Return on Net Asset Value (NAV) is a performance metric for assets minus liabilities in a company. It is the improvement over a given time span in the net asset value of a mutual fund or ETF (exchange-traded fund). The NAV return is calculated supported the daily NAV of the fund reported after the stock market’s close each trading day. it’s typically accustomed measure the performance of mutual funds, open-end funds, or exchange-traded funds (ETFs) because shares of the funds are typically purchased at their NAV.

The NAV return of a investment company is one measure of return and might show a discrepancy than the full return or the market return that investors realize because these products can trade at a premium or discount within the market to the fund’s computed NAV. It can even be wont to measure the worth of a corporation it’s like using the book or equity value. Furthermore, NAV return is beneficial to find intrinsic value, because it takes the change in net assets over time.

NAV return is often calculated daily for mutual funds, open-end funds, and ETFs supported the daily NAV of the fund, which is reported at the top of every trading day. The NAV may be a basic calculation performed by the fund’s accountants. It represents the entire assets minus total liabilities divided by outstanding shares. The NAV value changes daily, as assets are supported their market values.

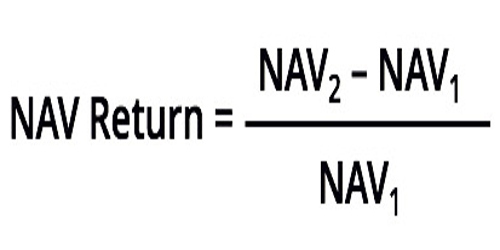

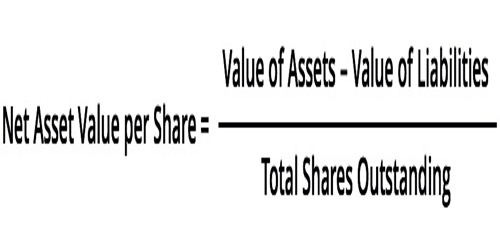

NAV return can be calculated using two methods:

- Find the return of total NAV.

- Find the return of NAV per share.

NAV Return Formula using Total NAV

Net Asset Value = Value of Assets – Value of Liabilities

Where:

NAV1 = NAV at time 1

NAV2 = NAV at time 2

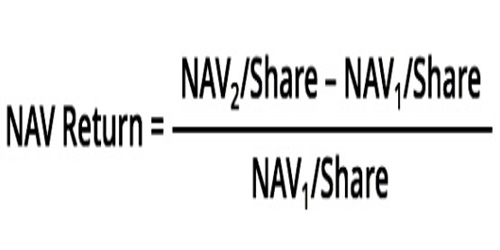

NAV Return Formula using NAV Per Share

Where:

NAV1/Share = NAV per share at time 1

NAV2/Share = NAV per share at time 2

Additionally, the net asset value (NVA) return is a straightforward indicator of efficiency, because it only contains the actual assets in the fund at the end of the day. Consequently, payments of dividends, interest, and capital gains paid out to shareholders will not be included in the total assets unless reinvested. Usually, the value is determined by accountants at the company.

The total return of an investment trust provides a performance figure that has distribution payouts. Additionally, the entire return of a fund includes the capital gains and losses from the securities held within the fund; also, it includes any expenses charged by the fund. Distribution payouts are the first reason an investor will see variations in NAV versus total return.

An investor must study the overall return of a fund as an entire, as an example, a dividend-seeking investor may only concentrate on the fund’s dividend yield, yet there are also high-performing funds that don’t give out dividends. Funds trading in real-time with a value can incur a market premium or discount that causes their market return to vary from the NAV return. Since the web asset value return doesn’t include dividends and other sorts of distributions, it’s going to not accurately depict the return a shareholder would receive in a very fund with a high dividend yield.

Investment companies have clarity in the reporting of their fund results to help investors define NAV return, total return, and market return. Hence, when evaluating the performance of a fund, it is important not to look at only one return or one element of an individual return; it is possible to evaluate the performance of a fund using multiple returns and ratios. Investors should monitor the returns they use to track the performance of their investments. Ensuring understanding of fund performance calculations will help an investor’s due diligence and performance comparisons.

Information Sources: