Preferred Dividends could be a fixed dividend received from Preferred stocks. If a company or an organization is unable to pay all dividends, claims to preferred dividends take precedence over claims to dividends that are paid on ordinary shares. The most good thing about stock is that it typically pays much higher dividend rates than common shares of the identical company.

Preferred shareholders enjoy guaranteed payments at higher dividend rates than common shareholders. This suggests that preferred shareholders can expect dividends on an everyday basis. If the board doesn’t declare payment to shareholders, the guaranteed payments for this era are put into arrears. This can be quite a sort of a liability account that the corporate puts on its books notifying that it owes money to the well-liked shareholders. Once a dividend is paid, the well-liked shareholders must be paid out any amount behind before their current payment is created.

Preferred dividends are issued based on the par value and dividend rate of the preferred stock. While preferred dividends are issued at a fixed rate based on their par value, this may be unfavorable in high inflation periods. This is because the fixed payment is based on a real rate of interest and is typically unadjusted for inflation.

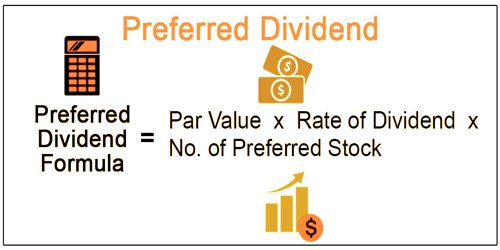

Here’s a simple formula for calculating preferred dividends on preferred stock –

Preferred Dividends = Par Value × Rate of Dividend × Number of Preferred Stock

If preferred shareholders want to invest in the preferred stocks, they need to look at the prospectus.

Preferred dividends are calculated annually by multiplying the dividend rate by the value. This will then be distributed per how often the company pays out its preferred dividends. Some preferred shares could also be cumulative, meaning that if a company decides to not pay dividends at a specific point, they’re obligated to accumulate any missed preferred dividend payments and pay them at a later date. Common shareholders won’t be able to receive any dividends until the popular dividends are paid fully to the preference shareholder.

All issuances of preferred shares contain the equity’s dividend rate and nominal value within the preferred shares prospectus. The dividend rate multiplied by the nominal value equates to the entire annual preferred dividend. If the full dividend to be received is paid move into installments, like in quarters, the issuer divides the entire preferred dividend by the quantity of periods to induce an approximate installment payment.

If the company doesn’t issue dividends high enough to cover the amount in arrears and the current preferred guarantee, the common shareholders will not receive any. In general, preferred dividends are for investors that are looking for less risk in an investment, while still providing the benefits that traditional shares and traditional debt do.

The preferred stock pays a fixed percentage of dividends. That’s why we can call it perpetuity because the dividend payment is equal and paid for an infinite period. However, a firm can choose to skip the equal payment of preferred dividends to preferred shareholders. And the firm can choose to pay the dividends in arrears.

It means that a firm won’t pay a dividend each year. Rather the due amount of dividend would accumulate over the period. And then the firm will pay the accumulated preferred dividends to the preferred shareholders. This feature of arrear payment is only available with the cumulative preferred stock. And the firm is legally obligated to pay off the previous year’s preferred dividend before paying the current year’s dividend.

Preferred stockholders typically receive the correct to preferential treatment regarding dividends, in exchange for the proper to share in earnings in far more than issued dividend amounts. Some preferred stockholders may receive the proper participation, during which their dividends aren’t restricted to the fixed rate of interest.

Information Sources: