Dissidents rights is a state corporate (or business substance) law empowering the investors to get a money installment equivalent to the reasonable estimation of their offers if the organization the board embraces a significant exchange with which the investor disagrees or assent. If they do not want to be a part of the merger, it gives dissenting shareholders a simple way out of the market. If the shareholders do not approve of the merger decision and wish to get out of the company, the rights of dissenters provide a clear way out for them. The rights of dissenters provide a shareholder with a simple way out of a business. There are numerous dangers related with nonconformists’ privileges, for example, the expense of cases or offers being underestimated in the evaluation cycle. For instance, when a hen an offer to-share consolidation or obtaining happens, the investors are qualified for request money installment for their offer in the event that they would prefer not to be a piece of the consolidation or union.

Generally, a company’s board of directors and officers oversee its daily activities. However, in the case of any large transactional undertaking, such as a merger or acquisition, shareholders have the right to express their opposition, which can change the essence of the company. Before the enactment making dissidents’ privileges, consolidations and acquisitions required a consistent vote for the arrangement from the investors of the organization. This considered only one disagreeing investor to reject the consolidation or procurement, despite the fact that it might have been to the greatest advantage of the organization. The rights of dissenters cannot, however, be exercised on the shares which are exchanged on the national exchange.

Example of Dissenters’ Rights

In general, the officers and directors run the routine operations of a company. If the company and the shareholder exercising the rights of the dissenters do not agree on the share’s fair value, it must be decided by a court case. Nonetheless, in the case of a major value-based endeavor that will change the idea of the organization, for example, consolidation and securing, the investors reserve the option to communicate their contradiction. State enactment removed this right, yet thusly, gave the investors the option to get the money installment for their offers all things being equal. The company’s shareholders are entitled to exercise the rights of the dissenters and to obtain the fair value of the shares in the case of any of the following acts taken by the company:

- If the corporation is one of the parties to a merger plan that has been made and the shareholder is entitled to vote, or the deal needs approval.

- In case of an offer trade plan being essentially, wherein the portions of the organization have been gained, and the investor was permitted to decide on the offer trade plan.

- A vote was permitted on the disposal of a portion or all of the company’s assets through a sale, swap, or lease other than the usual activity of the company and the shareholder. Such a provision may require dissolution, but not a provision following a court order or a provision in which shareholders are entitled to obtain their share of the net proceeds of the provision within one year of the date of disposal.

- On the off chance that the articles of fuse are changed, which influences the investors’ qualification to recover or drop the entirety of their offers in return for money. The investors can practice the nonconformists’ privileges whether or not or not they are permitted to decide on the articles of fuse change.

- However, when the proposed corporate action is canceled or a court with jurisdiction presses or permanently surrenders the corporate action plan, shareholders exercising the rights of dissenters do not collect cash compensation for the equal value of their shares.

Albeit dissenting rights have made it simpler to push forward with various corporate exchanges, certain business choices are as yet not without issues. Consolidation and securing must consistently be affirmed by the current investors of the organization. However, it is not mandatory for any shareholder who votes against the deal to accept shares in the surviving or successor company. They may, instead, exercise assessment rights. For any corporate activity submitted for casting a ballot at a gathering with investors, the gathering notice should indicate that the investors may practice the nonconformists’ privileges. Except in the absence of a conference, a written notice must be issued to shareholders concerning the right to disagree with the action taken by the company.

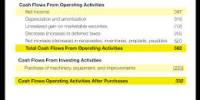

A dissenting shareholder who objects to an exceptional transaction can, under appraisal rights, have their pre-merger corporation shares measured and be paid by the pre-merger business for the fair market value of their shares. Before this enactment was passed, only one investor could stop a consolidation or securing by communicating their dispute in any event, when the consolidation or obtaining was the solitary feasible choice for the organization. When the payment request is issued, the corporation pays the approximate fair value of the shares to the opposing shareholders and sends the company’s balance sheet to the shareholders along with a clarification of the calculation of the fair value of the shares.

The monetary world has seen an increment in examinations corresponding to protesters’ privileges in numerous states, periodically because of the way that the evaluation valuations have been higher than the cost of the consolidated organization. If the shareholder does not agree with the company’s fair value estimate, he or she will inform the company in writing, along with his or her estimate. In the event that an arrangement isn’t gotten, the organization should initiate a court continuing in no later than 60 days and solicitation the court to assess the reasonable estimation of the offers. Although the practice of the rights of dissenters can have advantages, they do come with many dangers. The value can be much lower, resulting in a potential loss, than the merged price.

Information Sources: