The nominal interest rate (NIR) or nominal rate of interest refers to the rate of interest before considering inflation. An interest rate is considered nominal if the compounding frequency (e.g. a month) is not equal to the standard time period in which the nominal rate (normally one year) is quoted. Nominal also can confer with the advertised or stated rate of interest on a loan, without taking into consideration any fees or compounding of interest. The nominal rate is in contrast to the important rate regarding the inflation adjustment and effective rate regarding the compounding adjustment.

Real interest rate definition is useful to account for inflationary effects. Nominal interest rates (NIR) can be influenced by numerous factors, including demand and money supply, federal government intervention, central bank monetary policy, and many others. The nominal interest rate formula can be calculated as:

r = m × (( 1 + i)1/m – 1)

Where:

i = the effective rate

r = the stated rate

m = the number of compounding periods

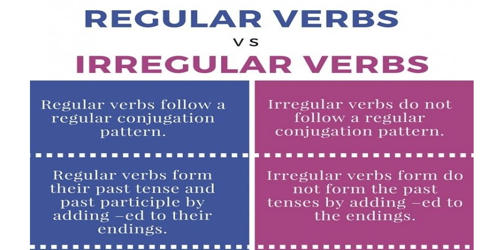

In contrast to an effective rate of interest, the nominal rate of interest refers to the speed laid out in the loan contract without adjusting for compounding. The NIR exists in contrast to real interest rates and effective interest rates. Real interest rates appear to be important to investors and lenders while effective rates are equally relevant to investors and lenders for borrowers. For example, if the lender is receiving 8 percent from a loan and therefore the rate of inflation is additionally 8 percent, then the (effective) real rate of interest is zero: despite the increased nominal amount of currency received, the lender would don’t have any cost like such a loan because each unit of currency would get devaluated thanks to inflation by the identical factor because the nominal amount gets increased.

Central banks set nominal short-term interest rates, which are the basis for additional interest rates paid by banks and financial institutions. Since their compounding intervals are the same, the NIR’s are not comparable; efficient interest rates compensate for this by “converting” nominal rates into annual compound interest. Ostensible financing costs might be held at misleadingly low levels after a significant downturn to invigorate monetary action through low genuine loan costs, which urge purchasers to take out advances and go through cash. By and large, contingent upon neighborhood guidelines, loan fees as cited by banks and in ads depend on ostensible, not powerful financing costs, and consequently may downplay the loan fee contrasted with the identical viable yearly rate.

A crucial condition for such stimulus measures, however, is that inflation should not be a present or a possibility in the near future. The relationship between the real interest value r, the nominal interest rate value R, and the inflation rate value i is given by

(1+r) = (1+R) / (1+i)

When the inflation rate i is low, the real interest rate is approximately given by the nominal interest rate minus the inflation rate, i.e.,

r ≈ R – i

The nominal rate refers to the annual rate of interest compounded by the number of periods in a year. It does not accept compounding. Nominal interest rates are therefore not necessarily equivalent because they have the same duration of compounding. The NIR is that the stated rate, and therefore the real charge per unit is that the interest after the expected losses because of inflation. Since the future inflation rate can only be estimated, the ex-ante and ex-post (before and after the fact) real interest rates may be different; the premium paid to actual inflation (higher or lower).

Conversely, during inflationary times, central banks tend to line nominal rates high. The term shouldn’t be confused with interest (as hostile compound interest) which isn’t compounded. The resulting elevated level of interest rates may have serious economic repercussions, as they have a tendency to stall spending. The effective interest rate is higher than the nominal interest rate so long as the compounding duration is less than one year. The shorter the compounding duration (more compounding cycles each year), the higher the effective interest rate, and the continuously compounded bond provides the highest effective rate, at the same nominal cost. To that end, the annual percentage rate (APR) differs from the nominal rate, because it takes fees under consideration, and annual percentage yield (APY) takes both fees and compounding into consideration.

Information Sources: