A pass-through rate is the interest rate on a securitized asset, such as a mortgage-backed security (MBS) that is paid to investors after the issuer of the securitized asset has deducted management fees, servicing fees, and guarantee fees. This rate works by deciding to invest in the securities as the return that investors know. It is often referred to as the rate of net interest. The reference to this sort of loan fee as a go through has to do with the way that the sum sent to the financial specialists goes from the installments on the fundamental home loans, through the compensation operator, and at last to the speculator.

The pass-through rate is lower than the interest rate on the individual securities within the sale (also known as the coupon rate on an MBS). It is important to remember that the pass-through rate is often lower than the borrower’s average interest rate on the mortgages used to back up the protection. After all other expenditures and fees are resolved; the pass-through rate is the net interest the issuer owes investors. This is on the grounds that different sorts of expenses are deducted from the paid intrigue. In mortgage-backed security (MBS), for instance, the sum sent to speculators goes from the installments on the basic home loans that make up the securitized contract security, through the compensation specialist and eventually to the speculator.

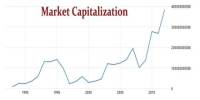

(Pass-Through Rate)

It is not unusual to establish a securitized asset pool that includes the use of mortgages as the backup for the securities. The pass-through rate on mortgages backing the protection is often going to be lower than the average interest rate paid by the borrower. This is so on the grounds that different expenses are deducted from the paid enthusiasm, including general administration charges, for the general administration of the security, the directing of exchanges identified with the security pool, and for ensures related with the protections in question. Several institutions that underwrite mortgages will plan and issue certain financial instruments. Fees are set up as percentages of the interest generated from the underlying mortgages or as flat rates, as specified in the terms and conditions regulating the issuance of the securitized asset.

However long the economy stays stable, the danger related with putting resources into this sort of security course of action stays low in contrast with some other venture choices, and the return acknowledged as the go through rate is almost certain to be viewed as fair for the level of danger included. There are several mortgages underwritten by several institutions, including banks. They also then take these mortgages, repackage them into a mortgage bundle, and market them as a mortgage-backed security (MBS) to investors.

The speculator that purchases the MBS gets the intrigue installments on the individual home loans that make up the securitized resource as intrigue installments/returns on the advantage. As a rule, it is conceivable to extend the measure of return that a speculator will acknowledge from the age of the pass-through rate. Typically, the return known as the pass-through rate is considered equitable for the amount of risk involved. As with every investment, there is the risk that unforeseen variables can occur that may affect the actual amount of net interest generated.

When putting resources into a securitized resource, financial specialists will extend the go through rate as the profit for their speculation. Obviously, unexpected elements may emerge and impact the measure of net intrigue produced. For instance, if the home loans that back the security convey a variable or drifting rate as opposed to a fixed rate, shifts in the normal pace of intrigue will affect the degree of return. For this reason, investors are doing well to try to predict any adjustments in the interest rate over the lifespan of the protection and to integrate them into the planned pass-through rate. This will help the investor decide whether the degree of risk associated with the underlying mortgages is worth the return on the protection.

Information Sources: