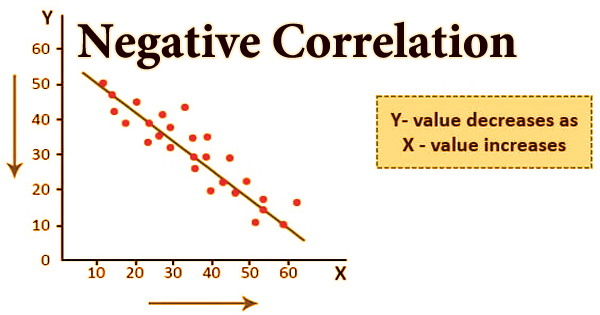

Negative correlation is a link between two items or variables in which one of them declines while the other increases. To put it another way, when variable A rises, variable B falls. Inverse correlation is another term for a negative correlation. This formula is used to examine the link between variables and the reason of a variable’s behavior in a number of contexts. It’s also worth noting that correlations might shift under certain conditions.

The variable A might have a -0.9 correlation coefficient and be significantly negatively linked with B. This indicates that for every positive change in variable B’s unit, variable A decreases by 0.9. A complete negative correlation indicates that the relationship between two variables is always the polar opposite. It’s useful in a variety of situations, but it’s especially crucial in the creation of financial portfolios. When two normalized random vectors are seen as points on a sphere, the correlation between them is the cosine of the arc of separation of the points on the sphere, and the correlation between them is the cosine of the arc of separation of the points on the sphere.

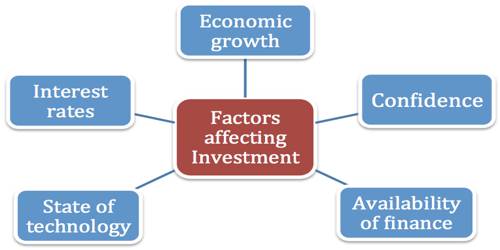

When creating diverse portfolios, a negative correlation is used so that investors can profit from price increases in certain assets while others decrease. For investors or analysts who are considering adding new investments to their portfolios, this idea is critical. When market uncertainty is high, rebalancing portfolios by replacing certain positive-correlation assets with negative-correlation securities is a typical concern.

Negative correlation between various stock markets or sectors provides for a more diversified portfolio that can better withstand market volatility and offer consistent returns over time. The portfolio moves cancel each other out, lowering risk and increasing return. Investors might begin closing offset holdings after market concern has subsided. A stock and put option on the stock, which increases in value when the stock’s price decreases, is an example of negatively correlated securities.

The correlation coefficient is a metric for determining how strong a connection between two variables is. However, a correlation value of -0.8 between two datasets is considered a significant negative connection. It would be deemed a mild negative connection if they had a correlation coefficient of -0.1. Negative correlation, also known as inverse correlation, is a statistical relationship between two variables in which their prices change in opposing directions.

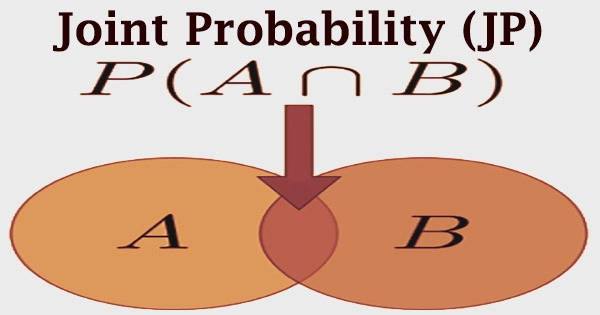

If variables X and Y, for example, have a negative correlation (or are negatively linked), Y will drop as X grows in value, and vice versa if X declines in value. A negative correlation is shown by a coefficient that is less than zero. When two instruments have a correlation of -1, the relationship between them is entirely inverse. When the economy is doing well, stocks generally outperform bonds; but, when the economy falters and interest rates are cut, bonds often outperform stocks.

Because stocks fall in value, bonds rise in value, and vice versa, this indicates a negative connection. While a varied portfolio cannot remove all risks, it can help when unexpected occurrences in the financial market occur. A negative cross-sectional connection between sickness and vaccination, for example, can be noticed when one has a higher than normal incidence and the other has a lower than usual incidence. Overall, negative correlations can assist managers in choosing how to allocate assets since they can help portfolio managers minimize portfolio volatility.

Similarly, if it is found in one place that times with a higher-than-average frequency of one overlap with a lower-than-average incidence of the other, there would be a negative temporal connection between sickness and vaccination. The correlation coefficient, which quantifies the strength of the correlation between two variables, measures the degree to which one variable move in relation to the other. When calculating a negative correlation, follow these easy procedures:

- Determine your two variables.

- Determine your method for finding the correlation.

- Calculate the correlation.

- Determine the type of correlation.

The correlation coefficient will be closer to -1 the stronger the negative correlation between two variables. Similarly, two variables with a perfect positive correlation would have a correlation value of +1, but two variables with a correlation coefficient of 0 are uncorrelated and move independently of one another. Negative correlation is a crucial notion in portfolio development. Negative correlation across sectors or regions allows for the construction of diversified portfolios that can better resist market volatility and smooth out long-term portfolio results.

A negative correlation between the returns on two separate assets increases the risk-reduction benefit of diversifying by keeping them both in the same portfolio in finance. The discipline of strategic asset allocation refers to the construction of big and complex portfolios with properly managed correlations to produce more predictable volatility.

Information Sources: