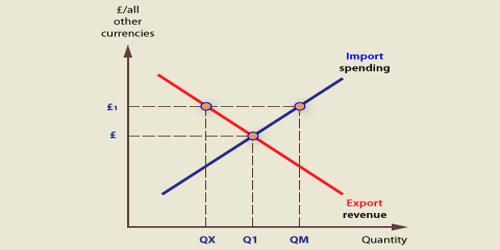

Exchange rates are determined in the foreign exchange market, which is open to a wide range of buyers and sellers where currency trading is continuous. Exchange rate regimes are the frame under which that price is determined. An exchange rate regime is a way a monetary authority of a country or currency union manages the currency in relation to other currencies and the foreign exchange market. It is also regarded as the value of one country’s currency in terms of another currency. Almost every exchange rate regime has its flaws, virtues, and particularities. It is closely related to monetary policy and the two are generally dependent on many of the same factors, such as economic scale and openness, inflation rate, the elasticity of the labor market, financial market development, capital mobility, etc. It is the way in which an authority manages its currency in relation to other currencies and the foreign exchange market.

There are two major regime types:

- fixed (or pegged) exchange rate regimes, where the currency is tied to another currency, mostly reserve currencies such as the U.S. dollar, euro, British Pound Sterling, or a basket of currencies. It is a currency system in which governments try to maintain their currency value constant against a specific currency or good.

- floating (or flexible) exchange rate regimes, where the economy dictates movements in the exchange rate. Floating exchange rate regimes simply use the forces of the market to dictate their currency’s exchange rates. It is a type of exchange rate regime wherein a currency ‘s value is allowed to freely fluctuate according to the foreign exchange market.

There are also intermediate exchange rate regimes that combine elements of the other regimes.

One of the key economic decisions a nation must make is how it will value its currency in comparison to other currencies. This classification of exchange rate regime is based on the classification method carried out by GGOW (Ghos, Guide, Ostry and Wolf, 1995, 1997), which combined the IMF de jure classification with the actual exchange behavior so as to differentiate between official and actual policies. An exchange rate regime is how a nation manages its currency in the foreign exchange market. To determine the most appropriate exchange-rate regime for a certain country is not a simple task as much will be at stake. An exchange rate regime is closely related to that country’s monetary policy. A country’s economy is hugely affected by this decision. The GGOW classification method is also called the Trichotomy Method.