The operating cash flow margin is a profitability ratio that measures the amount of cash generated by a company’s operating operations as a proportion of net sales over a specific time period. It, like operating margin, is a reliable indicator of a company’s profitability and efficiency, as well as the quality of its earnings. It calculates the percentage of sales revenue that is operational cash. It demonstrates how effectively a firm generates profit from its sales.

The amount of cash created by a business’s regular operational activities during a certain time period is known as operating cash flow (OCF). To get at the total cash earned or used in the period, it starts with net income, adds back any non-cash items, and compensates for changes in net working capital. Divide operating cash flow by sales to get the operational cash flow margin. This calculation is based on operating cash flow, which includes non-cash costs.

Investors and other financial experts use this as a profitability index. To fully measure a company’s performance and financial health, operational cash flow should be utilized in conjunction with net income, free cash flow (FCF), and other variables while undertaking financial analysis. The operating cash flow margin is a measure of a company’s ability to turn revenues into cash. Because it only contains transactions that entail the actual transfer of money, it is an excellent measure of earnings quality.

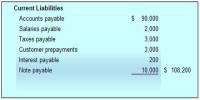

A company’s net sales are the funds it receives in return for its goods or services. It is the amount of money generated before deducting the cost of products sold. It differs from regular sales in that regular sales include discounts, returns, and promotions. Cash flow may be quite informative, especially when comparing performance to competitors in the same sector because it is influenced by sales, expenses, and operational efficiency. On the income statement, net sales is usually found.

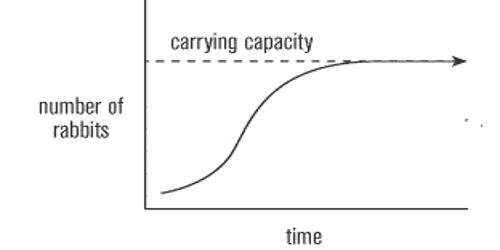

Companies can temporarily flatten operating cash flow margin by delaying accounts payable, pursuing consumers for payment, or running down inventories, just as they can increase operating cash flow margin by managing working capital more effectively. When compiling financial accounts, the fundamental difference is due to accounting regulations such as the matching principle and accrual principle.

Divide cash flow from operations (or operating cash flow) by net sales to get the operating cash flow margin. The operational cash flow margin would be reduced if net sales increased. A rise in operating cash, on the other hand, will enhance the operating cash flow margin.

Operating Cash Flow (OCF) Margin Formula:

OCF Margin = Cash Flow from Operations / Net Sales

Unlike the operating margin, the operational cash flow margin is not the same as the operating margin. Depreciation and amortization costs are included in the operating margin. The operational cash flow margin, on the other hand, subtracts non-cash items like depreciation. To boost the operational cash flow margin, raise operating cash as much as feasible while keeping net sales unchanged.

The operating cash flow margin is calculated by dividing operating cash flow by operating income. Another cash margin metric is the free cash flow margin, which includes capital expenditures. Deductions for non-cash expenditures like as depreciation, amortization, and others are not included in operating cash, but changes in working capital are. It can be calculated as follows:

Operating Cash Flow = Net Income + Non-Cash Expenses (Depreciation and Amortization) + Change in Working Capital

Non-cash costs like depreciation and amortization are included in the operating cash flow margin. This demonstrates a company’s capacity to convert revenues into operating cash flows. The operational cash flow margin is a statistic that assesses how successfully a firm converts revenues into cash flow. This also reveals how the firm is reducing manufacturing costs and other associated expenses.

This metric, which is also known as cash flows from operating activities, reflects the amount of money moving through a corporation that is connected to its primary business operations. A high cash flow margin indicates that a company is effectively converting sales into operating cash, which can then be used to pay shareholders or repurchase stock. The operating cash flow margin is a critical performance metric.

Information Sources: