banks. They can go for different campus and places to open account in the bank and increase people in more savings.

Are you satisfied with the interest rates of Savings, FDR, MSS, DBS and other account rate?

People keep money in to the bank and financial institution because to get some interest on their principal amount. In last few years many banks are came in to the market with new and attractive interest rates to attract customers and at the same to enhance the deposit of the bank. So banks are offer too high interest rate or pay high interest to the customer to capture the market. Though Premier Bank is a third generation bank in financial market but its strength and total capital is too good to compare to the other banks.

Currently Premier Banks offering 7.00% interest in saving account and they also provide daily interest rates on deposit, 11.95% in Monthly savings schemes or in DPS if any deposit 1000/- monthly then after 3(three) years account holders will get 42,300/- and after 5(five) years 82000/- but 10% will be deduct on profit. FDR is one the vest scheme of premier bank and total FDR deposit in uttara branch is more than 75 corer. Few months before Premier Offer highest FRD rate among the private bank. Currently PBL gives 12.25% in 1 (One) year fixed deposit, 12.00% on 6(Six) months and 11.75% on 3(Three) months deposit. Another attractive scheme of PBL is Double Benefit Scheme or DBS if any customers deposit 5 Lac taka then after 6 years the accounts holder will get 10 lac taka but 10% tax will be deduct by bank as government tax.

So from the survey maximum customers agree with the currents of the bank is good and only 3% said they are not happy with current rates and it should be boost up. Another interesting matter happen is that 13(thirteen) customers don’t do any comments on it. Overall its can be said it that customers are satisfied with the rates.

How is the service of online transaction?

Now days life became too fast and peoples are using new dimensional technology every where in life. Technology became part of the life. We are using internet through mobile phone, doing transaction over phone and net buying product and service from website. So in this stage banks are changing their view and creating new option for the customers. These new options helping banks and financial institute to get new customers from the market. Recently it’s been observe that maximum private banks provide online facility to their customers and The Premier Bank Limited is first ever private bank who provide its customers online facility. Its means if any one have an account any of the branch of premier bank then the account holder can deposit and withdraw the money from any branch of PBL.

But as per I observe and from survey maximum time customers are not at all satisfied with online transaction. PBL charge transaction fee for 1 lac customer have to pay Tk100/-. If an account holder places the cheque below 25(twenty) five thousand then without do any quarries bank pay the money but if any one place more then 50(fifty) thousand then bank take the permission from his/her branch.

But main problem face by the bearer of any cheque. If any person place bearer cheque in any branch of Premier Bank then for take the authorization branch call to account holder branch to confirm and let them know the amount, account holder name, leaf number who is bearing the cheque. After take the all information then branch call to the account holders who mainly issued that cheque. If the account holders confirm to the bank yes then that branch send e-mail or fax to the branch where bearer placed the cheque. So this procedure maximum time takes too much time and wait to the customer so here the motto “service first “not work at all. Some people became angry with executives why they are taking too much time. From survey I get the opinion of customers they answer like this 21(Twenty one) said online service is too bad, 29(twenty nine) told takes too much time, only 15 said fast and 5(Five) said average. So overall its been prove though premier bank introduce online banking first ever in Bangladesh but customers are not at all satisfied with the online service rather they are fed up.

Is there any credit card facility of PBL?

Motivate and convince new customers to the bank they are offering credit card facility also. Premier Bank offer to its customer VISA International Credit Card is accepted globally and Local Card is accepted at more than 3500 outlets across the country. Customers are getting free credit facility up to 45 days without any interest. Customers can also pay 5% of his or her billing amount every month. Other rates are highly competitive. Customers have the choice to apply for Gold Local and Gold International and Classis Local and Classic International. Premier bank credit card comes with:

- No Joining fee.

- Auto debit payment.

- Cash advance facility.

- Zero lost card liability

- Bonus reward program.

- Worldwide acceptance.

- Free credit up to 45 days.

- Photo card option.

- Real time online banking.

- 50% cash withdrawal facility from any of the VISA accepted ATM both.

When premier bank limited introduce VISA credit card on that time they give all account holder a Credit card as New Year surprise. So more or less all old customers of the premier bank has a credit card. 33% percent account holders told that they have credit card and they use that very frequently. 21% of new customers don’t know whether PBL offer credit card or not because now a days credit card not issuing from branch.

There is a separate card division in Banani Head Office and they issue he card and from 24 hours call center they inform about bills others dues. And to send a SMS customer get the balance of the credit card. In branch there is no separate marketing or card division for credit card.

So a senior officer of credit division has to deal with card which was previously issued by the branch and it’s a tough job for him to prepare proposal for loan and check all the credit card. In survey only 16 customers said that they don’t know anything about PBL credit card. So we can say it that customers know about the credit card and they don’t have any complain on credit card and more or less they are satisfied to use it.

How many days bank takes to issue a credit card?

Compare to current market everything of life became too fast and people want doesn’t waste time a single moments. But if it’s matter of money then its take time. If any one wants to get a credit card from Premier Bank then he or she have to submit followings papers:

- Complete VISA application form.

- Salary statements from office if the person is job holder if he is a businessman then have to submit bank statement.

- Tax Return certificate (TIN).

- 4 copies of passport size photograph.

If all the necessary papers are submit to the card division then they 7-12 days to issue a credit card. But if any one submits an application in branch credit division then it takes more time to issue a card. So better to submit papers in head office card division. From a telephone survey I came to know that 38 person said bank don’t take too much time to issue a new credit card, 12 person said bank takes more time and 7 have no comments and at the same time 13 person said bank take average time. So it’s been clear to me that customers satisfied on credit card issuing tome and others facilities.

How many days bank takes to sanction a loan?

Banks collects deposit from account holders who excess of money and give or provide money who have lack of money. Bank mainly and major task give loan to the people as investment. But before sanction a loan bank follow up the project where they are going to invest and what is the ROI (Return on Investment) rate. Premier Bank mainly offer

different types of loan such as Cash Credit(Hypo), SOD,PAD,LTR,CCS, Export Cash Credit, Packing Credit, Hire-Purchase, Personal Loan, lease finance and house and apartment loan etc. Easiest way of loan is SOD in SOD customer has to lien his/her FDR, MSS and MIS the procedure of the his loan finish within 10-15 minutes as because account holders have sign only some paper that’s all. Customers get 90% of loan on his/her principle amount. And car loan not issued by bank the directly because there are some agent of PBL who work for these. So sanction a loan premier doesn’t take enough time if it’s not big project or proposal. To get a long term loan for big investment then party have to submit a proposal to branch then branch send it to central credit division on that time its takes one or two weeks to get the loan. From a survey 56 person said that PBL don’t take too much time to sanction loan, 8 person said average time need and 6 person said bank take too much time. So we can say it customers are satisfied with credit division because they don’t have to waste time.

What is the rate of interest for loan?

Financial market became more and more competitive day by day and more banks are coming every New Year. So banks have to se the interest very carefully because for customers there are many doors open for them. Banks are motivated and encourage people to take more loans. Because as many as loan bank will provide their profit maximization will increase. Now days bank mainly give non funded loan on L/C and funded loan to investment project. In funded loan rate depend on the capital and pay back period. If payback period is 10 to 15 years then interest rate is low and if the pay back is short then interest rate is high. And mainly all type of interest rate is 18% in premier bank including all others service charge and disbarment. In premier bank there is no hidden charge and loan holder have to pay on monthly basis installments.

In survey its been clear that interest rate is moderate because 31 person agree with it, 19 person said that interest rate is too high compare to other private banks and mainly they don’t get the loan from bank.14 person told that interest is same as other private bank and they are happy with premier bank even the organizations who are opening L/C in premier bank don’t have any complains on margin rates. Even they share with me that it’s too easy to open L/C in Premier Bank and for which bank profit increasing day by day. Only 6 people don’t make any comments on premier interest. So its clear to me hat people don’t have dispute or problem with premier bank loan interest rates. And they are satisfied.

Are you satisfied with overall service of Premier Bank Ltd?

In these marketplace different people living with their own norms, value and ideology. And it’s so tough and impossible to satisfy any single person with his/her needs and wants at a time. Because with time people mind change and new opportunities are create. Some times this opportunities brings lots of things in life and some times people lost everything.

So people keep money in banks financial organization with optimism, faith that bank will use their money in different project and they will get profit. Because banks don’t have its own money and its do business with people money and this money people earned by very barely so bank also have to maintain this trustiness of people. Recently for some banks people losing its interest from private banks rather they are going to foreign bank and government bank. Where people not at all satisfied with the service. But there some bank who really think about customers and trying to provide customer best service as much as they be capable of. And Premier Bank Limited is one of them. But it’s also true that one person or service organization can satisfied all people or customers mind some may be happy with the service and some will not. So from survey I customer overall opinion on satisfaction level of customers in premier bank. some person said that they are not at all satisfied with premier bank and at the same time some person said that they are satisfied in some case, some person fully satisfied with the premier bank service and some person don’t make any comments on level of satisfaction actually they are regular customer of the bank so if they are not satisfied then they would not came here again and again.

After doing analysis and discussion its been prove to me that level of customers satisfaction at premier bank is good and accounts, credit card and loan holders are happy with the service and behavior of the employee.

Results & Findings

After analysis of collected data some useful observation were found. The findings are based on a survey comprising 70 clients of the bank. The observations are given below:

- Credit approval process of Premier Bank Limited is satisfactory

- Most of the clients are satisfied with the overall credit service of Kawran Bazar branch. It is good sign for Premier Bank Limited.

- Though General Banking is favorite section, other sections are also doing well.

- Business and service person are more related with this branch than other service holders group.

- The majority of clients receive information about this branch from friends. Rests of all receive information from family members, advertisement, employees and other sources.

- Nearest to home/office/business place was he first choice of clients to select this branch of Premier Bank limited for opening accounts. Customers or clients selected this branch of PBL due to its friendly service environment.

- 35.4% customers or clients thought that they are very satisfied with the bank for good behavior of the staffs, 22.9% are attracted by higher profit rate, and 18.8% of the respondent’s were attracted for the quality and SWIFT services of the bank.

- Most of the clients comment that the profit rate of the bank is satisfactory according to their A/C category.

- Customers or account holders of saving, current holders want ATM and debit card facility and other type of bonus schemes.

- Few clients of special scheme holders wanted to see some modification double benefits schemes.

- Maximum numbers of the customers are not satisfied with the physical facilities and environment of the branch compare to others bank branch.

- Many customers wanted better services like standard charted and HSBC.

- 30-40 age group customers want BO account facility and more profit rates.

- Corporate clients or customers want more new branch in business area.

- Many clients of this branch expect to see the existing service level continued without loss of quality for long.

- There is no available number of PC for employee in the bank that’s why to complete an important task take time.

- One important thing is that some clients are worried about the existence of this bank as it is a new one. In the market.

Reduce level of authority:

The Premier Bank should reduce the level of authority. It is not necessary to have permission of every kind credit authority more than 1 lac by executive committee. Level of authority can be reduced by placement of kind of credit on different level of authority. Only big and significant amount of loan should pass by all authority Or only high risk associated credit facilities should go through all the three level of authority. In my practical experience I found that a customer wanted to avail a Bank Guarantee against a work order within a short time because he had to participate the tender but my Branch Manager sent the proposal to Head Office and the before the sanctioning the facility the date of the tender already expired. It is mentioned here that this was happened for an new customer in case of old customers it might not be happened.

Delegation of authority:

Delegation of authority is very important to faster and easer the credit facilities. Every level of authority should have some power to approve loan. In the Premier Bank up to Tk. 1.00-Lac can be passed by the power of branch manager, which is very negligible. So, there are only few loan which are less than one lac take. So, ultimate all the loan have to travel all the way of clumsy long process of loan approval. There are many customers who do not like to do all this sort of time consuming process. Ultimately centralized authority making customers adverse from credit application. If authorities are also distributed to the branch level and branch managers are given power to approve a formidable amount of credit approval, than whole process will be faster easy.

Recommended Delegated Approval Authority Levels By Bangladesh in the Credit Risk Management Manual:

HOC/CRM Executives Up to 15% of Capital

Managing Director/CEO Up to 25% of Capital

EC/Board all exceed 25% of Capital

Diversification of credit products:

The Premier bank credit facilities should be more diversified. Though it has available almost all kinds of credit facilities in its portfolio, but there are some of the credit instruments are missing which are proved to be so profitable like, transportation sector financing, residential house financing etc. Most of the advances of The Premier Bank limited are centered to garments industry. It is very risky to have significant credits in a single sector. The more diversified the less the credit will be. If for any sudden restriction implied on garments goods export The PBL may face terrible problem exiting loan facilities. So, diversification of credit facilities will reduce the unsystematic risk associated with business. In my observation I found that due to more focused on Ready Made Garments and the tendency to finance only big project increase the credit risk of PNL. To overcome from this situation bank must be try to financed diversify area according to the Bangladesh Bank guidelines of credit risk management.

Reduce the cost of capital:

The Premier is the one highest interest provider tom the depositor. So, ultimately it has provided credit with higher interest to the interested debt holders. It is really tough to remain in such competitive business of commercial bank. SO, it should money from other source which relatively low cost. It should be arrange money from stock market which is very safe and lowest cost among the types of sources. It is also possible to collect money from government and different UN projects. More over if Premier Bank engaged them to collect utility bill like Electricity, Gas & Telephone in there different branches it also increase there deposit for the time being.

Reduce the influence of head office:

Any types of influence hamper the normal flow of activities. In the PBL it is seen that sometime many instructions are provided head office which hamper normal procedure of credit approval process. So, credit investigation and other important formalities before credit approval is not done properly. A credit officer could give his/her best to analyze the proposal as the branches are to much influence by Head Office. On the other hand revised situation are also taken place as for example branch forward a justified proposal to head office and the Head Office didn’t give as much attention as it require as a result decline the proposal.

More Focus on SME:

Most of the Premier bank credits are focus to high volume credits to different sectors especially on Ready Made Garments. But the bank should focus more on small and medium enterprise loan which are more profitable and less risky. If loan amounts leads small risk. More small and medium entrepreneurs are increasing day by day. They are doing good business in Bangladesh. SO, focus should SME credits. More over the has some social responsibilities also. Finance in SME will improve our agriculture and poultry industries.

Spread branches at sub urban level:

The Premier only has about twenty one branches in all over the country. Now a day people are more mobile than ever before. They want service from any parts of the country. Moreover sub cities are also center of many good businesses. Therefore The Premier Bank should spread branches in the relatively low profile cities, because are spreading to all parts of the country. Increasing numbers of branches will add value to the name of the Premier bank. If branches are spread all over the country the bank can financed more on agriculture sector as well as other sector like fertilizer, rural power etc.

Train employees about wide range business activities:

Efficient employees are prerequisites for doing good business. More over banks are dealing with wide range of activities. It has to known about every kind of business to invest in that sector properly. If employees are trained well about those factors they can identify sound credit proposal. They also able invest in new attractive sectors. If employees are not trained well it is likely that they will make mistakes in credit investigation and in the approval process. So, employee raining is very impotent in banking business to be successful. Without trained employee any organization could not get success. That’s why Bangladesh Bank presently more focus on the training of the employee.

- The Premier Bank Ltd. should introduce its TV advertisement with an early extent.

- Initiative must be taken for proper and effective marketing of this bank so that it will be able to draw a large volume of depositors.

- The relationships as well as network with other commercial banks need to be improved and enhanced so that the PBL can share fording business facilities in the relative competitive situation.

- The bank should the Relationship Managers and CRM employees to various training programs for increasing the efficiency of employees to provide better service to customers.

Conclusion:

Though Premier Bank Limited is new and third generation bank in the financial market, it has good future. This bank is trying to show some different example in commercial, industrial and Islamic banking section. Premier Bank Limited is performing modern banking with future vision banking system. So the PBL is getting extra priority from the people who want to do business with new dimensional modern flexible banking system. Premier Bank limited is also giving good profit rate than other private banking in the country and their market shares rate are profitable in this year. The purpose of this report was to analyzing the credit policy of Premier Bank Limited. From the survey I got acceptable credit approval process. And finally I can said it that maximum customers are satisfied with the current credit services of Premier Bank Ltd Mohakhali Branch.