Foreign Exchange is the exchange of one currency for another or the conversion of one currency into another currency. It is the conversion of one country’s currency into another. It is the mechanism or the ways and means through which the payments of international trade are conducted. These transactions can take place on the foreign exchange market, also known as the Forex Market. The rates of exchange are the prices of the various national currencies in terms of other national currencies. It is a global market for exchanging national currencies with one another. It also refers to the global market where currencies are traded virtually around the clock. It is the largest, most liquid market in the world, with trillions of dollars changing hands every day. The largest trading centers are London, New York, Singapore, and Tokyo. The term foreign exchange is usually abbreviated as “forex” and occasionally as “FX.” The foreign exchange market moves based on how currency valuations change in relation to other currencies through exchange rates.

Foreign exchange trading utilizes currency pairs, priced in terms of one versus the other. It is the over-the-counter market in which the foreign currencies of the world are traded. It is essential to international trade. It is considered the largest and most liquid market in the world. For example, a trader is betting a central bank will ease or tighten monetary policy and that one currency will strengthen versus the other. A country’s currency value may also be set by the country’s government. For instance, if a Chinese company wants to trade with a French company, both firms go through the foreign exchange market in order to complete the exchange, involving China’s currency, the yuan renminbi, and the eurozone’s euro.

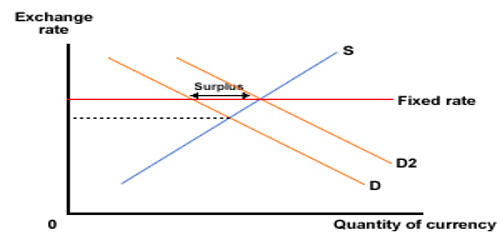

There are two types of exchange rates: floating and fixed.

- A floating exchange rate is free of government restrictions. Floating currencies include – U.S. dollar, euro, sterling, the Australian dollar, the Canadian dollar, and the Japanese yen.

- A fixed exchange rate involves government restrictions on the currency in order to protect its value. A fixed exchange rate system is usually used by countries with more vulnerable economies.

Types of Foreign Exchange Markets:

- Spot Market

These are the quickest transactions involving currency in foreign markets. These transactions involve immediate payment at the current exchange rate, which is also called the spot rate.

- Futures Market

As the name implies, these transactions involve future payment and future delivery at an agreed exchange rate also called the future rate. These contracts are standardized, which means the elements of the agreement are set and non-negotiable.