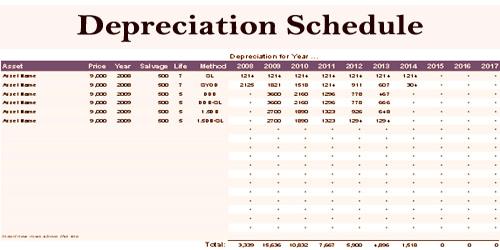

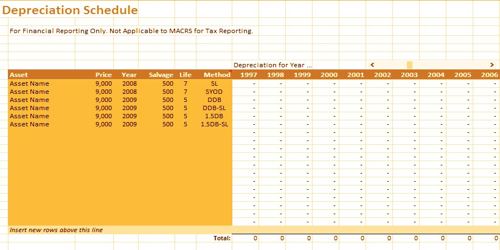

In financial modeling, a depreciation schedule or chart is necessary to forecast the value of the fixed assets of a business (balance sheet), depreciation cost (income statement), and capital expenditures (cash flow statement). This lets companies keep track of long-term assets and provides a glimpse at how they could depreciate over time. Deterioration happens as a monetary resource is spent. This incorporates various kinds of property, plant, and equipment (PP&E). As these advantages are utilized, they start to corrupt and lose esteem. The depreciation plan measures the depreciation costs of an asset depending on the date of acquisition, original expense, useful life (how long the business plans to use it), and records the start and end of the cumulative depreciation or the value of the resource until it is replaced.

Depreciation Schedule Template

Various resources lose an incentive at various rates. A devaluation plan helps diagram these distinctions. Accountants utilize these timetables not exclusively to register the cost, they additionally use it to follow starting and finishing gathered deterioration. The timetable will list the various classes of advantages, the sort of deterioration strategy they use, and the total devaluation they have brought about up to that point in time. Depreciation schedules usually provide the following details for accounting purposes:

- Description of asset

- Date of purchase

- Cost

- Expected life

- Method of depreciation

- Salvage value

- Current year depreciation

- Cumulative depreciation

- Netbook value = Cost – Cumulative Depreciation

A depreciation timeline allows businesses to keep track of their long-term investments and to see if they will depreciate over time. The straight-line method and the accelerated method are the two most common approaches used to measure depreciation cost. A straight-line process subtracts an asset’s salvage value and subtracts it from the initial cost. The outcome is then partitioned by an expected number of valuable years and the operational expense an equivalent measure of devaluation for every year. Typically, a summary of the asset, the date of purchase, how much it costs, how long the company plans to use the asset (life), and the value of the asset when the company intends to sell it (salvage value) are the details that a depreciation plan contains.

Example of Depreciation Schedule Template

Historic and projected capital expenditures (CapEx) can also be included in the depreciation plan. Prepare a capital expenditure section and reference historical CapEx from any periods available. By using an acceptable forecasting assumption, estimate future capital expenditures. Use intuition to evaluate the correct assumption of forecasting to use from the following:

- CapEx as a percentage of sales

- Fixed recurring amount

- Reasonable “hard dollars” that one would expect a company to incur as they operate

A quickened technique discounts devaluation costs all the more rapidly so as to limit the available salary. Besides, the deterioration plan presents data on the devaluation strategy, the deterioration of the current year, the total deterioration from the date the firm bought the advantage until today, and the netbook esteem. Businesses use it to report resource use to their stakeholders. Deprecation also takes down the assets’ historical value. This information can be checked by stakeholders and they know when to expect replacement assets acquired by a corporation.

Information Sources: