Functions of Credit Risk management in Non Banking Financial Institutions (NBFI) in Bangladesh,

A study on IDLC Finance Limited

The non-bank financial institutions (NBFIs) constitute a rapidly growing segment of the financial system in Bangladesh. The NBFIs have been contributing toward increasing both the quality and quantity of financial services and thus mitigating the lapses of existing financial intermediation to meet the growing needs of different types of investment in the country.

Today all NBFIs are playing a vital role for the growth of the nation’s economy with the best of their ability. During the world recession period NBFIs in Bangladesh act in a stringent manner so that their financial systems as well as the economy do not collapse. 29 NBFIs are now contributing to the growth of national economy. IDLC Finance Ltd as a leading and pioneer NBFI started their operation in 1986 and still they are dominating the NBFI sector as well as contributing to the prosper of economic development. Their success in this industry has inspired others to invest their capital in a profitable way.

As major business of all NBFIs are providing lease facilities to the business along with various types of loan to individual and organizations therefore risk is associated with each and every product they are offering. To minimize this risk every institution has its own risk management policies. A number of actions are taken so that risk associated to their investment can be minimized.

This report is emphasizes credit risk management in NBFIs in Bangladesh. In this regard IDLC Finance Limited has been taken as the sample organization, its, services, rules and regulation, corporate governance is also taken into consideration.

Objective of the study

The main objective of the study is to get a definite idea about how CRM plays a vital role in managing the risk associated with each and every product and services of IDLC Finance Limited. Furthermore, the orientation is very useful to detect whether the theoretical knowledge matches with real life scenario or not. Though the title ” Functions of Credit Risk management in Non Banking Financial Institutions (NBFI) in Bangladesh, A study on IDLC Finance Ltd” very lengthy area, the specific objectives are as follows:

- To know the necessity of Credit Risk Management.

- To learn about the whole CRM procedure.

- To know the decision making process of CRM.

- To know the functions of Special Asset Management part of CRM

- To know about the probable modification can be done in the whole CRM process.

METHODOLOGY OF THE STUDY

Analysis has been made on the basis of the objectives mentioned before in the context of ” Functions of Credit Risk management in Non Banking Financial Institutions (NBFI) in Bangladesh, A study on IDLC Finance Ltd”

The paper will be written on the basis of information collected from primary and secondary sources.

(i) Primary Data; Discussion with the respective organization’s officials.

(ii) For the completion of the present study, secondary data has been collected. The main sources of secondary data are:

- Annual Report of IDLC Finance Limited.

- Website of IDLC Finance Limited.

- Data from published reports of SEC, DSE

- Different Books, Journals, Periodicals, News Papers etc.

ILDC FINANCE LIMITED

IDLC Finance Ltd commenced its journey, in 1985, as the first leasing company of the country with multinational collaboration and the lead sponsorship of the International Finance Corporation (IFC) of The World Bank Group. Technical assistance was provided by Korean Development Leasing Corporation (KDLC), the largest leasing company of the Republic of South Korea.

The unique institutional shareholding structure comprising mostly of financial institutions helps the company to constantly develop through sharing of experience and professional approach at the highest policy making level.

IDLC offers a diverse array of financial services and solutions to institutional and individual clients to meet their diverse and unique requirements. The product offerings include Lease Finance, Term Finance, Real Estate Finance, Short Term Finance, Corporate Finance, Merchant Banking, Term Deposit Schemes, Debentures and Corporate Advisory Services.

The company has authorized capital of Taka 1,000,000,000 (10,000,000 shares of Taka 100 each) and paid up capital of Taka 250,000,000 (2,500,000 ordinary shares of Taka 100 each). IDLC has also established two wholly owned subsidiaries, IDLC Securities Limited and I, Cons Limited to provide customers with security brokerage solutions and IT solutions, respectively.

DIVISIONS AND DEPARTMENTS

The organization includes divisions which mainly deal with the products and services and departments which support in the operating activities. The divisions are the

- Corporate

- SME

- Merchant Banking

- Personal Investment

- Factoring

- Structured Finance

- Operations

The departments include

- Credit Risk Management (CRM)

- Treasury

- Human Resource

- Accounts and Taxation

- Administration and PR

- Operational Risk Management (ORM)/Internal Control Compliance(ICC)

- Special Asset Management(SAM)

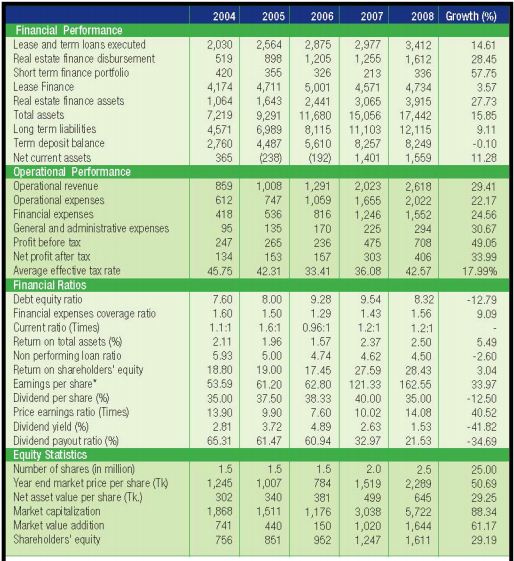

PERFORMANCE OF IDLC FINANCE LIMITED

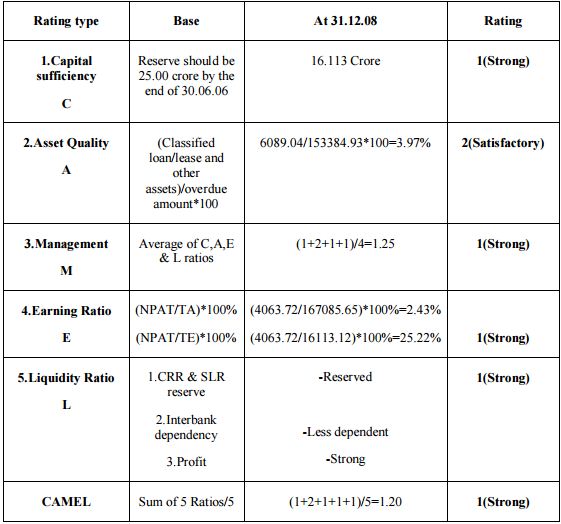

CAMEL RATING

CAMEL rating has improved to 1 comparing to the last year 2(Satisfactory)

Credit Risk Management

WHAT IS RISK?

In general Risk can be define as the “ Probability or threat of a damage, injury, liability, loss, or other negative occurrence, caused by external or internal vulnerabilities, and which may be neutralized through pre-mediated action.”

But in Finance risk is defined concerning some special factors of market and other externalities which can affect an individual or organization’s decision. In Finance risk is defined as “Probability that an actual return on an investment will be lower than the expected return.” Financial risk is divided into the following general categories: (1) Basis risk:

Changes in interest rates will cause interest-bearing liabilities (deposits) to re-price at a rate higher than that of the interest-bearing assets (loans). (2) Capital risk: Losses from unrecovered loans will affect the financial institution’s capital base and may necessitate floating of a new stock (share) issue.

Therefore to reduce this risk Banks, NBFIs, and other organizations take various types of measures so that it can be reduced in a minimal affordable limit. In Banks and NBFIs the core risk is credit risk. As Banks, NBFIs performs there major operations on providing loan, lease (for NBFIs) therefore there is a chance of default at time of repayment. So to reduce this default risk so that number of default payment does not increase and to forecast this probability with appropriate tools Banks, NBFIs always work on managing their Credit Risk.

Several Guideline and standards are prepared so that Credit Risk for individual banks and NBFIs can be reduced.

CREDIT RISK

Credit risk is the possibility that a borrower or counter party will fail to meet agreed obligations. Globally, more than 50% of total risk elements in banks and FIs are Credit Risk alone. Thus managing credit risk for efficient management of a FI has gradually become the most crucial task. Credit risk may take the following forms:

- In direct lease/term finance: rentals/principal/and or interest amount may not be repaid

- In issuance of guarantees: applicant may fail to build up fund for settling claim, if any;

- In documentary credits: applicant may fail to retire import documents and many others

- In factoring: the bills receivables against which payments were made, may fail to be paid

- In treasury operations: the payment or series of payments due from the counter parties under the respective contracts may not be forthcoming or ceases

- In securities trading businesses: funds/ securities settlement may not be effected

- In cross-border exposure: the availability and free transfer of foreign currency funds may either cease or restrictions may be imposed by the sovereign

Credit risk management encompasses identification, measurement, matching mitigations, monitoring and control of the credit risk exposures to ensure that:

- The individuals who take or manage risks clearly understand it

- The organization’s Risk exposure is within the limits established by Board of Directors with respect to sector, group and country’s prevailing situation

- Risk taking Decisions are in line with the business strategy and objectives set by BOD

- The expected payoffs compensate the risks taken

- Risk taking decisions are explicit and clear

- Sufficient capital as a buffer is available to take risk

CREDIT RISK MANAGEMENT PROCESS

Credit risk management process should cover the entire credit cycle starting from the origination of the credit in a financial institution’s books to the point the credit is extinguished from the books. It should provide for sound practices in:

- Credit processing/appraisal;

- Credit approval/sanction;

- Credit documentation;

- Credit administration;

- Disbursement;

- Monitoring and control of individual credits;

- Monitoring the overall credit portfolio (stress testing)

- Credit classification; and

- Managing problem credits/recovery

CREDIT PORCESSING/APPRAISAL:

Credit processing is the stage where all required information on credit is gathered and applications are screened. Credit application forms should be sufficiently detailed to permit gathering of all information needed for credit assessment at the outset. In this connection, NBFIs should have a checklist to ensure that all required information is, in fact, collected.

NBFIs should set out pre-qualification screening criteria, which would act as a guide for their officers to determine the types of credit that are acceptable. For instance, the criteria may include rejecting applications from blacklisted customers. These criteria would help institutions avoid processing and screening applications that would be later rejected.

Moreover, all credits should be for legitimate purposes and adequate processes should be established to ensure that financial institutions are not used for fraudulent activities or activities that are prohibited by law or are of such nature that if permitted would contravene the provisions of law. Institutions must not expose themselves to reputational risk associated with granting credit to customers of questionable repute and integrity.

The next stage to credit screening is credit appraisal where the financial institution assesses the customer’s ability to meet his obligations. Institutions should establish well designed credit appraisal criteria to ensure that facilities are granted only to creditworthy customers who can make repayments from reasonably determinable sources of cash flow on a timely basis.

Financial institutions usually require collateral or guarantees in support of a credit in order to mitigate risk. It must be recognized that collateral and guarantees are merely instruments of risk mitigation. They are, by no means, substitutes for a customer’s ability to generate sufficient cash flows to honor his contractual repayment obligations. Collateral and guarantees cannot obviate or minimize the need for a comprehensive assessment of the customer’s ability to observe repayment schedule nor should they be allowed to compensate for insufficient information from the customer.

Care should be taken that working capital financing is not based entirely on the existence of collateral or guarantees. Such financing must be supported by a proper analysis of projected levels of sales and cost of sales, prudential working capital ratio, past experience of working capital financing, and contributions to such capital by the borrower itself.

Financial institutions must have a policy for valuing collateral, taking into account the requirements of the Bangladesh Bank guidelines dealing with the matter. Such a policy shall, among other things, provide for acceptability of various forms of collateral, their periodic valuation, process for ensuring their continuing legal enforceability and realization value.

In the case of loan syndication, a participating financial institution should have a policy to ensure that it does not place undue reliance on the credit risk analysis carried out by the lead underwriter. The institution must carry out its own due diligence, including credit risk analysis, and an assessment of the terms and conditions of the syndication.

The appraisal criteria will of necessity vary between corporate credit applicants and personal credit customers. Corporate credit applicants must provide audited financial statements in support of their applications. As a general rule, the appraisal criteria will focus on:

- Amount and purpose of facilities and sources of repayment;

- Integrity and reputation of the applicant as well as his legal capacity to assume the credit obligation;

- Risk profile of the borrower and the sensitivity of the applicable industry sector to economic fluctuations;

- Performance of the borrower in any credit previously granted by the financial institution, and other institutions, in which case a credit report should be sought from them;

- The borrower’s capacity to repay based on his business plan, if relevant, and projected cash flows using different scenarios;

- Cumulative exposure of the borrower to different institutions;

- Physical inspection of the borrower’s business premises as well as the facility that is the subject of the proposed financing;

- Borrower’s business expertise;

- Adequacy and enforceability of collateral or guarantees, taking into account the existence of any previous charges of other institutions on the collateral;

- Current and forecast operating environment of the borrower;

- Background information on shareholders, directors and beneficial owners for corporate customers; and

- Management capacity of corporate customers.

CREDIT-APPROVAL/SANCTION

A financial institution must have some written guidelines on the credit approval process and the approval authorities of individuals or committees as well as the basis of those decisions.

Approval authorities should be sanctioned by the board of directors. Approval authorities will cover new credit approvals, renewals of existing credits, and changes in terms and conditions of previously approved credits, particularly credit restructuring, all of which should be fully documented and recorded. Prudent credit practice requires that persons empowered with the credit approval authority should not also have the customer relationship responsibility.

Approval authorities of individuals should be commensurate to their positions within management ranks as well as their expertise. Depending on the nature and size of credit, it would be prudent to require approval of two officers on a credit application, in accordance with the Board’s policy. The approval process should be based on a system of checks and balances. Some approval authorities will be reserved for the credit committee in view of the size and complexity of the credit transaction.

CREDIT DOCUMENTATION

Documentation is an essential part of the credit process and is required for each phase of the credit cycle, including credit application, credit analysis, credit approval, credit monitoring, and collateral valuation, and impairment recognition, foreclosure of impaired loan and realization of security. The format of credit files must be standardized and files neatly maintained with an appropriate system of cross-indexing to facilitate review and follow-up.

Documentation establishes the relationship between the financial institution and the borrower and forms the basis for any legal action in a court of law. Institutions must ensure that contractual agreements with their borrowers are vetted by their legal advisers. Credit applications must be documented regardless of their approval or rejection.

For security reasons, financial institutions need to consider keeping the copies of critical documents (i.e., those of legal value, facility letters, and signed loan agreements) in credit files while retaining the originals in more secure custody. Credit files should also be stored in fire-proof cabinets and should not be removed from the institution’s premises.

CREDIT ADMINISTRATION

Financial institutions must ensure that their credit portfolio is properly administered, that is, loan agreements are duly prepared, renewal notices are sent systematically and credit files are regularly updated.

An institution may allocate its credit administration function to a separate department or to designated individuals in credit operations, depending on the size and complexity of its credit portfolio.

A financial institution’s credit administration function should, as a minimum, ensure that:

- Credit files are neatly organized, cross-indexed, and their removal from the premises is not permitted;

- The borrower has registered the required insurance policy in favour of the bank and is regularly paying the premiums;

- The borrower is making timely repayments of lease rents in respect of charged leasehold properties;

- Credit facilities are disbursed only after all the contractual terms and conditions have been met and all the required documents have been received;

- Collateral value is regularly monitored;

- The borrower is making timely repayments on interest, principal and any agreed to fees and commissions;

- Information provided to management is both accurate and timely;

- Funds disbursed under the credit agreement are, in fact, used for the purpose for which they were granted;

- “Back office” operations are properly controlled;

- The established policies and procedures as well as relevant laws and regulations are complied with; and

- On-site inspection visits of the borrower’s business are regularly conducted and assessments documented.

DISBURSEMENT

Once the credit is approved, the customer should be advised of the terms and conditions of the credit by way of a letter of offer. The duplicate of this letter should be duly signed and returned to the institution by the customer. The facility disbursement process should start only upon receipt of this letter and should involve, inter alia, the completion of formalities regarding documentation, the registration of collateral, insurance cover in the institution’s favor and the vetting of documents by a legal expert. Under no circumstances shall funds be released prior to compliance with pre-disbursement conditions and approval by the relevant authorities in the financial institution.

MONITORING & CONTROL OF INDIVIDUAL CREDITS

To safeguard financial institutions against potential losses, problem facilities need to be identified early. A proper credit monitoring system will provide the basis for taking prompt corrective actions when warning signs point to deterioration in the financial health of the borrower. Examples of such warning signs include unauthorized drawings, arrears in capital and interest and deterioration in the borrower’s operating environment. Financial institutions must have a system in place to formally review the status of the credit and the financial health of the borrower at least once a year. More frequent reviews (e.g. at least quarterly) should be carried out of large credits, problem credits or when the operating environment of the customer is undergoing significant changes.

- Funds advanced are used only for the purpose stated in the customer’s credit application;

- Financial condition of a borrower is regularly tracked and management advised in a timely fashion;

- Borrowers are complying with contractual covenants;

- Collateral coverage is regularly assessed and related to the borrower’s financial health;

- The institution’s internal risk ratings reflect the current condition of the customer;

- Contractual payment delinquencies are identified and emerging problem credits are classified on a timely basis; and

- Problem credits are promptly directed to management for remedial actions.

- More specifically, the above monitoring will include a review of up-to-date information on the borrower, encompassing:

- Opinions from other financial institutions with whom the customer deals;

- Findings of site visits;

- Audited financial statements and latest management accounts;

- Details of customers’ business plans;

- Financial budgets and cash flow projections; and

- Any relevant board resolutions for corporate customers.

MAINTAINING THE OVERALL CREDIT PORTFOLIO

An important element of sound credit risk management is analyzing what could potentially go wrong with individual credits and the overall credit portfolio if conditions/environment in which borrowers operate change significantly. The results of this analysis should then be factored into the assessment of the adequacy of provisioning and capital of the institution.

Such stress analysis can reveal previously undetected areas of potential credit risk exposure that could arise in times of crisis.

Possible scenarios that financial institutions should consider in carrying out stress testing include:

- Significant economic or industry sector downturns;

- Adverse market-risk events; and

- Unfavorable liquidity conditions.

Financial institutions should have industry profiles in respect of all industries where they have significant exposures. Such profiles must be reviewed /updated every year.

CLASSIFICATION OF CREDIT

Credit classification process grades individual credits in terms of the expected degree of recoverability. Financial institutions must have in place the processes and controls to implement the board approved policies, which will, in turn, be in accord with the proposed guideline. This guideline may also be called as Credit Risk Grading (CRG), is a collective is a collective definition based on the pre-specified scale and reflects the underlying credit-risk for a given exposure. A Credit Risk Grading deploys a number/ alphabet/ symbol as a primary summary indicator of risks associated with a credit exposure. Credit Risk Grading is the basic module for developing a Credit Risk Management system.

Credit risk grading is an important tool for credit risk management as it helps the Financial Institutions to understand various dimensions of risk involved in different credit transactions. The aggregation of such grading across the borrowers, activities and the lines of business can provide better assessment of the quality of credit portfolio of a FI. The credit risk grading system is vital to take decisions both at the pre-sanction stage as well as post-sanction stage.

Two- types of factors play vital role in modeling the CRG, they are,

- Quantitative factors

- Qualitative factors

MANAGING PROBLEM CREDITS/RECOVERY

A financial institution’s credit risk policy should clearly set out how problem credits are to be managed. The positioning of this responsibility in the credit department of an institution may depend on the size and complexity of credit operations. It may form part of the credit monitoring section of the credit department or located as an independent unit, called the credit workout unit, within the department. Often it is more prudent and indeed preferable to segregate the workout activity from the area that originated the credit in order to achieve a more detached review of problem credits. The workout unit will follow all aspects of the problem credit, including rehabilitation of the borrower, restructuring of credit, monitoring the value of applicable collateral, scrutiny of legal documents, and dealing with receiver/manager until the recovery matters are finalized.

Financial institutions will put in place systems to ensure that management is kept advised on a regular basis on all developments in the recovery process, may that emanate from the credit workout unit or other parts of the credit department.

There should be clear evidence on file of the steps that have been taken by the financial institution in pursuing its claims against a delinquent customer, including any legal steps initiated to realize on the collateral. Where there is a delay in the liquidation of collateral or other credit recovery processes, the rationale should be properly documented and anticipated actions recorded, taking into account any revised plans submitted by the borrower.

The accountability of individuals/committees who sanctioned the credit as well as those who subsequently monitored the credit should be revisited and responsibilities ascribed. Lessons learned from the post mortem should be duly recorded on file.

Findings and Analysis — Credit Risk Management by IDLC Finance Ltd

PROCEDURAL WORK FLOW OF LEASE MARKETING

At the initial stage, IDLC concentrated to establish a market and then enlarge the market. The criteria based on which the market for lease financing has been established are as follows:

- Diversification of portfolio

- Selecting top industrial unit in the respective industry

- Financing for Balancing, Modernization, Replacement and Expansion (BMRE) of existing unit

- Priority of existing leases

- Set up priority based on sector wise performance

Primary focus of IDLC till now is in the area of financial leasing of industrial and professional equipment and vehicles for three to five years term with particular emphasis on BMRE of existing units. Instead of lending funds to purchase equipment, IDLC provides the equipment and extends the exclusive right to its use against specified rental payments at periodic intervals.

There are two types of client for which the procedural work flow would be different though the basic part would be the same. The different types of clients are

- Existing Clients – with whom IDLC has already been working

- New Clients – with whom IDLC has no business yet

FACTORS SCRUTINIZED DURING APPRAISAL PROCEDURE

According to the guideline provided by Bangladesh Bank, IDLC considers the following factors while appraising a client and its finance proposal:

- Business Risk Factors:

- Industry

- Size

- Maturity

- Production

- Distribution

- Vulnerability

- Competition

- Demand- supply situation

- Strategic importance for the group and for the country

- Concentration

- Market reputation

- Financial Risk Factors:

- Profitability

- Liquidity

- Debt management

- Post Balance sheet events

- Projections

- Sensitivity Analysis

- Peer Group Analysis

- Other Bank Lines

- Management Risk Factors:

- Experience/relevant background

- Track record of management in see through economic cycles

- Succession

- Reputation

- Structural Risk Factors:

- Identify working capital requirement

- Relate the requirement with asset conversion cycle

- Purpose of the facilities should be clear and thus mode of disbursement should be preferably structured in a manner to make direct payment to the third party through LC, pay order, Bangladesh Bank cheques etc.

- Security Risk Factors:

- Perishablilty

- Enforceability /Legal structure

- Forced Sale Value (calculations of force sale value should be at least guided by Bangladesh Bank guidelines)

RECOMMENDATION

As a pioneer and leading NBFI in Bangladesh IDLC Finance Ltd have been maintaining its quality in a smooth way. Their experience in the field of lease and other loan product make them very much cautious about the risk. A very skillful and technically enriched department always working in their full capacity to analyze the risk of the their product and services, So far they proof them as a successful organization in assessing risk and thus take care off it.

Undoubtedly IDLC Finance Ltd is the best in NBFI sector therefore findings are general and recommendation is not that much necessary for the organization in the overall Credit Risk Management Procedure. Still the following can be mentioned,

- More detail information shall be tried to find out so that assessment can be made more accurately.

- As market is very much flexible so special concentration should be given in assessing the individual industry risk.

- In case of individual client assessment should be made in more details.

- There shall be an extra caution in making provisions against all defaults so that unwanted risk can be absorbed more easily.

CONCLUSION

To conclude the report, it is imperative to mention that default clients have been a major problem for the Non Banking Financial Institutions for long and the financial institutions have been trying to minimize the default problem all along. The central bank of Bangladesh has been striving to assist the financial institutions to get out of the default problem and formulating policies for that purpose. As a continuance to this, Bangladesh Bank has been providing directives when and where it seems to be necessary.

In Bangladesh many business organizations are still facing problems in the functioning of smooth business operations and moreover they concentrate on making profit more than their safety as a result of this they sometime get out of safety caution to absorb the industry sock.

Therefore fall in to loss and sometimes get liquidated. The consequence of this is that NBFIs do not get their due amount in time which is a big and foremost risk to the organizations. To overcome this, a very important factor to which risk weights have to be raised is the past default behavior of the borrowers. From interviews with the higher management of IDLC, who are much knowledgeable in this area have opined that one the most important factors that can be used to predict the future payment performance of the borrower is his character regarding repayment of his borrowed fund.

Another critical matter is that the financial statements of the business organization in fact contain manipulated data. So the analysis of such statements leads to wrong and faulty conclusion. This problem can be solved by judging the financial statement by individual amount specially which will provide information for the beneficiary of the NBFIs.

Also, law enforcement needs to be stronger and faster so that the willful defaulters can be punished for their defaults promptly. This will also cause the genuine business people to be more cautious when availing finance from financial institutions. The CIB database is a good start in this respect and has served to improve the overall loan repayment situation by the borrower.

In the end, it can be remarked that the central financial authority as well as all the financial institutions have to continuously analyze the overall environment, economic, social, business, cultural and so on. Depending on this, they have to improve their risk evaluating procedure.