EXECUTIVE SUMMARY

Banks and other financial institutions play a vital role in forecasting the economic and social condition of a country. Banks in Bangladesh now constitutes the core of the country’s organized financial system. They mobilize the savings of people and channel the resources toward different sectors of the economy. Customer satisfaction is one of the most vital reflections of the progression toward advancement and development for any service institution. As service providing organization, providing best service is one of the mottos of the commercial banks. With the customers’ perception as well as satisfaction, the mirror image of service quality in private commercial banks can be obtained. The achievement of the customers’ satisfaction is the key feedback to improve service quality.

The report has organized in some chapters. Through the chapter including organizational information, the present position of Prime Bank has depicted. Financial conditions have analyzed more to determine the organizational position.

This study is mainly focused on measuring customer satisfaction level of National Bank Ltd. Like the other private commercial banks, NBL also competing with others to flourish in this country. Providing quality service is only means to flourish. Therefore, measuring the level of customer satisfaction is very crucial. Measuring customer satisfaction is not any single task. Customers’ expectations are also required to measure the level of customer satisfaction. Therefore, total required information has collected through the questionnaire. After essential calculations, it has found that the customers of National Bank Ltd. are overall satisfied regarding the provided services of the bank. The mean value customers’ perception is 4.03 and the expected mean value is 4.88. As the perceived mean value is over 4, the level of customer satisfaction of National Bank Ltd. is “Good”. In addition, the expected mean value demonstrate that, the customers are not expecting just about “World Class” services. As the expectation level of human being has no bounds, there are difference between the expectation and perception.

There is no predicament in the world that does not have any remedy. Customers also provide many suggestions to improve the level of provided services of PBL. Those suggestions are incorporate in this report after some modification by consulting some related research work. By implementing these recommendation levels of satisfaction of PBL can be improved.

Introduction

1.1 Origin of the Report:

BBA academic program is the building up to the theoretical knowledge about business administration. Which is the base of practical knowledge. One semester internship program is an attempt to provide business students an orientation to a real life business situation in which we can observe and evaluate the use and applicability of the theoretical concepts, which were taught in the classroom. As a student of business administration, I preferred to complete my internship program in a Financial Institution like Bank. Then I got a chance to complete the program in a leading private commercial bank; “The National Bank Limited.” My internship topic is “Policies and Practice of Credit Management in National Bank” and it was assigned to me by the Head Office of The National Bank LTD.It was a challenge for me to complete a report on such an important topic. But I have completed this report successfully thanks to continuous supervision of my academic supervision Ms. Farjana Afrin

1.2 Background of the study

This report has been prepared based on one selected listed Bank in Bangladesh. This report has been prepared based on the information of this bank. All information is secondary and collected from Internet, Brochures, annual report etc. Based on this information ratio has been calculated. For the calculation of ratio has been calculated to measure the current position of the Bank. At the same time compare with the market performance.

1.3 Objective of the study:

The objective of the report is to provide a general description of the traditional banking and an exposure of the banking environment of Bangladesh. It also provides an exposure of practices of different banking activities of NBL, LOCAL OFFICE. Observing the existing rules for banking and fulfilling the partial requirement of MBM program is another objective of the report.

I have completed my internship program in National Bank Ltd. And this report is about this bank. As one of the main objectives of internship is to gather job experience, I have tried to put some of the experiences that I have learnt from my internship in this report.

1.3.1 Primary Objective:

Primary objective of this report is to measure and analyze the operational and financial performance of National Bank Ltd.

# To acquaint with day–to–day functioning of service oriented banking business;

# To have practical exposure in banks that will help a lot to understand the future courses of the program

# To be familiar with day to day functioning and service offered by a commercial bank.

# To observe and analyze the performance of the specific branch and the bank as a whole.

# To make a bridge between the theories and practices on banking operations.

# To know about the international trade financing activities.

# To find out the internal and external lacking in the daily operation that would help to National Bank Limited for more progress.

1.3.2 The specific objectives of this report are –

# To present an overview of National Bank Ltd.

# To appraise the performance of National Bank Ltd.

# To apprise financial performance of National Bank Ltd.

# To identify the problems of National Bank Ltd.

# To recommend/ remedial measures of the development of National bank Ltd.

1.4 Scope of the study:

The report covers all the best possible ways of fuming efficient information. In my report I have tried at my level best to describe each and every function elaborately.

1.5 Source of information:

Information collected to furnish this report is both from primary and secondary in nature. I collected primary information by direct conversation with the credit officers. Sources of secondary information were Annual Report of National Bank. I also studied different books on Finance and Credit and searched through Internet for more information.

1.6 Methodology Of The Report

Methodology includes direct observation, face-to-face discussion with employees of different departments, study of files, circulars, etc. and practical work. In preparing this report, both primary and secondary sources of information have been used.

For collecting primary data, I had to ask the respective officer(s). Others are like –

# Direct communication with the clients;

# Exposure on different desk of the bank;

# File study.

The secondary sources are –

Annual Report of National Bank Ltd.;

Periodicals published by the Bangladesh Bank;

Different publications regarding banking functions, foreign exchange operation, and credit policies

I worked in the Mirpur Branch of National Bank Ltd. That is why the report has been prepared in the light of the functioning of the Mirpur Branch of IBBL.Both the Secondary and Primary Sources have been used to collect data for this research paper.

1.7 Limitations of the report:

To prepare the internship I encountered some limitations. The limitations are given below-

# Limitation of time was a major constraint in making a complete study, due to time limitation.

# It was too limited to cover all the banking area. Many aspects could not be discussed in the present study.

# Lack of comprehension of the respondents was the major problem that created a lot of confusion regarding verification of conceptual question.

# Another limitation of this report is Bank’s policy of not disclosing some data and information for obvious reason, which could be very much useful.

# As being an intern, it also created some problems as I was unable to acquire hands-on-experience in all the departments, due to the bank’s policy of maintaining secrecy and also because I did not get the opportunity in all the departments.

An Overview of the National Bank Limited

2.1 Profile of National Bank Ltd:

The National Bank Limited (NBL) has a prolonged and glorious heritage in the banking industry in Bangladesh. It is the pioneer in the local private commercial was inaugurated on March 1983 under the supervision of Bangladesh Bank. A glorious fact of the National Bank Limited is its approval as first private commercial bank from Bangladesh Bank in our country.

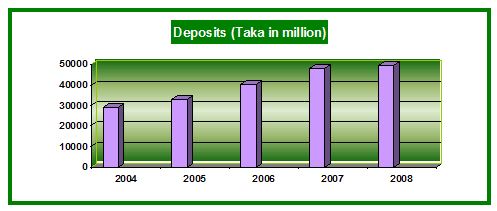

Economic development activities in the post liberation period required service from private commercial Banks. To fulfill this demand as well as to improve the commercial banking ser-vice in Bangladesh, the National Bank Limited emerged as a private limited company. The National Bank Limited is a remarkable addition to the private sector branch banking in Bangladesh. Aiming at offering commercial banking service to the customer’s door around the country, the National Bank Limited established 105 branches up to this year. This is the highest number for any private commercial bank operating in Bangladesh. This organization achieve customer’s confidence immediately its establishment in domestic and international markets.

NBL took participation in Nepal Arab Bank Limited, Nepal in 1995.Under a technical service agreement; NBL is extending management services to NBIL, in 1997. Bank opened a representative office in Yangoon, Myanmar. NBL is proud to be, first private Bank in Bangladesh who introduce credit card (Master Card) both local and international. The Bank has made agreement with Western Union Remittance services for speedy transfer of money allover the world.

The National Bank limited provides financing in capital market, Credit line and project financing, investment counseling, Underwriting any guarantee, Port folio management etc along with traditional banking service, Sanchay Prokalpo and Bonus Deposit scheme are- – praiseworthy banking service for the middle and lower income group. Recently, this organization has taken operational decision of two projects: Consumer Credit scheme and Credit Card marketing to widen its service and customer base. The National Bank Limited is always emphasizing the improvement of banking service and betterment of living standard of the general people of Bangladesh.

2.2 Vision:

Ensuring highest standard of clientele services through best application of latest information technology, making due contribution to the national economy and establishing ourselves firmly at home and abroad as a front ranking bank of the country are our cherished vision.

2.3 Mission:

Efforts for expansion of our activities at home and abroad by adding new dimension to our banking services are being continued unabated. Alongside, we are also putting highest priority in ensuring transparency, accountability, and improved clientele services as well as to our commitment to serve the society, through which we want to get closer and closer to the people of all strata. Winning an everlasting seat in the heart of the people as a caring companion in uplifting the national economic standard through continuous up gradation and diversification of our clientele services in line with national and international requirements is the desired goal we want to reach.

2.4 Commitments:

In Serving Customers | In Serving the Bank

| In Carrying Ourselves at Work

|

*Customer-first * Quality-focus * Credibility & secrecy | *Loyalty *Total commitment & dedication * Excellence through teamwork | * Discipline * Honesty & Integrity * Sincerity * Caring * Creativity |

2.5 Organization structure:

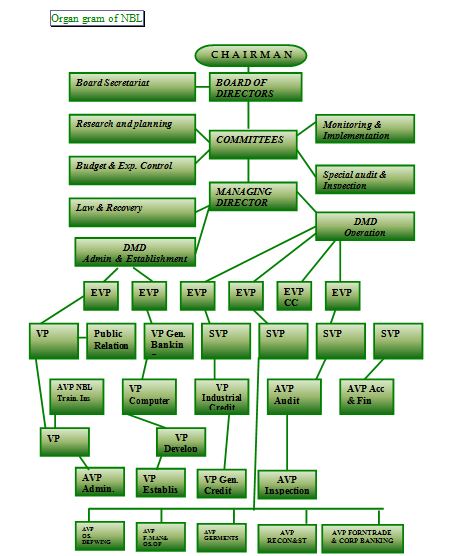

Functional oriented structure Organization structure plays an important role on the profitability of any organization. National bank limited is a centralized organization and operates in a. That is, its activities are designed on the basis of traditional banking business, such as credit, international division, investment, administration, and operation etc. NBL has A formal organizational structure that is highly specialized and centralized.

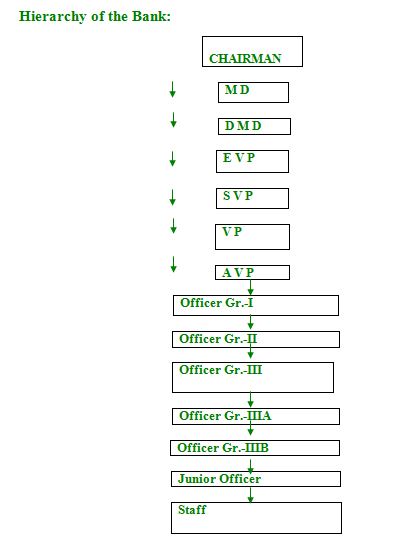

Organizational setup of the National bank Limited is consisting of three organizational domains. Firstly the central top management, which contains Board of Directors, Managing Director, Additional Managing Director and Deputy Managing director, Major responsibilities of this are to take central decision and transmit it to the second step. Secondly, Central executive level management, which contains executive vice president, senior vice president, vice president and Assistant vice president. Major responsibilities of this part are to supervise and control division/ department. Thirdly, branch operation management, which contains branch manager and other mid/ lower level management. Major responsibilities of this part are to the 75 branches of this bank and report to the Head office from time to time.

2.6 Management structure of National Bank Ltd.

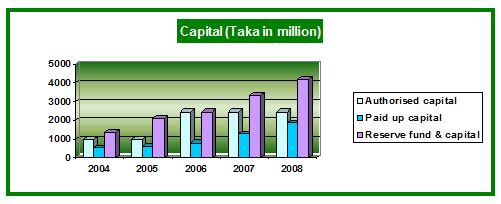

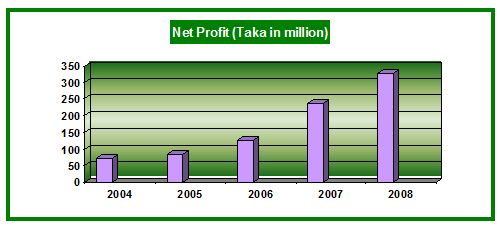

In 2001 National Bank Limited made commendable progress in all business, like deposit, credit, fund management, investment, foreign remittance, credit card & foreign exchange related business. Bank has expended business activities as holding previously & parallel by diversification its investment to a new product. As a major financier remarkable portion of total exports of the country. The total assets of the bank were Tk. 48732.1 million as on 31st December 2001, which is higher than Tk. 1584.02 million than the previous year. This is the sign of good management. The management processes are as follows:

2.6.1 Planning:

The strategic planning approach in NBL is top-down. Top management formulates strategy at the corporate level, and then it is transmitted through the division to the individual objectives. Board of directors or Executive committee usually takes the decision. In this process lower level manager are detached in making process, even brainstorming of lower level manager is absent in decision-making and planning process.

2.6.2 Organize:

Organizing of the National Bank Limited is based on Departmentalization. The organization is divided into twelve departments headed by Executive vice President or Senior Vice President. In the National Bank Limited the whole operation is centralized and authority is delegated by written guidelines. These guidelines are:

Operational manual approved by Head Office, where each aspect or banking operation is elaborately defined.

* Advance manual including advances limit for different management level.

* Bad and doubtful recovery manual.

* Code of conduct.

* Foreign banking guidelines.

* Central bank directives.

* Different management position holders in departments and branches practice their authorized power in different cases with administrative loophole.

2.6.3 Staffing:

Entry-level recruitment process of the National Bank Limited is conducted in three ways. One way is recruitment of probationary officer. Each probationary officer has one-year probation period. After completion of probation period the officer joins as officer grade III (b). The career path of probationary officer is headed toward different management positions. Second way of recruitment is to recruit non-probationary officer who joins as an assistant officer. The career path of an assistant officer is lengthier than probationary officer. The third way of recruitment is recruitment of staff and sub-staff such as typist, messenger, driver, guard, attendant, cleaner and other lower level positions. Promotion policy of NBL is basically based on seniority basis. Sometimes, employees are promoted to the higher position for their outstanding performance. However, it is found that the average length of a position held by an employee is around five years.

2.6.4 Controlling

The bank has strict control over its all-organizational activities. The Bangladesh Bank directives indicate some control measures. The central bank conducts credit inspection by a team. The National Bank Limited has audit and inspection department to take controlling measures in internal operations. Audit and inspection team send to the branches now and then and is responsible for preparing report that will be submitted to the chief Administration to take necessary actions.

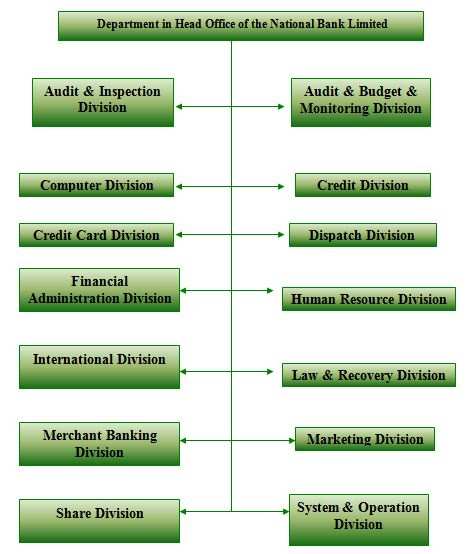

2.6.5 Division of NBL

* Audit & Inspection Division.

* ATM Card Division

* Board Secretariat

* Budget & Monitoring Division.

* Credit Division-1.

* Credit Division. -2.

* Credit Card Division.

* Classified Loan Recovery Division.

* Financial Administration Division.

* General Banking Division.

* Human Resources Division.

* International Division.

* Information System & Technology Division.

* Law & Recovery Division.

* Marketing Division.

* Merchant Banking Division.

* Public Relations Division.

* Protocol Division.

* Reconciliation Division.

* System & Operations

2.6.6 Introducing the branch:

National Bank Babu Bazar Branch is one of the largest branches of NBL is located in It started its function in the year 1987.

Presently there are 35 employees in this branch as of 20.09.1999, which includes

One SVP, 1 AVPs, 3 SPOs, 4 Pos, 18 Officers, 5 SOs, 4 Officers, One assistant and others are messengers, tellers, typist and security guards.

2.7 Deposit Products of NBL:

* Current Deposit.

* Savings Banks Deposits.

* Short Term Deposit.

* Monthly Savings Scheme (MSS).

* NBL Monthly Scheme.

* Special Deposits Scheme (SDS).

* Fixed Deposits.

* Sundry Deposits.

* Foreign Currency Deposits.

* Exporter’s FC A/C (RETN QUOTA).

* Resident Foreign Currency Deposit (RECD).

Deposit product of NBL:

| Special Deposit Scheme | Short-Term-Deposit (STD): | Current Deposits (CD A/c) | Monthly Savings Scheme

| Fixed Deposits (FD)

|

| For most of the people on fixed income the opportunity to supplement their monthly earning is a golden one. And NBL Special Deposit Scheme gives a customer just that. Under this scheme, customers can deposit money for a term of 5 years. The deposited money is fully refundable at the expiry of the term. At the same time, during the term period they can enjoy a monthly profit corresponding to their deposited amount. As for instance, under this scheme a deposit of Tk.55, 000/- gives a monthly income of Tk.500/- | Short Term Deposit or STD Account Opening procedure is similar to that of the current account. The rate of interest on this type of account is 5%. Withdrawals from this type of account require a prior notice of seven days. | Current Deposits (CD A/c) is a running A/c where a customer can draw, money frequently/continuously. Funds of CD A/c shall be payable on demand. Bank does not allow any interests on CD A/c. CD A/c is generally opened by Business men, Public Institutions, Corporate Bodies & other organizations who want to operate his A/c numerously& frequently. National Bank Limited provides the following types of current account: * Current account for individual (There must be a nominee) * Joint, current account (There must be a nominee) * Proprietorship current account: It may be CD A/c (Current Proprietor A/c)

| This scheme is specially designed for the benefit of the limited, income group members. This helps to accrue small monthly savings into significant sum at the end of the term. So, after the expiry of the term period the depositor will have a sizeable amount to relish on.

| Fixed Deposits (FD A/c) shall be opened for a longer period such as 3 (three) months to 3 (three) years or more. Generally who wants to invest his money safely can open FD A/c. The interest of FD A/c is negotiable & it depends on the volume of deposit and period. At present, our branch is allowing interest from 8% to 10.25% in FD A/c. It may be noted that no introduction is necessary to open FD A/c & The FDR is not negotiable instrument & cannot be transferred by endorsement.

|

2.8 Loan Products of NBL:

* Secured Overdraft (SOD)

* Investment against Imported Merchandise (LIM)

* Investment against Trust Receipt (LTR)

* Payment Against Document (PAD)

* House Building Investment

* House Building Investment (staff)

* Term Investment.

* Investment (general)

* Bank Guarantee

* 10. Export Cash Credit

* 11. Cash Credit (Hypo)

* 12. Cash Credit (Hypo)

* 13. Foreign Documentary Bill Purchase (FDBP)

* 14. Local Documentary Bill Purchase (LDBP)

General Discussion on Credit Risk Management

3.1 Defining Risk:

3.1.1 For the purpose of these guidelines financial risk in banking organization is possibility that the outcome of an action or event could bring up adverse impacts. Such outcomes could either result in a direct loss of earnings / capital or may result in imposition of constraints on bank’s ability to meet its business objectives. Such constraints pose a risk as these could hinder a bank’s ability to conduct its ongoing business or to take benefit of opportunities to enhance its business.

3.1.2 Regardless of the sophistication of the measures, banks often distinguish between expected and unexpected losses. Expected losses are those that the bank knows with reasonable certainty will occur (e.g., the expected default rate of corporate loan portfolio or credit card portfolio) and are typically reserved for in some manner. Unexpected losses are those associated with unforeseen events (e.g. losses experienced by banks in the aftermath of nuclear tests, Losses due to a sudden down turn in economy or falling interest rates). Banks rely on their capital as a buffer to absorb such losses.

3.1.3 Risks are usually defined by the adverse impact on profitability of several distinct sources of uncertainty. While the types and degree of risks an organization may be exposed to depend upon a number of factors such as its size, complexity business activities, volume etc, it is believed that generally the banks face Credit, Market, Liquidity, Operational, Compliance / legal / regulatory and reputation risks. Before overarching these risk categories, given below are some basics about risk Management and some guiding principles to manage risks in banking organization.

3.2 Risk Management.

3.2.1 Risk Management is a discipline at the core of every financial institution and encompasses all the activities that affect its risk profile. It involves identification, measurement, monitoring and controlling risks to ensure that

a) The individuals who take or manage risks clearly understand it.

b) The organization’s Risk exposure is within the limits established by Board of Directors.

c) Risk taking Decisions are in line with the business strategy and objectives set by BOD.

d) The expected payoffs compensate for the risks taken

e) Risk taking decisions are explicit and clear.

f) Sufficient capital as a buffer is available to take risk

3.2.2 The acceptance and management of financial risk is inherent to the business of banking and banks’ roles as financial intermediaries. Risk management as commonly perceived does not mean minimizing risk; rather the goal of risk management is to optimize risk-reward trade -off. Notwithstanding the fact that banks are in the business of taking risk, it should be recognized that an institution need not engage in business in a manner that unnecessarily imposes risk upon it: nor it should absorb risk that can be transferred to other participants. Rather it should accept those risks that are uniquely part of the array of bank’s services.

3.2.3 In every financial institution, risk management activities broadly take place simultaneously at following different hierarchy levels.

a) Strategic level: It encompasses risk management functions performed by senior management and BOD. For instance definition of risks, ascertaining institutions risk appetite, formulating strategy and policies for managing risks and establish adequate systems and controls to ensure that overall risk remain within acceptable level and the reward compensate for the risk taken.

b) Macro Level: It encompasses risk management within a business area or across business lines. Generally the risk management activities performed by middle management or units devoted to risk reviews fall into this category.

c) Micro Level: It involves ‘On-the-line’ risk management where risks are actually created. This is the risk management activities performed by individuals who take risk on organization’s behalf such as front office and loan origination functions. The risk management in those areas is confined to following operational procedures and guidelines set by management.

3.2.4 Expanding business arenas, deregulation and globalization of financial activities emergence of new financial products and increased level of competition has necessitated a need for an effective and structured risk management in financial institutions. A bank’s ability to measure, monitor, and steer risks comprehensively is becoming a decisive parameter for its strategic positioning.

The risk management framework and sophistication of the process, and internal controls, used to manage risks, depends on the nature, size and complexity of institutions activities. Nevertheless, there are some basic principles that apply to all financial institutions irrespective of their size and complexity of business and are reflective of the strength of an individual bank’s risk management practices.

3.3 Board and Senior Management oversight.

a) To be effective, the concern and tone for risk management must start at the top. While the overall responsibility of risk management rests with the BOD, it is the duty of senior management to transform strategic direction set by board in the shape of policies and procedures and to institute an effective hierarchy to execute and implement those policies. To

ensure that the policies are consistent with the risk tolerances of shareholders the same should Be approved from board.

b) The formulation of policies relating to risk management only would not solve the purpose unless these are clear and communicated down the line. Senior management has to ensure that these policies are embedded in the culture of organization. Risk tolerances relating to quantifiable risks are generally communicated as limits or sub-limits to those who accept risks on behalf of organization. However not all risks are quantifiable. Qualitative risk measures could be communicated as guidelines and inferred from management business decisions.

c) To ensure that risk taking remains within limits set by senior management/BOD, any material exception to the risk management policies and tolerances should be reported to the senior management/board that in turn must trigger appropriate corrective measures. These exceptions also serve as an input to judge the appropriateness of systems and procedures relating to risk management.

d) To keep these policies in line with significant changes in internal and external environment, BOD is expected to review these policies and make appropriate changes as and when deemed necessary. While a major change in internal or external factor may require frequent review, in absence of any uneven circumstances it is expected that BOD re-evaluate these policies every year.

3.4 Risk Management Framework:

3.4.1 A risk management framework encompasses the scope of risks to be managed, the process/systems and procedures to manage risk and the roles and responsibilities of individuals involved in risk management. The framework should be comprehensive enough to capture all risks a bank is exposed to and have flexibility to accommodate any change in business activities. An effective risk management framework includes

a) Clearly defined risk management policies and procedures covering risk identification, acceptance, measurement, monitoring, reporting and control.

b) A well constituted organizational structure defining clearly roles and responsibilities of individuals involved in risk taking as well as managing it. Banks, in addition to risk management functions for various risk categories may institute a setup that supervises overall Risk management at the bank. Such a setup could be in the form of a separate department or bank’s Risk Management Committee (RMC) could perform such function. The structure should be such that ensures effective monitoring and control over risks being taken. The individuals responsible for review function (Risk review, internal audit, compliance etc) should be independent from risk taking units and report directly to board or senior management who are also not involved in risk taking.

c) There should be an effective management information system that ensures flow of information from operational level to top management and a system to address any exceptions observed. There should be an explicit procedure regarding measures to be taken to address such deviations.

d) The framework should have a mechanism to ensure an ongoing review of systems, policies and procedures for risk management and procedure to adopt changes.

3.5 Integration of Risk Management

Risks must not be viewed and assessed in isolation, not only because a single transaction might have a number of risks but also one type of risk can trigger other risks. Since interaction of various risks could result in diminution or increase in risk, the risk management process should recognize and reflect risk interactions in all business activities as appropriate. While assessing and managing risk the management should have an overall view of risks the institution is exposed to. This requires having a structure in place to look at risk interrelationships across the organization.

3.6 Business Line Accountability

In every banking organization there are people who are dedicated to risk management activities, such as risk review, internal audit etc. It must not be construed that risk management is something to be performed by a few individuals or a department. Business lines are equally responsible for the risks they are taking. Because line personnel, more than anyone else, understand the risks of the business, such a lack of accountability can lead to problems.

3.7 Risk Evaluation/Measurement.

Until and unless risks are not assessed and measured it will not be possible to control risks. Further a true assessment of risk gives management a clear view of institution’s standing and helps in deciding future action plan. To adequately capture institutions risk exposure, risk measurement should represent aggregate exposure of institution both risk type and business line and encompass short run as well as long run impact on institution. To the maximum possible extent institutions should establish systems / models that quantify their risk profile, however, in some risk categories such as operational risk, quantification is quite difficult and complex. Wherever it is not possible to quantify risks, qualitative measures should be adopted to capture those risks.

Whilst quantitative measurement systems support effective decision-making, better measurement does not obviate the need for well-informed, qualitative judgment. Consequently the importance of staff having relevant knowledge and expertise cannot be undermined. Finally any risk measurement framework, especially those which employ quantitative techniques/model, is only as good as its underlying assumptions, the rigor and robustness of its analytical methodologies, the controls surrounding data inputs and its appropriate application

3.8 Independent review

One of the most important aspects in risk management philosophy is to make sure that those who take or accept risk on behalf of the institution are not the ones who measure, monitor and evaluate the risks. Again the managerial structure and hierarchy of risk review function may vary across banks depending upon their size and nature of the business, the key is independence. To be effective the review functions should have sufficient authority, expertise and corporate stature so that the identification and reporting of their findings could be accomplished without any hindrance. The findings of their reviews should be reported to business units, Senior Management and, where appropriate, the Board.

3.10 Managing Credit Risk:

Credit risk arises from the potential that an obligor is either unwilling to perform on an obligation or its ability to perform such obligation is impaired resulting in economic loss to the bank.

3.10.1 In a bank’s portfolio, losses stem from outright default due to inability or unwillingness of a customer or counter party to meet commitments in relation to lending, trading, settlement and other financial transactions. Alternatively losses may result from reduction in portfolio value due to actual or perceived deterioration in credit quality. Credit risk emanates from a bank’s dealing with individuals, corporate, financial institutions or a sovereign. For most banks, loans are the largest and most obvious source of credit risk; however, credit risk could stem from activities both on and off balance sheet.

3.10.2 In addition to direct accounting loss, credit risk should be viewed in the context of economic exposures. This encompasses opportunity costs, transaction costs and expenses associated with a non-performing asset over and above the accounting loss.

3.10.3 Credit risk can be further sub-categorized on the basis of reasons of default.

For instance the default could be due to country in which there is exposure or problems in settlement of a transaction.

3.10.4 Credit risk not necessarily occurs in isolation. The same source that endangers credit risk for the institution may also expose it to other risk. For instance a bad portfolio may attract liquidity problem.

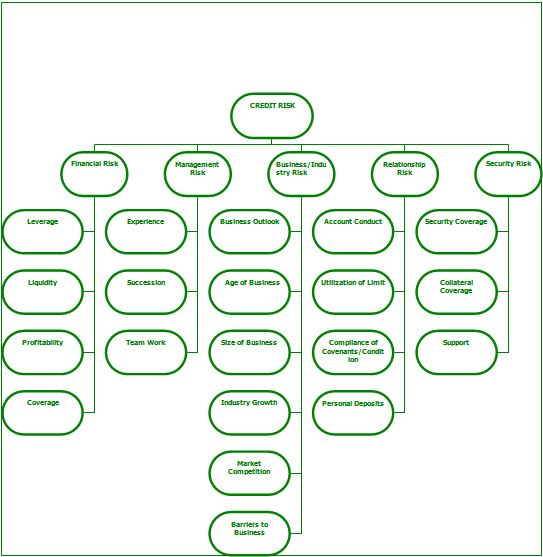

3.11 Components of credit risk management

A typical Credit risk management framework in a financial institution may be broadly categorized into following main components.

* Board and senior Management’s Oversight

* Organizational structure

* Systems and procedures for identification, acceptance, measurement, monitoring and control risks.

3.12 Board and Senior Management’s Oversight

3.12.1 It is the overall responsibility of bank’s Board to approve bank’s credit risk strategy and significant policies relating to credit risk and its management which should be based on the bank’s overall business strategy. To keep it current, the overall strategy has to be reviewed by the board, preferably annually. The responsibilities of the Board with regard to credit risk management shall, include:

* Delineate bank’s overall risk tolerance in relation to credit risk.

* Ensure that bank’s overall credit risk exposure is maintained at prudent levels and consistent with the available capital

* Ensure that top management as well as individuals responsible for credit risk management possesses sound expertise and knowledge to accomplish the risk management function.

* Ensure that the bank implements sound fundamental principles that facilitate the identification, measurement, monitoring and control of credit risk.

* Ensure that appropriate plans and procedures for credit risk management are in place.

3.12.2 The very first purpose of bank’s credit strategy is to determine the risk appetite of the bank. Once it is determined the bank could develop a plan to optimize return while keeping credit risk within predetermined limits. The bank’s credit risk strategy thus should spell out.

* The institution’s plan to grant credit based on various client segments and products, economic sectors, geographical location, currency and maturity.

* Target market within each lending segment, preferred level of diversification/concentration.

* Pricing strategy.

3.12.3 It is essential that banks give due consideration to their target market while devising credit risk strategy. The credit procedures should aim to obtain an in-depth understanding of the bank’s clients, their credentials & their businesses in order to fully know their customers.

3.12.4 The strategy should provide continuity in approach and take into account cyclic aspect of country’s economy and the resulting shifts in composition and quality of overall credit portfolio. While the strategy would be reviewed periodically and amended, as deemed necessary, it should be viable in long term and through various economic cycles.

3.12.5 The senior management of the bank should develop and establish credit policies and credit administration procedures as a part of overall credit risk management framework and get those approved from board. Such policies and procedures shall provide guidance to the staff on various types of lending including corporate, SME, consumer, agriculture, etc. At minimum the policy should include.

* Detailed and formalized credit evaluation/ appraisal process.

* Credit approval authority at various hierarchy levels including authority for approving exceptions.

* Risk identification, measurement, monitoring and control.

* Risk acceptance criteria.

* Credit origination and credit administration and loan documentation procedures.

* Roles and responsibilities of units/staff involved in origination and management of credit.

* Guidelines on management of problem loans.

3.12.6 In order to be effective these policies must be clear and communicated down the line. Further any significant deviation/exception to these policies must be communicated to the top management/board and corrective measures should be taken. It is the responsibility of senior management to ensure effective implementation of these policies.

3.13 Organizational Structure:

3.13.1 To maintain bank’s overall credit risk exposure within the parameters set by the board of directors, the importance of a sound risk management structure is second to none. While the banks may choose different structures, it is important that such structure should be commensurate with institution’s size, complexity and diversification of its activities. It must facilitate effective management oversight and proper execution of credit risk management and control processes.

3.13.2 Each bank, depending upon its size, should constitute a Credit Risk Management Committee (CRMC), ideally comprising of head of credit risk management Department, credit department and treasury. This committee reporting to bank’s risk management committee should be empowered to oversee credit risk taking activities and overall credit risk management function. The CRMC should be mainly responsible for,

* The implementation of the credit risk policy / strategy approved by the Board.

* Monitor credit risk on a bank-wide basis and ensure compliance with limits approved by the Board.

* Recommend to the Board, for its approval, clear policies on standards for presentation of credit proposals, financial covenants, rating standards and benchmarks.

* Decide delegation of credit approving powers, prudential limits on large credit exposures, standards for loan collateral, portfolio management, loan review mechanism, risk concentrations, risk monitoring and evaluation, pricing of loans, provisioning, regulatory/legal compliance, etc.

3.13.3 Further, to maintain credit discipline and to enunciate credit risk management and control process there should be a separate function independent of loan origination function. Credit policy formulation, credit limit setting, monitoring of credit exceptions / exposures and review /monitoring of documentation are functions that should be performed independently of the loan origination function. For small banks where it might not be feasible to establish such structural hierarchy, there should be adequate compensating measures to maintain credit discipline introduce adequate checks and balances and standards to address potential conflicts of interest. Ideally, the banks should institute a Credit Risk Management Department (CRMD). Typical functions of CRMD include:

* To follow a holistic approach in management of risks inherent in banks portfolio and ensure the risks remain within the boundaries established by the Board or Credit Risk Management Committee.

* The department also ensures that business lines comply with risk parameters and prudential limits established by the Board or CRMC.

* Establish systems and procedures relating to risk identification, Management Information System, monitoring of loan / investment portfolio quality and early warning. The department would work out remedial measure when deficiencies/problems are identified.

* The Department should undertake portfolio evaluations and conduct comprehensive studies on the environment to test the resilience of the loan portfolio.

3.13.4 Not with standing the need for a separate or independent oversight, the front office or loan origination function should be cognizant of credit risk, and maintain high level of credit discipline and standards in pursuit of business opportunities.

3.14 Systems and Procedures

3.14.1Credit Origination

* Banks must operate within a sound and well-defined criteria for new credits as well as the expansion of existing credits. Credits should be extended within the target markets and lending strategy of the institution. Before allowing a credit facility, the bank must make an assessment of risk profile of the customer/transaction. This may include,

a) Credit assessment of the borrower’s industry, and macro economic factors.

b) The purpose of credit and source of repayment.

c) The track record / repayment history of borrower.

d) Assess/evaluate the repayment capacity of the borrower.

e) The Proposed terms and conditions and covenants.

f) Adequacy and enforceability of collaterals.

g) Approval from appropriate authority.

* In case of new relationships consideration should be given to the integrity and repute of the borrowers or counter party as well as its legal capacity to assume the liability. Prior to entering into any new credit relationship the banks must become familiar with the borrower or counter party and be confident that they are dealing with individual or organization of sound repute and credit worthiness. However, a bank must not grant credit simply on the basis of the fact that the borrower is perceived to be highly reputable i.e. name lending should be discouraged.

* While structuring credit facilities institutions should appraise the amount and timing of the cash flows as well as the financial position of the borrower and intended

* Purpose of the funds. It is utmost important that due consideration should be given to the risk reward trade –off in granting a credit facility and credit should be priced to cover all embedded costs. Relevant terms and conditions should be laid down to protect the institution’s interest.

* Institutions have to make sure that the credit is used for the purpose it was borrowed. Where the obligor has utilized funds for purposes not shown in the original proposal, institutions should take steps to determine the implications on creditworthiness. In case of corporate loans where borrower own group of companies such diligence becomes more important. Institutions should classify such connected companies and conduct credit assessment on consolidated/group basis.

* In loan syndication, generally the lead institution does most of the credit assessment and analysis. While such information is important, institutions should not over rely on that. All syndicate participants should perform their own independent analysis and review of syndicate terms.

* Institution should not over rely on collaterals / covenant. Although the importance of collaterals held against loan is beyond any doubt, yet these should be considered as a buffer providing protection in case of default, primary focus should be on obligor’s debt servicing ability and reputation in the market.

3.14.2Limit setting

* An important element of credit risk management is to establish exposure limits for single obligors and group of connected obligors. Institutions are expected to develop their own limit structure while remaining within the exposure limits. The size of the limits should be based on the credit strength of the obligor, genuine requirement of credit, economic conditions and the institution’s risk tolerance. Appropriate limits should be set for respective products and activities. Institutions may establish limits for a specific industry, economic sector or geographic regions to avoid concentration risk.

* Some times, the obligor may want to share its facility limits with its related companies. Institutions should review such arrangements and impose necessary limits if the transactions are frequent and significant

* Credit limits should be reviewed regularly at least annually or more frequently if obligor’s credit quality deteriorates. All requests of increase in credit limits should be substantiated.

3.14.3 Credit Administration

Ongoing administration of the credit portfolio is an essential part of the credit process. Credit administration function is basically a back office activity that support and control extension and maintenance of credit. A typical credit administration unit performs following functions:

a. Documentation. It is the responsibility of credit administration to ensure completeness of documentation (loan agreements, guarantees, transfer of title of collaterals etc) in accordance with approved terms and conditions. Outstanding documents should be tracked and followed up to ensure execution and receipt.

b. Credit Disbursement. The credit administration function should ensure that the loan application has proper approval before entering facility limits into computer systems. Disbursement should be effected only after completion of covenants, and receipt of collateral holdings. In case of exceptions necessary approval should be obtained from competent authorities.

c. Credit monitoring. After the loan is approved and draw down allowed, the loan should be continuously watched over. These include keeping track of borrowers’ compliance with credit terms, identifying early signs of irregularity, conducting periodic valuation of collateral and monitoring timely repayments.

d. Loan Repayment. The obligors should be communicated ahead of time as and when the principal/markup installment becomes due. Any exceptions such as non-payment or late payment should be tagged and communicated to the management. Proper records and updates should also be made after receipt.

e. Maintenance of Credit Files. Institutions should devise procedural guidelines and standards for maintenance of credit files. The credit files not only include all correspondence with the borrower but should also contain sufficient information necessary to assess financial health of the borrower and its repayment performance. It need not mention that information should be filed in organized way so that external / internal auditors or SBP inspector could review it easily.

f. Collateral and Security Documents. Institutions should ensure that all security documents are kept in a fireproof safe under dual control. Registers for documents should be maintained to keep track of their movement. Procedures should also be established to track and review relevant insurance coverage for certain facilities/collateral. Physical checks on security documents should be conducted on a regular basis.

While in small Institutions it may not be cost effective to institute a separate credit administrative set-up, it is important that in such institutions individuals performing sensitive functions such as custody of key documents, wiring out funds, entering limits into system, etc., should report to managers who are independent of business origination and credit approval process.

3.14.4 Measuring credit risk

The measurement of credit risk is of vital importance in credit risk management.

A number of qualitative and quantitative techniques to measure risk inherent in credit portfolio are evolving. To start with, banks should establish a credit risk-rating framework across all type of credit activities. Among other things, the rating framework may, incorporate:

* Business Risk

* Industry Characteristics

* Competitive Position (e.g. marketing/technological edge)

* Management

* Financial Risk

* Financial condition

* Profitability

* Capital Structure

* Present and future Cash flows

3.14.5 Internal Risk Rating:

Credit risk rating is summary indicator of a bank’s individual credit exposure. An internal rating system categorizes all credits into various classes on the basis of underlying credit quality. A well-structured credit rating framework is an important tool for monitoring and controlling risk inherent in individual credits as well as in credit portfolios of a bank or a business line. The importance of internal credit rating framework becomes more eminent due to the fact that historically major losses to banks stemmed from default in loan portfolios. While a number of banks already have a system for rating individual credits in addition to the risk categories prescribed by SBP, all banks are encouraged to devise an internal rating framework. An internal rating framework would facilitate banks in a number of ways such as,

* Credit selection.

* Amount of exposure.

* Tenure and price of facility.

* Frequency or intensity of monitoring.

3.14.6 The Architecture of Internal Rating System:

The decision to deploy any risk rating architecture for credits depends upon two basic aspects,

a) The Loss Concept and the number and meaning of grades on the rating continuum corresponding to each loss concept.

b) Whether to rate a borrower on the basis of ‘point in time philosophy’ or ‘through the cycle approach.

Besides there are other issues such as whether to include statutory grades in the scale, the type of rating scale i.e. alphabetical numerical or alphanumeric etc. SBP does not advocate any particular credit risk rating system; it should be banks own choice. However the system should commensurate with the size, nature and complexity of their business as well as possess flexibility to accommodate present and future risk profile of the bank, the anticipated level of diversification and sophistication in lending activities.

A rating system with large number of grades on rating scale becomes more expensive due to the fact that the cost of obtaining and analyzing additional information for fine gradation increases sharply. However, it is important that there should be sufficient gradations to permit accurate characterization of the under lying risk profile of a loan or a portfolio of loans

3.14.7 The Operating Design of Rating System:

As with the decision to grant credit, the assignment of ratings always involve element of human judgment. Even sophisticated rating models do not replicate experience and judgment rather these techniques help and reinforce subjective judgment. Banks thus design the operating flow of the rating process in a way that is aimed promoting the accuracy and consistency of the rating system while not unduly restricting the exercise of judgment. Key issues relating to the operating design of a rating system include what exposures to rate; the organization’s division of responsibility for grading; the nature of ratings review; the formality of the process and specificity of formal rating definitions.

3.14.8 What Exposures are rated?

Ideally all the credit exposures of the bank should be assigned a risk rating. However given the element of cost, it might not be feasible for all banks to follow. The banks may decide on their own which exposure needs to be rated. The decision to rate a particular loan could be based on factors such as exposure amount, business line or both. Generally corporate and commercial exposures are subject to internal ratings and banks use scoring models for consumer / retail loans.

3.14.9 The Rating Process in Relation to Credit Approval and Review

Ratings are generally assigned /reaffirmed at the time of origination of a loan or its renewal /enhancement. The analysis supporting the ratings is inseparable from that required for credit appraisal. In addition the rating and loan analysis process while being separate are intertwined. The process of assigning a rating and its approval / confirmation goes along with the initiation of a credit proposal and its approval. Generally loan origination function (whether a relationship manager or credit staff) initiates a loan proposal and also allocates a

Specific rating. This proposal passes through the credit approval process and the rating is also approved or recalibrated simultaneously by approving authority. The revision in the ratings can be used to upgrade the rating system and related guidelines.

3.14.10 How to Arrive at Rating

The assignment of a particular rating to an exposure is basically an abbreviation of its overall risk profile. Theoretically ratings are based upon the major risk factors and their intensity inherent in the business of the borrower as well as key parameters and their intensity to those risk factors. Major risk factors include borrowers financial condition, size, industry and position in the industry; the reliability of financial statements of the borrower; quality of management; elements of transaction structure such as covenants etc. A more detail on the subject would be beyond the scope of these guidelines, however a few important aspects are,

a) Banks may vary somewhat in the particular factors they consider and the weight they give to each factor.

b) Since the rater and reviewer of rating should be following the same basic thought, to ensure uniformity in the assignment and review of risk grades, the credit policy should explicitly define each risk grade; lay down criteria to be fulfilled while assigning a particular grade, as well as the circumstances under which deviations from criteria can take place.

c) The credit policy should also explicitly narrate the roles of different parties involved in the rating process.

d) The institution must ensure that adequate training is imparted to staff to ensure uniform ratings

e) Assigning a Rating is basically a judgmental exercise and the models, external ratings and written guidelines/benchmarks serve as input.

f) Institutions should take adequate measures to test and develop a risk rating system prior to adopting one. Adequate validation testing should be conducted during the design phase as well as over the life of the system to ascertain the applicability of the system to the institution’s portfolio.

Institutions that use sophisticated statistical models to assign ratings or to calculate probabilities of default, must ascertain the applicability of these models to their portfolios. Even when such statistical models are found to be satisfactory, institutions should not use the output of such models as the sole criteria for assigning ratings or determining the probabilities of default. It would be advisable to consider other relevant inputs as well.

3.14.11 Rating review

The rating review can be two-fold:

a) Continuous monitoring by those who assigned the rating. The Relationship Managers (RMs) generally have a close contact with the borrower and are expected to keep an eye on the financial stability of the borrower. In the event of any deterioration the ratings are immediately revised /reviewed.

b) Secondly the risk review functions of the bank or business lines also conduct periodical review of ratings at the time of risk review of credit portfolio.

* Risk ratings should be assigned at the inception of lending, and updated at least annually. Institutions should, however, review ratings as and when adverse events occur. A separate function independent of loan origination should review Risk ratings. As part of portfolio monitoring, institutions should generate reports on credit exposure by risk grade. Adequate trend and migration analysis should also be conducted to identify any deterioration in credit quality. Institutions may establish limits for risk grades to highlight concentration in particular rating bands. It is important that the consistency and accuracy of ratings is examined periodically by a function such as an independent credit review group.

* For consumer lending, institutions may adopt credit-scoring models for processing loan applications and monitoring credit quality. Institutions should apply the above principles in the management of scoring models. Where the model is relatively new, institutions should continue to subject credit applications to rigorous review until the model has stabilized.

3.15. Credit Risk Monitoring & Control

Credit risk monitoring refers to incessant monitoring of individual credits inclusive of Off-Balance sheet exposures to obligors as well as overall credit portfolio of the bank. Banks need to enunciate a system that enables them to monitor quality of the credit portfolio on day-to-day basis and take remedial measures as and when any deterioration occurs. Such a system would enable a bank to ascertain whether loans are being serviced as per facility terms, the adequacy of provisions, the overall risk profile is within limits established by management and compliance of regulatory limits. Establishing an efficient and effective credit monitoring system would help senior management to monitor the overall quality of the total credit portfolio and its trends. Consequently the management could fine tune or reassess its credit strategy policy accordingly before encountering any major setback. The banks credit policy should explicitly provide procedural guideline relating to credit risk monitoring. At the minimum it should lay down procedure relating to,

a) The roles and responsibilities of individuals responsible for credit risk monitoring

b) The assessment procedures and analysis techniques (for individual loans & overall portfolio).

c) The frequency of monitoring.

d) The periodic examination of collaterals and loan covenants.

e) The frequency of site visits.

f) The identification of any deterioration in any loan.

Given below are some key indicators that depict the credit quality of a loan:

a. Financial Position and Business Conditions. The most important aspect about an obligor is its financial health, as it would determine its repayment capacity. Consequently institutions need carefully watch financial standing of obligor. The Key financial performance indicators on profitability, equity, leverage and liquidity should be analyzed. While making such analysis due consideration should be given to business/industry risk, borrower’s position within the industry and external factors such as economic condition, government policies, and regulations. For companies whose financial position is dependent on key management personnel and/or shareholders, for example, in small and medium enterprises, institutions would need to pay particular attention to the assessment of the capability and capacity of the management/shareholder(s).

b. Conduct of Accounts. In case of existing obligor the operation in the account would give a fair idea about the quality of credit facility. Institutions should monitor the obligor’s account activity, repayment history and instances of excesses over credit limits. For trade financing, institutions should monitor cases of repeat extensions of due dates for trust receipts and bills.

c. Loan Covenants. The obligor’s ability to adhere to negative pledges and financial covenants stated in the loan agreement should be assessed, and any breach detected should be addressed promptly.

d. Collateral valuation. Since the value of collateral could deteriorate resulting in unsecured lending, banks need to reassess value of collaterals on periodic basis. The frequency of such valuation is very subjective and depends upon nature of collaterals. For instance loan granted against shares need revaluation on almost daily basis whereas if there is mortgage of a residential property the revaluation may not be necessary as frequently. In case of credit facilities secured against inventory or goods at the obligor’s premises, appropriate inspection should be conducted to verify the existence and valuation of the collateral. And if such goods are perishable or such that there value diminish rapidly (e.g. electronic parts/equipments), additional precautionary measures should be taken.

External Rating and Market Price of securities such as TFCs purchased as a form of lending or long-term investment should be monitored for any deterioration in credit rating of the issuer, as well as large decline in market price. Adverse changes should trigger additional effort to review the creditworthiness of the issuer.

3.16 Risk Review

* The institutions must establish a mechanism of independent, ongoing assessment of credit risk management process. All facilities except those managed on a portfolio basis should be subjected to individual risk review at least once in a year. The results

Of such review should be properly documented and reported directly to board, or its sub committee or senior management without lending authority. The purpose of such reviews is to assess the credit administration process, the accuracy of credit rating and overall quality of loan portfolio independent of relationship with the obligor.

* Institutions should conduct credit review with updated information on the obligor’s financial and business conditions, as well as conduct of account. Exceptions noted in the credit monitoring process should also be evaluated for impact on the obligor’s creditworthiness. Credit review should also be conducted on a consolidated group basis to factor in the business connections among entities in a borrowing group.

* As stated earlier, credit review should be performed on an annual basis, however more frequent review should be conducted for new accounts where institutions may not be familiar with the obligor, and for classified or adverse rated accounts that have higher probability of default. * For consumer loans, institutions may dispense with the need to perform credit review for certain products. However, they should monitor and report credit exceptions and deterioration.

3.17 Delegation of Authority

* Banks are required to establish responsibility for credit sanctions and delegate authority to approve credits or changes in credit terms. It is the responsibility of banks board to approve the overall lending authority structure, and explicitly delegate credit sanctioning authority to senior management and the credit committee. Lending authority assigned to officers should be commensurate with the experience, ability and personal character. It would be better if institutions develop risk-based authority structure where lending power is tied to the risk ratings of the obligor. Large banks may adopt multiple credit approvers for sanctioning such as credit ratings, risks approvals etc to institute a more effective system of check and balance. The credit policy should spell out the escalation process to ensure appropriate reporting and approval of credit extension beyond prescribed limits. The policy should also spell out authorities for unsecured credit (while remaining within SBP limits), approvals of disbursements excess over limits and other exceptions to credit policy.

* In cases where lending authority is assigned to the loan originating function, there should be compensating processes and measures to ensure adherence to lending standards. There should also be periodic review of lending authority assigned to officers.

3.18 Managing Problem Credits

* The institution should establish a system that helps identify problem loan ahead of time when there may be more options available for remedial measures. Once the loan is identified as problem, it should be managed under a dedicated remedial process.

* A bank’s credit risk policies should clearly set out how the bank will manage problem credits. Banks differ on the methods and organization they use to manage problem credits. Responsibility for such credits may be assigned to the originating business function, a specialized workout section, or a combination of the two, depending upon the size and nature of the credit and the reason for its problems. When a bank has significant credit-related problems, it is important to segregate the workout function from the credit origination function. The additional resources, expertise and more concentrated focus of a specialized workout section normally improve collection results

* A problem loan management process encompass following basic elements:

a. Negotiation and follow-up. Proactive effort should be taken in dealing with obligors to implement remedial plans, by maintaining frequent contact and internal records of follow-up actions. Often rigorous efforts made at an early stage prevent institutions from litigations and loan losses

b. Workout remedial strategies. Some times appropriate remedial strategies such as restructuring of loan facility, enhancement in credit limits or reduction in interest rates help improve obligor’s repayment capacity. However it depends upon business condition, the nature of problems being faced and most importantly obligor’s commitment and willingness to repay the loan. While such remedial strategies often bring up positive results, institutions need to exercise great caution in adopting such measures and ensure that such a policy must not encourage obligors to default intentionally. The institution’s interest should be the primary consideration in case of such workout plans. It needs not mention here that competent authority, before their implementation, should approve such workout plan.

c. Review of collateral and security document. Institutions have to ascertain the loan recoverable amount by updating the values of available collateral with formal valuation. Security documents should also be reviewed to ensure the completeness and enforceability of contracts and collateral/guarantee.

d. Status Report and Review. Problem credits should be subject to more frequent review and monitoring. The review should update the status and development of the loan accounts and progress of the remedial plans. Progress made on problem loan should be reported to the senior management.

Credit Management Policy of The National Bank

4.1 Introduction:

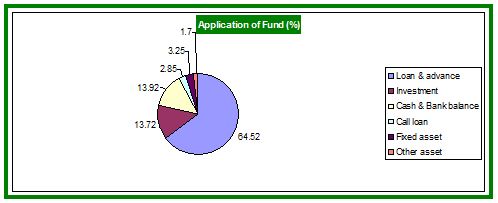

Credit extension or lending is the principal business of a bank. Credit Constitute more than 60% of a banks asset and remain the main source of its income. But credit is also the most risk bearing asset and if not managed prudently, it may cause server financial losses to the bank. This conflicting characteristic of credit provides all the significance to credit management. Strong and effective credit management is essential to ensure the financial health of a bank. The dominant objective of credit management is to maximize profit within a consistent framework of risk and credit discipline. Credit management involves credit planning, credit policies, credit producer, credit administration, credit monitoring and credit recovery.

4.2 Principles of Credit Management:

The management of credit risk is central to a sound credit management process. The basic principles a bank has to follow in its credit risk management are:

* Selection.

* Limitation.

* Diversification.

4.2.1 Selection:

Selection of borrower is the most important aspects of credit risk management. The quality of the credit portfolio of bank depends to a large extent on the quality of its borrowers. To judge the quality of borrower the bank takes into a borrower the bank takes into consideration the following.

* Character (borrowers’ honesty, willingness and commitment to pay debts).

* Capacity (the success of business).

* Capital (financial condition).

* Collateral.

* Condition (economic).

4.2.2 Limitation:

A system of limits for different types and categories of lending have to be set. The essential requirement is to establish maximization amount that may be loaned to any borrower or a group of connected borrowers and to any one industry or type of industries. Lending limits have been set taking the banks capital and resources into account.

4.3 Credit policy:

The bank should have established credit policies containing:

1) Lending guidelines

2) Credit assessment process and

3) Approval authority

4.3.1 Lending guidelines:

Lending guidelines should clearly outline the senior management’s view of business development priorities and the term and condition that should be followed for loans to be approved. The lending guidelines should provide the key foundations to formulate recommendations for loan approval and should include the following:

* Industry and business segment focus

* Types of loan facilities

* Singles borrower/group exposure limit

* Lending caps for a specific sector

* Discouraged business types

* Loan facility parameter (e.g. maximum size, maximum tenor, security requirement).

4.3.2 Credit assessment:

The bank must undertake through credit and risk assessment before taking decision on loan approval. For credit assessment the following should be taken into consideration.

* Amount types of loan proposed

* Purposed of loans

* Loan structure (Tenor, repayment schedule, interest)

* Security

* Borrower analysis

* Supplier/buyer analysis

* Financial analysis

* Financial performance

* Account conduct

For the assessment the risk-grading manual of Bangladesh Bank should be followed.

4.3.3 Approval Authority:

The authority to sanction approves loans must be clearly delegated to senior executives by the Chief Executive or the Board of Directors. Approval authority should preferably be delegated to individual executives and not to committees to ensure accountability in approval process.

4.4 Credit Procedure’s:

The bank should have clear guidelines for procedure to be followed for loan approval. The approval process should provide for the RM/Marketing team should recommend segregation of Relationship Management/ Marketing from the Approving Authority and forwarded to the approval team and be approved by the individual executives.

4.5 Credit Administration:

Credit administration is responsible to ensure proper documentation and compliance of terms and conditions of approval before disbursement of loan. For this reason it is essential that the function of credit administration be strictly segregated from Relationship Management/Marketing.

4.6 Credit Monitoring:

To minimize credit losses, monitoring procedures and systems should be in place that should be in place that should provide an early indication of the deteriorating financial health of a borrower. Strong credit monitoring system helps in identifying potential weakness of material nature requiring closes supervision and attention of the management.

4.7 Credit Recovery:

The bank should have a separate credit recovery unit, the primary functions of which including the following:

* Determine action plan/recovery strategy

* Pursue all options to maximize recovery

* Ensure adequate and timely loan loss provision based and expected losses.

* Regular review of classified loans.

4.8 Principle Of Good Lending

In appraising a credit proposal, every banker follows a few general principles of goods lending, these are stated below:

4.8.1 Safety:

Safety first is the main slogan of principle of good lending. While lending a banker must feel certain that the money will definitely come back. The banker is to ensure that the money advanced by him will be employed in a productive field and repaid with interest.

4.8.2 Liquidity:

Money will come back is not all? That must come back within a reasonable time or on demand. Employment of funds for shirt-term requirements and not locked up in long term schemes is desirable. The repayment through definite, but slow in coming back does not serve the purpose of liquidity. Recovery of mortgage money of much higher value than advance money through court process involving few years is safe but not liquid.

4.8.3Purpose:

The banker should ensure practicably that the borrower applies the money borrowed for a particular purpose accordingly. Advances for personal expense, say, marriages, pleasure tours or repayment of a previous outstanding debt are ordinarily refused by banks. Banks also discourage advance for hoarding stocks or speculative activities.

4.8.4 Profitability:

Banks must make profit to meet up the expenses of deposit interest, establishment, staff salary, rent, stationery etc.and then make reserve or pay dividend to shareholders. After considering all these factors a bank decides upon its lending rates. A particulars transaction may not appear profitable in itself. But borrowers some ancillary business may be highly remunerative to the lending bank. In this way, the transaction may on the whole be profitable for the bank.

4.8.5 Security:

Banks lend out of borrowed money against security. Security serves as a safety valve for an emergency. Apart from this character, capacity, and capital of the borrower are well looked into when an advance is granted.

4.8.6 Spread:

Risk is always inherent in every advance. A successful banker is an expert in assessing such risk. He is keen on spreading/ dispersing lending risks over a large number of borrowers, industries, areas and different types of securities. For example, advancing against only one type of security will run if that class of security steeply depreciates.

4.8.7 National interest:

An advance satisfying all the aforesaid principles may run counter to national interest. In the changing concept of banking, advancing to priority sectors such as agriculture, small industries and export-oriented industries are assuming greater importance than security.

4.9 Credit Processing With Special Reference to Credit Risk Management:

Credit Processing covers the tasks from receipt of application for credit along with all required Papers/documents/information to evaluation/analysis of the application and Preparation of the proposal for ultimate approval.

Processing of Credit covers the following stages:

* Receipt of Credit application.

* Credit Investigation.

* Matching of credit application with policy.

* Mode and sufficiency of securitization.

* Credit evaluation in terms various risks involved for ultimate approval.

For banks, extension of credit basically is full of risks; Such as risks are to be managed properly, in course of the whole process of credit approval. Credit risks are virtually, the possibility that a borrower will fail to repay the debt within the maturity date of the loans/as per terms of sanction. Credit risks arise from banks lending operation. Expansion of banks lending operations today has increased the sphere of risks; addressing devices of risks are therefore to be taken care of at every stage of credit decision.

Credit risks are so exhaustive that a single device cannot encompass all the risk. Moreover lending to day has assumed such diverse nature, that newer techniques are to be applied to effectively contain risks. With this end in view credit risks management has to be done in order to enable the bank to manage loan portfolio in order to minimize losses. In the present scenario of fast changing, dynamic global economy and the increasing pressure of globalization, liberalization, consolidation and dis-intermedeation, it is essential to under take robust credit risks management policies and procedures, sensitive and responsive to these changes.

In the initiation of credit processing the prospective borrower has to initially pass the selection process/various steps-

4.10 Credit assessment:

A through credit and risk assessment is to be conducted before granting of loans, and once approved all facilities are to be reviewed at least annually. Credit assessment should be presented in a credit application duly singed/approved by the official of the branch.

In case an account deviates from the guidelines the same should be identified in credit applications and the originating officials of the branch should provide justification for approval. Bank will conduct financial analysis on a regular basis and monitor changes in the financial condition.

The proposals are in proposal format that originates in the credit department of the branch and is processed and approved by the head of branch/Regional Head/Head office Management/Executive committee as per delegated authority. At the time of originating a proposal accuracy of all information to be ensured. Originating officers shall follow credit principles, credit policy and guidelines and conduct due diligence on new borrowers, principals and guarantors. They will also adhere to the NBL, s established Know Your Customer (KYC), Money Laundering guidelines, and Bangladesh Banks regulations. For initiating credit relationship credit officer will call on the client, visit factory/business center to see. Production facility/stock/storage pattern/business transaction/reputation etc and through these, to assess possibilities of establishing a remunerative relationship. He/She will also conduct due diligence to get market information on the borrower from industry sources, competitors, local area. Branch Manager may also be part of this process. In this regard, if required, the BM/Credit officer will also take help of head Office Engineer/HO personnel for initial assessing credit needs of large borrowers.

Based on findings of such calls/visit/inspection, Credit Officer, along with the Branch Manager, will initiate proposal, containing information on client’s background, business, market share, integrity, credit exposure/existing banking relationships, and credit needs along with pricing etc.