Market value added (MVA) is the difference between the current market value of a firm and the capital contributed by investors. It is a calculation that shows the difference between the market value of a company and the capital contributed by all investors, both bondholders, and shareholders. Essentially, it is used to determine exactly how much value the firm has accumulated over time.

This concept drives the difference between the market value of a business and the cost of the capital invested in it. It is a term that refers to the currently very important valuation measurement of enterprise performance. If MVA is positive, the firm has added value. If a company has been performing well, it means that it has been retaining earnings. If it is negative, the firm has destroyed value. Also, a negative MVA signal to investors that the company is not using its capital effectively or efficiently. The amount of value-added needs to be greater so than the firm’s investors could have achieved investing in the market portfolio, adjusted for the leverage (beta coefficient) of the firm relative to the market. It expresses the wealth of the owners (shareholders).

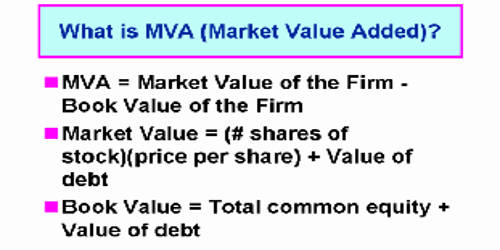

Basic formula – The formula for MVA is:

MVA = V – K

where:

- MVA is a market value-added,

- V is the market value of the firm, including the value of the firm’s equity and debt,

- K is the capital invested in the firm.

MVA is the present value of a series of EVA values. MVA is economically equivalent to the traditional NPV measure of worth for evaluating an after-tax cash flow profile of a project if the cost of capital is used for discounting. The MVA is derived by comparing the total market value of the firm and the book value of the invested capital.

To derive market value-added, follow these steps:

- Multiply the total of all common shares outstanding by their market price,

- Multiply the total of all preferred shares outstanding by their market price,

- Combine these totals,

- Subtract the amount of capital invested in the business.

Advantages of Market Value Added is it makes companies more attractive to potential investors. Investors will always prefer companies with higher MVA because it shows the firm’s ability to create wealth for its stockholders. Increasing MVA or increasing shareholder wealth is the primary goal of any business and the reason for its existence.