Financial Analysis of HSBC Bank (Period: 2008-2012)

This report elaborates some key financial findings of HSBC from the 2008 to 2012 and tries to give a meaningful interpretation of the major findings. The findings will provide a snap shot of HSBCs performance over the last couple of years and how they have been doing as a global bank. The report also contains my role as an intern in HSBC Bangladesh and what I have done in these four months of my stay in the management office of HSBC. I have tried to relate my academic learning in the practicality of an office premises and also used the opportunities to learn the things outside the theories of academic books. The report is broken down into several parts for the ease of reading. This report showcases my four months experience in HSBC.

Introduction

The history of banks dates back to the fourteenth century in the wealthy cities of the renaissance Italy. Throughout history hundreds of banks came into existence however their main objective has remained the same ‘to link together customers that have capital deficits and customers with capital surpluses’. Based upon this principles banks have came up with innovative products and services fulfilling the demands of time and coping with the changes of globalization in the twentieth and twenty-first centuries.

Among hundreds of banks in the world today HSBC stands out as one of the biggest financial institutions of the world. Popularly known for their tag line ‘worlds local bank’ HSBC has had a paradigm shift in their strategy and follows the tag line ‘as the World’s Leading International’. HSBC has over millions of customers spread throughout the world geography and have over thousands of employees who cater to the needs of the customers. HSBC had grown over the years by consistently buying and acquisition of other key banks and have increased their threshold whenever it found the opportunity. And today it thrives and continues to still grow in times of world financial crisis.

However it is also important for HSBC to look out for potential future customers and retain the existing customers by providing superior services and reaching out to them through marketing and promotional activities. The motivating factor for doing my internship in HSBC corporate banking marketing division is that I wanted to know how a bank promotes its products and services. How it does branding and how it communicates its values and imperatives through its corporate sustainability measures. This internship program not only helped me put my marketing knowledge and theories in to action but also made me be very professional in my approach and has given me a small aperture to view how it’s like to work in a major global organization; its environment, culture, values and how it works.

Objective of the report

Broad Objective:

- To get an overall idea about the financial performance of HSBC over the last five years.

- To relate the theoretical knowledge with the financial findings and interpret key figures.

Specific Objective:

- To know the financial performance of HSBC in the last five years.

- To present my observation and suggestion to the bank.

Methodology

This report contains both primary and secondary date. The sources that have been used to gather and collect data is given below-

Primary Source

- Personal interview

Secondary Sources

- Annual Report of HSBC from 2008-2012

- Official Web site

- HSBC Banglanet

- HSBC intranet

A snapshot of HSBC

HSBC started its journey in 1865 with a small idea – a local bank serving international needs. It was founded by a Scottish gentleman named Sir Thomas Sutherland. Today HSBC has around 7,200 offices in 85 countries and territories across Africa, Asia, Europe, North America and South America, and around 89 million customers.

With its diversified human resource and technological acumen in the twenty first century HSBC provides the following financial services throughout the globe: personal, commercial, corporate, investment and private banking; trade services; cash management; treasury and capital markets services; insurance; consumer and business finance; pension and investment fund management; trustee services; and securities and custody services. The current Group chairman is

As of 31 December 2012 it had total assets of $2.693 trillion, of which roughly half were in Europe, the Middle East and Africa, and a quarter in each of Asia-Pacific and the Americas. Douglas Flint and the Group Chief Executive is Stuart Gulliver.

A brief history of HSBC

After the British established Hong Kong as a colony in the aftermath of the First Opium War, local merchants felt the need for a bank to finance the growing trade between China and Europe (with traded products including opium). They established the Hongkong and Shanghai Banking Company Limited in Hong Kong (March 1865) and Shanghai (one month later).

In 1991 HSBC Holdings plc was established in the United Kingdom as the parent company to the Hongkong and Shanghai Banking Corporation. Their acquisition of the Midland Bank gave HSBC a strong foothold in the UK.

Major acquisitions in South America started with the purchase of the Banco Bamerindus of Brazil for $1bn in March 1997 and the acquisition of Roberts SA de Inversiones of Argentina for $600m in May 1997.

HSBC expanded their operations in Europe with acquisition of Turkish bank in 2001.

In May 1999, HSBC expanded its presence in the United States with the purchase of Republic National Bank of New York for $10.3bn. these acquisitions gave HSBC a strong presence in both North and South America.

In September 2003 HSBC bought Polski Kredyt Bank SA of Poland for $7.8m. [22] In June 2004 HSBC expanded into China buying 19.9% of the Bank of Communications of Shanghai.

Under the leadership of the Group Chief Executive Stuart Gulliver HSBC show a paradigm shift in its strategy and it is no longer to be as the ‘Worlds Local Bank’ as the cost associated with this was spiralling and US$3.5bn needed to be saved by 2013. Further to CEO Stuart Gulliver’s plan to cut $3.5 billion in costs over the next 2 years, HSBC announced that it will cut 25,000 jobs and exit from 20 countries by 2013 in addition to 5,000 job- cuts announced earlier in the year.

The consumer banking division of HSBC will focus on the United Kingdom HSBC acquired Marks & Spencer Retail Financial Services Holdings Ltd for £763m in December 2004. UK, Hong Kong, high-growth markets such as Mexico, Singapore, Turkey and Brazil, and smaller countries where it has a leading market share.

HSBC in Bangladesh

The headquarters of HSBC Bangladesh is Anchor Tower and the management office is SPL in Tejgaon industrial area. These are the two major establishments which heads HSBCs operation in Bangladesh. In Bangladesh, HSBC started its operations in 1996 and today, it serves customers in Dhaka, Chittagong and Sylhet through a network of 13 offices, 39 ATMs and 9 Customer Service Centers (CSC). HSBC is the only bank to be present in 7 Export Processing Zones (EPZs) of Bangladesh.

HSBC operation in Bangladesh

Retail Banking and Wealth Management: With a network of 13 offices, 38 ATMs, 9 Customer Service Centers, an offshore banking unit, and offices in 7 EPZs, HSBC offers a full range of personal banking and related financial services including current and savings accounts, personal loans, time deposits, travelers cheques and inward and outward remittances. However HSBC is curtailing RBWM (for example the termination of Amanah) and focusing more on Corporate Banking. The only personal account a person can have is HSBC select, which requires a minimum of BDT 1 million to be deposited while opening an account.

Commercial banking: Commercial banking is a traditional strength of the HSBC Group. In Bangladesh, HSBC is a popular choice for customers because of the Group’s international reach and a wide range of financial services and products. HSBC has an offshore banking unit (OBU) license and can therefore also provide foreign currency financing to qualifying customers. In addition, there are 7 business development centers in the country’s major 7 EPZ areas including Dhaka, Chittagong, Adamjee, Mongla, Comilla, Karnaphuli and Ishwardi.

Corporate and institutional banking: Corporate and institutional banking provides dedicated relationship management services to HSBC’s clients in major corporate and financial institutions. The Bank’s focus is on fostering long-term relationship based on its international connections and extensive knowledge of Asia and Asian business.

Trade and Supply Chains: Trade finance and related services are a long-standing core business of HSBC based on the depth and spread of its corporate customer base, highly automated trade processing systems and extensive geographic reach.

Payments and cash management: HSBC is one of the leading providers of payments and related services to financial institutions, corporate and personal customers in Bangladesh. Underpinned by the Group’s extensive network of offices and capabilities, payments and cash management assists companies in efficient cash management through the provision of payments, collections, and liquidity and account services.

Custody and clearing: HSBC is a leader in custody and clearing in the Asia Pacific region and the Middle East. The network uses advanced securities clearing system, which was developed in house and provides round-the-clock online real-time access to clients’ securities portfolios. Investment banking and markets: This division brings together the advisory, financing, asset management, equity securities, private banking, trustee, private equity, and treasury and capital market activities of the HSBC Groups.

Treasury and capital markets: HSBC’s treasury and capital markets business ranks among the largest in the world and serves the requirements of supranational, central banks, international and local corporations, institutional investors, and financial institutions as well as other market participants.

Financial Analysis of HSBC 2008-2012

Return on Assets (With Breakdowns)

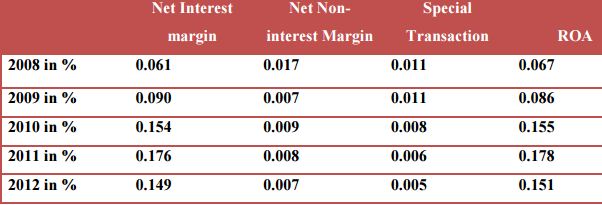

Return on Assets ratio (ROA) of a bank gives an idea of how efficiently a bank is using its assets to generate profit. We can also divide the bank’s ROA into its components part. Components of a bank’s ROA are net interest margin, net non interest margin and special transaction. The sum total of this components results in ROA of a bank. Such a breakdown of the components of a bank’s earning can be very helpful in explaining some of the recent changes that bank have experienced in a particular financial position.

ROA of HSBC with its breakdown is given below:

ROA interpretation

The ROA of HSBC have seen ups and downs over the last five years with the lowest in 2008 and the highest in 2011 of 0.067% and 0.178% respectively. The main reason for the rise of ROA in the year 2011 is due to the increas of the newt profit margin which rose to a substantial percentage of 0.176%. Net non-interest margin was highest in 2008 at 0.017%.

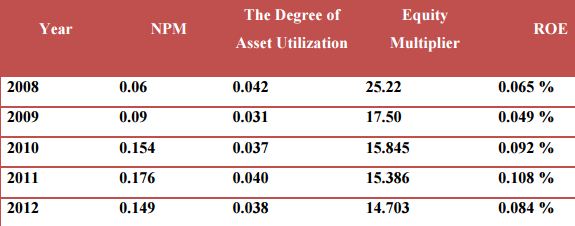

ROE (With Breakdowns)

Return on Equity is a ratio that measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested. ROE is expressed as a percentage. It also has several components which are net profit margin, asset utilization and equity multiplier. Each component of this simple equation is a telltale indicator of a different aspect of the bank’s operation.

ROE breakdown

ROE interpretation

ROE has three components, clearly when any of these four ratios begins to drop, the overall ratio drops. The product of NPM, the degree of asset utilization and equity multiplier gives the ROE ratio. The ROE of HSBC peaked at 2011 when it rose to a 0.108 %. And the lowest was in 2009 when it got stuck at 0.049%.The equity multiplier was highest in 2008 and lowest on 2012 which is good for the organization. The equity multiplier is a way of examining how a company uses debt to finance its assets. This ratio shows a company’s total assets per dollar of stockholders’ equity. A higher equity multiplier indicates higher financial leverage, which means the company is relying more on debt to finance its assets. The banks performance was best in 2011 when the net profit margin was highest at 0.176% and equity multiplier was relatively low at 15.386%.

The equity multiplier went down on 2012 at 14.703% however the net profit margin also went down at 0.149%.

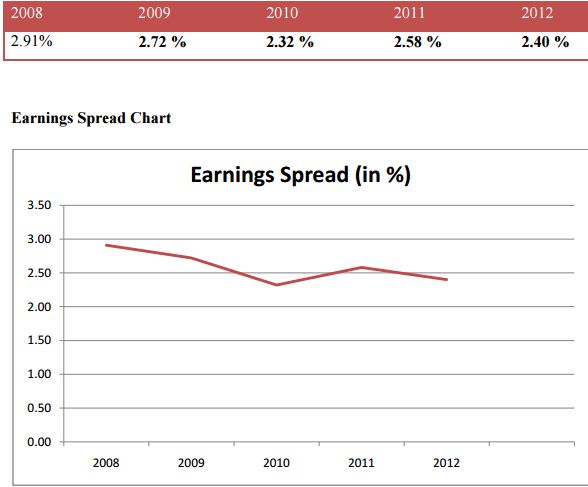

Earnings Spread

Another traditional measure of the earning efficiency with which a bank is managed is called the earning spread. It is calculated from: Earnings Spread= (Total Interest income/Total Earning assets) – (Total Interest expense/ Total interest bearing bank liabilities)

Earning Spread of HSBC 2008-2012

Earnings Spread Interpretation

The earnings spread has been positive for the last five years which is a good sign however it has not grown over the years rather it has been declining.

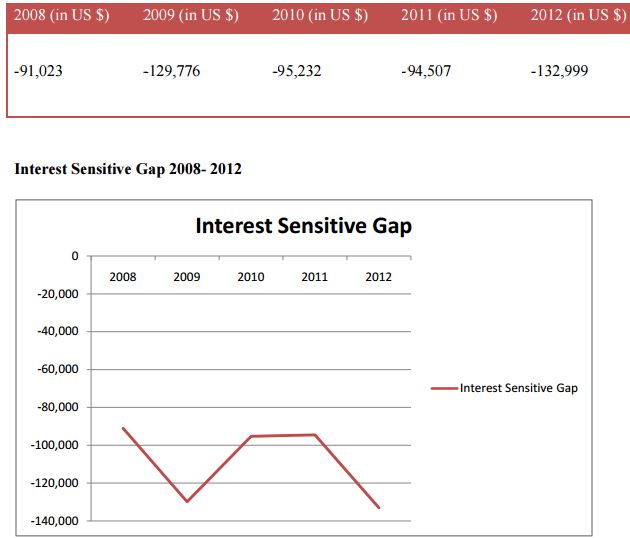

Interest Sensitive Gap

A gap exists between interest sensitive assets and interest sensitive liabilities are called Interest Sensitive Gap. If interest sensitive assets in each planning period exceed the volume of interest sensitive liabilities subject to reprising, the bank is said to have a positive gap and to be assets sensitive. In the opposite situation, when interest sensitive liabilities are larger than interest sensitive assets, the bank then has a negative gap as well as said to be liability sensitive.

Interest Sensitive Gap Interpretation:

HSBC has always had more interest sensitive liabilities than interest sensitive assets throughout the last five years. As of 2012 the interest sensitive liabilities are increasing and in its highest. If there is a substantial amount of change in the interest rates then it will have a negative affect on the bank.

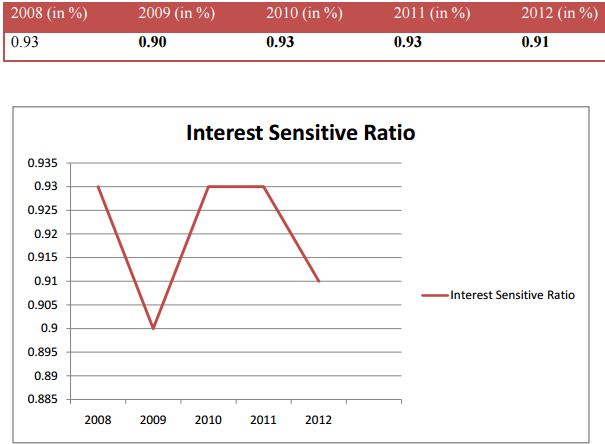

Interest Sensitivity Ratio

The comparison between ISA and ISL, sometimes called the Interest Sensitivity Ratio. In this instance an ISR of less than 1 tells us we are looking at a liability sensitive bank while an ISR greater than unity points to an asset sensitive bank.

Interest Sensitive Ratio 2008-2012

Cash Position Indicator

Cash and deposits due from depository institutions divided by total assets, where a greater proportion of cash implies the bank is in a stronger position to handle immediate cash needs. Cash position indicator implies the how the bank efficiently handle immediate cash needs.

Cash Position Indicator interpretation

Cash position indicator implies the how the bank efficiently handle immediate cash needs. HSBC has maintained an average of 70% of cash position which is quite good however at 2012 it was 60% which is the joint lowest with the 60% of 2008 in these five year period.

Liquid Securities Indicator

Government securities divided by total assets implies liquid securities indicator. It compares the most marketable securities a bank can hold with the overall size of its assets portfolio. The greater the proportion of government securities the more liquid the bank’s position tends to be.

Liquid securities indicator interpretation

HSBC has lot most nonexistent percentage of liquid securities. This means they do not rely on marketable securities for liquidity. They have maintained 0.01 % throughout the last five years.

Capacity Ratio

It implies the ratio between net loan and total assets. It is a negative liquid indicator because loan and lease are considered as most illiquid assets a bank can hold.

Capacity ratio interpretation

HSBC has been very consistent in keeping their capacity just below fifty percent. For a bank of HSBC’s size it’s good to have the figures they have been able to maintain. However they should investment money in instruments which can quickly be liquidated.

Leverage Ratio

Leverage Ratio is measured by dividing core capital and total assets. This ratio is measured to identify whether the bank is well capitalized or not. A leverage ratio greater than 5% would be considered as well capitalized. A leverage ratio of 4% or more would be considered adequate capitalization. Below 4% is considered as undercapitalized. If the leverage ratio falls below 3%, it is called significantly undercapitalized and when it falls below 2%, considered as critically undercapitalized.

Leverage ratio interpretation

HSBC stands strong as a well capitalized bank as its leverage ratio is higher than 5 for the last three years. The ratio is also increasing from 2008 when it was below 4 %. The bank has performed well as a well capitalized financial institution over the last five years.

The financial crisis of 2007-2008

Over the span of the last five years the performance of 2009 has been the worst. The ROA was the lowest in five years. ROE was also at the lowest at 0.049 %. Earnings per share fell to $ 0.34 which is lowest of the five years. This shows the impact of the stark global financial crisis that occurred in the 2007-2008 period. It was the worst financial crisis after the Great Depression of the 1930s and it was very much manifested itself in the financial performance of HSBC in 2009.

Financial analysts and economists still debate over the cause of this global financial calamity. But some common theories are the bursting of the U.S. housing bubble, which peaked in 2006, caused the values of securities tied to U.S. real estate pricing

Although HSBC provides a very friendly and congenial atmosphere for its employees however working long hours can take its toll. In my four months stay at HSBC I have observed some departments working long before the working hours specially Financial Control Department (FSD), Compliance Department, and Commercial Banking Department (CMB). I am sure all the employees are passionate and sincere about their work however I also think maintaining a healthy social life outside the office is equally important to motivate and eradicate boredom of the routine work. Maintaining a proper work – life balance is important and the management to plummet, damaging financial institutions globally. The financial crisis was triggered by a complex interplay of policies that encouraged home ownership, providing easier access to loans for subprime borrowers, overvaluation of bundled sub-prime mortgages based on the theory that housing prices would continue to escalate, questionable trading practices on behalf of both buyers and sellers, compensation structures that prioritize short-term deal flow over long-term value creation, and a lack of adequate capital holdings from banks and insurance companies to back the financial commitments they were making.

A lot of HSBC loans went as bad debts and HSBC could not retrieve this money this also had an adverse effect on their performance.

Proper Work -life balance should make sure that the employees finish their work within office hours and have some time to spend with family and friends.

More Storage facility for inventories

The marketing department should have a dedicated space for storing its temporary inventories. All the CDs and DVDs marketing department are stacked inside paper cartons. These CDs and DVDs contain valuable data, photos, videos of HSBC Bangladesh and should be properly stored for future use but there are not any place for properly showcasing these CDs. HSBC organizes frequent events and entertains its customers and sends invitation cards; it also sends clothing materials and various gifts to charity organizations and sometimes there is an influx of items which becomes hard to store and eats up office space and reduces the office’s ambience so there should be a dedicated store room which should be shared by commercial marketing, rbwm marketing, corporate sustainability and communications department.

Reduce Bureaucratic red tapes

In their quest to become world’s leading international bank HSBC has shrouded itself with a bureaucracy red tapes which hinders the efficient flow of work unnecessarily. For example checking CIB report (a report to see if somebody has a loan) for intern is pretty useless and time consuming.

Conclusion

HSBC wants to establish itself as the Leading International Bank in the world and their goal is to connect business with new opportunities around the globe. It wants to pave a smooth avenue for businesses who wants to reach where it was unreachable. While focusing on commercial banking they have made the strategic move of reducing their operations in the retail banking in Bangladesh. While people comprehends that this is a step backwards HSBC is focusing in reaching something even bigger where stakes are high in a competitive world environment. My experience in the management office was very revealing and it gave in an hands on experience on how a multination organizations work, its climate, environment and most importantly how the people in it thinks and work. This internship process has also helped me to network with some very brilliant individuals both inside and outside work and being acquainted with these individuals would definitely benefit me later in my professional career. I hope I can apply and demonstrate all the learning s in HSBC at my next work place!