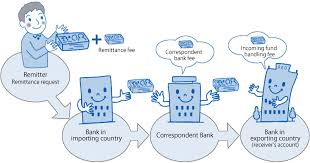

Remittance:

This Department deals with the basic paying and receiving of funds into the Bank, for the clients. They transfer, or wire money abroad as well as locally through TT or SWIFT, etc. They deal with Foreign Currency time placements and balance certificates for clients. They work very closely with the cash department. It is the Remittance Department, which also issues monthly salaries both locally and internationally for some of their clients. They also sell Government bonds to clients and organizations.

Remittance Department works as an intermediary for clients and actions taken on their accounts. Automatic credits and debits are not necessary done, especially in cases of International transactions. Sometimes credit will be available at a certain value date. They deal with fund transfers both locally and abroad as well. They deal with Inter – Bank transfers, for example, if there is a Bank transfer where BASIC does not have a branch like Kurigram then they will transfer their fund to a Bank in Dhaka that has an office in Kurigram. Through these various functions, they are able to serve their clients.

A principal mode of remitting fund abroad is through SWIFT – Society for Inter – Bank financial communication an online communication system. Other traditional mode TT. Telex, Mailing of Drafts, and transfer of TCs is also used. In both case of incoming and outgoing remittances the purpose is to be disclosed. Local fund transfer is also done here, their areas of transfer activities include:

- Issuance of Pay order

- Salaries

- TT to Chittagong

- TT to other parts of the country

Inward Remittance

Function in Inward Remittance

Step 1: Fund Received

Step 2: Clarification by

- Own Client

- Other Client

Step 3: If the fund is for own client

- Check faster account

- Valid IRC Copy

- Vat Register Certificate

Step 4: Transferring the fund

Outward Remittance

Bank Condition: Client must have an account in BASIC

Process:

- Travel Mucilaginous

- Document transfer by SWIFT other transaction activities

Types of Transaction (Remittance Department):

- Govt. Bond Sold

- Govt. Bond Encasement

- Govt. Bond interest paid

- Other Bank check collection

- Standing instruction

- Credit Advance/Debit Advance

- Outgoing Payment Instruction

- Collection item both local/Foreign

- Incoming Payment Instruction Pay order Installed

- Salary Disbursed

- Foreign Currency Draft Issued

- Correspondence

- Incoming Collection

- Bangladesh Bank Check Collection

Issuance procedure of foreign currency note:

- To verify the approved T.M form or Bangladesh Bank permit

- To issue foreign currency notes by endorsing in the passport.

- Voucher preparing with accounting treatment:

Party’s Account ……………………Dr.

Foreign Currency Notes on Hand A/C…………………Cr.