The difference between the numbers of gross charge-offs and any recovery of delinquent debt is a net charge-off (NCO). Net charge-offs refer to the debt owed to a business which is unlikely to be recovered by that business. The obligation is discounted at first as a gross charge-off; in any case, if any measure of the obligation is recuperated sometime in the not too distant future, the sum is deducted to show up at net charge-offs. It is profoundly impossible that a moneylender will encounter 100% assortment on the entirety of its credits extraordinary.

By comparing the charged-off amount to the average outstanding loan that the company has, the net charge off ratio is usually measured. A creditor will establish a loan loss provision as a routine matter, an estimate of the amount it thinks will not be repaid (based on historical data), and then charge off the amounts it determines will not come back. Furthermore, the proportion might be breakdown into various classifications of credits, for example, result type, area, or size, to have a point-by-point investigation. Frequently the case shortfall arrangements are in the ballpark of genuine gross charge-offs, yet inevitable recuperation can happen, which when gotten against net charge-offs produces a net charge-off figure. Also, microfinance or bank (the company) may need to benchmark the ratio to the previous period or the industry average in order to have a better analysis of loan performance.

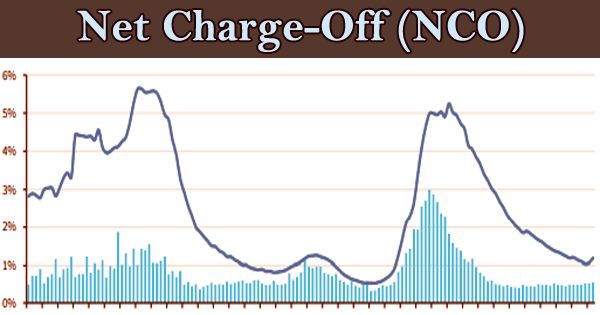

(Example of Net Charge-Off)

During an accounting period, a lender will decrease the loan loss provision by the amount of net charge-off and then refill the provision. The loan loss provision arises as an expense on the income statement and would therefore lower operating profits. A charge-off is a debt which the debtor (lender) is considered to be unlikely to collect. It very well maybe because of a few reasons, for example, crumbling in the borrower’s credit wellbeing or the obligation installment’s been delinquent for quite a while. The expression “charge off” and “discount” ordinarily have a similar significance in bookkeeping. This is because the advances that have been charged-off or discounted would be taken out from the accounting report.

The divisions of real estate (residential, commercial, farmland), consumer, leasing, commercial and industrial (C&I), and agricultural loans are also broken down. With the assumption that they will not be able to recover 100 percent of the loans they have given, most debtors loan out money. It is therefore common practice that a loan loss provision is typically defined in the form of a “Provision for Credit Losses (PCL).”

With the method of using the amount of loans charged off to minus the corresponding recovery amount over the span, investors can measure the net charge off ratio; then break the result with the average loan outstanding.

Net Charge Off Ratio = Gross Charge Off Ratio – Subsequent Recovery Amount / Average Loan Outstanding

If debtors are able to recover any of the amount that has been charged-off, however, then it will net the gross charge-off recoveries to exceed net charge-offs. The allowance for loan losses is decreased by the volume of the net charge-off at the end of the accounting period and is then replenished on the basis of new forecasts for loan losses for the next accounting period.

The formula of the net charge off ratio can also be determined using the amount of loans written off to minus the amount of loans recovered during the time after being written off.

Net Charge Off Ratio = Written Off Loan Amount – Amount Recovered after Written Off / Average Loan Outstanding

In the equation, we may need to compute net charge off proportion by annualizing the figure of the advance sum recouped when it’s anything but an entire year. Banks screen their net charge-off rate, which is the proportion of credit misfortunes to add up to advances. It is a budgetary metric that can be utilized to look at the advanced book nature of banks among one another. In any case, contrasts in net charge-off rates may come from various business blends.

Information Sources: