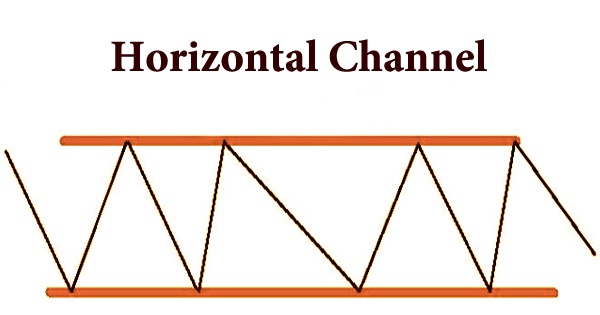

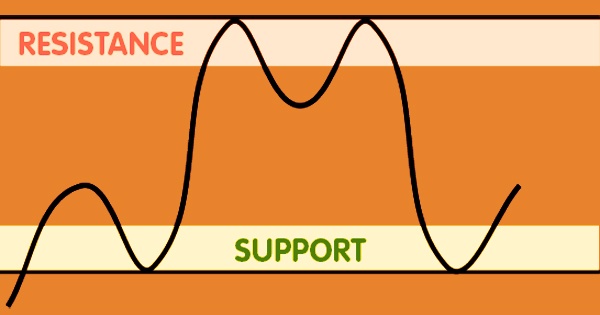

Horizontal channels are trendlines that bind variable pivot highs and lows to depict the price contained between the upper and lower lines of resistance. Traders use horizontal lines, also known as a sideways pattern or price range, to define breakouts and assess where price action is decisive. Purchasers and merchants battle, and it is just at the exit of the even channel that they concede to a course; either there are a greater number of purchasers than dealers or there are a larger number of venders than purchasers; henceforth the solid power of the development at the level channel’s exit. A horizontal channel gives traders specific entry and exit points for their trades.

To aid in study, the top trend line of a horizontal channel becomes the tension line, while the bottom trend line becomes the support line. A rectangle pattern appears in a horizontal channel or sideways trend. It consists of at least four contact points. This is on the grounds that it needs in any event two lows to interface, just as two highs. It doesn’t empower the expectation of the following development’s heading; financial backers are just gotten on the flat channel’s exit (Bullish if an upwards exit; Bearish if a downwards exit).

Some scholars, however, prefer a bullish exit if the movement prior to the appearance of the horizontal channel was bullish, and a bearish exit if the movement prior to the appearance of the horizontal channel was bearish (in short: to make the horizontal channel a continuation pattern). A horizontal channel’s patterns breakout happens during value union, a period when the exchange is restricted inside explicit value goes and is described by scarcely any exchanging openings. The price change in a trading session is framed by the opposition (pivot low) and help (pivot high).

During periods of price consolidation, horizontal channels form. The pivot highs (resistance) and pivot lows (support) describe a trading range (support). On pivots, trend lines are drawn to provide a visual representation of price action. Two parallel horizontal lines form a horizontal channel, which frames the price’s evolution. The “resistance side” is the upper line. The bottom line is referred to as the “support line.” A technical buy signal is a new high in the price above the horizontal channel. A technical sell signal is a new low in price below the horizontal channel (or rectangle pattern).

The passing pattern lines on turns show a visual image of costs in real life. The ways empower the dealer to see the steady fall or ascent of cost over the long haul. Another high and a new low address a purchase signal in the cost over the level channel and a sell signal in the cost underneath the even channel, separately. When the price is in the center of a support or resistance range, but not especially close to either, it does not mean anything about the future price. If the price is dropping towards help, it is likely to reverse and grow once more. If the price is rising and approaching resistance, it is likely to reverse and fall back.

A horizontal channel is affirmed/legitimate on the off chance that it has great swaying between the two equal even lines. Every one of these lines more likely than not been contacted in any event twice to approve the example. In a horizontal channel, the buying and selling forces are identical before a breakout or breakdown occurs. The horizontal channel is a powerful chart pattern that is often ignored. It consolidates a few types of specialized investigation to give merchants exact focuses for entering and leaving exchanges, just as controlling danger.

Any trading day, a horizontal channel is a typical chart pattern. Until there is a breakdown, the opposing powers of buying and selling are close. Despite the fact that a horizontal channel is an important trend tracker, it is often ignored. Channels are divided into three categories: Ascending channels are those that are angled upward. Channels that are calculated down are called dropping channels. Rising and slipping channels are likewise called pattern channels on the grounds that the cost is moving all the more predominantly one way. Many traders assume that a horizontal trend channel is only a temporary interruption in a dominant trend in any direction, rather than a real horizontal trend.

- There are three ways traders can use to locate horizontal channels in a graph.

- Traders can locate the channel manually by looking through charts.

- Traders can utilize stock screeners that recognize horizontal channels.

- Traders can subscribe to service providers who compile chart patterns daily.

By offering buy and sell points, horizontal channels offer a transparent and systematic way to trade. The trading rules for entering long or short positions are as follows.

- Sell your current long position and/or take a short position when the price reaches the channel’s peak.

- If you have no trades available, do nothing, or keep your current trades when the price is in the center of the channel.

- Cover your current short position and/or take a long position when the price reaches the bottom of the channel.

Different dealers accept that a level channel addresses a “fleeting tranquility before all hell breaks loose” of a significant pattern inversion. On account of this equivocalness, level channels should just be utilized related to other specialized investigation instruments. The benefit of utilizing a level channel is that it rapidly uncovers exchanging exit and enter focuses to a financial backer. As a result, the horizontal channel’s support and resistance points are closely controlled. Technical analysis indicators that smooth out market action, such as trend lines, moving averages, and Fibonacci retracement levels, can be used to construct a horizontal channel.

Information Sources: