The on-balance volume indicator (OBV) is a technical analysis indicator that attempts to link price and volume in the stock market. It additionally alludes to a specialized pointer of force that uses the positive or negative progression of the volume of exchanging to mirror the general purchasing and selling tension on a monetary resource, with the point of foreseeing the plausible heading of close-term value changes. Granville’s New Key to Stock Market Earnings, published in 1963, was the first book to incorporate the OBV metric. The OBV, like other volume-based measures like the negative volume index, Klinger volume oscillator, and money flow index, can only operate on markets with exchange volume.

The OBV is dependent on a total amount that has been accumulated over time. To put it another way, OBV monitors rising or dropping volume to predict future price movements. OBV was created by Joseph Granville, who claimed that volume was the driving force behind markets, and it was designed to forecast when significant market movements would occur based on volume shifts. He compared the predictions made by OBV to “a spring being wound tightly” in his book. As volume spikes without a noticeable shift in the stock’s price, he believes the price will ultimately leap upward or downward.

The point of checking the OBV is to foresee the plausible heading of close term value changes. The OBV works by keeping a running count on volume as per the heading of a security. As the price of a security rises, volume is applied to the running total to measure the OBV figure. When the price of a security falls, volume is deducted from the operating total to arrive at the OBV figure. The OBV indicator’s deviation from the current market trend also indicates an imminent trend shift.

Contrasting relative activity between value bars and OBV produces more significant signs than the green or red volume histograms usually found at the lower part of value diagrams. The concept behind the indicator, which was created in the 1960s, was that if volume dropped without a corresponding move in the security, a down move would soon follow. Similarly, if volume rises without a corresponding increase in protection, the market is expected to grow.

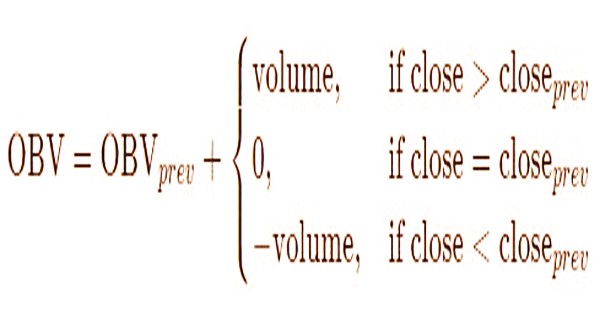

Formula for Calculating On-Balance Volume (OBV):

where:

OBV = Current on-balance volume level

OBVprev = Previous on-balance volume level

volume = Latest trading volume amount

Since OBV is a cumulative indicator that measures the running total of positive and negative amount, the measurement starts with a chosen starting value of the OBV at a previous point in time, such as the OBV at the previous trading day’s close.

If the closing price of the asset is higher than the previous day’s closing price:

OBV = Previous OBV + Current Day’s Volume

If the closing price of the asset is the same as the previous day’s closing price:

OBV = Previous OBV (+ 0)

If the closing price of the asset is lower than the previous day’s closing price:

OBV = Previous OBV – Current Day’s Volume

Absolute volume for every day is allotted a positive or negative worth relying upon costs being sequential that day. A higher close outcome in the volume for that day to get a positive worth, while a lower close outcome in negative worth. Traders begin to expect a potential pattern shift in price when the OBV predictor makes a substantial move without a corresponding move in price or in the opposite direction of price. The hypothesis behind OBV depends on the qualification between keen cash specifically, institutional financial backers and less complex retail financial backers.

The money that mostly drives markets is thought to be institutional funds on low volume days, while retail traders and investors are most involved on high volume days. It is not necessary to measure the on-balance volume manually on a regular basis. Irrefutably the mathematical estimations of the OBV at some random point in time are not considered as significant as the OBV’s overall directional development, which is effectively shown with an outline line.

The indicator is cumulative, but the time interval is set by a dedicated starting point, so the actual number value of OBV is centered on the start date arbitrarily. At the point when costs are going up, OBV ought to be going up as well, and when costs make another assembly high, at that point OBV ought to as well. Assuming OBV neglects to go past its past assembly high, this is a negative dissimilarity, proposing a frail move. Traders and analysts instead focus on the dynamics of OBV changes over time, with the slope of the OBV line carrying much of the study weight.

The indicator’s premise is that price matches amount, which is a commonly held assumption among technical analysts. Traders who keep an eye on the stock’s on-balance volume should expect to see an increase in volume until the stock price starts to grow. Alternately, a falling volume pattern is deciphered as a sign that the stock value itself is probably going to enter a relating downtrend soon. One drawback of OBV is that it is a leading indicator, which means it can make predictions but not much about what has actually happened based on the signals it generates.

The on-balance volume indicator is commonly used by traders as a verifying technical indicator of a stock’s price level. For example, if a stock’s price is gradually rising, traders watching the on-balance volume indicator should expect it to rise as well. To check for OBV line breakouts, add a moving average line to the OBV; traders will confirm a price breakout if the OBV indicator allows a concurrent breakout. At the point when the OBV veers from the heading of a security’s value development, it very well might be an early marker of a forthcoming pattern change.

Another thing to keep in mind when using the OBV is that a big volume spike on a single day will throw the indicator off for a long time. For example, an unexpected profit declaration, being added or taken out from a list, or enormous institutional square exchanges can make the pointer spike or dive, however, the spike in volume may not be demonstrative of a pattern. Traders who track trends will use the OBV’s signals in combination with indicators to help them recognize the pattern. Similarly, those who prefer to spot possible market turning points may combine the OBV with price reversal indicators (e.g., certain types of oscillators, moving average crossover strategies).

Information Sources: