Employees possess stock in the firm where they work, and there is a discrepancy between the average cost basis and the current market value of the shares owned; this is known as net unrealized appreciation or NUA. The term “net” refers to the sum less the cost. The net profit or loss of the employer stock is equal to the fair market value of the employer stock less the cost basis of the employer stock. The “paper” profit of the employer stock is unrealized appreciation.

The net undiscovered appreciation (NUA) is the distinction in esteem between the normal expense premise of portions of boss stock and the current market worth of the offers. A few organizations give workers stock possession in the organization as a type of pay or motivation. The NUA is significant in case you are conveying exceptionally liked boss stock from your assessment conceded business supported retirement plan, for example, a 401(k). To qualify for the advantageous NUA tax treatment, a stock must fulfill three criteria: it must be issued in-kind, a lump-sum distribution must be made by the employer retirement plan, and a lump-sum distribution must be made after a triggering event, according to the Internal Revenue Code (IRC).

Many people approaching retirement have substantial 401(k) and other employer-sponsored retirement plans. Employees can deal with the company stock they’ve collected over time from the employer in two ways when they retire or leave the firm:

- The first option is to transfer the assets to an IRA (individual retirement account), which is a tax-advantaged vehicle for saving money for retirement.

- The net unrealized appreciation technique, on the other hand, permits workers to transfer shares in a taxable account under different tax policies, resulting in considerable tax savings as compared to the first strategy.

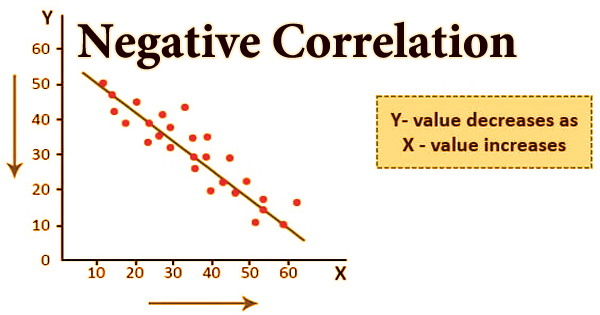

Normally, distributions from charge conceded retirement accounts are treated as common pay at the hour of distribution. Standard pay is charged at a higher rate than long-haul capital additions. The representatives pay an annual assessment on the expense premise of the stock they own and pay a lower capital increases to charge on the excess distribution (just when the stock is sold, and gains are figured it out). The NUA election is only available when stock is deposited in a tax-deferred account, such as a 401(k) or conventional IRA, and it applies only to shares of the firm for which you are or were employed.

Your customers must take a lump-sum distribution of all assets in their employer-sponsored retirement plan account when using the NUA approach. Employer stock is often distributed in-kind and transferred to a brokerage account. The remainder of the resources might be turned over. Roth IRAs don’t fit the bill for NUA on the grounds that they are not charge conceded, and money market funds don’t meet all requirements for NUA in light of the fact that they are for the most part currently dependent upon the capital additions charge.

If the shares are kept after the distribution, any further profits will be taxed at the short or long-term capital gains rate, depending on the time between the distribution and the sale. Nonemployer-stock resources in a customer’s boss-supported arrangement might address a chance for a rollover to an IRA. In such a situation, if a shortfall happens, the measure of net hidden appreciation gain will be decreased by the comparing sum.

The optimum moment to implement the NUA approach is when the employer stock has a very low-cost base. Select the employer stock that makes the most sense for the NUA approach. The investor’s age is a key factor to consider when determining the efficacy of NUA’s tax treatment. The more seasoned an individual is, the more limited their retirement time skyline, and in this way, the NUA is more gainful.

The IRS permits workers who have organization stock in their 401(k) plans to exploit the NUA rule. For a more youthful individual, there is a ton of time for the resources for turn over to an IRA and develop on a conceded charge premise. While the bulk of a 401(k) portfolio will be taxed as ordinary income at market value, shares of employer stock will only be taxed as regular income on a cost basis. There is a chance that NUA gains will be postponed for a long time because the NUA stock does not have to be sold right away.

The initial value of the employer stock is the cost basis. This means that any additional value acquired after the stock was first purchased will be taxed as capital gains rather than regular income. To qualify for the above-mentioned NUA tax treatment, a stock must fulfill three conditions, according to the Internal Revenue Code (IRC):

- Stock should be distributed in-kind: The employee’s shares must be moved immediately to a taxable investment account in order for the aforementioned requirement to hold. They cannot sell shares for cash, nor can they employ stock options or repurchases, and the NUA tax treatment will not apply to the options.

- Lump-sum distribution should be made by the employer retirement plan: Under such circumstances, the retirement plan’s whole account balance must be dispersed in a single tax year. After the distribution, no money can be kept in the plan.

- Lump-sum distribution should be made after a triggering event: The distribution must be made after a triggering event in order for the aforementioned two requirements to hold. Death, incapacity, the end of service, or attaining retirement age are all examples of triggering events. As a result, if a person is working and no triggering event has happened, a stock will not qualify for NUA treatment.

After selling the organization stock, the NUA will be dependent upon the capital additions charge, which might be significantly lower than your present annual expense rate. Note that you can’t utilize NUA rules to save money on charges with a Roth IRA, since those all around offer tax-exempt withdrawals in retirement. A taxable brokerage account, on the other hand, would already be liable to capital gains tax on the sale of investments, thus net unrealized appreciation isn’t applicable.

The compromise is that customary personal assessments would not have been expected until you sold the offers, later on, a long time or a long time from now. In view of this compromise, it is ideal to just circulate the least expense premise shares under the NUA rules to enhance the duty results. If you own shares of your employer’s stock in a workplace retirement plan, net unrealized gains might be a valuable tax planning tool.

Information Sources: