Financial performance evolution of Yellow by Beximco

Yellow is a design driven brand that celebrates creative and original thinking to highlight a lighthearted and optimistic view of life through a superior quality product. Yellow started its journey from 2004 in a very short premise. Now it has gone international.

There is no annual report available for YELLOW for general people. YELLOW is a part of BEXTEX Ltd. Financial reports are made under BEXTEX’S name by summing all the firms’ expenses and earnings, who are under BEXTEX Ltd. No financial reports are published under the name of YELLOW or other firms who belongs to BEXTEX Ltd. But as I worked as an intern in the company, I had access in the internal data. That’s why I got few financial statements and I have worked with that information.

This report applies Financial Performance Yellow by Beximco. . Different financial ratios are evaluated such as liquidity ratios, asset management ratios, profitability ratios, debt management ratios and finally measure the best performance of the company. The graphical analysis and comparisons are applied for the measurement of all types of financial ratio analysis I hope this report will help the concerned management to take ideas about the past performance and avoid the short comes and take the positive aspects to apply in future.

INTRODUCTION

Now a day’s Internship is getting admired because students are getting introduced with the real world. Internship program is a compulsory 4-credit course, which provides us with the opportunity to gain practical knowledge about the corporate world.

This internship program and the study have following purposes:

- To get and organize detail knowledge on the job responsibility.

- To experience the real corporate world.

- To experience the role of a team player.

- To compare the real scenario with the lessons learned in the University

- To fulfill the requirement of BBA Program.

- To get a general idea about operating procedures and functions of Accounts and Finance Department of Yellow.

- To get idea about purchase documentation & payment procedures;

- How the chain works are completing.

OBJECTIVE OF THE REPORT:

The objective of the report can be viewed in two forms:

- General Objective

- Specific Objective

General Objective:

This internship report is prepared primarily to fulfill the Bachelor of Business Administration (B.B.A) degree requirement underMr. Riyashad Ahmed, Assistant Professor and Coordinator, EMBA Program, BRAC University

Specific Objective:

More specifically the objective of this report is to show what are the major functions of Accounts and Finance Departments atYELLOW and their financial condition. After reading this report readers will have knowledge about the following issues:

- An overview of YELLOW and BEXIMCO Textiles Limited;

- Products and Services of YELLOW and BEXIMCO Textiles Limited;

- Details analysis of the Financial Statements of years 2010 and 2011 ofthe company;

- How the real corporate world works;

- How to face and behave in a critical situation;

- Logical decision based on the analysis;

INTRODUCTION OF BEXIMCO:

The BEXIMCO Group is the largest private sectorconglomerate in Bangladesh. As BEXIMCO has grown over the years, the flagship platform now has operations and investments across a wide range of industries including textiles, trading, marine food, real estate development, construction, information and communication technologies, media, ceramics, pharmaceuticals, financial services and energy. The Group sells its products and services in the domestic Bangladesh market as well as international markets. BEXIMCO is the largest employer in the private sector in Bangladesh and employs over 48,000 people worldwide.

BEXIMCO encompasses one of South Asia’s largest vertically integrated textile and garment companies. The Textile division is a fully integrated manufacturer of cotton and polyester blended garments for men, women and children, both for domestic and export markets.

BEXIMCO is also the largest exporter of pharmaceuticals in Bangladesh with a presence in 45 countries. The Pharmaceuticals division manufactures and sells generic pharmaceutical formulation products, active pharmaceutical ingredients (API) and intravenous (IV) fluids. The Group is also the largest ceramics exporter and has an investment in GMG Airlines, the largest private commercial airline in Bangladesh and in Unique Hotels & Resorts, which owns the Westin Hotel in Bangladesh.

Beximco Textiles Ltd is a member of Beximco group. It is one of South Asia’s largest vertically integrated textile and garment companies with in-house analytical and creative abilities. Beximco Textiles is the result of merging Beximco Knitting Ltd, Beximco Denim Ltd, Freshtex together.

It also includes garments factories they are SS Fashion, Padma Textiles, Dacca Fashion, IKAL 1, IKAL 2 and CFDL.

Over the years, BEXIMCO has developed in-house design capabilities with teams based in Bangladesh and Spain. Furthermore it has partnered with some of the world’s renowned design institutes, including Fashion Institute of Technology, Parsons, London School of Fashions, NIFT and NID, for access to talented designers. The Group has built strong working relationships with its core clients through a continuous dialogue. The Group’s technology partners include Invista, Huntsman, CHT, Rudof and Clariant. Key clients include American Eagle, Arcadia Group, Calvin Klein, H&M, JC Penney, Macy’s, Tommy Hilfiger, Warnaco and Zara. The Group is planning to expand the textiles business through capacity additions. Post expansion, the annual capacity of knit fabric is expected to increase to 80 million lbs from 11 million lbs currently and the annual capacity of apparel knits is expected to reach 145 million pieces from 20 million pieces currently.

HISTORICAL BACKGROUND OF BEXIMCO:

Today the BEXIMCO Group (“BEXIMCO” or the “Group”) is the largest private sector group in Bangladesh. BEXIMCO was founded in the 1970’s by two brothers – Ahmed Sohail Fasiur Rahman and Ahmed Salman Fazlur Rahman. Since the early days, the Group has evolved from being primarily a commodities trading company to a leading, diversified group with a presence in industry sectors that account for nearly 75% of Bangladesh’s GDP. BEXIMCO’s corporate mission is “Taking Bangladesh to the world”.

Beximco textile Ltd. (the “Company”) was incorporated in Bangladesh as a Public Limited Company with limited liability on 8 March 1994 and commenced commercial operation in 1995 and also went into the public issue of shares and debentures in the same year. The shares of the Company are listed in the Dhaka and Chittagong Stock Exchanges of Bangladesh. Beximco Synthetics Limited, a member of BEXIMCO Group, has been a manufacturer of

Polyester Filament Yarns, namely, Partially Oriented Yarn (POY) and Draw Texturized Filament Yarn (DTFY) since July 1, 1994 and has an annual production capacity of 28 million linear meters.

OVERVIEW OF BEXIMCO TEXTILE:

BEXITEX Ltd. (Beximco Textile Ltd.) is the most modern composite mill in the region. BEXTEX Ltd. has an installed capacity of 288 high-speed air-jet looms in its weaving section and a high-tech dyeing and finishing section with a capacity of 100,000 yards of finished fabric per day. This company is located at the Beximco Industrial Park. BEXTEX Ltd. has a state of the art composite knit fabric production mill, which serves the growing needs of high-quality knit garments exporters in Bangladesh. The project was set up as a state of the art knit fabric knitting, dyeing and finishing facility. During the year the Company produced and sold high quality of knit fabrics and bringing forth all the latest in hardware (Machins) and soft technologies in knitting, dyeing and finishing of knit fabric.

BEXTEX Ltd. also has cotton and polyester blended yarn-spinning mill, with 122,000 yards spindles per day and is one of the largest spinning mills of the country. The mill was set up to feed the country’s export oriented industries. BEXTEX Ltd. produces specialized finishes of denim cloth for export in finished as well as cloth only form.

Commitment to the Environment:

BEXIMCO TEXRILE Ltd. is very committed to preserve a healthy and pollution-free environment. It has a very efficient waste collection and disposal system. In order to reduce air pollution by exhaust of gas from engine-generators, it maintains a costly plant that uses the exhaust gas to generate steam for chilling unit. Above measures not only help keep the water & air free from pollution but also help save cost of water treatment & air conditioning. The company uses only AZO-free dyes and is dedicated to ensure a healthy and eco-friendly environment. Beside all this to keep the environment fresh Bextex has planted lots of trees inside the ‘Beximco Industrial Park’, which also makes the place look attractive.

CORPORATE GOVERNANCE:

The maintenance of effective corporate governance remains a key priority of the Board of BEXTEX Limited. Recognizing the importance of it, the board and other senior management remained committed to high standards of corporate governance. To exercise clarity about directors’ responsibilities towards the shareholders, corporate governance must be dynamic and remain focused to the business objectives of the Company and create a culture of openness and accountability. Keeping this in mind, clear structure and accountabilities supported by well understood policies and procedures to guide the activities of Company’s management, both in its day-today business and in the areas associated with internal control have been instituted.

Internal Financial Control:

The directors are responsible for the Company’s system of internal financial control. Although no system of internal control can provide absolute assurance against material misstatement and loss, the Company’s system is designed to provide the directors with reasonable assurance that problems are timely identified and dealt with appropriately. Key procedures to provide effective internal financial control can be described in following heads:

Management structure: The Company is operating through a well defined management structure headed by chief executive officer (CEO) under whom there is executive directors, general managers for various departments and according to hierarchy, various senior and mid level management staffs. The CEO and the executive directors, general managers meet at regular intervals represented also by finance, marketing and personnel heads.

Budgeting: There is comprehensive management reporting disciplines which involve the preparation of annual budgets by all operating departments. Executive management reviews the budgets and actual results are reported against the budget and revised forecasts are prepared at regular intervals.

Asset management: The Company has sound asset management policy, which reasonably assures the safeguarding of assets against unauthorized use or disposition. The Company also follows proper records and policy regarding capital expenditures.

Functional reporting: In pursuance with keeping the reliability of financial information used within the business or for publication, the management has identified some key areas which are subject to monthly reporting to the chairman of the board. These include monthly treasury operations and financial statements. Other areas are also given emphasis by reviewing on a quarterly basis. These include information for strategy, environmental and insurance matters.

PRODUCTS of BEXTEX:

Yarn Products

- Count – Ranging from 6 – 120

- Fiber – Cotton ( super – combed, combed, carded)

- CVC – 60% cotton, 40% polyester

- TC – 65% polyester-35% cotton; 100% polyester both regular and sewing thread Lyocell, Tencel, Modal, Rayon, Viscose etc

Fabric Products

- Poplins

- Twills

- Oxfords

- Seersuckers

- Canvas

- Rib stops in 100% Combed Cotton

- CVC and CVS/TC

- Stretch

- Wrinkle Free

- Easy Care

- Peach

- Chintz

- Paper Touch

- Teflon Coated

- Water Repellent

- Water Resistance

- Rubberized

Knit Products

- Jersey : In 100% Combed Cotton, CVC, CVS/TC, and Lycra mix

- Polo Pique : In 100% Combed Cotton, CVC and CVS/TC

- Back Pique : In 100% Combed Cotton, CVC and CVS/TC

- Herringbone : In 100% Combed Cotton and CVS/TC

- Popcorn : In 100% Combed Cotton and CVS/TC

- Bubble Knit : In 100% Combed Cotton, CVC and CVS/TC

- Crepe : In 100% Combed Cotton and CVS/TC

- Engineering Stripe : In 100% Combed Cotton and CVS/TC

- Feeder Stripe : In 100% Combed Cotton and CVS/TC

- Auto Stripe : In 100% Combed Cotton and CVS/TC

- Rib : In 100% Combed Cotton and CVS/TC

- Jacquard : In 100% Combed Cotton and CVS/TC

Denim Products

Chambray: In classic indigo colors ranging from 4oz to 5.5oz/Yd2

Denim (blue): In classic indigo colors ranging from 4oz to 15oz/ Yd2

Denim (black): In sulfur black colors ranging from 4oz to 15oz/ Yd2

Colored Denim: In a variety of colors – both in sulfur & reactive dyes(warp dyed)

Over dyed Denim: In a variety of colors on indigo blue & sulfur black

Bull Denim: In a variety of reactive colors ranging from 10oz to 13oz/ Yd2 (piece dyed)

Stretch Denim: In classic indigo colors ranging from 4.5 oz to 13.75 oz/Yd2

YELLOW & DESCRIPTION OF THE JOB

YELLOW by BEXIMCO:

BEXIMCO Group is also present in retail apparel through “Yellow”, a youthful brand sold through BEXIMCO owned outlets. Yellow is a design driven brand that celebrates creative and original thinking to highlight a lighthearted and optimistic view of life through a superior quality product. Yellow captures a modern interpretation of fashion and relaxed attitude expresses a comfortable and confident quality. The adventurous spirit of the line is built from BEXIMCO Group’s heritage in innovation and living a life full of passion that is open to discovery. Yellow is inspired by its customers; Unconventional yet high-quality.

Yellow started its journey from 2004 in a very short premise. Now it has gone international. At present yellow have 11 outlets in Bangladesh and 4 outlets in Pakistan.

There is no annual report available for YELLOW for general people. YELLOW is a part of BEXTEX Ltd. Financial reports are made under BEXTEX’S name by summing all the firms’ expenses and earnings, who are under BEXTEX Ltd. No financial reports are published under the name of YELLOW or other firms who belongs to BEXTEX Ltd. But as I worked as an intern in the company, I had access in the internal data. That’s why I got few financial statements and I have worked with that information.

Yellow Product Categories:

Yellow has a wide range of clothing products for man, woman and kids. It also sells accessories that include wallet, belt, socks, women purse, ornaments, shoes etc.

The Yellow Man:

Yellow is very much successful by its men products. Its men products include the following items:

- Formal shirts

- Casual shirts

- Polo shirts

- T-shirts

- Punjabis

- Pajama

- Formal pants

- Casual pants

- Sweaters & Jackets

- Blazers

- Shoes

- Accessories

Yellow believes that their clothes reflects confident, intelligent and successful individual who believes in making his own destiny. Yellow compliments one’s lifestyle by offering products for every occasion. From office mornings to an evening with friends, Yellow answers one’s need for individuality, quality and style by providing superior, fashion forward products.

The Yellow Woman:

Yellow offers a wide range of products for women especially for young girls. Their products include high quality western outfits as well as outfits that combine both western and Bangladeshi culture. Following items are provided by yellow for women:

- Knit Top

- Woven Top

- Denim Bottom

- Casual Bottom

- Legging

- Shoe

- Accessories

- Sweater & Jacket

- Luxurious Lawn

They believe that their outfits give a stylish, intelligent and confident look. These wardrobes compliment modern lifestyle. They are on top of the fashion trends and confirm with high standards of quality and reflect young and lighthearted approach to life.

Yellow makes dresses that suits one up in semi-casual attire for business meetings, and provide the matching accessories to go with that. Yellow products are inspired by their young, confident and successful customers.

The Yellow Kid:

Yellow has a wide range of clothing for both boys and girls kids. They are very conscious about the quality of these products. Yellow kids clothing are as follow:

- Kids Boys:

- Boys Panjabi

- Polo shirt

- T-Shirt

- Boys pajama

- Denim pant

- Short pant

- Sweater & Jacket

- Boys Set

Kids Girls:

- Woven Top

- Knit Top

- Bottom

- Girls Set

- Sweater & Jacket

ACCOUNTS & FINANCE DEPARTMENT OF YELLOW:

I am doing my internship at the Accounts & Finance department of Yellow. The responsibilities of this department are to maintain and control each and every perspective related to accounts and finance. The main responsibilities of Accounts department are as follow:

- To keep a detailed report of daily sales.

- To maintain daily cashbook.

- To manage the expenses.

- To do all kind of payments including salaries.

- To keep journals of every transaction.

- To keep control over the inventories.

- To prepare financial statements.

- To do the forecast about the future Sales and Expenses.

- To do the other accounts related work.

These responsibilities are discussed in details in this section:

To keep a detailed report of daily sales:

Everyday a good number of sales are made in each outlets of yellow. These sales include both cash and card sales. Card sales are transferred directly to the banks. The sales that are done in cash those reports are sent daily by the shop in-charges to the accounts department.

They send these reports via mail and SMS. Based on these reports and bank statements a daily cash report is prepared. At the end of the month all the detailed financial statements and day to day expense reports are also sent to the accounts department. This monthly reports are then checked with the inventory, cash amount and card deposit in the banks. These monthly reports are sent through courier (mail).

To maintain daily cashbook:

Another important responsibility of the department is to maintain daily cashbook. In this cashbook only the cash transactions are included. This report helps to comprehend the current cash position of the company that is really important to distinguish. Cash transactions like cash sales, expenses that are made in cash, other cash receipt etc are incorporated in the cashbook. In the cash book these transactions are entered on a daily basis. This is very supportive while preparing the financial statements at the end of the month as well as end of the year.

To manage the expenses:

Everyday various kinds of expenses take place both in the shops and the corporate office. All these expenses are controlled by this department. There are two kinds of expenses that are made. They are

- Fixed Expenses and

- Variable Expenses

Fixed Expenses: Fixed expenses are predetermined in nature and do not change repeatedly. They are usually preset and are made after a certain period. These expenses are comparatively less frequent and usually in large amount than the variable expenses. For example: Store rent, utility bills, salary, transportation cost, etc are some of the expenses of their fixed expenses.

Variable Expenses: As we know variable expenses are inconsistent in nature. There is no specific time or period assigned for these kinds of expenses. The payment of various fabric bills, accessories bills, conveyance, and shop maintenance expense, various head office expenses and factory expenses etc are the example of variable expenses.

These expenses are again divided into three categories. They are Factory related expenses, Head Office related expenses and Shop related expenses. Under these expense head the following expenses are incorporated;

- Factory Related Expenses:

- Factory worker wages.

- Workers benefit.

- Factory rent.

- Machine rent.

- Power & utilities.

- Repair and maintenance.

- Other manufacturing expenses.

- Depreciation.

Head Office Related Expenses:

- Local Officers Salary.

- Local officers benefit.

- Expat salaries.

- Expat benefits.

Shop Related Expenses:

- Shop employee’s salaries.

- Shop administrative expenses.

- Shop rent.

To Do All Kind Of Payments Including Salaries:

The yellow accounts department performs the responsibilities of doing all the payments of both the fixed and variable expenses. These payments are made from the income earned by sales and other income sources. They execute these payments by both cash and bankcheques.

Every cheque has to sign by the Head of Account of Beximco Textile. Yellow is currently using IFIC Bank accounts for their payments.

To Keep Journals Of Every Transaction:

Accounts department have to keep journals of the transactions that are made daily. For these journal entries they use their own software named FellowBTX. These entries are divided into some different categories of journals. They are the journal entries of cash payment journal, sales journal, bank payments, contra entries, cash received and bank received. Different head transactions are made under different groups that are categorized in the mentioned software.

These journals are then automatically moved to ledger accounts. These accounts are checked regularly to keep match with the actual expenses and income.

To Keep Control Over The Inventories:

Inventories are considered as asset for a company. Fabrics and accessories that are purchased for making finished products are the inventories of yellow. Though inventories are assets for a company but access of inventories is bad for the company. All the financial records of the inventories are kept by this department. They monthly check the closing stocks and monitor the overall condition of inventories. This department tries to keep a balance between the demand and supply available in the inventory.

To Prepare Financial Statements:

Financial statements are the reflection of a company’s overall status. These financial statements include the Profit & Loss statement, Cash flow statement and the Balance Sheet.

The accounts and finance department of yellow performs the duty of preparing these financial statements. They prepare the Profit & Loss statement monthly, Cash flow statement periodically and Balance sheet on yearly basis.

To Forecast About The Future (Long term and Short term):

They forecast about the future sales based on the previous data. This helps to understand what will be the condition of the firm in future. They also forecast about future investment whether that will be profitable or not. This forecasting helps to invest in profitable projects and to take necessary steps to increase the sales volume.

FINANCIAL STATEMENT ANALYSIS

FINANCIAL STATEMENTS:

The Accounting process or financial reporting system, which generates financial information for external users, encompasses five principal financial statements:

- Balance sheet ( statement of financial position)

- Income statement ( statement of earnings)

- Statement of cash flows

- Statement of stockholders’ equity

Financial statements provide information about the assets (resources), liabilities (obligations), income & cash flows, and stockholders’ equity of the firm. The effects of transactions and other events are recorded in the appropriate financial statements.

- The income statement reports revenues, expenses, and gains & losses.

- The balance sheet shows assets, liabilities, & stockholders equity; the statement of stockholders’ equity reports capital transaction with owners.

- The statement of cash flows includes operating investing, and financial inflows and outflows. Many transactions are reflected in more than one statement so that the entire set is required to evaluate the firm.

- Footnotes provide information about the accounting method, assumptions, and estimates used by management to develop the data reported in the financial statements. They are designed to allow users to improve assessments of the amounts, timing, and uncertainty of the estimates reported in the financial statements. Footnotes provide additional disclosure related to such areas as:

- Fixed assets

- Inventories

- Income taxes

- Pension and other postemployment benefit plans

- Debt (interest rates, maturity schedules, and contractual terms)

- Lawsuits and other loss contingencies

- Marketable securities and other investments

- Hedging and other risk management activities

- Business segments

- Significant customers, sales to related parties and export sales.

Other Sources of Financial Information also work as financial statements. These statements also represent firms’ position. Management discussions and analysis act as a source of information of financial information. Companies with publicly traded securities have been required since 1968 to provide a discussion of earnings in the MD & A sections. The MD & A is required to discuss:

- Results of operations, including discussion of trends in sales and categories of expense

- Capital resources and liquidity, including discussion of cash flow trends

- Outlook based on known trends.

Some other sources of financial information are:

- Companies that issue securities to the public are required to publish a registration statement including a prospectus.

- Proxy statements, issued in connection with shareholder meetings, contain information about board members and management, executive compensation, stock options, and major stockholders.

- Many companies prepare periodic “fact books” containing additional financial and operational data. Corporate press releases also provide new information on a timely basis.

- In addition, many companies hold periodic meetings or conference telephone calls to

- Keep the financial community apprised of recent developments regarding the company.

NEED FOR FINANCIAL STATEMENT ANALYSIS:

The financial reporting system is not perfect. Analysis of these statements helps both the company and its investors to understand the overall financial condition of the company. Here some reasons of the need for financial statement analysis are given below:

- In an ideal world, the user of financial statements could focus only on the bottom lines of financial reporting: net income and stockholders’ equity.

- The financial reporting system is not perfect. Economic events & accounting entries do not correspond precisely; they diverge across the dimensions of timing, recognition & measurement.

- Economic events and accounting recognition of those events frequently take place at different times.

- Long – lived assets are written down, most of the time, in the Fiscal Period of management’s choice.

- Generally Accepted Accounting Principles (GAAP) permit economic events that do receive accounting recognition to be recognized in different ways by different financial statement prepare.

- Financial reports often contain supplementary data that, although not included in the statements themselves, help the financial statement users to interpret the statements or to adjust measures of corporate performance to make them more comparable.

- Information from outside the financial reporting process can be used to make financial data more useful.

RATIO ANALYSIS:

Financial ratios are used to compare the risk and return of different firms in order to help equity investors and creditors make intelligent investment and credit decisions. Ratios can also provide a profile of a firm, its economic characteristics and competitive strategies and its unique operating, financial and investment characteristic. By doing ratio analysis it is possible to understand a company’s past, current and future probable financial situation.

Four ratio categories measure the risk and return relationships. These categories are:

- Liquidity Analysis:Measures the ability to meet the near-term obligations. Ability to convert into cash. By analyzing the ratios mentioned bellow liquidity analysis has been done for yellow by Beximco.

- Current Ratio

- Quick Ratio

- Profitability Analysis:Measures the income of the firm relative to its revenues and invested capital. The following ratios are used to analyze the profitability;

- Gross margin

- Operating margin

- Net profit Margin

- ROA ( Return On Asset)

- ROE ( Return On Equity)

Activity/ Asset management Analysis:

- Evaluates revenue and output generated by the firm’s assets. The following ratios include in the activity analysis:

- Inventory turnover ratio

- Total asset turnover Ratio

- Fixed asset turnover Ratio

- Average sales collection period

- Average payment period

Debt management ratio/Solvency Analysis: Debt Management Ratios attempt to measure the firm’s use of Financial Leverage and ability to avoid financial distress in the long run. These ratios are also known as Long-Term Solvency Ratios.

- Debt to asset ratio

- Times Interest Earned (TIE)

Liquidity Analysis:

Short-term lenders and creditors must assess the ability of a firm to meet its current obligations. The ability depends on the cash resources available as of the balance sheet date and the cash to be generated through the operating cycle of the firm. The shorter the cycle, the more efficient the firm’s operations and cash management is. The longer cycles may be indicative of cash shortfalls and increased financing costs.

Liquidity Analyses is made to understand the liquidity position of a company. Liquidity position of a company means the ability of a company to pay its short term obligation, by using its short term Assets. Three ratios are used to conduct the liquidity analysis. They are the current ratio, quick ratio and cash ratio. Among these three ratios Current and quick ratio are analyzed in here.

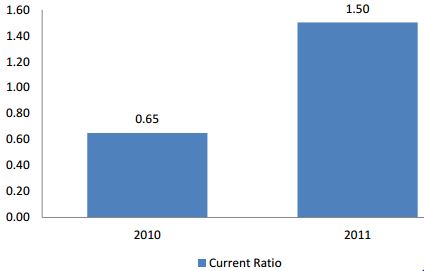

Current Ratio:

Current ratio uses all the current assets of the company. Higher current ratio is good for a company. But this may be as a result of higher inventory, which is bad for the company because the company may fail to sell its goods and it may also indicate assets are tied up as current assets (in the form of Cash or Receivables) which does not earn anything.

In 2010 current ratio of Yellow was 0.65 which means Yellow had taka 0.65 to pay 1 taka of its current debt. This was a bad situation for the company. In 2011 current ratio was 1.50 which means Yellow had taka 1.50 of current assets against taka 1 of current liability. In 2011 the condition of the company was better than 2010. It also indicates in 2011 Yellows current assets might have tied up a bit. But overall we can say that in 2011 the current ratio position was better than 2010.

The comparisons of the data for 2010 and 2011 are shown in the diagram below:

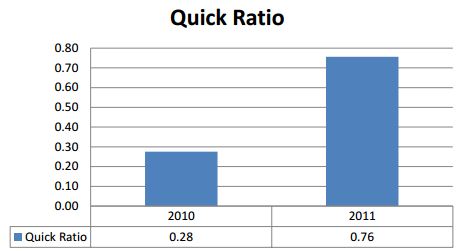

Quick Ratio:

A more conservative measure of liquidity analysis is the quick ratio. The assets included in this ratio are called quick asset because they can be quickly converted to cash. Inventory and prepaid expenses are excluded from this ratio. If this ratio is much lower than the current ratio, then it is considered that firm is facing liquidity problem. It signifies that the company may have higher inventory that the firm is unable to selland higher prepaid expenses.

Quick Ratio of Yellow for the year 2010 and 2011 are:

In 2010 the quick ratio was lower than the current ratio of 2010 but in 2011 the quick ratio was even much lower than the current ratio of 2011. It indicated that the company had more cash and accounts receivable and securities available in 2011 and it also indicates that inventory of the company was higher than 2010. The comparisons of the data for 2010 and 2011 are shown in the diagram below:

Recommendation:

As I have worked with previous date rather than recent data because of some privacy issues. From my report the concern management will be able to know what they should avoid and what they should adopt more to perform well in the future. Though I have recommended the necessary steps after in each ratios discussed previously. All I can recommend now them to focus more on their Loan issues and utilize the outstanding stock stored in their factory. At the same time a regular basis checking of all the transaction of all shops as well as a strong observation and support of Beximco Group.

Conclusion:

It is said that, coming up with better idea for a successful firm is a very difficult task. As a new player in the market, I tried heart and soul to analyze the specific aspects (finance and accounting) of the firm. I have lack of practical knowledge and experience. So the recommendations I made could be outdated beside any professional report. Working in a firm like Yellow was a real challenge for certain reasons. The firm is not so old in the market as well as its’ growing level. It needs a long way to reach the maturity. Still it is making a healthy business which is a very good sign. As a fresh student, this is my first experience in real life. I tried to use my theoretical knowledge in the work place. I could relate a lot of theories with real life. On the other hand, a number of theories came to no use. But this is just a short span of time. I gathered my experience and learned about the working environment. I hope this will help me a lot in my professional life.