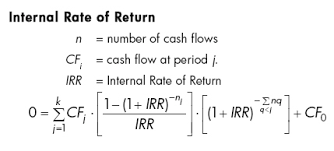

Internal Rate of Return (IRR) is the discount rate often utilized in capital budgeting that creates the net present value coming from all cash flows at a particular project adequate to zero. Generally conversing, the higher a project’s internal charge of return, the greater desirable it should be to undertake the undertaking. As such, IRR can supply to rank a number of prospective projects a strong is considering. Assuming all other factors are equal on the list of various projects, the project using the highest IRR would possibly be considered the best and undertaken primary.

Internal Rate of Return