Internal Audit is a function, while Internal Control is a system. Internal audits are performed at specific times to assess: 1) if the company has a good understanding of the risks that it faces, and 2) if the controls put in place to mitigate risks are effective. There is one very important distinction to be made: it is not the job of internal auditors to identify risks, nor to specify the controls that are needed. Internal Audit evaluates whether the process leading to the identification of risks is working well, checks whether controls already in place are working according to the way they are intended to, and evaluates an organization’s governance system and process.

Definition of Internal Audit –

Internal audit is defined as an unbiased, rational assurance, and consulting function, developed by the management, to keep a check on the activities of the organization. It involves regular and critical analysis of the functions of an organization, for the purpose of recommending improvements. It is aimed at assisting members of the firm in discharging their responsibilities in an effective manner.

An internal audit is important in;

- Reporting on the authenticity and accuracy of accounting records

- Ensuring accounting standards comply

- Detecting and preventing fraud

- Verifying business liabilities incurred

- Identifying gaps in the operations and recommending solutions

- Assisting in the development of periodical action plans

For internal audits to be effective, the audit process includes:

- Audit planning

- Conducting audits

- Improvement actions

Generally speaking, auditing is a systematic process of objectively obtaining and evaluating information and affirmations in order to ascertain their degree of correspondence with the established criteria, as well as communicating the results to interested users. Auditing consists of verifying and certifying financial surveys by an independent expert in order to deliver an opinion on the comprised data materiality and accuracy. The role of auditing is to ensure data users of the compliance with accounting principles and practice as well as of a precise, clear and complete image of the company’s financial status and performance, in the accounts and financial surveys.

Definition of Internal Control –

Internal Control can be understood as a system developed, implemented, and maintained by the company’s management, in order to ensure the achievement of objectives concerning:

- Effectiveness and efficiency of operations,

- Protecting assets,

- Prevention and detection of frauds and errors,

- Accuracy and completeness of financial reporting,

- Adherence to relevant laws.

Internal control has 5 components, namely:

- Monitoring

- Control activities

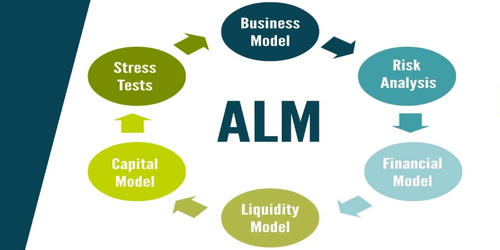

- Risk Assessment

- Control environment

- Information and communication

Although these elements are interconnected to each other, their implementations vary from firm to firm, based on the set structures. Internal control, however, needs regular review to identify weak areas and give recommendations. This can be done with the use of a checklist, flowcharts, questionnaires, and narrative records.

Internal Control is made up of procedures, policies, and measures designed to make sure that an organization meets its objectives, and that risks that can prevent an organization from meeting its objectives are mitigated. While the Internal Audit function is performed by internal auditors, Internal Control is the responsibility of operational management functions. Another point of contrast is frequency. An internal audit is a check that is conducted at specific times, whereas Internal Control is responsible for checks that are on-going to make sure operational efficiency and effectiveness are achieved through the control of risks. Some risk experts even say that Internal Control is a part of a company’s day-to-day management and administration.

Key Differences Between Internal Control and Internal Audit –

The difference between internal control and internal audit can be drawn clearly on the following grounds:

- The methods and procedures implemented by the management to control the operations, so as to help the organization in achieving the desired ends, is called as an internal control. The auditing program adopted by the firm, to review its financial and operating activities by the expert, is called an internal audit.

- While internal control is a system designed, implemented, and maintained in an organization. Internal Audit is an audit function designed by those charged with governance, to keep a check on the activities of the firm.

- In internal control, the work of one person is verified by another, whereas in the case of an internal audit, every single component of work is verified.

- In the internal control system, checking is performed simultaneously, while carrying out work. On the contrary, in internal audit system work is checked after it is performed.

- The basic objective of the internal control system is to ensure compliance with management policies. In contrast, internal audit aims at the detection of fraud.

Internal audit refers to an unbiased, independent, objective assurance and a consulting activity strategically developed by the management to improve a company’s activity while internal control refers to a process designed by a company’s stakeholders aimed at providing reasonable assurance on the reporting, operations, and compliance of an organization. While the two have differences, both ensure that a company’s goals are achieved by mitigating risks through effective controls.

Information Sources: