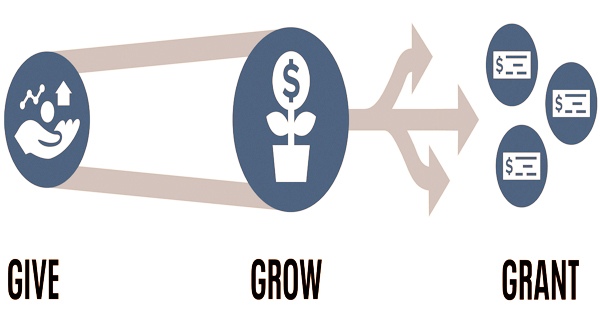

A donor-advised fund (often referred to as a DAF) is a charitable giving vehicle managed by a public charity for the benefit of organizations, families, or individuals. DAF collects donations from a variety of sources and aims to democratize philanthropy by accepting contributions as low as $5,000. To participate in a donor-advised fund, a donating individual or association opens a record in the asset and stores money, protections, or other monetary instruments. They offer duty benefits of up to half of changed gross pay and can hold reserves endlessly.

Donors can make a charitable donation, get a tax credit right now, and then suggest grants from the fund over time. They relinquish ownership of any assets they contribute to the fund, but they maintain advisory rights over how their money is invested and distributed to charity. Non-cash assets such as equities, mutual funds, bonds, and complicated assets such as private S- and C-corp shares are also accepted by DAF. Some view donor-advised funds as holding tanks for money and assets set up to enable rich people to get tax benefits.

A donor-advised fund is an account with a sponsoring organization, usually a public charity, where an individual can make a charitable donation and maintain advising powers to disburse charitable gifts over time while receiving an immediate tax advantage. Donors may make as many contributions to the fund as they like, and then suggest donations to their preferred charities whenever it makes sense for them. Furthermore, businesses may provide this service to clients at a lower cost than if the money were handled privately.

By combining many contributors and executing large numbers of philanthropic transactions, donor-advised funds (DAF) democratize philanthropy. DAFs allow contributors to send money to charity in a more flexible fashion than direct donating or setting up a private foundation. Although the first donor-advised funds were established in the 1930s, they were not legally recognized in the Code until the Pension Protection Act of 2006.

Donor-advised funds gained popularity and exposure in the 1990s, and they are now one of philanthropy’s fastest-growing vehicles. Donor-advised funds account for more than 3% of all charitable contributions in the United States. Unlike private foundations, donors to donor-advised funds can deduct up to 50% of their adjusted gross income for cash contributions and up to 30% of their adjusted gross income for appreciated securities donations.

On average, it takes around 24 months to convert a donation to a donor-advised fund into a grant from the donor-advised fund. Donors can avoid capital gains taxes and get immediate fair-market-value tax deductions by transferring assets such as limited partnership interests to donor-advised funds. DAFs have grown in popularity because to their flexibility, which allows donors to donate when, what, how, and where they want. Donors select a donor-advised fund as a philanthropic giving vehicle for a variety of reasons.

Donor-advised funds, according to the National Philanthropic Trust, have become a more efficient way of contributing to charities. Assets held in donor-advised funds increased by 16.2 percent to $141.95 billion in 2020, up from $122.18 billion in 2018. Donors benefit from administrative ease (the sponsoring organization handles the paperwork after the first contribution), cost savings (a foundation requires around 2.5 % to 4 % of its assets each year to operate), and tax advantages by making their grants through the fund. Using a donor-advised fund to make philanthropic contributions might be a tax-efficient method to leave a generous legacy. Here are the benefits of a donor-advised fund:

- Maximize tax benefits

- Contribute immediately, build a philanthropic strategy and donate when you’re ready

- Grow your contributions over time, making more charitable dollars available to nonprofits

- With an irreversible gift, you may ensure that charitable contributions get to the organizations you care about

- Simplify organization and administration

- Create a charitable legacy

- Choose how you are acknowledged

- Develop a philanthropic vision and philosophy

- Reach international charities and NGOs while still receiving a federal tax credit

When compared to a private foundation, a donor-advised fund offers both advantages and disadvantages. Both can accept contributions of unique or illiquid assets (for example, part ownership of a private firm, art, real estate, partnerships or limited partnership shares), but a donor-advised fund can take advantage of larger tax benefits (depending on the gift). There are over 700 community foundations and hundreds of more faith-based organizations that sponsor donor-advised funds. Because they were the first to provide alternatives to wasteful checkbook giving and the complexities of forming a private foundation, these organizations have been dubbed “pioneers” in the donor-advised fund field.

The donor simply recommends the sponsoring organization where the money should go in a donor-advised fund. There are about 30 donor-advised fund organizations in the United States. The bulk of these organizations, such as the Vanguard Charity Endowment Program, the Schwab Charitable Fund, and the Fidelity Charitable Gift Fund, are charitable branches of for-profit financial services companies. Furthermore, most donor-advised funds are limited to giving to IRS-approved 501(c)(3) organizations or their international counterparts.

National and international charities that specialize on a certain topic or geographic location are generally supported by public foundations. As a result, public foundation staff typically have specialized knowledge to assist donor-advised fund holders in identifying issues that are important to them. Donor-advised funds have a significant cost advantage (foundations have a 2.5–4% overhead expense to maintain, a 1–2% excise tax on NET investment earnings, and a required 5% spending of assets each year), but they may also have one more disadvantage: a limited lifetime, which varies depending on the sponsor. Other public charities, such as colleges and hospitals, create donor-advised funds within their own walls with the goal of furthering their own philanthropic goals.

Donors obtain the greatest tax benefit allowed while avoiding excise fees and other restrictions imposed on private foundations since the fund is housed by a public charity. Non-cash assets, such as cheques, wire transfers, and cash holdings from a brokerage account, are accepted by many donor-advised funds in addition to cash and cash equivalents. The donor obtains the maximum tax deduction at the moment of donation, and the organization that manages the fund gains exclusive control over the gift, providing donor advisory status. Individuals and corporations may benefit more by donating non-cash assets since they can result in a larger write-off.

Information Sources: