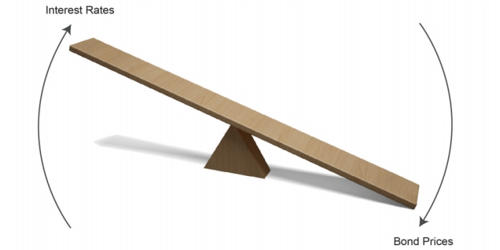

Interest rate risk is the potential for investment losses that result from a change in interest rates. It is the probability of a decline in the value of an asset resulting from unexpected fluctuations in interest rates. It is the risk that arises for bond owners from fluctuating interest rates. If interest rates rise, for instance, the value of a bond or other fixed-income investment will decline. It is mostly associated with fixed-income assets (e.g., bonds) rather than with equity investments.

How much interest rate risk a bond has depends on how sensitive its price is to interest rate changes in the market. It can be reduced by holding bonds of different durations, and investors may also allay interest rate risk by hedging fixed-income investments with interest rate swaps, options, or other interest rate derivatives. The sensitivity depends on two things, the bond’s time to maturity, and the coupon rate of the bond. So, Interest Rate Risk is the chance that an unexpected change in interest rates will negatively affect the value of an investment.

Calculation

Interest rate risk analysis is almost always based on simulating movements in one or more yield curves using the Heath-Jarrow-Morton framework to ensure that the yield curve movements are both consistent with current market yield curves and such that no riskless arbitrage is possible.

There are a number of standard calculations for measuring the impact of changing interest rates on a portfolio consisting of various assets and liabilities. The most common techniques include:

- Marking to market, calculating the net market value of the assets and liabilities, sometimes called the “market value of portfolio equity”

- Stress testing this market value by shifting the yield curve in a specific way.

- Calculating the value at risk of the portfolio

- Calculating the multiperiod cash flow or financial accrual income and expense for N periods forward in a deterministic set of future yield curves

- Measuring the mismatch of the interest sensitivity gap of assets and liabilities, by classifying each asset and liability by the timing of interest rate reset or maturity, whichever comes first.

The most common tools for interest rate mitigation include:

- Diversification

If a bondholder is afraid of interest rate risk that can negatively affect the value of his portfolio, he can diversify his existing portfolio by adding securities whose value is less prone to the interest rate fluctuations (e.g., equity).

- Hedging

These strategies generally include the purchase of different types of derivatives. The most common examples include interest rate swaps, options, futures, and forward rate agreements (FRAs).

There are two types of interest rate risk:

- Price Risk

It is the risk of change in the price of the security which may result in an unexpected gain or loss when the security is sold.

- Reinvestment Risk

It refers to the risk of change in the interest rate which may lead to the non-availability of the opportunity to reinvest in the current investment rate.