Executive Summary:

We are in new dynamic millennium of 21st century. It is very interesting to observe how organizations are involved to shape them for a new arena. Especially banks are directly in action to upgrade the economic position of countries every time. We all know that bank is a service-oriented organization. It renders banking services to the customers. No doubt customer services contribute vastly and rapidly to the development of business as well as the economy.

Banking system of Bangladesh has gone through three phases of development- Nationalization, Privatization, and Lastly Financial Sector Reform. First Security Islami Bank Limited (FSIBL) first incorporated in Bangladesh as a private commercial bank on on 29 august 1999. The bank is conducting their banking activities in Bangladesh through 46 branches.

The objective of FSIBL is to offer Islami shariah based banking activities, to contribute social and economical development, creating employment opportunities, service to their valued customers, provide efficient computerized banking System, enhance foreign exchange operation, accept deposits on profit loss sharing basis, established a welfare orientated banking system.

Mainly operations of FSIBL go under the following heads:

General banking

Investment

Foreign exchange

General banking is the starting point of all the banking operations. It is the department, which provides day-to-day services to the customers. It opens new accounts, remit funds, issue bank drafts and pay orders etc. Provide customer through quick and sincere service is the goal of the general banking department.

Bank investment is an important catalyst for bringing about economic development in a country FSIBL plays an important role to move the economic wheel of the country. Providing different sorts of credit and schemes like loan against imported merchandise (LIM), SME, Trust Receipt, Bank Guarantee, Industrial Loan, IT loan, Consumer Credit scheme, Executives Car Loan, House Finance is the main spring of the credit department.

As a service-oriented organization FSIBL is serving it’s customer through it’s different departments; Foreign exchange department plays significant roles through providing different services for the customers. Letters of credit is the key player in the foreign exchange business. With the globalization of economies, international trade has become quite competitive. Timely payment for exports and quicker delivery of goods is, therefore, a pre-requisite for successful international trade operations. To ensure this purpose FISBL transmit L/C through SWIFT (Society for Worldwide Inter bank Financial Telecommunication) to the advising bank.

First security Islami Bank Limited is providing different sorts LC services like L/C opening, lodgment, BLC (bills under letter of credit), Back to back LC etc. Foreign exchange department also provide foreign remittance lie traveler’s cheque, money Gram foreign demand draft, endorsement of US dollar in passport.

Prelude:

We are living in global village now. Cultural, political, competitive, and economic differences among countries create barriers for companies that want to operate abroad. But information technology makes the world smaller. Over the past ten years banking system have become accustomed to accepting the rapid pace of changes in terms of products and services. Changes such as computerized banking, consumer credit, automated tellers etc, have been introduced. Money deepening increased over time as the marketers become competitive and more funds were channeled through the system. Globalization is a combination or much freer trade in goods and services combined with free capital movement. The study on foreign trade related with globalization. Globalization is not mere trade liberalization and capital movement; rather it is about growing public awareness. world knows what is happening in the field of development and politics. The world economy has witnessed speeding tip in the process of globalization – the broadening and deepening of international inter-relationships in trade and investment over the last decade and a half world trade growth has accelerated since the mid- 1980s, outpacing the growth of world output and Foreign Direct Investment (FDI) flows to developing countries have increased significantly. The most important causes of globalization are in short technological change and liberalization of national and international trade policies. The mistakes and errors (if any) lie on us for inadequate knowledge.

Origin of the Report:

This report has been prepared as a requirement of the internship program of B.B.A students of Stamford University Bangladesh. The organization attachment started on 18 July and ended on 18 October 2009. This Three months internship period has helped me to match our theoretical knowledge with practical understanding. My report is on the process of foreign exchange of FSIBL. In this part I have tried to see the things what are being done in this department of the branch. I have also tried to present my personal observations from each department of this branch. I had an opportunity to be acquainted with the practical banking prevailing in Dilkusha Branch, FSIBL. The knowledge, which has been acquired in my Internship Period, I have tried my level best to show in this report.

Rationality of the study:

As a partial requirement of BBA Degree, internship report is very important. We have learnt four year at university basically the theoretical season. It is a great opportunity to secure vacuum in training season. When I worked at First Security Islami Bank Limited I learnt lots of things which I did not learn before. It is well established organization and they have so many clients. I talked to some of them and learnt lots of things about the banking system of Bangladesh, financial market and the total economic market of Bangladesh. During my practical orientation season I knew how the Bangladesh Bank Clearing House work, how to sanction the loan and overall services of the Bank.I think it is very important for a student to increase their vacuum with practical and theoretical vacuum as well.

Objectives of the study:

The main objective of education is to acquire knowledge. To acquired knowledge ultimately we must do some practical application in addition to theoretical knowledge. Through this report, I tried my level best present my practical knowledge as well as to find out-

- Draw a general picture of foreign exchange operations in FSIBL

- The views of import & export sector of Bangladesh through FSIBL

- Find out the contribution in remittance of FSIBL

Scope of the study:

The study would focus on the following areas:

- General banking, Credit Operation and Foreign Exchange of FSIBL.

- Financial statement of FSIBL.

- Credit appraisal system of FSIBL.

- Organization structures and responsibilities of management.

Each of the above areas would be critically analyzed in order to determine the efficiency of First Security Islami Bank’s general banking, credit operation and foreign exchange system.

In order to make the report more meaningful and presentable, two sources of data and information have been used widely.

The “Primary Sources” are as follows :

Face-to-face conversation with the respective officers and staffs of the Branch.

Informal conversation with the clients.

Practical work exposures from the different desks of the four departments of the Branch covered.

Relevant file study as provided by the officers concerned.

The “Secondary Sources” of data and information are –

Annual Reports of First Security Islami Bank Ltd.

Periodicals published by Bangladesh Bank.

Web site of the bank.

Different related bank documents.

Prior research report

Various books, articles, compilations etc. regarding general banking functions, foreign exchange operations and credit policies.

After collection of data, a list of table was prepared on the basis of aims and objectives of the study and processing, editing and coding of the data were done simultaneously. The tabulated data were then analyzed and condensed to obtain the result.

Limitations of the Study:

The main limitation here is as an internee I could not share all the information every time for the organization internal security. There are some other limitations these limitations are as follows:

- The major Problem was time constraints. The duration of my internship Program was only three months. But this allocated time is not enough for a complete and fruitful study.

- Bank is a sophisticated business sector. So Bank is not interested to provide me confidential data. As a result in my report there is a confidential data limitation.

- Bank is very busy organization in comparison to others. There is rush of people for about whole the day and the officers have to transact with them. So it is very tough and sometimes burden for them to allocate extra time for an Internee.

- The bank has very little adequate quality of readymade data and information. I have to find out different types of information from their files and other manuals. It was very much difficult and time consuming.

Overview of the First Security Bank:

First Security Islami Bank Limited ( FSIBL) was incorporated in Bangladesh on 29 August 1999 as a banking company under Companies Act 1994 to carry on banking business. It obtained permission from Bangladesh Bank on 22 September 1999 to commence its business. The Bank carries banking activities through its Fifty two(52) branches in the country. The commercial banking activities of the bank encompass a wide range of services including accepting deposits, making loans, discounting bills, conducting money transfer and foreign exchange transactions, and performing other related services such as safe keeping, collections and issuing guarantees, acceptances and letter of credit.

Vision of the Bank:

To be the unique modern Islami bank in Bangladesh and to make significant contribution to the national economy and enhance customer’s trust and wealth, quality investment, employee’s value and rapid growth in shareholder’s equity.

Mission of the Bank:

The bank has chalked out the following corporate objectives in order to ensure smooth achievement of its goals:

- To be the most caring and customer friendly and service oriented bank.

- To create a technology based most efficient banking environment for its customers.

- To ensure ethics and transparency in all levels.

- To ensure sustainable growth and establish full value of the honorable shareholders and

- Above all, to add effective contribution to the national economy.

Objectives of the Bank:

The objectives of the FSIBL are given below:

- To provide efficient computerized banking system.

- To enhance foreign exchange operations.

- To accept deposits on profit-loss sharing basis.

- To establish a welfare-oriented banking system.

- To play a vital role in human development and employment generation.

- To contribute towards balanced growth and development of the country through investment operations particularly in the less developed areas.

- To establish participatory banking instead of banking on debtor-creditor relationship.

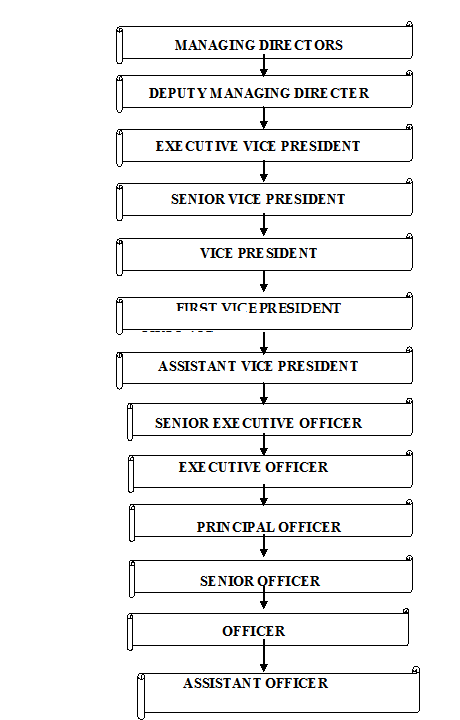

Organ Gram Of FSIBL:

Performance of FSIBL:

This has been appreciable improvement in the performance of the bank in all respect. As such, there has been a noticeable rise in deposits as advanced as also in foreign exchange business. Profits of the bank witnessed a marked up trend from TK. 12.17 crore in 2002 to TK.22.12 crore in 2003 showing a rise of 74.04 percent. All these have been possible due to the pursuit of pragmatic and prudential policies in overall management of the bank under the able the guidance of the board of the directors. As a part of prudential policies provision has been made for bad and doubtful loans to the tune of TK. 8.64 crore against lone classified during 2003.

Credit Rating Agency of Bangladesh (CRAB) has given BBB 3 (pronounced triple B three) rating in Long Term and “ST-4” rating in Short Term to First Security Islami Bank Limited. Commercial Banks rated ‘BBB’ have adequate capacity to meet their financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead the Banks into a weakened capacity to meet their financial commitments. BBB rated banks are subject to moderate credit risk. Such banks are considered medium-grade and as such may possess certain speculative characteristics. At the same time, banks rated “ST-4” in short term are considered to have below average capacity for timely repayment of obligations. Such capacity is highly susceptible to adverse changes in business, economic, or financial conditions than for obligations in higher categories.

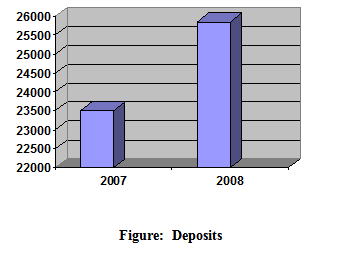

The total deposit of the bank increased sharply by 80.56 percent from Tk. 23,504.54 million at the end of 2007 to Tk. 25,854.54 million at the end of 2008. A graphic presentation of the year wise movement has been given below:

2.4 Financial Highlight

| Particulars | 31 Dec 2007 | 31 Dec 2006 |

| Paid-up Capital | 1,000,000,000 | 900,000,000 |

| Total Capital Fund | 1,347,916,019 | 1,147,285,290 |

| Capital Surplus/(deficit) | (125,708,856) | 92,854,020 |

| Total Assets | 26,941,780,871 | 20,448,667,971 |

| Total Deposits | 23,504,045,031 | 17,591,996,452 |

| Total Loans and Advances | 18,616,225,315 | 13,646,387,225 |

| TotalContingent LiabilitiesandCommitments | 5,114,783,363 | 3,058,703,340 |

| Credit Deposit Ratio (in %) | 79.20% | 77.57% |

| Percentage of Classified Loans against total Loans and Advances(in | 6.50% | 9.75% |

| Profit before tax & provision | 128,530,728 | 202,623,523 |

| Amount of Classified Loans | 1,210,643,000 | 1,330,787,000 |

| Provision kept against Classified Loans | 707,694,000 | 707,694,000 |

| Provision Surplus/(deficit) | 136,733,91 | 16,630,400 |

| Cost of Fund | 9.06% | 8.52% |

| Interest Earning Assets | 23,803,097,996 | 18,326,209,803 |

| Non-interest Earning Asset | 3,138,682,875 | 2,121,458,168 |

| Return on Investment (ROI)(in %) | 7.11% | 5.97% |

| Return on Assets (ROA)(in %) | 0.47% | 0.99% |

| Income from Investment | 177,752,561 | 123,256,585 |

| Earning Per Share (Tk.) | 3.20 | (16.28) |

Source:www.fsiblbd.com

Key Features of the Banking services:

Computerized Banking system

The head office and the other branches have been provided with the State-of-the-art computer hardware as well as software to carry on day-to-day accounting and routine work efficiently and quickly. The FSIBL is moving to the next stage of automation through introduction of on line banking in all branches.

SWIFT services

- Quick transmittal of documentary credit and other financial messages

- Improve automation

- Transfer the found instantly

- Quick remittance

- Manage risks

ATM Banking:

First Security Islami Bank Ltd. has implemented successfully Automated Teller Machine (ATM ) /DBDIT card transaction from June 25, 2008 . Through Automated Teller Machine (ATM ) /Debit card, customer can avail the facilities like withdrawal money, balance inquiry and purchase goods from Point of sale (POS) using Dutch Bangla Bank Ltd. ATM Booth and POS.

At present, the bank has 49 branches of which 21 branches are in Dhaka, 16 branches are in Chittagong, 05 branches are in Sylhet,01 branch is in Rajshahi, 03 branch is in Khulna and 01 branch is in Barishal.

All the 49 branches are computerized under distributed server environment. FSIBL has already started their on-line and SMS banking facilities for their clients.

Products and Services of FSIBL:

|

| |||||||||||||||||||||||||||||||||||||||||||||

Functions of First Security Islami Bank Ltd.

The functions of FSIBL are divided into three sections these are:

1) General Banking.

3) Investment

2) Foreign Exchange.

Under these three sections FSIBL do their services. Each of this section serves various services for satisfying their clients.

General Banking:

General department performs the majority functions of a bank. It is the core department of any bank. The activities of general banking of FSIBL are mainly divided into the following categories:

- Account opening section

- Local remittance section

- Online branch banking section

- Deposit scheme section

- Clearing section

- Cash section

- Accounts section

Procedure of Account Opening:

Account Opening (Normal Account):

- Collect an Account opening form from the Bank

- Fill all the requirements of the form.

- Nominee is must be specified.

- Photograph is most important for any account.

- The account holder sign of his/ her own self in front or the specific bank principle officer in the account opening form

Account Opening (Saving Account):

- Collect an Account opening form from the Bank.

- Fill all the requirements of the form (Must be introduced by introducer)

- Nominee is must be specified.

- Photograph is most important for any account.

- The account holder sign of his/her own self in front or the specific bank principle officer in the account opening form.

- Ø To open this account the most important things is that Passport Photocopy or the National ID Card Photocopy must have to add with the account opening form.

Account Opening (Current Deposit Account):

- Collect an Account opening form from the Bank.

- Fill all the requirements of the form (Must be introduced by introducer)

- Nominee is must be specified.

- Photograph is most important for any account.

- To open this account the most important things is that Passport Photocopy or the National ID Card Photocopy must have to add with the account opening form.

Checklist of Documents to be obtained for various types of Accounts

Sole Proprietorship:

- Request letter

- Photograph of signatories attested by introducer.

- Copy of valid Trade License.

- TIN Certificate.

- Signature & photograph of each nominee

Partnership:

- Request letter

- Photography of signatories attested by introducer.

- Partnership Deed.

- Partners letter of authority to open account and authorization for operation.

- Copy of valid Trade License, TIN & VAT certificate.

- Tenancy Agreement copy

Limited Liability Company:

1. Request letter. 2. Photograph of signatories attested by introducer. 3. Copy of Memorandum and Articles of Association. 4. Copy of Certificate of Incorporation and commencement of business (In case of public Ltd. Co.). 5. Copy of Board Resolution to open the account and authorization for operation. 6. List of Directors and signatories along with addresses.

Association/Trust/Society:

1. Request letter. 2. Photograph of signatories attested by introducer. 3. Copy of Resolution of governing body to open the account and authorization for operation. 4. Copy of consolation / bylaws/ rules. 5. Certificate of registration. 6. List of authorized signatories and members of the governing bodies along with address. 7. Trust Deed (for Trust account only).

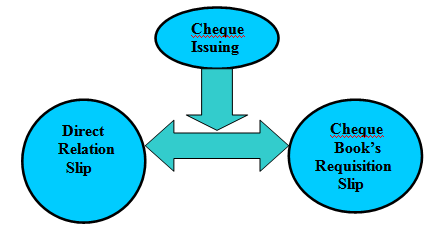

Cheque Book Issues Types of Cheque Book’s: ▫ Savings Account – 10 Leaves ▫ Current Deposit Account – 10 Leaves ▫ Current Deposit Account – 25 Leaves (CDTF)

Cheque Issuing is Two Types:

Customers Service Officer receives these types of slip from the client’s and gives the cheque books under processing. Processing means Cheque Book’s collect from the VOLT and the put account number in the cheque book, write down the serial number of the cheque book in the requisition slip and cheque book register, then Verified client signature. After all this things the Principal officer sign in the cheque leaves and sent the cheque book to another Principal officer for sign, after his sign the client receive the cheque book. These things the Principal Officer for sign, after his sign the client receive the cheque book. Then Principal Officer posting that cheque books leaves number in the computer data processing system.

A cover file containing the requisition slip is effectively preserved as vouchers. If any defect is noticed by the ledger keeper, he makes a remark to that effect on the requisition slip and forward it to the cancellation officer to decide whether a new cheque book to be issued to the customer or not.

Account Closing:

For two reasons, one can be closed. One is by banker and other is by the customer.

By banker:

If any customer doesn’t maintain any transaction within six years and the A/C balance becomes lower than the minimum balance, banker has the right to close an A/C.

By customer:

If the customer wants to close his A/C, he writes an application to the manager urging him to close his A/C.

Closing process for current & savings A/C

After receiving customer’s application the officer verifies the balance of the A/C. He then calculates interest and other charges accumulated on the A/C. If it bears a credit balance, the officer writes advice voucher. He gives necessary accounting entries post to accounts section. The balance is returned to the customer. And lastly the A/C is closed.

But in practice, normally the customers don’t close A/C willingly. At times, customers don’t maintain any transaction for long time. Is this situation at first, the A/C becomes dormant and ultimately it is closed by the bank.

Remittance:

Remittance of funds is ancillary services of FSIBL. It aids to remit fund from one place to another place on behalf of its customers as well as non- customers of Bank. FSIBL has its branches in the major cities of the country and therefore, it serves as one of the best mediums for remittance of funds from one place to another. The main instruments used by FSIBL, Dilkusha Branch for remittance of funds.

▫ Payment Order Issue/Collection

▫ Demand Draft Issue/Collection

▫ T.T. Issue/Collection

▫ Travellers Cheque Issuance

▫ IBC / OBC Collection.

Investment Division:

Investment operation is the vital operation, which earn greater share of total revenue. Well planned and appropriate investment policy frame work is a pre-requisite for achieving the goal of the Bank i.e. implementation.

The special feature of the investment policy of the Bank is to invest on the basis of profit- loss sharing system in accordance with the tenets and principles of Islamic Shariah.

Functions of Investment Division:

The main functions of this division are:

a). Bai (Buying and Selling) Modes:

- Bai – murabaha.

- Bai – mujjal.

- Bai – salam

b). Share Modes

- Mudaraba

- Musharaka

c).Ijara Modes

- Hire Purchase

- Hire purcahase under Shirkatul malek.

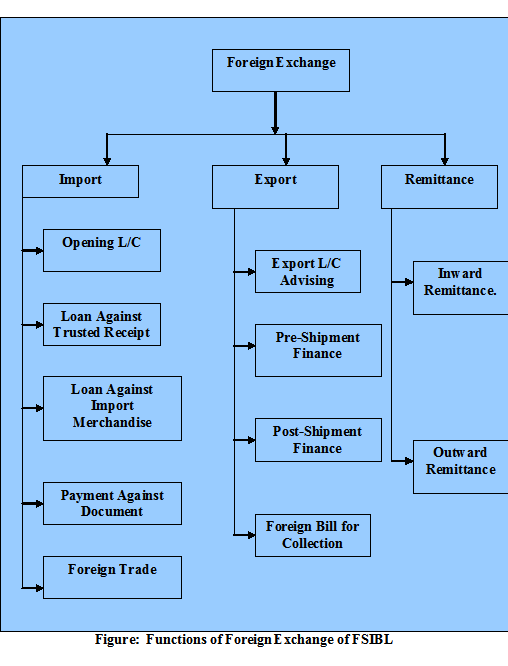

Foreign Exchange Division:

Foreign Exchange means exchange foreign currency between two countries. If we consider ‘Foreign Exchange’ as a subject, then it means all kind of transactions related to foreign currency. In other wards foreign exchange deals with foreign financial transactions.

Sub Division of Foreign Exchange:

There are three kinds of foreign exchange transactions:

- Import.

- Export.

- Remittance.

Meaning of Foreign Exchange:

Foreign Exchange means currency & trade exchange say conversion of one to another. This is a part of economic & Science. This is a big deal divided into different currencies instrument such as Draft, Traveler Cheque, Bill of Exchange business including sell, purchasing of currency notes & TC etc. Currency Exchange means the conversion of one Currency in to another. The foreign exchange activities of FSBL are divided into three parts: The bank has established correspondent relationship with over 220 foreign correspondents all over the world viz. The Hong Kong and Shanghai Banking Corporation Ltd., USA Mashreq Bank Psc, UAE, Union De Banque Arabes Et Francaises, Franch and ICIC bank, and India to cater to the needs of the bank’s customers engaged in international trade. Our bank is maintaining adequate number of Nostro accounts in important currencies of the world to facilitate payments and transfer of funds. The Bank is providing excellent services to the clientele in foreign exchange and foreign trade operations through the above foreign correspondents. Foreign exchange is mainly combination of three parts. Those are given below:

- Import

- Export

- Remittance

These three parts are most essential parts of Foreign Exchange Operations of FSIBL at Dilkusha branch. Not only FSIBL but also all banks of Bangladesh have maintained these rules for foreign exchange operations.

Foreign Exchange Market:

Foreign Exchange market means the process where foreign currency is bought & sold. In this more that supply, currency value. Ultimately following are the features of foreign exchange market.

- Bank & client.

- Different Banks in the come foreign exchange market.

- Different Bank & Schedule Bank of the same country.

- Different Control Bank.

First Security Islami Bank Ltd. (FSIBL) is a Bank that follows the following two craters in respect & payment of foreign exchange.

- Local currency market value &

- Foreign currency market value.

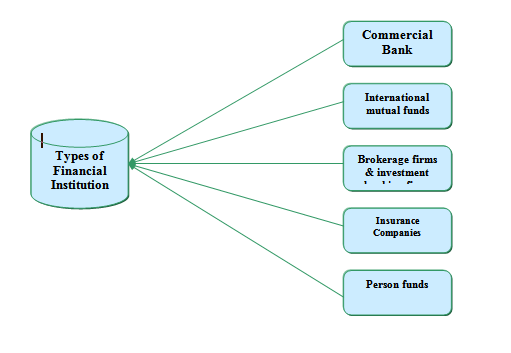

Types of Financial Institution:

Source: Reading materials for Foreign Exchange and Financial in International Trade.

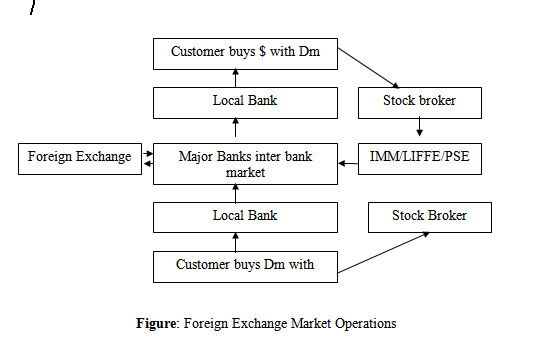

Foreign Exchange Market Operation:

Foreign exchange dealers in each bank usually operate from one room; each dealer has several telephones and is surrounded by video screen and news taps. Only the head or regional offices of the larger banks actively deal in foreign exchange. Foreign exchange brokers may be used as middlemen to find a taker or takers foe the deal. Brokers do not trade on their own account but specialize in setting up large foreign exchange transaction in return for a commission. Most small banks and local offices of major banks do not deal directly in the inter bank foreign exchange market.

Structure of Foreign Exchange Markets:

How Foreign Exchange is Being Controlled:

Foreign Exchange is being controlled by the following ways:

- To stabilize the rate of exchange

- To protect domestic industries

- For proper implementation of plans

- To increase the bargaining strength

- To check over invoicing & Under invoicing

- To check the Blank marketing and smuggling

- For regulating the international movements of goods

Authorized Dealer Branch:

Bangladesh Bank in exercise of the power under section 3 of Foreign Exchange regulation Act. 1947 issues a license to schedule bank where they have adequate trained officer/staff to deal in Foreign Exchange. The banks that are authorized dealers.

Arbitrage of Foreign Exchange:

Arbitrage can be defined as simultaneous buying and selling of foreign currencies for the purposes of making profit Arbitrage is carried out mostly by banks, they keep constant watch over the latest development in the financial market of the world.

Foreign Exchange Regulation Items:

Foreign exchange regulations items are given below:

- Bangladesh Bank Manual

- Foreign Exchange Circular

- Public notice

- Import and export policy gazette

- Ministry of commerce circular

- Guise line for foreign exchange regulation

Foreign Exchange Business of FSIBL:

1.Import: The Bank’s foreign exchange business relating to import was tk.6605.40 million at the ends of December 2005.

2. Export: Bank’s foreign exchange business relating to export was tk.2856.40 million at the ends of December 2005.

3.Inward Remittance: During 2005the Bank handled inward remittance from Bangladeshi workers abroad to the tune of tk.62.21 million against 32.692 million in 2004.

Functions of Foreign Exchange of FSIBL:

The Bank actions as a media for the system of foreign exchange policy. For this reason, the employee who is related of the bank to foreign exchange, especially foreign business should have knowledge of these following functions:

Method of Effecting Payment of FSIBL:

First Security Islami Bank Ltd. follows the following method to make payment between countries:

1. Telegraphic Transfer (TT):

This is an instruction for transfer of money by telegram, cable or telex from bank in one country to another bank in different center. This is an instruction from the importers bank to the exporter’s bank. The TT is realized by us from the party as per bank circular.

2. Mail Transfer:

This transfer is the order to pay cash to 3rd party. This transfer is sent by mail and the charge must be realized ad per bank circular.

3. Drafts and Cheque:

A Draft is order issued by one bank to another bank or its branch.

Letter of credit Meaning:

Letter of credit (L/C) can be defined as a “Credit Contract” whereby the buyer’s bank is committed (on behalf of the buyer) to place an agreed amount of money at the seller’s disposal under some agreed conditions. Since the agreed conditions include, amongst other things, the presentation of some specified documents, the letter of credit is called Documentary Letter of Credit. The Uniform Customs & Practices for Documentary Credit (UCPDC) published by international Chamber of Commerce (1993) Revision Publication No. 500 defines Documentary Credit:

Any arrangement however named or described whereby a bank (the “issuing bank”) acting at the request and on the instructions of a customer (the “Applicant”) or on its own behalf

- Is to make a payment or to the order of a third party(the beneficiary) or is to accept and pay bills of exchange(Drafts)drawn by the beneficiary, or

- Authorizes another bank to effect such payment or to accept and pay such bills of exchange (Drafts)

- Authorizes another bank to negotiate against stipulated documents provide that terms and conditions are complied with.

Types of Documentary Credit:

Documentary Credits may be either:

(a) Revocable credit.

(b) Irrevocable credit.

(a) Revocable credit:

A revocable credit is a credit that can be amended or cancelled by the issuing bank at any time without prior notice to the seller.

In case of seller (beneficiary), revocable credit involves risk, as the credit may be amended or cancelled while the goods are in transit and before the documents are presented, or although presented before payments has been made. The seller would then face the problem of obtaining payment on the other hand revocable credit gives the buyer maximum flexibility, as it can be amended or cancelled without prior notice to the seller up to the moment of payment buy the issuing bank at which the issuing bank has made the credit available. In the modern banking the use of revocable credit is not widespread.

(b) Irrevocable credit

An irrevocable credit constitutes a definite undertaking of the issuing bank (since it can not be amended or cancelled without the agreement of all parties thereto), provided that the stipulated documents are presented and the seller satisfies the terms and conditions. This sort of credit is always preferred to revocable letter of credit.

Parties To a letter of Credit:

The parties are:

- The Issuing Bank,

- The Confirming Bank, if any, and

- The Beneficiary.

Other parties that facilitate the Documentary Credit are:

- The Applicant,

- The Advising Bank,

- The Nominated Paying/ Accepting Bank, and

- The Transferring Bank, if any

- Importer – Seller who applies for opening the L/C.

- Issuing Bank – It is the bank which opens/issues a L/C on behalf of the importer.

- Advising / Notifying Bank – is the bank through which the L/C is advised to the exporters. This bank is actually situated in exporters country. It may also assume the role of confirming and / or negotiating bank depending upon the condition of the credit.

- Negotiating Bank – is the bank, which negotiates the bill and pays the amount of the beneficiary. The advising bank and the negotiating bank may or may not be the same. Sometimes it can also be confirming bank.

- Paying / Accepting Bank – is the bank on which the bill will be drawn (as per condition of the credit). Usually it is the issuing bank.

- Reimbursing bank – is the bank, which would reimburse the negotiating bank after getting payment – instructions from issuing bank.

First Security Islami Bank certify the CIB (credit information bureau) and all agreements are made before opening L/C as a result its goods are not sold again raising the products price or reducing the product price. It sis the single deal system, Because FSIBL deal’s with the business of selling any buying, not loaning.

Some Important Documents of L/C

(a) Forwarding:

Forwarding is the letter given by the advising bank to the issuing bank. Several copies are sent to the issuing bank. All copies including original should be kept in the bank.

(b) Bill of Exchange:

According to the section 05, Negotiable Instruments (NI) Act-1881, A “bill of exchange” is an instrument in writing containing an unconditional order signed by the maker, directing a certain person to pay [on demand or at fixed or determinable future time] a certain sum of money only to or to the order of a certain person or to the bearer of the instrument. It may be either at sight or certain day sight. At sight means making payment whenever documents will reach in the issuing bank.

(c) Invoice:

Invoice is the price list along with quantities. Several copies of invoice are given. Two copies should be given to the client and the other copies should be kept in the bank. If there is only one copy, then its photocopy should be kept in the bank and the original copy should be given to the client. If any original invoice contains the custom’s seal, then it cannot be given to the client.

(d) Packing List:

Packing list is the letter describing the number of packets and there size. If there are several copies, then two copies should be given to the client and the remaining should be kept in the bank. But if there is only one copy, then the photocopy should be kept in the bank and the original copy should be given to the client.

(e) Bill of Lading:

Bill of Lading is the bill given by shipping company to the client. Only one copy of Bill of Lading should be given to the client and the remaining copy should be kept in the bank.

(f) Certificate of Origin:

Certificate of origin is a document describing the producing country of the goods. One copy of the certificate of origin should be given to the client and the remaining copy should be kept in the bank. But if there is only one copy, then the photocopy should be kept in the bank and the original should be given to the client.

(g) Shipment Advice:

The copy mentioning the name of the insurance company should be given to the client and the remaining copies should be kept in the bank. But if only one copy is given, then the photocopy should be kept in the bank and the original copy should be given to the bank.

Form – IMP:

This form is prepared for maintaining account of the money, which goes out side the country for the purpose of payment. This form is required by Bangladesh Bank. It is an application for permission under 4/5 of the Foreign Exchange Regulation Act, 1947 to purchase foreign currency for the payment of import.

Copies of IMP – Form:

IMP – FORM has four copies:

- Original copy for Bangladesh Bank.

- Duplicate copy for authorized dealers. It is issued for processing Exchange Control Copy of bill of entry or certified invoice.

- Triplicate copy for authorized dealers’ record.

- Quadruplicate copy for submission to the bank in case of imports where documents are retired.

Following documents are sent with FORM-IMP:

- Letter of Credit Authorization Form,

- One copy of invoice,

- Indent copy / proforma invoice.

The following information is included in the FORM-IMP:

- Name and address of the authorized dealer,

- Amount of foreign currency in words and figures,

- Names and address of the beneficiary,

- L/C Authorization Form number and date,

- Registration number of L/C Authorization Form with Bangladesh Bank, and

- Description of the goods.

6.1 Meaning of Import

Import means lawfully carrying out of anything from one country to another country for buying. It will be occurred according to the government law. First Security Islami Bank Ltd.(FSIBL)’s foreign exchange business relating to import was Tk.6605.40 million at the ends of December 2005.Ther are different years import happened by FSIBL at Dilkusha branch. Those are given bellow:

| Year | Total L/C | Amount in US $ | Exchange Rate | Amount in BDT |

| 2006 | 474 | $5,744,019.22 | 73.80 | 423,944,000.56 |

| 2008 | 500 | $37,742,857.14 | 70.00 | 2,642,000,000.00 |

Table: Import performance from 2006 to 2008 at Dilkusha.

Classification of Import

There are Three types of import. They are given below:

- Commercial import

- Industrial import

- Import under wage

6.3 Import Mechanism:

To import, a person should be competent to be an ‘importer’. According to Import and Export (Control) Act, 1950, the officer of Chief Controller of Import and Export provides the registration (IRC) to the importer. After obtaining this, the person has to secure a letter of credit authorization (LCA) from Bangladesh Bank. And then a person becomes a qualified importer. He requests or instructs the opening bank to open an L/C.

Import procedure of FSIBL

An importer is required to have the following to import through PBL—

- Applicant has to apply for opening L/C by a prescribed form.

- Applicant has to submit the Letter of Indent or Letter of Proforma Invoice.

Letter of Indent:

Many sellers have their agent in seller’s country. If the contract of buying is made between the buyers and the agent of the sellers then Letter of Indent is required.

Letter of Proforma Invoice:

If the contract is made directly between the buyers and the sellers then Letter of Proforma Invoice is needed.

- Applicant has to submit IRC (Indentors Registration Certificate). It is a certificate being renewed every year. This certificate is necessary if the contract is made between the buyers and the agents of the sellers. IRC is of two types – COM and IND. COM is given for commerce purpose and IND is given for industrial purpose.

- Applicant has to submit LCAF (Letter of Credit Authorization Form).

- Applicant has to submit insurance document.

- Applicant has to prepare FORM-IMP.

- Recently, there has been made a provision to give a certificate named TIN (Tax Payers Identification Number). Taxation department issues this certificate.

- Then after proper scrutiny bank will open an L/C.

While opening L/C, importer must keep certain percentage of the document value in the bank as margin

Restriction regarding source of procurement of goods:

Goods from south Africa and Israel or goods orienting from these two countries shall not be importable goods shall not be importable in the flag vessel of those two countries.

Import at Competitive Rate:

Import shall be made at the most competitive rate and the importers may be required, at any time, to submit documents regarding the price paid or to be paid by them. This order shall be exempted up to TK.1.00 lac for opening L/C.

Pre-shipment Inspection:

Unless otherwise specified per-shipment inspection of imported goods shall not be obligatory in case of import by the private sector importers.

Import on CER basis:

All imports by sea air and land route shall be made on cost and freight basis, Import on free on board basis may be made strictly observing Bangladesh Bank’s circular, before opening L/C necessary insurance cover note should have to be purchased form the insure co. no import shall be allowed on CIF basis without prior approval from the ministry of commerce.

6.6Import Authorization

Import License not required: No import license will be necessary import of any item.

Import against LCA form: Unless otherwise specified no import irrespective of the source of finance, shall be allowed exchange through submission LCA form, duly filled in, to the concerned nominated Bank.

Import against LCA form but without opening: Import against LCA form may be allowed without opening of letter of credit in the e following cases:

- Import of books, Journals, Magazines and periodicals on sight draft or essentials bill basis.

- Import of any permissible item for an amount not exceeding US$ 2500/-only during calendar year against remittance made from Bangladesh at WES rate.

Deferred Payment:

L/C may be open under deferred payment basis:

Direct Payment in Abroad: Only for Bangladeshi National who live in abroad for service. Those who are entitled to purchases the importable goods for direct payment to the beneficiary from his own service without opening any L/C, The goods must be sent to the Bangladesh.

Time limit opening L/C: Letter of credit shall be opened by all importers within 120 days from the sate of registration of LCAF with the Bangladesh Bank unless otherwise notified.

Document required to be submitted along with LCA from:

- L/C application form duly signed by the importer.

- Indent for goods issued by indenture or pro-forma invoice obtained from the foreign supplier, as the case may be end

- Insurance cover note.

Import L/C (Letter of Credit):

A letter of credit is a conditional bank undertaking of payment. In other orders letters of credit is a letter form the importer Bankers to the exporter that the bills if drawn as per terms and conditions complied with will be honored on presentation.

Classification of L/C:

- 1. Revocable L/C

- 2. Irrevocable L/C

- 3. Transferable L/C

- 4. Revolving L/C

- 5. Red clause L/C

- 6. Green clause L/C

- 7. Back to Back L/C

Documents submitted by the importer before opening of the L/C:

- Trade license (Valid)

- Import registration Certificate (Must kept in the bank custody )

- Passbook import

- Income tax declaration

- Membership certificate

- Memorandum of articles (in case of Ltd. Co.)

- Register deed (in case of partnership firm)

Bank will supply the following papers /document before opening L/C

- L/C application from

- IMP from

- Charge documents paper

The above paper must be completed dully filled and signed by the party and verified signature.

L/C application and procedure for opening L/C:

For opening L/C the client is to submit to the bank an application in the printed format of the designed bank. This is called L/C application form, which is also an agreement between the import and the bank. The form is to be stamped under stamp act. I n force in Bangladesh, The importer must be submit the L/C and IMP and indent or contract. Purchase order/ pro-forma invoice along with L/C application must be completed in and signed by the authorized person of the importer giving the following particulars:

Full name and address of the supplier of beneficiary and importer

Brief description of the goods

L/C value for US$ etc which must not exceed the ALCA value

The unit price quantity, quality of the goods

Origin of the goods, port of loading and port of destination must be mentioned

Model of shipment (Sea Air, Road etc.)

List date of shipment and negotiation time

Tenor of draft

Mode of advising L/C

Instrument to add confirmation if required.

LCA number

Examination of L/C application:

On receipt of L/C application it must be checked by an officer of L/C section very carefully in the following manner:

That all the information mentioned in above column has been furnished.

That the terms to be Imported are eligible according to importers entitlement

Thee goods are not being imported or originated from Sou8th Africa or Israel

That all the cutting /permit etc are endorsed

That the validity of the L/C must not exceed the validity of LCA.

L/C ids opened within the validity period permitted in the license

Retirement procedure for Deferred payment of issuance Bills:

When the draft is returned by the draw (importer) after duly accepted by him the following procedure to be maintained,

- The maturity date is to be worked out and noted in the bill register and also in due date diary. The due date dairy may be maintained by the dealing officer and the manager in charge of foreign exchange department.

- The foreign corresponding should be advised the due date maturity and the authorized to debit the NOSTRO account or to claim reimbursement on due date as per L/C terms.

- All the documents delivered to the importer except accepted bill of exchange or draft.

Charges for L/C opening:

L/C commission:

L/C commission 50% within 90 days , first quarter and subsequently increase 30% and upon on 15% vat.

FCE-(Foreign Correspondent Charge):

Below $25 up to $2500, If applicant want to bear the application charge then addition $75 will be charged.

Telex per telex 300 taka .But if amendment is consider then per amendment 500 taka and of courier telex ,then it will be 1500 taka

- Handing charge tk200 fixed.

- Stamp charge-per L/C 360 taka

L/C margin- that means cash security ordered by Bangladesh Bank for industrial items it is liberal and for luxuries items it is highly cost.

Essential things contain of L/C form:

- L/C Number

- Shipping Period

- Importer name and address

- IRC (Import Registration Certificate)

- Years of renewal

- L/C value

- Source of financing

- Description of goods

- HSC (Harmonious system code.)

Processing and opening of Back to Back L/C procedure:

An exporter serious to have an Import L/C limit under back to back arrangement. Must have applied to the designed bank in prescribed forms for sanction for opening of back to back L/C. In that case the following information is to be furnished by the applicant:

- Full particulars of bank account

- Types of business (Proprietorship, Partnership, Ltd .co.) In case of Ltd. Co. Balance sheet of last 3 years and the name of directors.

- Historical Background

- Amount of limit required

- Goods to be imported Security to be offered

- Repayment schedule and source of fund

- Other liabilities of the customer with the bank

- Statement of assets and liabilities

- Trade license

- Valid bonded warehouse license

- Membership certificate

Other Documents Necessary For Import:

- L/C Terms

- Draft

- Invoice

- Recording in the Register

Import Performance of FSIBL:

FSIBL’s import business stands at TK. 9,687 crore during 2008 as against target of TK. 10800 crore. Achievement is 89.69% with 29.97% growth rate. Its performance in import business in last 3 years was not up to the mark. The prospect of import business in our country is hopeful. So, it wants to develop its area of business

| Years | 2004 | 2005 | 2006 | 2007 | 2008 |

| Taka in Crore | 3379 | 4624 | 5980 | 7453 | 9687 |

Table: Performance of Import Business

Achievement and the growth of Import of FSIBL:

| Years | 2004 | 2005 | 2006 | 2007 | 2008 |

| Achievement (%) | 101.38% | 101.40% | 89.20% | 89.15% | 89.69% |

| Growth (%) | 30.41% | 36.85% | 29.33% | 24.63% | 29.97% |

Figure: Achievement and growth of import

Meaning of Export:

Export means lawful carrying out of anything from one country to another country for sale Export business handled by the FSIBL during 2003 stood at 2807 million, showing a growth Of 41.17 percent from TK. 1988.4 million during 2002. In 2005 witch exports are happened By FSIBL at Dilkusha branch, those are given below:

To become an exporter an ERC (exporter Registration Certificate) must be obedient from the office of CCI & E.

| Month Amount in us $ Amount in BD TAKA |

| January 174,444.73 10989828.99 February 382,336.70 23322538.7 March 323,079.95 20289420.86 April 454,725,57 28556765.8 May 313,854.53 19725757.21 June 481,126.14 30298160.39 July 424,438.77 27694630.12 August 24550757.9 TOTAL $2,930,837.74 185,427,859.97 |

Table: Export performance from jan’2005 to aug’2005 at Dilkusha Branch

Definition of Exporter:

The importers and exporters trade of the country is regulated by the importers Exporters control act 1950. No person / firm is allowed to export any thing from Bangladesh unless he is registered with CCI and E under the registration order (Importer and Exporter) 1952. To become an exporter an ERC (exporter Registration Certificate) must be obedient from the office of CCI & E.

Procedure for Maintaining Export Registration Certificate (ERC):

For obedient Export Registration Certificate (ERC), intending Bangladesh Exporters are required to apply to the CCI & E authority in the prescribed from along with the following documents:

- Nationality Certificate

- Copy of valid Trade License

- Income Tax Certificate

- Bank certificate

- Copy of rent receipt of the business firm

- Registered partnership deep in case of partnership concerns

- Memorandum of articles & association and incorporation certificate in

On satisfaction of the CCI & E the potential exporter is advised to deposit export registration fee of TK.1, 000 /- through treasure chalan to Bangladesh bank / sonali bank for enabling them to issue ERC. The ERC may be renewed every year on payment of renewal fee of TK.1, 000/- through treasury chalan as started.

Different Types of Export:

There are three types of export. Those are given below:

- Export under L/C

- Consignment basis export

- Export against advancement payment

Export under L/C:

Exporters are allowed to export the commodity under irrevocable letter of credit. Under this type of export, exporter will ship the goods as pr terms of the credit and will get payment as per arrangement as arrangement of the credit.

Consignment basis export:

Exports are allowed against firm contract. As per contract, importer will ship the goods and the buyer will make payment after selling the consignment.

Export against advancement payment:

Sometimes exporter receives payment in advanced. In that case Authorized dealer should obtain a declaration from the exporter on the

General Rules for Export:

There are rules, which are mandatory for export of any goods form Bangladesh. The rules are under:

- No person can export any goods from Bangladesh unless he is duly registered as an exporter with the CCI & E.

- All export must be declared on the on the EXP form, which is consisting of 4 copies.

- Export much is against any of the following:

a. Export L/C.

b. Firm Contract

c. Advance Payment.

- Transport documents related to land route or sea and any other Authorized Dealer. The Airway Bill And Any Other documents of title to car 4 go may be drawn to the order of a bank in the country of import. However in case of advance payment transport document may be drawn to the order of Foreign Import Bank endorsement of transport documents is prohibited Directions under SI. No shall not apply in the following cases;

- Export of Trade sample

- Personal Effects.

- Goods Shipped under the order of Govt .

- Export of fresh fish vegetable and fruits.

- Gift package for less than Tk.50/-

- EXP” must be submitted to the Bank by the exported and Bank will submit the Duplicate Copy to the Bangladesh Bank within 14 days from the date of shipment.

- Payment for goods exported should be received through an authorized dealer in freely convertible currency.

- Export proceeds must be received by the export within 4 months.

- Overdue export bills statement to Bangladesh Bank should be submitted by the 15th of the month following quarter to which it relates.

- In case of short shipment exporter should give a notice of short shipment of/n the prescribed from in duplicate the prescribed from in duplicate the customs who will forward a Certified copy of the notice to the Bangladesh Bank.

Stages & Mechanism of Export:

There are some stages and mechanism of export. Those are given bellow:

- Exporter will make the goods ready for shipment.

- Arrangements have to be taken for inspection of goods by the competent authority as per credit terms.

- Exporter will declare on EXP form against export L/C firm contract /advance payment.

- Exporters have to arrange approval for export from custom authority on EXP from by submitting export L/C, export permission from CCI & E.

- After completion of custom formalities, shipping company will receive the goods and will issue B.L.

Export Document Checking:

After submission of export document by the exporter, FSIBL must check, whether the entire required document submitted or not. FSIBL must examine all document stipulated in the credit with reasonable care to ascertain or not they appear, on their face to be in compliance with the term and condition of the credit .Document not stipulated in the credit will not be examined by the FSIBL. To examine document FSIBL must follow the L.C term and international Banking practice. Some Common discrepancies in export document:

- Late presentation

- Part shipmen effected

- Consignee/Notify party differs

- F. CR presented instead of B/L

- B/L shows “freight collect “instead freight prepaid

- B/L is clause

- Description of goods differs

- Unit price differs

- Per shipment inspection certificate absent

- Late shipment

Export Financing:

To meet up the cost of goods to be exported, the exporter may require Bank finance. Besides, he may require finance for go down rent, freight etc. Even after shipment of the goods, exporter may require Bank finance to meet-up his expenditure up o repatriation of the export proceeds. There are two type of export finance:

- Pre-shipment finance

- Post -shipment finance

Pre-shipment finance:

Per-shipment investment is finance, allowed by a Bank to an exporter, to meet the cost up to shipment of the goods to overseas buyer. The purpose of the investment is to purchase raw materials or finished goods or manufacturing processing, packing and transporting the goods.

Post-shipment finance:

There is time gape between exports of the goods and realization of the proceeds. So exporter may require finance in that period to continue his business. So Bank may finance against export document ensuring the following:

- Export document comply the credit terms.

- Buyer is Bona-fide.

- Parties past performance is satisfactory.

- Any other security in case of export under contract.

Security of Pre-Shipment Investment:

Security of pre-shipment investment is given bellow:

- FSIBL will mark on the related export L/C.

- FSIBL will finance against having sufficient time to procure the goods for export.

- Finance to be after arrival of the imported raw materials under Back to Back L/C.

- FSIBL will supervise the production from time to time ensure export of the goods in time.

- FSIBL will adjust the liability proportionately from related export documents.

EXP Requirement:

All export from Bangladesh must be declared by the shipper on EXP form to the FSIBL enabling them to submit the duplicate within 14 days from date of shipment. The shipper is required to repatriate the export proceeds within 4 months from the date of shipment otherwise penalty is imposed upon them A careful watch is to be ensure that the sale proceeds are received on due date. A due date diary must be maintained to pursue the individual case.

Inspection of Goods:

The goods should be kept ready for inspection of the competent authorities and issue a certificate of quality control required under regulation: for example:

- Export promotion Bureau.

- Custom Authorities who will inspect the goods under Sea customs Act.

- Chamber of commerce and industry.

- Other agencies authorized to inspect the goods before shipment.

Send shipping advice:

On shipment of goods and receipt of bill of lading and other documents from the clearing and forwarding agents send a shipping advice to the importer abroad so that the latter may stand making arrangement for taking delivery of the consignment.

Shipping Requirement of Exporter in the Context of Export:

Every exporter under foes certain sequential formalities when takes up the venture of exporting goods First of all the exporter comes into contact with the buyer and negotiate the commodity contract, while negating the commodity contract and exporter takes into consideration three resects:

- A Cost of the commodity

- Insurance.

- Freight component

Required Documents /Papers of L/C Stipulation:

- There are different documents and papers of stipulation are given bellow:

- Commercial invoice

- Certificate of origin

- Negotiable bill of lading

- Pre-shipment inspection certificate.

- Quantity and Quality certificate.

- Fumigation certificate depending the nature of cargo

- Photo sanitary certificate depending the nature of cargo

Sending Export document on Collection:

If the documents are discrepant exporters Bank will send the document to the issuing Bank on collection, at the request a risk of the exporter. At the time of sending documents on collection the following voucher to passed.

- Dr. outward foreign bill lodged A/C

- Cr. outward foreign bill lodged A/C

After realization of the proceeds, above entries to reserve and the following voucher to be passed.

- Dr. IBG A/C IBW@ Mid rate (Bangladesh Banks buying rate +TT documentary /2)

- Party’s current account

- Cr. Party’s investment account

- Cr. Party’s investment income a/c

- Cr. Income a/c

- Cr.Telex charge

- Cr. F.C held against Back to Back L/C

Export Incentives:

To promote the export business, government has declared some incentives for exporter. Following are the main incentives as per export policy 1997-2002 declared by the ministry of commerce:

- Retention Quota: Export dared allowed to deep 40% of their export proceeds to their F.C A/C It is 7.5% in case of export against switch import is higher, proportionately.

- Investment Period: Normally export finance, as working capital is allowed for 180 days. Now it has been extended up to 270 days for frozen foods, tea and leather

- Credit Card: Exporters are allowed to get credit cards for business tour.

- Investment Facility: Commercial Bank may finance for export, up to 90% of FOB value of the export L/C

- No Compensation: Commercial Bank will not impose compensation on overdue sight export bill under irrevocable export L/C.

- Duty Draw Back: Those exporters, who are not available bonded warehouse facility, are entitled to get duty draw back facility. They will pay the duty to the custom authority at the time of importing the raw materials and after realization of the export proceeds. They will apply for draw back duty paid earlier authority will pay back the duty.

- Duty Free Capital Machinery: 100% export oriented industries outside EPZ are also allowed to import capital machinery’s free of duty.

- Cash Incentives: Deemed exporters are allowed 25% cash incentive by Bangladesh Bank

- Stock Lot Disposal: Rejected garments and leather may be sold to local market paying 20% duty on the imported raw materials.

Meaning of Remittance:

The word “Remittance” originates from the word “remit” which means to transmit money/ fund. In banking terminology, the work “remittance means transfer of fund one place to another. When money transferred from one country to another is called “Foreign Remittance”

Foreign Remittance:

The basic function of this department are outward and inward remittance of foreign exchange from one country to another country. In the process of providing this remittance services; it sells and buys foreign currency. The conversion of one currency into another takes place at an agreed rate of exchange in where the banker quotes, one for buying and another for selling. In such transactions the foreign currencies are like any other commodities offered for sales and purchase, the cost (convention value) being paid by the buyer in home currency, the legal tender

Function of the Remittance Section:

- Handling of all incoming and outgoing foreign and local remittance is the major

- Function for this department.

- Handling of incoming and outgoing T.T.

- Outstation Cheque Collection.

- Outstation Cheque Purchase.

- Demand Draft Handling.

- Other assorted work

Remittance of Fund

Remittance of fund is to be collected in two ways. First of all, it comes from inward basis and then, it happens outward.

8.5 Inward remittance

Any person can remit funds to another through Inland remittance by using the following means of remitting funds with charges

- Pay Order (PO).

- Demand Draft (DD).

- Telegraphic Transfer (T.T).

- Mail Transfers

Pay Order (PO)

A pay order is a written under, issued by a branch of the Bank, to pay a certain sum of money to a specific person or a bank. It may be said as to be a banker’s cheque as it is issued by a bank and payable by itself.

Demand Draft (DD)

This is an instrument through which customers money is remitted to another person/Firm/organization in outstation (outside the clearing house area) form a branch of one Bank to an outstation branch of the same Bank or to a branch of another Bank (with prior arrangement between that Bank with the issuing branch).

Telegraphic Transfer (TT):

A Telegraphic Transfer is a method of remittance, which is effected by the banker through a coded telegram attested by secret cheek signal, on receipt of which, the paying office pay the amount to the payee by crediting his account.

Foreign Remittance:

Foreign remittance is the transfer of foreign currency from one country to another country. In another word, foreign remittance means, remittance in foreign currency that are received in and made out abroad. Actually, foreign remittance is purchase and sale of freely convertible foreign currencies as permissible under exchange control regulations of the country. Foreign remittance is very important for the country as valuable foreign exchange is involved in the transfer mechanism. Foreign remittance takes place in two ways-

FIGURE: Modes Of Foreign Remittance

Instruments of Foreign Remittance:

Cash for : Dollar, pound, France Fr. Riyal or any other currency.

T.C. : Travelers cheque.

F.D.D : Foreign demand draft.

T.T : Telegraphic Transfer, cable transfer or swift transfer.

M.T : Mail Transfer.

I. MO : International Money order.

Cheque : By any person & institution.

P.O : Payment order.

Inward Remittance:

Remittance comes from foreign countries to our country is called inward remittance. To the bankers or ADs inward remittance means purchase of foreign currency by authorized dealers. Generally, inward remittances are received by draft, mail transfer, TT, purchase of foreign bills & travelers Cheque, export bills. Basically, these are the formal channels of receiving inward remittance. A local bank also receives indenting commission of local firm also comes under purview of inward remittance.

Outward Remittance:

Remittance from our country to foreign countries is called outward foreign remittance. On the other word, sales of foreign currency by the authorized dealer or formal channels may be addressed as outward remittance. The authorized dealers must utmost caution to ensure that foreign currencies remitted or released by them are used only for the purposes for which they are released. Out ward remittance may be made by appropriate method to the country to which remittance is authorized. Most outward remittance is approved by the authorized dealer on behalf of Bangladesh Bank. Outward remittance may be made for following purposes –

- Travel

- Medical treatment

- Educational purpose

- Attending seminar etc.

- Balance amount of F.C account.

- Profit of foreign companies.

- Technical assistance

- New exporters up to USD 6,000/- for business promotion

- F.C. remittance can be made for fare, exhibition from export retention quota.

SWOT Analysis:

Every organization is composed of some internal strengths and weaknesses and also has some external opportunities and threats in its whole life cycle. The following will briefly introduce the First Security Islami Bank Ltd. internal strengths and weaknesses, and external opportunities and threats.

STRENGTHS

- Superior Quality: First Security Islami Bank Ltd.. provides its customers excellent and consistent quality in every service. It is of priority that customer is totally satisfied.

- Dynamism: First Security Islami Bank Ltd.. draws its strength from the adaptability and dynamism it possesses. It has quickly adapted to world class standard in terms of banking services. It has also adapted state of the art technology to connect with the world for better communication to integrate facilities.

- Efficient Management: All the levels of the management of FSIBL are solely directed to maintain a culture for the betterment of the quality of the service and development of a corporate brand image in the market through organization wide team approach and open communication system.

- Experts: The key contributing factor behind the success First Security Islami Bank Ltd of is its employees, who are highly trained and most competent in their own field. FSIBL provides their employees training both in-house and out side job.

WEAKNESS

- Limited Workforce: FSIBL has limited human resources compared to its financial activities. As a result many of the employees are burdened with extra workloads and work late hours without any overtime facilities. This might cause high employee turnover that will prove to be too costly to avoid.

- Poor Technology Infrastructure: As previously mentioned, the world is advancing e-technology very rapidly. Though FSIBL has taken effort to join the stream of information technology, it is not possible to complete the mission due to the poor technological infrastructure of the country.

OPPORTUNITIES

- Government Support: Government of Bangladesh has rendered its full support to the banking sector for a sound financial status of the country, as it has become one of the vital sources of employment in the country now. Such government concern will facilitate and support the long-term vision of FSIBL.

- Evolution of E-Banking: Emergence of e-banking will open more scope for the Bank to reach the clients not only in Bangladesh but also in the global banking arena. Although the bank has already entered the world of e-banking but yet to provide full electronic banking facilities to its customer.

- Information Technology: Banking and information technology might give the bank leverage to its competitors. Nevertheless there are ample opportunities for FSIBL to go for product innovation in line with the modern day need.

THREATS

- Mergers and Acquisition: The worldwide trend of merging and acquisition in financial institutions is causing concentration. The industry and competitors are increasing in power in their respective areas.

- Frequent Currency Devaluation: Frequent devaluation of Taka and exchange rate fluctuations and particularly South-East Asian currency crisis adversely affects the business globally.

- Emergence of Competitors: Due to high customer demand, more and more financial institutions are being introduced in the country. Many banks are entering the market with new and lucrative products.

BCG Matrix:

The BCG matrix provides framework for evaluating the relatives performance of business in which a diversified organization operates. It also prescribes the preferred distribution of cash and other resources among these business. The BCG matrix uses two factors to evaluate an organization’s set of business:

- The growth rate of a particular market

- The organization’s share of that market

The matrix suggest that fast-growing markets in which an organization has the highest market share are more attractive business opportunities than slow growing markets in which an organization has small market share . Dividing market growth and market share in to two categories (low and high) creates the simple matrix in following figure:

|

HIGH LOW

| Stars | Question marks |

| Cash Cows | Dogs |

Relative Market Share:

The matrix classifies the types of business in which a diversified organization can engage as dogs, cash cows, question marks, and stars.

BCG Matrix for FSIBL:

Companies that are large enough to be organized into strategic business units face the challenge of allocating resources among those units. In the early 1970’s the Boston Consulting Group developed a model for managing a portfolio of different business units (or major product lines). The BCG growth-share matrix of FSIBL displays the business units of the market growth rate vs. market share relative to their competitors.

Figure: BCG Growth Share Matrix of FSIBL:

To know about BCG Matrix position of FSIBL we have know about the banks overall position like deposit, loan & advances, paid up capital, branches etc. And all of these things I discuss in previous part so not now to discuss these again. From previous discussion we see that bank trying to improve their financial position . As bank do not have enough capital more than they have very small share of a market that is not expected to grow Because FSIBL do not hold much economic promise

From above it is clear that First Security Islami Bank is in DOGS position of BCG Matrix. Where their business unit that has a small market shares in a mature company. FSIBL is somewhat Dog in their company. The bank does not have substantial cash, but it ties up capital that could better be deployed elsewhere. Unless FSIBL has some other strategic purpose, it should be liquidated if there is little prospect for it to gain market share.

Limitations of BGC matrix:

Some limitations of the BCG matrix model include:

- The first problem can be how we define market and how we get data about market share

- A high market share does not necessarily lead to profitability at all times

- The model employs only two dimensions – market share and product or service growth rate

- Low share or niche businesses can be profitable too (some Dogs can be more profitable than cash Cows)

- The model does not reflect growth rates of the overall market

- The model neglects the effects of synergy between business units

- Ø Market growth is not the only indicator for attractiveness of a market

Product Life Cycle (PLC):

Product Life Cycle (PLC): The course of product’s sales and profits over its lifetime. It involves five distinct stages. They are as

- Product development: It begins when the company finds and develops a new product idea. During product development, sales are zero and the company’s investment costs mount.

- Introduction: It is a period of slow sales growth as the product is introduced in the market profits is nonexistent in this stage because of the heavy expense of product introduction.

- Growth: It is a period of rapid market acceptance and increasing profits.

- Maturity: It is a period of slow down in sales growth because the product has achieved acceptance by most potential buyers. Profits level off or decline because of increased marketing outlays to defend the product against competition.

- Decline: It is the period when sales fall off and profits drop.

Figure : Product Life Cycle of FSIBL:

9.6Product Life Cycle (PLC) For FSIBL:

From the figure of Product Life Cycle we see that the position of FSIBL is in Growth stage where market acceptance and profits increasing rapidly. The company uses several strategies to sustain rapid market growth as long as possible. They trying to improves their service quality and adds new features and models to provide the best services for their customers.

Recommendation:

- Giving better customer service, full computerized of all activities, supply of new PC’s in place of old one, sufficient numbers of PC needed for proper working.

- Interior decoration should be introduced for client’s comfort. The management should give more emphasis on the advertisement of the bank about their operations.

- The spread out mechanism of the bank should be faster and progressive as well.

- Online banking should be introduced fluently in all branches to compete with multinational banks.

- More products of varied interests should be introduced for the diversified client group.

- The Bank should request the govt. to take necessary steps to reduce fluctuation of domestic currency worth against us dollar, to improve economic and political conditions and to increase port or harbor facilities.

- It should take proper stapes to recover the shortage of foreign currency.

- The bank should take new marketing strategy which will responds and take effective steps to increase faith on them.

- Ø To enhance the image of the bank and to assume social responsibility, the bank should engage itself to various social programs like scholarship to poor but meritorious students, Campaign against dowry and other social evil etc

- Bank can introduce more advanced MIS system to mobilize its day to day activities. It will help the employee to do their works more quickly and at the same time maintaining their quality of work.

- The bank should try to arrange more training programs for their officials. Quality training will help the officials to enrich them with more recent knowledge of International Trade Financing.

- The entire employee should be assigned with proper and specific assignment.

Conclusion:

First Security Islami Bank limited is one of the most potential Banks in the banking sector. It has a large portfolio with huge assets to meet up its liabilities and the management of this bank is equipped with the expert bankers and managers in all level of management. So it is not an easy job to find out the drawbacks of this branch. I would rather feel like producing my personal opinion about the ongoing practices in Dilkusha Branch.

From the beginning, the prime objective of the FSIBL was to increase capitalization, to maintain disciplined growth and high corporate ethics standard and enhance the health of the share holders. Its customer service is very much impressive than of other financial institutions. Their effective strategy, time demand offerings, up to date rules and regulations to cope with international market and their friendship customer services easily impress the clients. So, now The FSIBL is in leading position in financial Institutional sectors in Bangladesh. The financial performance of the bank in recent years is pretty well. Moreover, any laxity in operational ground can considerably be compensated through the cordial services provided by a staff of talented officers or employees.

Overall, the bank must make a positive attempt to be more outward looking in their goals and aware of what is happening. They must also emphasize on the domestic scenario more closely and analyze any certain trends and strategies of their competitors. The bank must accept any failures and think of them as an objective to pursue future goals instead of blaming such failures on other factors.