The listing requirements include various criteria and minimum standards set by stock exchanges, such as the New York Stock Exchange, for the purpose of allowing the exchange to become a member. When practicable after fulfillment of the Listing Requirement, the Company will make sure about the posting of the portions of Common Stock endless supply of the Convertible Note and upon the activity of the Warrant on Principal Market (subject to legitimate notification of issuance) and will keep up such posting for the lesser of (a) five (5) years or (b) inasmuch as some other portions of Common Stock will be so recorded. Only if the listing conditions of exchange are met will a business list securities for trading.

A listing refers to the shares of the company being on the public list (or board) that is formally exchanged on a stock exchange. Some stock exchanges allow a foreign company’s shares to be listed and can, subject to conditions, allow dual listing. Occasionally, companies that do not meet the listing criteria may still be able to sell their securities for over-the-counter (OTC) trading. Ordinarily, the responsible organization is the one that applies for a posting yet in certain nations a trade can list an organization, for example since its stock is as of now being exchanged through casual channels.

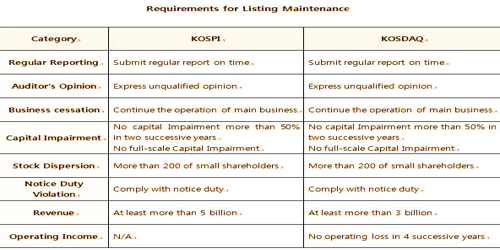

Listing Requirements Example

Listing requirements are a set of conditions that must be met by a business before security is listed on an organized stock exchange, such as the New York Stock Exchange (NYSE), the Nasdaq, the London Stock Exchange, or the Tokyo Stock Exchange. The exchange can de-list stocks whose market value and/or turnover fall below critical levels. Delisting often results from a merger or sale, or the business going private. The prerequisites commonly measure the size and piece of the overall industry of the security to be recorded, and the fundamental money related suitability of the responsible firm. Trades set up these principles as a method for keeping up their own notoriety and perceivability.

Per stock exchange has its own a criterion or guidelines for listing. The issuing company typically must retain a collection of similar but less strict trading conditions once security is mentioned, otherwise, the security faces delisting. There is no legal penalty for being delisted; it merely results in removal from the relevant exchange. Starting posting prerequisites normally incorporate providing a past filled with a couple of long stretches of fiscal summaries (not needed for “elective” markets focusing on youthful firms); an adequate size of the sum being set among the overall population (the free buoy), both in total terms and as a level of the absolute extraordinary stock; an affirmed outline, for the most part including feelings from autonomous assessors, etc.

Listing requirements are not entirely obstacles to trading, since businesses are still free to sell over-the-counter (OTC) securities; however, they have virtually no liquidity, regulatory control, credibility, or exposure since listed on one of the major stock exchanges. Delisting, on the other hand, refers to the process of withdrawing a company’s stock from a stock exchange so that investors are no longer able to buy stock securities on that exchange. This ordinarily happens when an organization leaves business, bows out of all financial obligations, no longer fulfills the posting rules of the stock trade, or has become a privately owned business after a merger or procurement, or needs to diminish administrative revealing complexities and overhead, or if the stock volumes on the trade from which it wishes to delist are not noteworthy.

Listing requirements vary by transaction, but there are some metrics that are almost always included. The two most important categories of requirements deal with the size of the company (as specified by the annual profits or market capitalization) and the liquidity of the shares (it is already appropriate to issue a certain number of shares). However, delisting does not necessarily mean a change in the core strategy of the group.

Information Sources: