Foreign Exchange Operations of

United Commercial Bank Limited

Banking is the topic, practice, business or profession almost as old as the very existence of man, but literarily it can be rooted deep back the days of the Renaissance (by the Florentine Bankers). It has sprouted from the very primitive Stone-age banking, through the Victorian-age to the technology-driven Google-age banking, encompassing automatic teller machines (ATMs), credit and debit cards, correspondent and internet banking. But the foreign exchange services have been a vicinity of concern not only to bankers but to all in the business. The axle of this study is to have a clearer picture of how United Commercial Bank LTD, (UCBL) manages its Foreign Exchange performance.

Objectives of the study:

Objective of the study acts as a bridge between the starting point and the goals of the study. To illustrate the objectives properly, presented into two parts:

General:

- To observe the Foreign Exchange Operation of United Commercial Bank Limited and their services.

Specific:

- To observe the major outline of Foreign Exchange Business.

- To observe Credit line arrangement.

- To observe the Foreign correspondents of UCBL.

- To observe the post important financing operations.

- To analysis the expansion of foreign trade Business of the UCBL.

- To identify the problems of it‟s financing.

- To recommend solutions to the problems faced by UCBL in Foreign Exchange Department.

OVERVIEW OF BANGLADESH ECONOMY AND FINANCIAL INSTITUTES

Bangladesh is a least development country and the economy of this country is agrobased. The agriculture system is primitive and frequently affected by natural disaster. Poverty is the main problem of this country. About 31.5% of its population is living below the poverty line whoever as about 12% of the population is living below the hard core poverty line. After the devastating flood of year 1998 and 1999, the economic activities of the country resumed by taking various rehabilitation program and bumper production of the agriculture sector helps to recover that below. Bangladesh economy has faced severe set back again after the terrorist attack on world trade center of USA on September11, 2001 and afghan war. This event has changed the world economic scenarios and caused global economic recession. This global recession has severely affected export system and Bangladesh economy like readymade garments industry, frozen food, manpower export, hotel and tourism sector etc. Due to global recession foreign financial assistance also severely affected. To overcome this situation government has taken various sect oral reform plan (closer of Adamze jute Mill is an example of it). Govt. also prepares the current fiscal year‟s budget to decrease the foreign aid dependency. Although global recession has caused the ever lowest foreign currency reserve of US$14572.22(12 months) in million in 2013 which is increased to US$12763.16(9 months) million in September 2014 by various positive steps taken by the government anti money laundering law, emphasis on remittance through proper banking channel. According to Bangladesh economic analysis 2002 of ministry of finance, income is increased by 1.73% and population is increased 1.71%.

Overview of Financial institutes of Bangladesh:

Financial institutes play an important role of the economic development of any country. The objective of these institutions is to accumulate the scattered deposit and invest it in a productive manner for economic emancipation. There are 52 schedule Banks (January 2013) operate in Bangladesh of them 4 nationalized commercial Banks, 30 Private Banks, 8 Islamic Commercial Bank and 10 Foreign Banks. There are also 04 Non- schedule Banks (January 2013) operate in Bangladesh. For proper monitoring of the operations of Banks, Bangladesh bank introduces ”Problem Bank Monitoring Division” in addition to Camel Rating. To increase the economic activities Bangladesh Bank reduces the Bank rate to 6% from 7%. To increase Customer service Banks are using Various modern techniques like on line banking ATM, Money Gram, Credit Card etc.

A Bank is usually defined as a financial institution which deals in money.

Today however the function of a Bank have increased so much that it is considered a very vital agent of development in country like ours. Because of their positive involvement in trade industry, business finance and a host of other allied services, Banks today form a very important part of an economy. A bank like private commercial bank helps to develop economy as follows:

The nationalized banks, countries margin operational banking units could not demonstrate and achieve optimistic results in terms of overall economic growth. The gloomy picture of nationalized banks is mainly due to:

- Lack of quality of services.

- Minimum of commitment toward institutions.

- Management inefficiency.

- Excessive intervention of collective bargaining agent (CBA).

- Lack of security.

- Documentation of loans and advances debarring legal action in case of default.

- Slow rate of recovery of loan.

- Lack of supervision and monitoring of loans and advances.

- Directive loans.

- Political instability.

Transitional inconsistency while formulating policy issue on banking. Due to inefficient and continuous loosing concern of public sector, the main objective of privatization policy was-

- To reduce deficit of the Govt. to meet continuous loss of public enterprises.

- To improve operative efficiency of enterprise.

- To introduce competitiveness in all spheres of economic activities except few areas where Govt. control of economic activities was unavoidable.

In the country 80s it was increasingly felt that a number of PCBs might have improve their position putting nationalized banks into competition. The launching of PCBs has finally created a significant impact in quality of services in banking. Banking being a service industry, it is not easy to quantity to performance of this sector like manufacturing. The performance of the banking sector in terms of generating profit, expansion of bank branches, mobilization of deposits, deployment of advances, involvement in foreign trade and generating of employment. It is revealed from the loan operations of banks. The PCBs provide operation mainly for trading (internal trading, export and import trade) and construction while the NCBs are providing finance for priority areas like agriculture, industry and export import tasks. PCBs have shown some efficiency in terms of branch expansion employment generation, mobilization of deposits and deployment of advances but their activities remained concentrated in city areas. They could not provide finance for priority sector like agriculture. The key to success of private sector banks is identified as a professional efficiency in choosing various risk assets, personalized quantity of services, result oriented business strategy and achievement against stipulated target. But by rapidly issuing fresh licenses to the promoters of private banks, the quality of entrepreneurs is not being ensured and developed. As a result too many banks are chasing same customers/entrepreneurs within limited deposit base. Now a day, the banking business exclusively depends on quality of services in terms of new innovative strategies for boosting banking operations compatible to international standard. Modern technology, equipment and innovation like computerized money counting machine, automatic teller machine (ATM) etc. are being utilized to a great extent for survival and to face competitors. PCBs have already explored new financial products by introducing master card, credit card to attract customer/entrepreneurs. Many PCBs have implemented various attractive schemes acceptable to the existing and prospective customers such as the customer credit scheme, marriage and educational scheme, micro credit scheme and small loan scheme etc. In this respect PCBs are keen for development of human resources to train and equip their manpower with new ideas and products to enable them to contribute to the greater innovation. The PCBs are talking part in stimulating foreign exchange reserve by financing 100% export oriented RMG industries. Neutrally 65% of export earnings of Bangladesh is generated by this sector. The PCBs are participating and financing in various types of medium and long term industries either wholly or partly through consortium arrangement among the member Banks. The PCBS are also general investor and recently a package program has been derived to stabilize the countries capital market by launching merchants‟ banks which will extend loan to the brokers and general investors. The nationalized banks are talking advantages of restrictions imposed on nonnationalized banks while mobilizing deposits form government autonomous and semiautonomous bodies. The total available funds of Govt. sector, the PCBs are restricted to the range of 25% to 40% of these funds only. Such dual practice is not desirable when we are hoping the theory of free market economy. Above all, PCBs have been playing an indispensable role in the money market for the growth and development of our economy along with all nationalized specialized and foreign Banks. The better performance of PCBs will finally be recognized still when they offer better quality of service based on new ideas/ products. We foresee a good future for the PCBs. They are expected to develop their lending role in the near future in financial market. The importance of variant economic refers to the due attention to a sound financial system. The base of financial services in Bangladesh is quite narrow. By improving the financial structure and financial super structure, our financial system can be made sound.

Administration of Foreign Exchange Operation by UCBL

After the relaxation of economic barrier at 90‟s, firms become interested to do business globally and banks play a key role in this aspect. For doing foreign exchange business in favor of firm, bank follows some administrative framework and this chapter describes the administration of foreign exchange business of United Commercial Bank Ltd. and the role of Bangladesh Bank in foreign exchange business. United Commercial Bank has 84 Branches of which 19 are authorized by Bangladesh Bank through which bank can do Foreign Trade business.

Foreign Exchange Business Mechanism:

Foreign exchange business comprises three areas: export, import and remittance. In order to start a business with the bank involving foreign exchange, a prospective client has to fulfill the following requirements:

Primary requirement:

When a company wants to go for any export or import through a bank, he has to fulfill some common criteria. Let us first consider the issue of import. For importing goods through a bank, the importer has to meet the following criteria:

- He has to be a customer of the bank; that means, he has to have a CD Account with the bank.

- In case of import, he must have an IRC (Import Registration Certificates).

- He has to have experience of importing the same goods through the bank. If he has no such experience, the goods that he wants to import have to be approved by the Import policy.

- The item of import has to have marketability.

- He has to fix a right price for the goods to be imported.

If these requirements are fulfilled by the customer, the banker may proceed to prepare the proposal for the customer. If the board approves the proposal, the authorized banker can open L/C in favor of the customer by taking Pro-forma Invoice or Indent. In cases of export, the customer has to fulfill the following requirements:

- The exporter has to be a customer of the bank; that means, he has to have a CD Account with the bank.

- The exporter has to give an Export LC or Contact against which he can open L/C.

- The goods to be exported must be approved by the Export Policy.

If the customer fulfills these criteria, the authorized banker can go for business with him.

Import Section:

The Import Section helps business and other people to import goods. In international environment, buyers and sellers are, in most of the cases, unknown to each other. So a seller always seeks guarantee for the payment for his exported goods. It is the bank that guarantees the seller the payment for the goods on behalf of the buyer. This guarantee is called Letter of Credit. Thus the contract between the importer and the exporter is given a legal shape by the banker by its „Letter of Credit‟.

Legislations for Import:

Imports are foreign goods and services purchased by consumers, firms & Government agencies in Bangladesh. To import, a person should be competent to be an „importer‟. According to Import and Export Control Act, 1950, the office of the Chief Controller of Imports and Exports (CCI & E) provides the registration (IRC) to the importer. Import of goods in Bangladesh is regulated by the

- Ministry of Commerce in terms of the Import and Export Control Act, 1950;

- Import Policy Order and the Public Notice issued by the Office of the Chief Controller of Imports and Exports (CCI&E)

- At present it is regulated by the Import Policy Order (1997-2002), which came into effect on June14, 1998. The duration of the Import Policy Order was extended up to June 2003 by an amendment. This policy directs certain import procedures and administers the whole activity.

Facilities provided by import section

- Opening of Letter of Credit

- Facilitating payments to the exporter on behalf of the importer

- Providing funded and non-funded credit facility

- Issuing bank guarantee in foreign currency on behalf of foreign companies.

Import Mechanism

Letter of Credits can be opened with any of the Branch authorized to deal in foreign exchange. Bank issuing L/Cs has to perform the following functions that are to be done in the different stages:

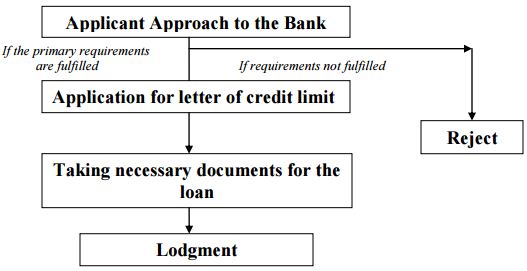

(i) Applicant’s approach to the bank

The applicant of Letter of Credit must be a known customer to the bank. He has to approach the bank to open a Letter of Credit for import of goods through an application in the letterhead pad.

(ii) Application for letter of credit limit

Before opening Letter of Credit, importer applies for Letter of Credit limit. To have an import Letter of Credit limit, an importer submits an application to the import division of United Commercial Bank furnishing the following information –

- Particulars of account maintained with the bank

- Nature of business

- Required amount of limit

- Payment terms and conditions

- Goods to be imported

- Security offered

- Repayment schedule

A credit officer scrutinizes this application and accordingly prepares a credit limit proposal (CLP) and forwards it to the Head Office Credit Committee (HOCC). The committee, if satisfied, sanctions the limit and returns it to the branch. Thus the importer is entitled to an approved credit limit. Once a party succeeds in opening an L/C through United Commercial Bank Ltd, generally it requires no fresh credit limit on subsequent occasions; however, further approval of the Head Office is required only if it proposes to increase its credit limit.

(iii) Taking necessary documents from the applicant

A bank takes the following documents with the application from the applicant while opening a Letter of Credit:

- Application for Letter of Credit duly signed by the importer

- Letter of Credit Authorization Form (L/CAF)

- Import Permit Form (IMP)

- Valid Import Registration Certificate (IRC)

- Indent or Pro-forma Invoice

- Valid Membership Certificate

- Documents evidencing payment of fee for current year for Import Registration Certificate (IRC)

- Declaration by the importer that he has paid income tax and submitted returns to the Income tax authority for the last three years

- Insurance Cover Note and Stamped Tax Insurance Policy

Note: For import of capital machinery and initial spares to set up a new industry, a Letter of Credit can be opened without Import Registration Certificate (IRC). No waiver from the Chief Controller of Imports and Exports is necessary for this purpose.

(iv) Lodgment

After the scrutiny, the following steps are taken to process for lodgment of import documents received from the negotiating bank. Lodgment means retirement of funds. Usually payment is made within seven days after the documents have been received. If the payment is deferred, the negotiating bank may claim interest for making delay.

However, after receiving the documents, the Branch authority collects the documents by contacting the importer. Lodgment Constitutes the Followings:

- Conversion of foreign currency amount of the bill and the charges of the foreign bank into Taka is done separately by applying Bills Collection (B.C.) selling rate ruling on the date of lodgment. If the forward exchange was booked, the booked rate is applied. Payment against Documents (PAD) is made by debiting PAD account and crediting Head Office account. Full particulars of the documents are entered in the prescribed PAD register allotting a consecutive serial number.

- Documents are endorsed under seal and signature.

- “Inter-Brach credit advice” (IBCA) is sent to the Head Office along with a prescribed statement to provide them credit for the payment from their overseas account through United Commercial Bank Limited General Account.

- Head Office (International Division) in receipt of the IBCA and the statement will respond the entry by debit to branch account (through United Commercial Bank Limited General Account) and contra credit to NOSTRO Account of the negotiating bank abroad. To arrange necessary fund for payment, a requisition is sent to the International Department.

- As the T.T & O.D rates are paid to the ID, the differences between these two rates remain as exchange gain for the Branch.

- As soon as the above formalities are completed the importers are served with PAD bill intimations for retirement of concerned import document. A letter of intimation (P.A.D. intimation) regarding receipt of the documents should be sent to the applicant with a request to take delivery of the documents on settlement of all dues against it and mentioning the maturity date of P.A.D.

- The Import mechanism is completed with the lodgment because most of the import operates by the United Commercial Bank Ltd. is cash letter of credit.

Export Section:

Bangladesh exports a large quantity of goods and services to foreign households. Creation of wealth in any country depends on the expansion of production in the export sector in international trade. Most of the exporters who export through United Commercial Bank are readymade garment exporters. They open export Letters of Credit here to export their goods, which they open against the import Letters of Credit opened by their foreign importers.

Export Policy

Export policies formulated by the Ministry of Commerce, GOB provide the overall guideline and incentives for promotion of exports in Bangladesh. Export policies also set out commodity-wise annual target. It has been decided to formulate these policies to cover a five-year period to make them contemporaneous with the five-year plans and to provide the policy regime. The export-oriented private sectors, through their representative bodies and chambers, are consulted in the formulation of export policies and are also represented in the various export promotion bodies set up by the government. However, Exports forms Bangladesh are regulated by the following Acts, Guidelines and authorities:

- Bangladesh Bank by issuing guidelines and circulars in compliance with Foreign Exchange Regulation Act-1974 under the authority given to it by the aforesaid Act. It controls physical and payment aspects of exports.

- Ministry of Commerce by issuing Export Policy Order under the authority given to it by Export –Import Act, 1950; It outlines the Government‟s export development strategies and lays down the package of incentives to promote exports. It also provides the list of items, which are either banned for export or whose export is subject to fulfillment of certain conditions.

- Controller of Export and Import

- Export Promotion Bureau

- National Board of Revenue (Regarding duties and customs issues)

- Ministry of Finance by providing Financial Assistance (like cash incentives, fixation of lower interest rate of export credit etc.)

Back-to-back Letter of Credit

There is another area of export. In readymade garments sector the exporter has to import the raw materials for completing the order. In that case the exporter may seek financing facility from the bank. In this situation the bank finance the exporter by opening back to back L/C against the Export L/C. There are four types of Back-to-Back L/Cs. These are:

- Back to Back Local (Within Bangladesh)

- Back to Back EPZ

- Back to Back EDF

- Back to Back Foreign

Back-to-back L/C mechanism:

(i) Application for Opening Back to Back L/C

At first the exporter applies for opening BTB L/C against the Export L/C. He has to write an application to the Branch Manager stating the amount of the L/C along with a L/C form and Pro-forma Invoice.

(ii) BTB L/C Issue

The authorized officer issues the L/C if the document is OK and sends the L/C to the bank of the beneficiary.

(iii) Bill sent by the beneficiary’s bank for acceptance

When the exporter gets an L/C he sends his goods to the importer and the bill for the export sends to the importer bank. If there is no discrepancy in the document then the opening bank give acceptance and fix the due date of payment according to the tenor.

(iv) Payment made by the Importer

When the bill is due, the bank pays it with the money that the importer receives from the export. The proceeds are given to the exporter (importer for BTB L/C). This is his profit.

The Back-to-Back L/C Mechanism is completed here.

Remittance section:

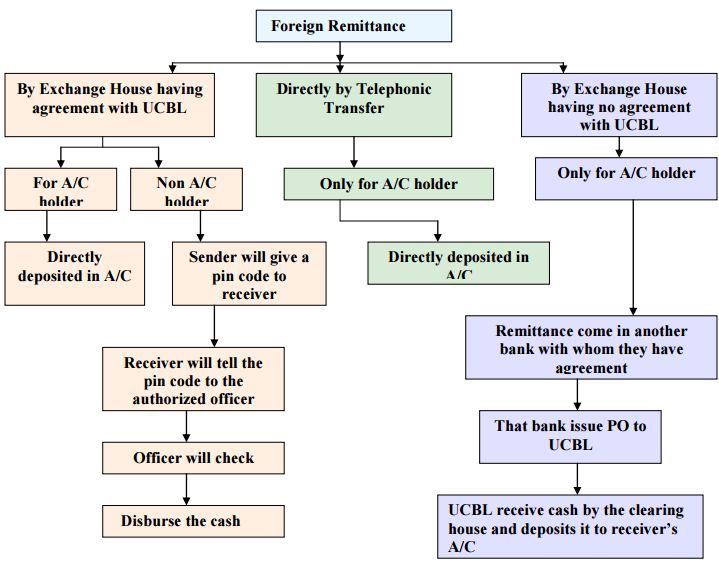

Our economy depends highly on foreign remittance. The people who are working abroad send currency through the help of bank. United Commercial Bank Ltd. follows three ways to collect foreign remittance. The mechanism is presented in Figure.

Mechanism of remittance collection:

United Commercial Bank Ltd. follows three ways for collecting remittance. These are: exchange houses with which bank has agreement, direct telephonic transfer and the exchange house with which bank has no agreement.

(i) Exchange House with which UCBL has agreement

In this way the remittance can come for anyone. He can be an A/C holder can be not. If the receiver is an A/C holder the remittance directly deposited to his account. If he is not an A/C holder then the procedure is different. The sender‟s bank will give a pin code that the sender has to inform the receiver. The receiver than tell the pin code, his name and other information to the authorized officer. The officer will check and if everything is alright, the officer will give the cash to the receiver. The following are the name of some of the Exchange Houses that UCBL has agreement with:

- LARI Exchange Co.

- CITY INTL Exchange Co.

- Mustafa-Sultan Exchange Co.

- Western Union

- Ria Money Transfer.

(ii) Telephonic Transfer

The bank provides this service only to its A/C holders. When the remittances come it is directly deposited to receiver‟s account.

(iii) Exchange house having no agreement with UCBL

This is another way that the bank follows. This service is also limited to its A/C holders.

If a remittance is sent through an exchange house having no agreement with UCBL, it comes to the bank that has an agreement with the exchange house. After getting the remittance, the bank issues a pay order in favor of UCBL. Then UCBL collects the cash through clearing house and deposits it to receiver‟s account.

This is the administration of foreign exchange business. In this process the foreign exchange department accomplishes its responsibilities.

Submission of Return to Bangladesh Bank:

The Authorized Dealer (AD) must maintain adequate and proper records of all Foreign Exchange transactions including transaction on non-resident taka A/C. in their books and furnish such particulars in the prescribed form of Return to Bangladesh Bank. The purpose of submission of return to the Bangladesh Bank is to keep systematic and proper records of all dealing in foreign exchange transaction. Every single transaction that Bank does has to be reported on Bangladesh Bank Website. Other than that, there are yearly, quarterly, monthly, weekly statements which is submitted to Bangladesh Bank.

Findings

It is not so easy to find out and analyze the Foreign Exchange performance regarding this mechanism within short time span. Despite of this, an inclusive approach has been taken to find out of foreign exchange activities of United Commercial Bank Limited in this paper. After evaluating the performance I get to see that the bank lacks in earning foreign currency which is a disappointment for the bank. The bank should look over this and try to increase export more. For further evaluation of the bank‟s position and its future prosperity I have done SWOT analysis for UCBL.

SWOT analysis is a simple framework for generating strategic alternatives from a situation analysis. The complete elaboration of SWOT analysis is following

S = Strength.

W = Weakness.

T = Threat.

O = Opportunities.

SWOT analysis is very helpful to measure and evaluate a stated objective within a very short time. Hence this approach has been adopted in this paper. After monitoring closely and working proactively in the Foreign Exchange Department of United Commercial Bank LTD. Principal Branch the following Strength, Weakness, Threat, and Weakness has been found-

Strength

According to the CAMEL rating of 2011 United Commercial Bank Limited is one of the satisfactory banks of Bangladesh. This rating is based on Capital Adequacy, Asset Quality, Management, Earnings, and Liquidity of the bank. Bangladesh Bank monitors these parameters and publishes the ranking. This top most position of United Commercial Bank is the most important strength of the Bank. This is the reason why every household clients and corporate clients relies on this bank. Other strengths are-

- The Bank has well reputation in the market.

- Has good relation with Importers and Exporters.

- Sound Import and Export operation.

- Executives working in the Foreign Exchange Division are highly qualified and experienced. They are quite capable of handling large scale of export and import transactions and making a profitable customer relationship with the clients.

- The Branch follows the Foreign Exchange rules and regulation very strictly

- In export and import activities there are lots of provisions of making unethical and unlawful transactions. But UCBL gives it utmost attention so that such unethical and unlawful does not takes place. This image of UCBL is also a vast strength of the Bank.

- Recently UCBL has gone through an agreement with different exchange house to provide quick and more authentic remittance service to its clients.

Weakness

There is no unmixed blessing in the earth. Every object in the world has some lacking. So it is quite natural to have some perforates in the performance of the United Commercial Bank Limited.

- In Foreign Exchange Division UCBL still uses lots of register for maintaining its foreign exchange transactions. It is time consuming and there are lots of chances for making mistakes. Computer software should be used to maintain these transactions to ensure timeliness and error free recording.

- There is no customer complain desk in the Bank‟s branches. It is not only important part of the foreign exchange activities but also for other two department of the Bank- General Banking and Credit Department.

- Being a well reputed Bank, UCBL no longer wants to conduct smaller L/C request coming from small parties and as a result they are neglecting a huge number of potential customers.

- While dealing with government bank, the bank faces a problem because the website of Bangladesh Bank is very slow which delays the process of reporting.

Opportunities

- As stated earlier that UCBL is one of popular bank in Bangladesh. Both exporters and importers have their faith on this Bank. This is a great opportunity for UCBL.

- The percentage of classified loans is below 2% which is far better than international standard.

- United Commercial Bank Limited has already 139 branches all over the country and recently they have planned to set up branches in some other places of the country.

Threat

- Economic stagflation and economic break down of the country especially after 9/11.

- As country‟s export is RMG sector depended, reduce in RMG export has affected foreign exchange department of the Bank.

- The margin for opening L/C is different for different customers. The margin is more for new customers while the margin is less for corporate and reputed customers.

- Government continuous pressure to reduce interest rate.

- Frequent fluctuation of domestic currency worth against US Dollar.

- Political crisis and decaying country image as exporter.

- Rapid increase of private sector Bank in number and size.

Recommendations:

Being a modern bank, UCBL is expected to compete with in a dynamic environment comprised by many Govt. and Non-Govt. banks, Local and Foreign banks. On the basis of my observation and responses from Bank‟s employees and customers, I found out some necessary steps should be taken by the bank o enhance its performance potentiality.

Three months internship at Foreign Exchange Department is not enough to suggest anything about a huge organization like UCBL, but according to my observation, I made the following suggestion that may improve the performance of Foreign exchange

Department and other departments:

- As in Foreign Exchange Department, it is required to communicate with foreign banks and organizations frequently: so to make process fast and easy whole bank should be well equipped and use faster communication system.

- Bank should open more Nostro accounts for efficient processing of L/C.

- Charges in foreign exchange include SWIFT charges, Document Handling Charges, Stamps Charges as well as VAT. If such charges could be reduced, UCBL will definitely attract more customers.

- If the Bank reduces the rate of margin then perhaps they can attract more customers. At the moment, Companies with good relationship with the banks only benefits with lower margin level over others.

- In order to report Bangladesh bank about TC, DD and other foreign remittance transactions, the necessary documents should be collected from customers on time.

- The bank may introduce some promotional program to increase export. If bank give more emphasis to export parties they will be influenced.

- The bank should follow the UCPDC (Uniform Customs and Practices for Documentary Credit) rules very strictly to avoid the risks involved in Foreign Trade Business.

- The scenario of International Business is quite dynamic. Newer trends are taking place time to time. This may create a tension between exporters-importers and the bankers. To reduce confusion and making long term profitable customer relationship the Bank should arrange seminars, workshops, discussion etc. this will help the Bank to run in safe mode.

Conclusion:

Bank is a very important and vital for economic development in mobilizing capital and other resources. UCBL is also contributing to the advancement of the socioeconomic condition of the country. To keep pace with the current market and demand, UCBL is following several strategies and taking new initiatives, offering new products and services to the customers. The bank should maintain well-structured communication from upper level to lower level. UCBL have a strong position in the competitive market. It is among one of the fastest growing Bank. As the economy of Bangladesh is increasing so is the foreign trade and UCBL Bank like always have played its role in making sure that things go smoothly. The bank is doing its best to provide better Import, Export and Remittance services to the customers. Export, Import is showing positive trends even after the global challenges that we are facing today. However, the bank needs to improve its remittance. The foreign trade handled by bank is increasing in recent year; this may be because of opening of new branches in different business centers.