Post-money valuation is a company’s equity value after it earns the cash from an investment round it is undertaking. This value is equal to the pre-money valuation number and the new equity level. This refers to the average market value provided to a start-up after the completion of a round of investment from venture capitalists or angel investors. A company’s post-money value applies to the aggregate value of its shares and not the individual share price. Despite the fact that the value worth will be affected by putting extra money on the asset report, the individual offer cost will be unaffected. These valuations are utilized to communicate how many proprietorships outside speculators, for example, investors and blessed messenger financial specialists, get when they make money infusion into an organization.

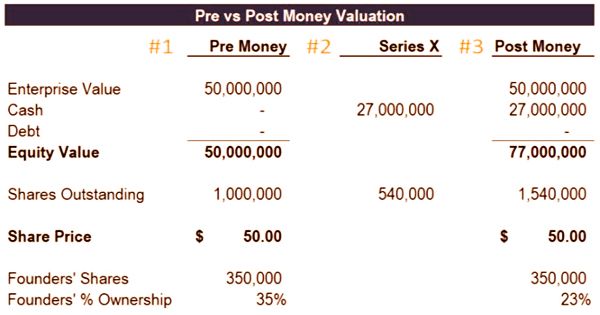

To assess the amount of equity they need to obtain in return for any capital injection, investors such as venture capitalists and angel investors use pre-money valuations. Below is a three-part example of how to measure a company undertaking a Series X financing round’s post-money valuation.

(Example of Post-Money Valuation)

- Part 1 – The following firm has a $50 million pre-money equity valuation. The company has one million shares pending until the funding round, and therefore a share price of $50.00.

- Part 2 – The Company would raise $27 million in new equity at a $50 million pre-money valuation, resulting in the issuance of 540,000 new shares.

- Part 3 – The Company would add $27 million in cash to its $50 million pre-money value (assuming no transaction costs) to arrive at a $77 million post-money valuation. The firm will have 1.54 million shares outstanding after the exchange, but its share price stays at $50.00.

The sum of outer speculators put into an organization is equivalent to the organization’s post-money valuation duplicated by the portion of the organization those financial specialists own after the venture. Equally, the inferred post-cash valuation is determined as the dollar measure of speculation isolated by the value stake picked up in a venture. Dilution becomes a concern in subsequent funding rounds of a rising private business. In negotiating terms that balance new equity with reasonable dilution ratios, prudent founders and early investors will take caution, to the extent possible.

To calculate the post-money valuation, use the following formula:

Post Money Value = Pre Money Value + Value of Cash Raised

or,

Post Money Value = Pre Money Share Price × (Original Shares Outstanding + New Shares Issued)

More precisely, a financial investment agreement’s post-money valuation is given by the formula PMV = N × P, where PMV is the post-money valuation, N is the number of shares the business has after the investment, and P is the price per share at which the investment was made. Since a company’s value can be very subjective, and since founders often have ambitious forecasts for the company, Venture Capital (VC) companies almost always invest to “bridge the valuation gap” through preferred shares.

Extra value raises may include liquidation inclinations from favored stock. Different kinds of financing, for example, warrants, convertible notes, and investment opportunities must be thought of, if pertinent, in weakening estimations. Critically, an organization’s post-money valuation isn’t equivalent to it’s fairly estimated worth. The post-money valuation equation doesn’t consider the extraordinary highlights of favored stock. It accepts that favored stock has a similar incentive as normal stock, which is generally false as favored stock regularly has liquidation inclination, support, and different highlights that make it worth more than basic stock.

Information Sources: