Payment Automation with HSBC for Robi Axiata Limited

The telecommunication industry is known to be a dynamic industry all over the world. The changes in technology, open new doors towards unexploited opportunities. Countries that can respond to these changes timely and appropriately can grow successfully in the industry. Bangladesh is fast adapting to the changes in technology with the outside world. The past few decades have seen a lot of rapid changes in the telecommunication sector of Bangladesh. “At present there are six mobile operators in our country. According to the number of subscribers and profitability Grameenphone Limited is in the top position among the six operators. Except Teletalk though their local names are Grameenphone, Banglalink, Robi, Airtel, Citycell but their main companies are the world’s famous and big organization(Zamil & Hossen, 2012).” “Bangladesh has discovered a way to grow its telecom sector in spite of the odds.

Following a number of boom years of expansion the Bangladesh mobile market started showing signs of growth moderating in 2009. The strong growth has been helped enormously by the deregulation of the country’s telecom sector. Despite the progressive regulatory regime, the country was slow to move forward with 3G ( 3rd mobile services. The first 3G license in the country was awarded to Teletalk in 2012. The operators moved quickly to launch their respective offerings and by March 2014 there were around 2.5 million 3G subscribers in total.(Evans, 2014)”

As at the end of May 2015, the total number of mobile subscribers has increased to 125.971 million (Mobile Phone Subscribers in Bangladesh May 2015, 2015) which is a 8.372% increase from the previous year’s 116.239 million at the end of May 2014 (Mobile Phone Subscribers in Bangladesh May 2014, 2014).Table 1 illustrates the spread of subscribers over the six different mobile operators.

Overview of the company

Robi Axiata Limited is one of the dynamic and leading countrywide GSM communication providers in Bangladesh. “It commenced operation in 1997 as ‘Telekom Malaysia International (Bangladesh) with the brand name ‘Aktel’. In 2010, the company was rebranded to ‘Robi’ and the company changed its name to ‘Robi Axiata Limited’ (Company Profile). ” It is a joint venture company between Axiata Group Berhad, Malaysia and NTT DOCOMO INC. Robi is focused on developing products and services that meet the demand of the everyday user.

“Axiata is an emerging leader in Asian telecommunications with significant presence in Malaysia, Indonesia, Sri Lanka, Bangladesh and Cambodia. In addition, the Malaysian grown holding company has strategic mobile and non-mobile telecommunications operations and investments in India, Singapore, Iran, Pakistan and Thailand. Axiata Group Berhad, including its subsidiaries and associates, has approximately 120 million mobile subscribers in Asia, and is listed on Malaysia’s stock exchange (Bursa Malaysia) (Shareholders).”

“Robi draws from international expertise of Axiata and NTT DOCOMO INC. Services support 2G and 3.5G voices, CAMEL (Categorized Applications for Mobile Enhanced Logic) Phase II & III and 3.5G Data/GPRS (General Packet Radio Service)/EDGE (Enhanced Data for GSM Evolution) service with high-speed Internet connectivity. The company has the widest international Roaming coverage in Bangladesh connecting 600 operators across more than 200 countries. Since its inception in 1996, Axiata Group and its predecessor Telekom Malaysia has invested around BDT 11,000 Core in the form of equity till 2012 (Company Profile).”

Robi is committed to ensure that they stay a customer centric company with their overall innovative and advanced technology usage. The expertise they receive from Axiata Group and NTT DOCOMO INC will ensure that they have the leading edge in technology over its rivals in the industry.

Divisions and Departments

Robi Axiata Limited operates with following Divisions and Departments.

Divisions:

- Finance Division

- Marketing Division

- Human Resource Division

- Information Technology Division

- Technical Division

Departments:

- Administration Department

- Internal Audit Department

- Coordination Department

- Corporate Strategy Department

- Corporate Affairs Department

- Credit Control Department

The Corporate Finance Department

An Overview

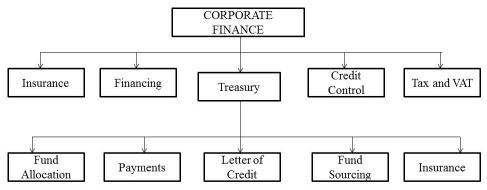

The Corporate Finance Department of any organization can be viewed as one of the most important departments in an organization. The department can be broken down into 5 major aspects

- Insurance

- Financing

- Credit Control

- Treasury

- Tax and (Value Added Tax) VAT

The treasury section can be further divided into five major parts

- Fund Allocation- Allocating funds for payments

- Payments- This is where all the local vendor payments are handled

- Letter of Credit- Deals with the foreign vendors and their payments on behalf of Robi

- Fund Sourcing-When the allocated funds are not enough, and the company runs into deficit, the deficit amount has to be financed for future operations.

- Insurance- Insurance on major assets that belong to Robi Axiata, of which around 2/3 is imported from international vendors

Insurance

All the major assets that belong to Robi are insured under five reputed insurance companies in Bangladesh. The total values of all the assets are divided among these five insurance companies to diversify the risk. The two main insurance companies naming Reliance Insurance and P that have the highest credit ratings hold around 80% of the company’s total assets. Since it is highly risky for these insurance companies to be liable to a large amount of assets, the insurance companies are under constant supervision of lead insurers that make sure that if the insurance company goes default, the company can regain the money that the insurance company is unable to pay.

Financing

Financing has two main branches. Robi is most concerned about Long term financing. Long term financing can be both in respect of local and international vendors. Local loans tend to have higher interest rates than international loans. Internationally Robi indirectly purchases loans from international banks that are foreign denominated currency. The maturity of these loans is mostly two years. Before applying for a foreign loan Robi first has to get regulatory approval and then a Cost Benefit Analysis. A thorough diligence is conducted before these loans are approved.

Credit Control

This is an activity carried out in the purpose of

- Increasing sales revenue by extending credit to customers who are at credit risk.

- Minimizing the risk of loss from their vendors who are identified as bad debts

It is mandatory to make sure that these vendors do their concerned payments on time, but also it is equally important to do a thorough background check and conducting a credit rating before beginning to work with them.

Treasury

The treasury works with mainly 7 local and international banks. Out of which HSBC (Hong Kong and Shanghai Banking Corporation) and SCB (Standard Charted Bank) are fully automated and provide printed cheques daily. Eastern Bank however, used for Inhouse cheques normally those of which the expected disbursement date is already expired. The treasury department also handles the petty cash of all the employees that are entitled to claim for petty cash.

Tax and VAT

There are two main branches of Taxation. One is Direct Tax, which includes Income Tax and Corporate Tax. The other is Indirect Tax which includes VAT, Supplementary Duty, Customs Duty, Excise Duty and Regulatory Duty. The Monitory Policy which is handled by the Bangladesh Bank and the Fiscal Policy which is handled by the Ministry of Finance. Robi can be categorized as a large tax payer.

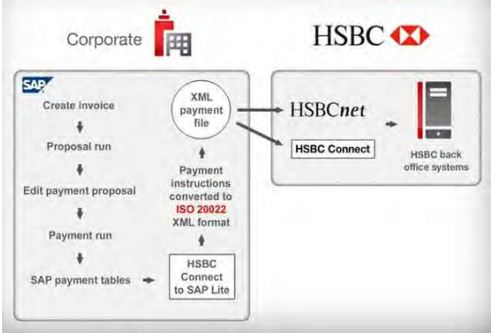

Payment Automation

In this chapter we focus mainly on the Payment Automation types that Robi uses in order to make payments to its vendors and employees. A detailed description illustrates how documents handed to Robi for payment are processed till the final outcome. “For customers who process large volumes of payments and receivables, our fully automated host-to-host solution, HSBC Connect, is your single global pipeline to a wide range of HSBC banking services worldwide. HSBC Connect integrates directly with your accounts payable and receivables system, offering a secure, flexible and highly efficient solution for your payment, collection and reconciliation needs” (HSBC Connect to SAP). We will also be able to see how this process has enriched the company’s value, and makes it easier with the use of technological Applications such as SAP. The chapter also discusses the payment automation process and how HSBCnet plays its vital role in fulfilling the requirements of Robi Axiata. This chapter also contains details about the payment authorization process and the Limits of authorization.

Types of Vendor Payments

Robi uses the following methods for their vendors

- Instant payment

- Automation payment

- Discount Payment

- On line fund transfer

- BEFTN (Bangladesh Electronic Fund Transfer Network)

- BACH (Batch Automated Clearing House)

Instant payment

This is one of the payment methods that Robi applies when they make payments to their vendors. This is used only to instant support to the vender’s and employee’s payment and also if there is any systematical problem in the automation payment process only in this case use instant payment process. Through SAP, EBL cheques are printed with the vendor code and their document number, net payment amount and all these information are printed in house and then the Cheque is sent for the two authorized signatories according to the net amount to be paid to the vendor.

Automation Payment

Automation payment is also an alternative payment process to pay the vendors. In automation payment system bills are sent by the vendor after their assigned job is completed. The bills are handled in batches and there is individual document numbers for every single bill of vendors. After it has been processed by Accounts Payable and Corporate Finance, Treasury, the batch is sent to the bank by using straight to banking system. The two authorized signatories of the batch are determined by the limits of authority so that the batch can be approved by then and automated cheques are sent by the bank accordingly as advised by Robi.

Discount Payment

Discount payment is one of the instant payments to the vendor’s. It’s occurs when the vendor’s want to get the payment before the expected disbursement date. In this case Robi follows discount payment process the process is vendors must have to 10% consider of their net amount. This 10% also for a year and it is multiply by days that the vendor’s get earlier before the measured date and also for this payment we need to take permission from corporate finance assigning person.

Online Fund Transfer

In some cases Robi pays their vendor’s by the using of Online Fund Transfer system. In the fund transfer system an application is sent to the bank manager with company account number and also mentions the transferable account number in an official Robi pad and it is send to the Bank by approving of assigning person. Online fund transfer are conducting two ways one is BEFTN (Bangladesh Electronic Fund Transfer Network) another one is BACH (Bangladesh automated clearing house

The Payement Automation Process

The entire payment automation process takes a lead time of near about one month to be processed.

Scope: The process covers invoice and payment processing for all technology local invoices.

Input: Delivery of technology materials or services by the vendors as per Purchase Order (PO)

Upon completion of the material or service delivery vendor submits Bill of Quantity (BOQ) to One Stop Service (OSS) of Robi Axiata for verification and certification of work completion or final bill for payment processing.

Concerned official of OSS receives and checks the documents BOQ and other relevant documents or final bill as per standard checklist.

If the documents are found correct and complete, concerned officials of OSS records the receipt in online register by entering relevant information such as vendor name, received date, PO Number, invoice reference etc.

If the official of OSS finds that the documents are incorrect/ incomplete or any discrepancies with the checklist s/he returns the documents to the vendor for resubmission.

Concerned officials of OSS forwards the received BOQ/ final bill to respective department. S/he sends the BOQ and relevant documents to respective user departments (technology) and final bill to respective units Accounts Payable (AP) of finance at the end of every day.

Upon receiving of BOQ, challan and other documents concerned officials of respective unit of technology checks the documentation and schedule the site visit for physical verification. As the BOQ in respect of physical existence. During verification concerned site engineers make necessary corrections in the submitted BOQ, challan etc.

If it is required to take any corrective measure by vendor to complete the work, s/he informs vendor accordingly and forwards the documents to OSS to return to the vendors and resubmit upon necessary corrections

If physical verification found that no further corrective measure is required by the vendor, concerned site engineer prepares Work Completion Certificate (WCC) through SAP and passes necessary entry for Goods Receipt (GR) in SAP. [For materials received through Warehouse, the GR is done by warehouse staff s/he also calculates Liquidated Ascertained Damages (LAD) changes if any as per the conditions of PO and prepares vendor account statement.

Concerned site engineer forwards the verified BOQ, challan, LAD charges, vendor account statement and all other document to Technology Compliance (TC) for checking and review.

A concerned official of technology compliance checks the BOQ corrections, rates as per PO, LAD, calculations etc. If any discrepancy is found s/he makes necessary corrections or returns to user department for necessary actions.

If documents are found correct and complete and complete concerned officials of TC sends the verified BOQ WCC, vendor account statement etc. to OSS to forward to respective vendor for final bill.

Concerned officials of OSS scans the WCC and vendor account statement and uploads it in a common network place for onward processing by finance. S/he then forwards the documents to respective vendors to submit final bill within the next 3 days.

Concerned officials of the respective unit (AP) of finance receives the final bill from OSS and pulls the relevant scanned documents WCC, account statement etc. from common network location.

S/he checks and verifies the final bill and relevant WCC, LAD, etc. If any discrepancy is found s/he communicates with TC and takes necessary actions.

If the documents are found correct and complete s/he performs the Invoice Verification and parks the document in SAP. Appropriate authority (as per LOA), of finance checks the parked documents in SAP and post if for payment.

Concerned officials of AP forwards the documents to treasury, finance for onward processing for payment Concerned officials of treasury, finance prepares batch in SAP/Cheque (where required) based in the received invoices and release/ forward for authorization by signatories.

Authorized Limits

- For any amount exceeding BDT 40,000,000 or USD 500,000 to be signed by Chief Financial Officer, Robi Axiata Limited with ANY ONE (1) signatory from Group A

- For any amount exceeding BDT 8,000,000 and up to BDT 40,000,000 or USD 500,000 to be signed by ANY TWO (2) from Group B

- For any amount exceeding BDT 8,000,000 or USD 100,000 to be signed by the signatory from Group B ANY ONE (1) from Group C

- For any amount exceeding BDT 2,000,000 and up to BDT 4,000,000 or USD 50,000 to be jointly signed by ANY TWO (2) signatories from Group C

- For any amount up to BDT 2,000,000 or USD 25,000 to be signed by the signatories from Group D jointly with ANY ONE (1) from Group C (Approval on Updates Authorised Signitories of Bank Accounts, 2014).

Respective signatories authorize batch/sign off cheques for payment disbursement. For batch instructions, cheques are prepared at the end of bank and sent in to Robi Axiata treasury, finance every day.

As per the disbursement schedule treasury, finance forwards the cheques to OSS communicate the respective vendors and disburse the cheques accordingly.

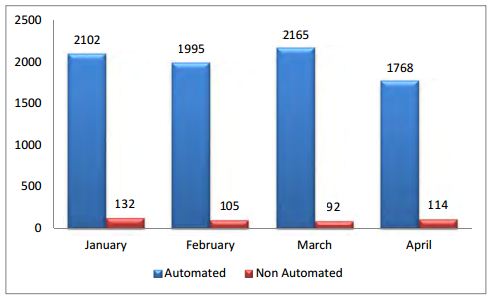

Figure – Total Number of Cheques issued in the first Quarter of 2015

Figure indicated the number of total cheques that were generated for the first quarter of 2015. According to this, a total of 2234 cheques were generated in the month of January of which 2102 cheques were generated through automation. The number of cheques generated through the non-automated process has seen a considerable decrease with respect to the number of total cheques that are generated within a month. In the last month of the quarter, it has been noted that the total number of cheques that were generated add up to 1882 from which 94% were automated and only 114 cheques were non- automated.

HSBC.net

Figure- Payment Automation Process

HSBCnet helps large organizations with customized financial solutions. It allows the companies to process a large amount of financial transactions with in a limited time frame in the most cost effective manner. There are some key features of HSBCnet that have enhanced the efficiency of the organization.

- One easy-to-use consolidated interface

- Multilevel, end-to-end security

- Customizable workspace and choice of HSBCnet in supported local language and time zone

- Centralized, automated and scheduled enhancements mean there is no need to download software updates

- Comprehensive, yet easy to use with intuitive navigation, online learning resources and telephone support in your local language when you need it

- Align with your in-house treasury management systems and enterprise resource planning systems (Client Access )

Analysis of Payment Automation

In this chapter we will analyze the payment automation mechanism used by Robi. We will be able to understand how this system is used to enhance the productivity and the efficiency of Robi’s stakeholders. We will also discuss in brief about how this technology can help customers as a target group and how Robi plans for future with the automated payment system in full function.

Value Chain Analysis

Value chain activities can be transformed from being a core competency to a distinctive competency for a firm, but for this we first may need to do a Value Chain Analysis (VCA). A VCA is the first step towards transforming a company’s value chain activities to build a competitive advantage over the industry rivals. For this this Robi has to first identify the tasks or activities within the value chain activities. Then they have to evaluate the cost of conducting each activity. The result can help them understand which of the value chain activities the company can perform at low cost and thus also serve the company as a competitive advantage.

- Identify Value Chain Activities- Robi should first try to assess their current value chain and identify all the key activities within the value chain. All the different activities in the value chain are attached with individual costs. So, they have to target the activities that they can perform at lower costs than others and then try to build a competency with that activity.

- Core competencies in some activities- After evaluating each value chain activity, the company can identify that in some activities can be performed better than others using the available resources and with minimum cost. These activities can become the core competencies of the company. Moreover, the company can also analyze other competitor value chains and compare with the company’s value chain activities and see if the company is doing better in this activity than its competitors.

- Core competencies transform to distinctive competencies-The identified core competencies can be transformed into distinctive competencies once the company can excel at performing this chosen activity with the minimum amount of resources. If they can perform this activity with minimum cost and time than the rival firms, the company can create a valuable distinctive competency. Here, the company has to be very careful about its total cost in the value chain activities. Performing one value chain activity may directly or indirectly raise the cost of another value chain activity.

Creating Value for Stakeholders

Robi Axiata has been able to create exception value for each of its stakeholders through the use of new technology and automation of the payment process for its vendors. The use of world renowned software applications and heavy investment on Robi’s infrastructure by its current shareholders has added value and stakeholder satisfaction is maintained through smooth service. By using technical expertise and soft wares to carry out business operations Robi has been able to serve each of its stakeholders in a unique manner. Here are some of the ways how payment automation has created value to Robi’s stakeholders

Workforce View

- More innovation- Continuous training on technological up gradation will help the workforce come up with new and innovative ideas for improving the current offers.

- Greater productivity- Employees are motivated to come up with more efficient ways of conducting the task and thus they understand how the job adds value to the organization and boosts productivity.

- Employee satisfaction- Due to the use of technology, the work load is minimized and therefore employees enjoy working.

Vendor’s View

- Transparency- Maintaining the transparency throughout the payment process allows vendors to constantly track their payments.

- Flexible Paying- Vendors have the ability to demand for their payment method, this way they can get discounted or advance payments.

- Fast service- Vendors can receive fast service. With the use of technology, work flow is cut short and allows faster processing of vendor documents keeping up a high quality of service.

Shareholder’s view

- Higher Returns on Investment- Shareholders are bound to receive higher returns on their investment as more sales are generated through the use of high technological expertise and quality service.

- Improve the good will of the group- Through the high performance of one of the sister companies it can impact the overall good will of the entire Axiata Group.

Management View

- Quicker Decision Making- Automated process can lead to faster decision making as some of the steps of the workflow are completely omitted, and all the information needed for decision making are there right in front of you.

- Meet the expectation of all stakeholders- The expectation of all the stakeholders are met as the management is able to keep a balance of all the processes and achieve the vision and the mission of the group.

Customer’s View

- Customer Centric Business- Customers start to feel that the business is fully focused on providing satisfactory service to them. They will feel that the company is trying to do the best they can to keep them happy.

- Customers may want to be a part of the company’s success-As customers begin to feel that the company is doing a lot for their benefit, they would also want to be a part of it. The organization can find loyal and committed employees to work under them.

Future with Automation and Targets for 2015

Customers are becoming extremely tech savvy, as years go by it is therefore highly mandatory that businesses today adapt to the changes in technology to make sure that tasks are completed as fast as possible. The automation system has allowed Robi to speed up their payment methods, and thus enhanced their progress in the fierce industry.

The technical know-how of their shareholders Axiata Group Berhad, Malaysia and NTT DOCOMO INC have allowed Robi to grow leaps and bounces above their competitors. The use of technology has not only made them a more reliable company but also made them a much better customer oriented company. With the use of such technology as payment automation, Robi has been able to cut down a lot of costs and labour hours, thus allowing them to focus more specifically on their greatest asset. Robi have managed to drag back a lot of customers recently as they become an increasingly technologically advanced service provider.

Robi aims at achieving the following targets by the end of 2015 with regard to automation.

- Payment summary for approval

- Flexible signing

- Staff payment through SCB and HSBC Host2Host (H2H)

- Auto bank reconciliation

- Auto cash budget preparation

- Employee Fund Transfer (EFT) payment

- Auto tax and VAT deduction

- Auto annual Cash Flow

- Advance Payment

Recommendations

Though Axiata Group Berhad and NTT DOCOMO (Robi) is a well-established company in Bangladesh and running successfully in the domestic market, it has a handful of internal weaknesses which are written below:

- In terms of payment automation, a large number of cheques still remain with the Finance department because vendors don’t come to collect them. So they should establish a method to inform the vendors to come and receive the cheques.

- Finance department should standardize the petty cash form, as it has been noticed that some petty cash users are unaware of how to categorize their individual expenses.

- Customers have been switching to other operators as a result of their poor network infrastructure. So, Robi should have quick expansion in network development all over Bangladesh if it wants retain its current customers and also attract new customers

- Introducing a loyalty package for customers who have used Robi SIM for more than 5 years

- Introduce small offers for ordinary Robi SIM users.

Conclusion

Robi Axiata Limited is recognized as one of the top mobile companies in Bangladesh. It covers the whole Bangladesh by its network. There are many product and services offered by Robi that give them a competitive edge over the other mobile operators in the market. At the moment the company is growing at a rapid pace. Robi’s takes its decisions based on raw facts collected market research and survey. Their “Listen to Customers” is one of the incentives that Robi has taken in order to keep constant interaction with its valued customers. All the employees at Robi have to undertake this survey, and listen to the footages recorded by the customer care service. This helps the employees understand the changing needs and wants of the customers and also helps the company to bring up changes according to customer preference.

For any company, whether it is small or big like Robi, Financial Management is one of the major aspects. They have to maintain the current working process and work towards achieving efficiency within that process. The use of world rewound Applications such as SAP has given the company a big boost and it has helped the company and especially the Finance Department overcome a lot of time consuming manual work. With exceptional network coverage and a call rate that is parallel to the industry’s best, Robi will not have to remain the third best operator in the country. In fact if they can focus on achieving their long term goals they will sooner or later take over the 2nd spot in the mobile operators list.