Operating cash flow (OCF), cash flow provided by operations, Cash flow from operating activities (CFO), or free cash flow from operations (FCFO) is the amount of cash generated from a company’s daily operating activities over a given period of time. OCF indicates if a company can produce sufficient positive cash flow to sustain and expand its operations, otherwise, external capital expansion funding can be needed. Operating cash flow (OCF) is characterized by the International Financial Reporting Standards as cash generated from operations less taxes and interest paid, investment income earned and less dividends paid to give rise to operating cash flow.

There are two techniques for operating cash flow (OCF) on an income proclamation: the aberrant strategy and the immediate strategy. OCF starts with net gain (from the base of the pay articulation), includes back any non-money things, and modifies for changes in net working capital, to show up at the complete money created or devoured in the period. To ascertain money created from tasks, one must figure money produced from clients and money paid to providers. To better measure, the performance and financial health of a business, operating cash flow should be used in combination with net profits, free cash flow (FCF), and other metrics when carrying out financial analysis.

In reality, operating cash flow (OCF) is the financial effect of a company’s net income (NI) from its primary business operations. It also referred to as operating cash flow, is the first portion shown on the cash flow statement. Knowing how to measure how much cash flow was generated in a given period is critical.

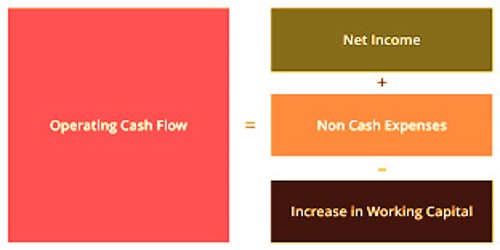

Formula (short form):

Operating Cash Flow = Net Income + Non-Cash Expenses – Increase in Working Capital

Formula (long form):

Operating Cash Flow = Net Income + Depreciation + Stock Based Compensation + Deferred Tax + Other Non Cash Items – Increase in Accounts Receivable – Increase in Inventory + Increase in Accounts Payable + Increase in Accrued Expenses + Increase in Deferred Revenue

Two strategies for introducing the working income area are satisfactory under generally accepted accounting principles (GAAP) the backhanded technique or the immediate strategy. In any case, if the immediate strategy is utilized, the organization should at present play out a different compromise along these lines to the roundabout technique. Utilizing the backhanded strategy, total compensation is acclimated to a money premise utilizing changes in non-money accounts, for example, devaluation, records of sales, and accounts payable (AP). Since most organizations report an overall gain on a gathering premise, it incorporates different non-money things, for example, devaluation and amortization.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a non-GAAP measure which can be used to determine the profitability of business on the basis of networking capital. Moreover, the concept of revenue recognition of a company and matching expenditures to revenue timing will result in a significant difference between OCF and net revenue. Financial analysts sometimes like better to have a look at income metrics because they strip away certain accounting anomalies. Operating income, specifically, provides a clearer picture of this reality of the business operations.

Unfortunately, one number can’t easily be said to be always higher or lower than the other. OCF is sometimes higher than net income (as seen above with Amazon), and sometimes the reverse is true. If a company doesn’t get enough capital from its core business activities, they’ll need to find temporary sources of external financing through sponsorship or acquisition. However, this is often unsustainable within the long term. Therefore, operating income is a vital figure to assess the financial stability of a company’s operations.

Information Sources: