Horizontal analysis is a method of analyzing financial statements that involve comparing specific financial data from one accounting period with data from subsequent periods. Based on historical data, it analyses the change in financial statements over two or more accounting periods. It can either utilize total examinations or rate correlations, where the numbers in each succeeding period are communicated as a level of the sum in the pattern year, with the standard sum being recorded as 100%. Analysts use such an approach to analyze historical trends.

Horizontal analysis, also known as base-year analysis, is the comparison of the value of the same line item in the next accounting period to the value of the baseline accounting period. The current year’s data are compared to those of the base year to determine trends or changes. The purpose is to find out if there has been an increase or decrease in specified numbers. In horizontal analysis, investors can utilize a percentage or an absolute comparison.

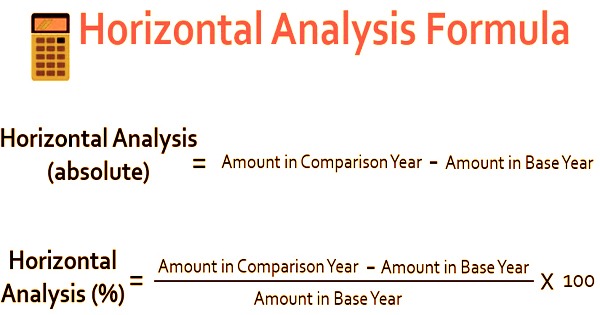

Deducting the amount in the base year from the amount in the comparative year yields the horizontal analysis (absolute terms) formula. Mathematically, it is represented as,

Horizontal Analysis (absolute) = Amount in Comparison Year – Amount in Base Year

The horizontal analysis (% change) formula is calculated by dividing the difference between the amount in the comparison year and the amount in the base year in the base year. Mathematically, it is represented as,

Horizontal Analysis (%) = ((Amount in Comparison Year – Amount in Base Year) / Amount in Base Year) × 100

Horizontal Analysis is used to compare trends from one year over year (YoY) or quarter over quarter (QoQ). Vertical analysis can also be used to compare it. While vertical investigation examines a specific budget summary utilizing just one base budget report of the revealing time frame, level examination contrasts a particular fiscal report and different periods or the cross-sectional examination of an organization against another organization. If specific historical periods of bad performance are chosen as a reference, horizontal analysis can be modified to make the current time appear better.

Through flat investigation of fiscal summaries, financial backers would have the option to see two real information for continuous years and would have the option to analyze every single thing. It enables investors and analysts to evaluate what has been driving a company’s financial performance over time and identify trends and growth patterns. The requirements for the preparation of financial statements, as described in the Generally Accepted Accounting Principles (GAAP), require financial statements to be consistent and comparable in order to appropriately compare and analyze firms and their financial performance.

Consistency imperative here implies that similar bookkeeping techniques and standards should be utilized every year since they stay consistent throughout the long term. Level investigation empowers investigators to survey relative changes in various details after some time and task them into what’s to come. An examination of the income statement, balance sheet, and cash flow statement over time reveals what is driving a company’s performance and if it is functioning efficiently and successfully.

Understanding the concept of horizontal analysis is critical; it aids in analyzing the trend in each line-item year over year (YoY). Any distinct deviation in pattern might be a sign of some inconsistency in detailing that requires prompt examination. It tends to be utilized to evaluate the presentation of an organization throughout some stretch of time. This method of analysis can provide a comprehensive view of the subject company’s financial situation.

Critical company performance indicators, including as profit margins, inventory turnover, and return on equity, can be used to spot emerging issues and strengths. Likeness imperative, then again, directs that an organization’s fiscal summaries and other documentation be to such an extent that they can be considered in contrast to other comparable organizations inside a similar industry. Horizontal analysis is used to improve and enhance these constraints during financial reporting.

Horizontal analysis also enables comparing growth rates and profitability amongst companies in the same industry more easier. As a result, analysts and investors can identify elements that fuel a company’s long-term financial success. They are additionally in a situation to decide development examples and patterns, like irregularity. The strategy likewise empowers the examination of relative changes in various lines of items and to make projections into what’s to come.

Although a change in accounting rules or the occurrence of a one-time event can have an impact on horizontal analysis, these events should be reported in the financial statements’ footnotes to ensure consistency. Flat investigation can likewise be utilized to think about development rates and benefit over a particular period across firms in a similar industry. Nonetheless, when utilizing the examination procedure, the correlation (current) period can be made to show up remarkably terrible or great. It is determined by the base year chosen and the accounting periods used to begin the analysis.

Horizontal analysis has the drawback of causing variances when comparing account balances from one period to the next because the aggregation of information in the financial statements may have changed over time, causing revenues, expenses, assets, or liabilities to shift between different accounts and appear to cause variances when comparing account balances from one period to the next. Thus, a few organizations move the development and benefit patterns announced in their monetary level investigation report utilizing a mix of techniques to separate business portions. Notwithstanding, bookkeeping changes and oddball occasions can be utilized to address such inconsistency and improve level investigation exactness.

Information Sources: