A line of credit (LOC) is a preset cap for borrowing that can be used at any time. In fact, LOC is a convenient and versatile method for borrowing that gives individuals access to a particular, pre-approved sum of money that they can later use at any time for any reason. The borrower will take money out if needed before the cap is reached, and in the case of an open line of credit, when money is repaid, it can be borrowed again. Compared to a standard loan, one of the benefits of a line of credit is that it does not have to be used for a particular reason and no interest on the unused balance is paid.

There are many types of line of credit (LOC) such as an overdraft cap, demand loan, special purpose, export packaging credit, term loan, discounting, industrial bill purchase, typical revolving credit card account, etc. It is an agreement between a bank and a client that determines the maximum loan sum that the client can borrow from a financial institution. The borrower can get to assets from the credit extension whenever as long as they don’t surpass the most extreme sum (or credit limit) set in the understanding and meet some other necessities, for example, making ideal least installments. It might be offered as an office. LOC can be made sure about by security or might be unstable.

Example of Line Of Credit (LOC)

All LOCs consist of a fixed sum of cash that can be lent paid back and lent again as required. Borrowers may apply to a bank, credit union, or other financial institution for lines of credit. The funds become available very quickly after application and approval, usually by the next business day. The lender shall set the rate of interest, the size of payments, and other rules. A few credit extensions permit you to compose checks (drafts) while others incorporate a kind of credit or charge card. On account of business credit extensions, the loan specialist assesses productivity and different business markers that show the practicality of borrowers’ business and its capacity to repay the acquired sum.

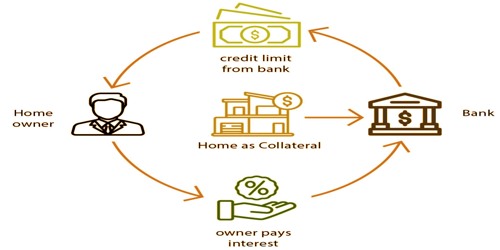

As noted above, a LOC may be secured (by collateral) or unsecured, with higher interest rates being usually subject to unsecured LOCs. LOC, sometimes applied to creditworthy borrowers by banks, financial companies, and other approved consumer lenders to meet fluctuating customer cash flow needs, is often used to indicate a customer’s credit cap, i.e. the maximum amount of credit a customer is authorized. A credit line has built-in versatility, which is its key gain. The LOC is usually called the credit cap in the case of credit cards. An overdraft limit can be named that.

Not at all like home value credit extensions, which are made sure about by the value in clients’ home, individual credit extensions are commonly unstable, which implies the loan specialist won’t need security as a method of insurance on the off chance that they default. Borrowers can demand a specific sum; however, they don’t need to utilize everything. Instead, they can adjust their spending on the LOC to their needs and just owe interest on the amount they draw, not on the entire line of credit. After repayment protection has been issued, the company that receives the loan will continuously draw up to a certain defined amount from the bank.

Functions of Line Of Credit (LOC)

Likewise, borrowers can alter their reimbursement sums varying, in light of their spending plan or income. They can reimburse, for instance, the whole exceptional parity at the same time or simply make the base regularly scheduled installments. A cash credit account is usually protected by a fee on the organization’s current assets (inventory). Pledge or hypothecation may be the type of charge made. Many credit lines are loans that are unsecured. This implies that the borrower does not promise any collateral to the lender to back the LOC.

Lines of credit can be a valuable financing alternative for some events or unanticipated occasions, such as finishing home redesigns, paying for a kid’s instruction, and making sure about an extra income for a business. One striking exemption is a home equity line of credit (HELOC), which is made sure about by the value in the borrower’s home. From the bank’s viewpoint, made sure about credit extensions are appealing in light of the fact that they give an approach to recover the serious assets in case of non-installment. A company credit line is very similar to personal credit lines. Entry to a certain sum of funding is provided by a financial institution. A business line of credit may be unsecured or backed (typically by inventory, receivables, or other collateral). Credit lines are also referred to as revolving and can be repeatedly dipped into.

A personal line of credit refers to borrowing money from customers to fund personal expenses such as home repair, larger purchases, special events, or just to smooth out dips in personal income. If they are trying to consolidate their higher-interest loans, it can also be useful. Secured lines of credit are attractive to individuals or business owners because they usually come with a higher overall credit cap and slightly lower interest rates than unsecured lines of credit.

A fee for setting up a line of credit would usually be paid by the bank or financial institution. Unsecured credit lines tend to come with interest rates that are higher than secured LOCs. Usually, the charge will cover the cost of handling the applications, carrying out security checks, legal fees, organizing collateral, registrations, among other items. The lender will call the amount lent due at any time with a demand LOC. Depending on the terms of the LOC, payback (until the loan is called) can be interest-only or interest plus principal. At any time, the borrower will spend up to the credit cap.

To get a line of credit, clients need to apply for one at a loan specialist a bank, or another budgetary establishment. The moneylender will evaluate and inspect the client’s financial soundness dependent on their salary and record of loan repayment. It is critical to demonstrate to the bank that they are an okay, trustworthy borrower. Securities-Backed Line of Credit (SBLOC) require the borrower to make month to month, premium just installments until the advance is reimbursed in full or the business or bank requests installment, which can occur if the estimation of the financial specialist’s portfolio falls beneath the degree of the line of credit.

Under the credit line, no interest is usually charged until the customer finally draws on some or all of the credit facility. There will also be a charge, which may be a monthly, quarterly, or annual charge, for keeping the credit facility open. A line of credit’s key benefit is the opportunity to borrow only the amount required and to stop paying interest on a large loan. That said, when taking out a line of credit, borrowers need to be mindful of potential issues.

Information Sources: