Executive Summary

Prime Bank Limited is a second-generation private commercial bank established in Bangladesh in the year 1995 under the Companies Act, 1994. Since inception, it is committed to provide high quality financial services to the countrymen with a view to accelerate economic development of the nation.

The report prepared as a requirement of the internship program ,it is mainly focused on Corporate and consumer credit of PBL.I have segmented this report into some major part as First one: Introduction, Background of the study, objectives, Methodology and limitations of the study. Second one an overview of Prime Bank Limited Like as historical Background mission, vision and, a brief of PBL. Third one is Corporate &Consumer credit as definition of both, types of credit, documentation etc. Fourth one: Findings and analysis of the credit (Corporate &Consumer) credit disbursement sector wise, credit disbursement year wise. Credit recovery etc.

1.1 Introduction:

A banking institution is indispensable in a modern society. It Plays a vital role in the economic development of a country and forms the core of the money market in an advanced country. In recent times the banking sector over the world has been undergoing a lot of changes due to deregulation, technical innovation, globalization etc. Bangladesh banking sector is lagging far behind in adopting these changes. Bank plays an important role in the business sectors and in the industrialization of a country. Basically the banks take deposits from the customer against interest and lend it to the borrowers against interest cessation period. Under these circumstance of bank offers different interest rates and other options to the customers to remit and deposit their money. These options are very common among all the banks, but only the customer services and facilities vary from bank to bank.

In our country there are Govt. bank, semi Govt. banks, and private sector Commercial Banks of Bangladesh. The Banking Business started its crucial moment when Bangladesh economy was undergoing through massive economy reforms and pursuing unilateral and multinational trade liberalization with the backdrop of the World Bank Made International Monetary Fund (IMF) recommendations. The Prime Bank Limited with its ninety branches over the country is providing the best quality and services to the valued customer.

1.2 Background of the study:

Commercial banking sector plays an important role in mobilization of the countries scattered savings and channelizing the same into various desirable sectors of the national economy. The government policy of denationalizing same of the erstwhile Nationalized(Banks NCBs) and allowing the entrepreneurs or establishing of banks in private sector had been to create a competitive banking environment in order to achieve the objective of greater mobilization.

As I have perform an Internship in Prime Bank Limited ,Mouchak Branch .I have worked almost in every sector of the Bank Like General Banking ,Credit, Foreign Exchange ,Clearing etc.Though I m Supervised my Advisor Md.Mohsin to prepare a report on “Corporate Vs Consumer Credit”-A critical study on Prime Bank Limited (with special reference on Mouchak Branches

1.3 Justification of the study

In our economy, there are mainly three types of schedule commercial banks are in operation. They are Nationalized Commercial Banks, Local Private Commercial Banks and Foreign Private Commercial Banks. Prime Bank has discovered a new horizon in the field of banking area, which offers different General Banking, Investments and Foreign Exchange banking system. So I have decided to study on the topic “A Critical Study of Credit Operation of Prime Bank Limited”. Because the Internship program of the university is an integral part of the BBA program. So it is obligatory to undertake such task by the students who desirous to complete and successfully end-up their BBA degree. This also provides an opportunity to the students to minimize the gap between theoretical and practical knowledge. During the internship program the teachers of the department are attached to actively and constantly guide the students.

Students are required to work on a specific topic based on their theoretical and practical knowledge acquired during the period of the internship program and then submit it to the teacher. That is why I have prepared this report

1.4 Objectives of the study:

The main objective of the study is to analyze the performance of corporate and consumer credit of prime Bank Limited. To achieve this main objective the following sub objectives have been undertaken:

I. To give a theoretical framework of Corporate and Consumer Credit.

II. To measure the corporate credit disbursement during the 2009 of PBL (Mouchak Branch).

III. To identify the problems related to Credit Disbursement faced by PBL..

IV. To know the different types products under Corporate and Consumer Credit.

- Prepare a Recommendation for developing an ideal platform for a proper Credit Operation Process

1.5 Methodology of the study:

To achieve the set of objectives of the study secondary data have been used during 2008 to 2009 .these data were collected from the annual reports and website of PBL.Though a number of techniques are available to appraise the performance of a bank, but in this study we have used the relevant approach of credit.

Primary Sources of Data:

Collecting data directly from the practical field is called primary sources of data. The method that will be used to collect the primary data is as follows:

- Face to face conversation with the intuitional client &Customers.

- Face to face conversation to the customer on random basis.

- Discussion with officials Prime Bank Mouchak Branch.

Secondary Sources of data:

- The secondary data will be collected from the accounts of prime bank limited .To clarify different conceptual matters, internet and different articles published in the journals magazine will be used.

- Annual Reports of Prime bank limited.

- Other Published documents of Bangladesh bank.

1.6 Limitations of the Study:

The major limitations which I have found for conducting this study are:

i. Like any other research, this report is limited to time and resource and only three months are not enough to cover such area of banking as well as preparing this report which may takes more than a year.

ii. Lack of adequate information of banking institution for preparing this report. So this report is based on only publicly available information.

iii. Lack of experience has also acted as constraints for the exploration of the topic. Extensive analysis of all the finance and banking concept is not possible due to enlarge and diversification of the topic.

iv. Although bankers have tried their best to help me, their nature of job is such that gives them little time to discuss.

v. As I was the only one person, this report seriously suffered manpower constraints for a vast research.

2.1 Background of Prime Bank Ltd:

During the booming years of the banking industry of Bangladesh a group of highly successful local entrepreneurs conceived an idea of floating a commercial bank with different outlook. As pre their views the idea was competence, excellence and consistent delivery of reliable service with superior value products. Consequently, Prime Bank Ltd. was created and commencement of business started on 17 – April 1995. The founders are well reputed tycoons of Bangladesh in the field of trade and commerce and their stake ranges from diversified business sectors of the country.

The Bank offers almost all kinds of Commercial Corporate and Personal Banking services covering all segments of society within the framework of Banking Company Act and rules and regulations laid down by our central bank.

It has already made significant progress within a very short period of its existence. The bank has been graded as a top class bank in the country through internationally accepted CAMEL rating. The bank has already occupied an

Enviable position among its competitors after achieving success in all areas of business operations so far.

Prime Bank Ltd. has consistently turned over good returns on Assets and Capital. Until the year 2007, the bank has achieved an operating profit of Tk. 3257 million and its capital funds stood at Tk 6382 million. Out of this, Tk. 2659.21 million represents reserves and retained earnings and Tk. 2275 million consists of paid up capital by shareholders. Even after the business environment and default culture, quantum of classified loan in the bank is very insignificant and stood at less than 1.35%. The bank’s current capital adequacy ratio of 11.50% is in the market.

Finally, Prime Bank Ltd. has already made significant progress within a very short period of its existence. The bank has been graded as a top class bank in the country through internationally accepted CAMEL (Capital, Asset, Management, Earnings and Liquidity) rating. The bank has already occupied an enviable position among its competitors after achieving success in all areas of business operation.

2.2 Company Vision:

Every Company has their own vision. By fixing vision they can set their future growth. Prime Bank Ltd has its own vision to be leader in the banking industry.

To be the best Private Commercial Bank in Bangladesh in terms of efficiency, capital adequacy, asset quality, sound management and profitability having strong liquidity.

2.3 Company Mission:

To build Prime Bank limited into an efficient, market driven, customer focused institution with good corporate governance structure. Continuous improvement in business policies, procedure and efficiency through integration of technology at all levels.

Brief Profile of Prime Bank Limited |

1. Date of Incorporation : 12th February, 1995

2. Date of Inauguration of Operation : 17th April, 1995

3. Name of the Chairperson of the board : Mr. Ajam J Chowdhury

4. Name of the Managing director : Mr. M. Ehsanul Haque

5. Number of Branches : 84

6. Number of Employees : 1500

7. Publicly Traded Company : Share quoted daily in DSE & CSE

8. Credit Card : Member of Master Card

9. Banking Operation System : Both Conventional and Islamic Banking System.

10. Technology Used : Member of SWIFT On line Banking

UNIX based Computer System

11. Head Office : Adamjee Court Annex II, 119120 Motijheel C/A, Dhaka-1000. Phone: 9567265 (PABX) Telex: 642459 PRIME BJ 671543 PBL MJ B

Fax: 88-09567230/956097 E-mail: primebank@bangla.net

Web Site: www.prime-bank.com

SWIFT: PRBLBDDH

2.5 Network of the Branch:

The bank established its business on 17th April 1995. The first branch was opened at Motijheel area in Dhaka. Now the total number of branches will be 71 at the end of the year 2008. PBL divided its branches network into six zones i.e. Dhaka, Chittagong Khulna, Rajshahi, Sylhet & Barisal Arena with 38, 14, 2, 6, 10 & 1 branch respectively among these branches, 25 of them have been licensed by Bangladesh bank as Authorized Dealers in Foreign Exchange.

Dhaka Zone:

Motijheel

Foreigm Exchange

IBB Dilkusha

Mohakhali

Kawranbazar

Mouchak

Elephant Road

Gulshan

Bangshal

Narayangonj

Gonakdari

Moulvi Bazar

Uttara

Satmasjid Road

New Eskaton

Madhabdi

Banani

Islamic Banking Branch

Pragatisarani

Shimrail

Panthapath

Dhanmondi

Asad gate

Tongi

SBCTower

Mirpur- 01

Tangail

Asulia

Bijoy Nagor

Ring Road

Pallabi

Bashundhara

Joypara

Adamjee EPZ

Bhairab

Mynensingh

Sylhet Zone

Sylhet

Islamic Banking Branch

Court Road

Beani Bazar

Upashar

Tajpur

Bishwanath

Sreemangal

Subid Bazar

Bare Lekha

Chittagong Zone

Jubliee Road

Agrabad

Khatungonj

IBB Pahartoli

Fatikchari

Laldighi

Hathazari

Cox’s Bazar

Feni

Comilla

Raojan

Offshore Banking Unit

Prabartak More

Rajshahi Zone:

Rajshahi

Bogra

Naogaon

Rangpur

Dinajpur

Chapai Nawabgonj

Barisal Zone

Barisal

Khulna Zone

Khulna

Jessore

2.6 Main Products of prime Bank Limited.

2.3 Products and Services

Prime Bank Limited offers various kinds of deposit products and loan schemes. The bank also has highly qualified professional staff members who have the capability to manage and meet all the requirements of the bank. Every account is assigned to an account manager who personally takes care of it and is available for discussion and inquiries, whether one writes, telephones or calls.

Deposit Products

Contributory Savings Schemes (CSS)

Under this scheme Minimum size of the monthly installment is Tk.500.00 and multiples of Tk.1000.00. Maximum installment size shall be 25000.00 for five year period. Lump sum amount shall be paid after maturity or monthly pension shall be paid for the next 5 years according to size of deposit.

Lackhopati Deposit Scheme:

Under this scheme size of the monthly installments are Tk.250.00, Tk.500.00, Tk1285.00, Tk.2400.00 depositor will receive Tk.1,00,000.00 after a number of period depending on installment size .Higher the installment size lower will be the maturity period .

Prime Millionaire Scheme:

This scheme is similar as Lackhopati deposit scheme only the installment amounts is larger and at maturity depositor will get 10, 00,000.00.

Education Savings Scheme (ESS):

Under this scheme parents can save for their children’s education by paying a certain amount of monthly installment and Lump sum amount shall be paid after maturity.

Monthly Benefit Deposit Scheme (MBDS):

Under this scheme customer can deposit a fixed amount of money for five years .The amount has to be 100,000 or multiple of 100,000 he / she will receive 900 per month as interest on every lac during those five years.

Double Benefit Deposit Scheme (DBS) :

Under this scheme a customer can keep a fixed amount of money for six year end of the maturity period the amount will become double .The amount has to be multiple of 25000.

Fixed Deposit Receipt Scheme (FDR):

Under this scheme customer can devote a fixed amount of money for one month, three months, six months or twelve months for interest rate of 7.5%, 11% or 11.5%.

Current Account:

Current Account is a non interest bearing checkable deposit (Demand Deposit) which allows the owner of the bank accounts to write checks to third parties.

Savings account:

Savings Account is an interest bearing checkable deposit (Negotiable order of withdrawal) which allows the owner of the bank accounts to write checks to third parties.

Loan and Advances Products:

Loan and advances have primarily been divided into two major groups:

Fixed term:

These are the loans made by the Bank with fixed repayment schedules. Fixed tern loans are categorized into three based upon its tenure which is defined as follows:

Short term : Up to 12 months

Medium term : More than 12 and up to 36 months

Long Term : More than 36 month

Continuing Loans:

These are the loans having no fixed repayment schedule, but have an expiry date at which it is renewable on satisfactory performance of the customer. Furthermore, all categories of loans are accommodated under the following prime sectors:

Agriculture: Credit facilities to the customers of doing agro business falls under this category.

Term Loan to Large & Medium Scale Industry: This category of advances accommodate the medium and long term financing for capital formation of new Industries or for an existing units who are engaged in manufacturing of goods and services.

Term Loans to Small & Cottage Industries: These are the medium and long term loans allowed to small & cottage manufacturing industries. No short term or continuous credits will be included in this category.

Working Capital: Loans allowed to the manufacturing units to meet their working capital requirements, irrespective of their size – big, medium or small, fall under this category. These are usually continuous credits and as such fall under the head “Cash Credit”

Export Credit: Credit facilities allowed to facilitate export of all items against Letter of Credit and/or confirmed export orders fall under this category. It is accommodated under the heads “Export Cash Credit (ECC)”, Packing Credit (PC), Foreign Documentary Bill Purchased (FDBP) etc.

Commercial Lending: Short term Loans and continuous credits allowed for commercial purposes other than exports fall under this category. It includes import financing for local trade, service establishment etc. No medium and long term loans are accommodated here. This category of advance is allowed in the form of (i) Loan against Imported Merchandise (LIM), (ii) Loan against Trust Receipt (LTR), (iii) Payment against Documents (PAD), (iv) Secured Overdraft (SOD), (v) Cash Credit etc. for commercial purposes.

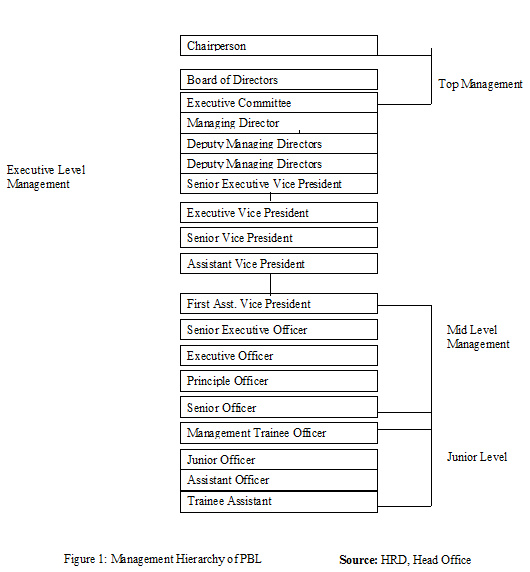

Prime Bank limited is a public limited company. The shareholders are the proprietors of the banks. There are 22 members of the Board of Director who are managing the total management & Human Resources of the bank. Among them 18 members are directly elected by the shareholders for two years. At present, Mr. Ajam J. Chowdhury is the chairperson of PBL & the Managing Director of this bank is Mr. M. Ehsanul Haque. The chairperson & Managing Director both are the members of this bank. The chairman of the bank is the head of the Board of Directors. The main function of the Board of Directors is to formulate policy. From the top to the bottom management body of Prime Bank Limited can be divided into four levels:s

Top Level Management

Executive Level Management

Mid Level Management

Junior Level Management

2.8

A Brief of Prime Bank Limited, Mouchak Branch

Among the Seventy one Branches of Prime Bank, Mouchak Branch is one of the most reputed and respected Branches in all aspects. From the very beginning, this branch is contributing a lot to the bank. A brief of Prime Bank Limited, Mouchak Branch is given below:

Manager: Hasan Mohiuddin Bhuiyan, Executive Vice President

Manager (Operation): Abdul Motaleb Bhuiyan Vice President

Credit in Charge: Sharmina Banu, Assistant Vice President

Foreign Exchange in Charge: Mst.Maleka Ferdousi Khanam Senior Executive officer

General Banking in Charge: Muradur Rahman Pathan (Executive officer)

Total number of employees: 24

Prime Bank Mouchak Branch has three main departments, which are –

General Banking Department

Credit Department

Foreign Exchange Department

3.1 Section 1: Theoretical Aspects of Credit:

Definition:

Credit is defined as confidence in a borrower’s ability and intention to repay. People use the credit they have with financial institution, business, and individuals to obtain loans. And they use the loans to buy goods and services.

The credit a person has typically determines how much they will be permitted to borrow, for what purpose, for how long, and at what interest rates.

Credit is general sense means an act of allowing person or person’s immediate use of money with payment deferred until an agreed future date

However, lending money is not without risk and therefore banks make loans and advances to farmers, traders, businessmen and industrialist against either tangible (land, building, stock etc.) or intangible security. Even then, the banks run the risk of default in repayment. Therefore, the banks follow cautious measures while lending money to others. This core function of a bank is performed by the Credit Department of the bank. In this case, the relationship of bank and customer is that of the creditor and debtor.

3.2 Types of Credit Facilities

Depending on the various nature of financing, all the credit facilities have been brought under two major groups: (a) Funded Credit and (b) Non-funded Credit. Under non-funded credit, there are basically two major products namely Letter of Credit and Letter of Guarantee.

Under Funded Credit, there are the following products:

Loan (General)

Short, Medium & Long term loans allowed to individual/firm/industries for a specific purpose but for a definite period and generally repayable by installments fall under this type. These are mainly allowed to accommodate financing under the categories (I) Large & Medium Scale Industry and (ii) Small & Cottage Industry.

Housing Loan (Commercial)

Loans allowed to individual/enterprises for construction of house for commercial purpose only fall under this type. The amount is repayable by monthly/quarterly installments within a specified period.

Home Loan

Loans allowed to individuals for purchase of apartment or construction of house for residential purpose fall under this type. The amount is repayable by monthly installments within a specified period.

House Building Loan (Staff)

Loans allowed to the employees of PBL for purchase of apartment/construction of house shall be known as House Building Loan (Staff) or HBL (Staff).

Lease Financing

Lease Financing is one of the most convenient sources of acquiring capital machinery and equipment whereby a customer is given the opportunity to have an exclusive right to use an asset usually for an agreed period of time against payment of rental.

Consumer Credit Scheme (CCS):

It is a special credit scheme of the Bank to finance purchase of consumer durable by the fixed income group to raise their standard of living. The loans are allowed on soft terms against personal guarantee and deposit of specified percentage of equity by the customers. The loan is repayable by monthly installments within a fixed period.

SOD (Financial Obligation):

SOD (Financial Obligation) is allowed to individuals/firms against financial obligations (FDR, MBDS, and Scheme Deposits of PBL or similar products of other banks). This is a continuous loan having usual maturity period of 1 (one) year and renewable for further periods at maturity.

SOD (General)

SOD (General) is allowed to individuals/firms for miscellaneous purpose. This is a continuous loan having usual maturity period of 1 (one) year and renewable for further, periods at maturity.

SOD (Work Order)

Advances allowed against assignment of work order for execution of contractual works falls under this type. This advance is generally allowed for a definite period and specific purpose. It falls under the category “Others”.

SOD (Export):

Advance allowed for purchasing foreign currency for payment of Back to Back (BTB) L/C liability where the exports do not materialize before due the date of import payment. This is an advance for temporary period and categorized “Export Finance”.

PAD

Payment made by the Bank against lodgment of shipping documents of goods imported through L/C falls under this type. It is an interim advance connected with import and is generally liquidated against payments usually made by the customer for retirement of the documents towards release of imported consignment from the customs authority.

LIM

This is funded credit facility allowed for retirement of shipping documents and release of goods imported through L/C taking effective control over the goods by pledge in go downs under Bank’s lock & key. This is a temporary advance connected with import which is known as post-import finance and falls under the category “Commercial Lending”.

LTR

Advance allowed for retirement of shipping documents and release of goods imported through L/C falls under this type. The goods are handed over to the importer on trust with the arrangement that sale proceeds will be deposited to liquidate the loan account within the specific time.

ECC

Funded credit facility allowed to a customer for export of goods falls under this type and is categorized as “Export Cash Credit”. The advances must be liquidated out of export proceeds within 180 days.

Packing Credit (P.C.)

Advance allowed to a customer against bills under BTB L/C and/or firm contract for processing/packing of goods to be exported falls under this type and is categorized as “Export Credit”. Packing Credit must be adjusted from proceeds of the relevant exports within 180 days.

FBP

Payment made to a customer through Purchase or Foreign Currency Cheques/Drafts falls under this type. This temporary advance is adjustable from the proceeds of the cheque/draft.

3.3 Credit Monitoring Process

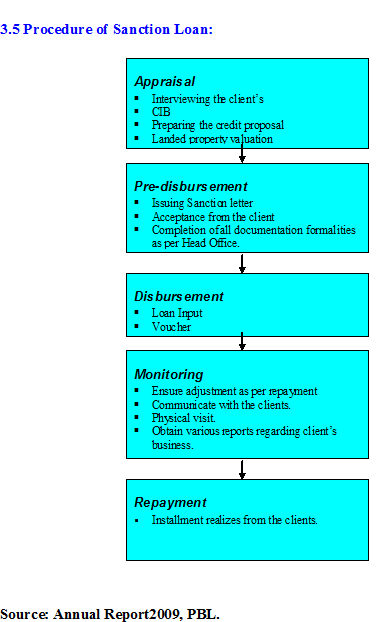

Credit monitoring process starts immediately after disbursement of the facility. The customers start repayment the loan from the next month. Simultaneously, Branch relationship Officer starts monitoring the loan on site basis. If the officer finds any deviation to the terms and conditions of the loan or borrower’s wealth, he/she sends an Early Alert Report to the Corporate Banking Division. An Early Alert Account is the one that has risks or potential weakness requires monitoring, supervision or close attention of the management. After having the Early Alert Report, Credit Administrative Division monitors the loan on an off-site basis and thereby reports the Credit Risk Management Division to take necessary action. On the other hand, if any clients fail to pay three monthly installments simultaneously, the Relationship officers reminds the clients through phone calls, reminds later or visit in person where necessary.

3.4 Mode of Recovery

To remove the financial burden bank’s recovered the loan amount along with interest through monthly installment. Generally these amounts are round figure and during the determination of the installment amount bank consider the payment ability of the client. The entire loan amount shall be paid into equal monthly installment throughout the loan period. Any excess or shortage has adjusted with last installment. Dues shall be recoverable in the following manners:

a) In equal monthly installments.

b) The monthly installment shall be payable by the 8th of every month, but the first installment shall be payable by the 8th of the subsequent month of disbursement.

c) Through deduction from the monthly salary of the client wherever applicable, by his employer. In this regard the concerned employee shall authorize irrevocably his employer to deduct the said amount from his monthly salary. The client can only revoke this authority with the concurrence of the bank.

3.6 : Section 2: Corporate Credit/term Credit of the Bank:

3.7 Main Product under corporate Credit:

Corporate credit viz corporate banking is the central of all lending operations of Prime Bank limited .As major part of the Banks asset portfolio falls under this segment of credit, several strategic business units (SUBS) are working under the umbrella of corporate banking division namely (1) General Credit Unit, (2) Export finance Unit 3) Lease Finance Unit 4) Syndications and Structured Finance Unit 5) Industrial Project Finance Unit etc.

A brief description of Banks corporate banking activates by its major SUBs during the years is summarized below:

Commercial Loans:

Accounts for one –half of corporate lending with the largest share of the corporate lending and includes a complete range of banking services covering commercial lending, working capital loans, and trade finance (documentary credit and post –import finance). Under this segment, the bank has provided supports to large and reputed business in Bangladesh engaged in commodity trading, financing infrastructures (roads, bridges transportation etc.) and numerous industrial ventures.

Export Finance:

Next to inward remittances, proceeds from export of countries products and services is the main sources of foreign exchange earnings for the country .Export financing accounts for a considerable portion of Banks lending portfolio, and the bank is providing s complete banking solution to its export oriented customers through its twenty –five (25) authorized dealer (‘AD’) branches two off-shore banking units. Bangladesh performed better than anticipated during 2008-2009 securing an export volume growth of 10.31 percent from that of the previous year, and bagging proceeds of USD 15.8billion.out of total exporting customers of the bank.

Loan Syndications:

The bank has already passed ten (10) successful years of loan Syndication as a lead arranger, the first local private commercial bank in Bangladesh to rejoice such an accomplishment .The bank has so far arranged syndicated loans for highest number of projects (total twenty) including two (2) very important projects in telecommuting and ceramic sectors during 2009 .The telecommunication company financed in 2009 got one of the two interconnection exchange( ICX ) licensees granted in the private sector till date pursuant to the International long distance Telecommunication Service (ILDTS)policy 2007.

Project Financing:

The bank has always supported pioneering and non conventional undertaking and had kept its project financing window open and accessible during the year 2009 to support entrepreneurship, innovative ideas and commercially, economically and environmentally rewarding ventures. Project finance solely by the bank ,other than those arranged and covered by Syndication and Structured finance ,Export finance and General Credit Unit ,include fifty (50) in numbers and exceeds tk.6000 million in volume ,covering industrial ,energy ,social and physical infrastructure and information technology sectors. During the year 2009,the has financed implementation of the only private sector International Internet Gateway (IIG) project Pursuant to the international long distance Telecommunication Services (ILDTS)policy 2007.

Environment- Friendly Project:

The bank financed establishment of a 35000 m^3/day central effluent treatment plant by a joint venture company on a 16000 sft-land located at Dhaka Export processing Zone to treat the effluent produced by the industries located therein.PBL has also provided support for establishment and operation of a handful of effluent treatment plants for readymade garments and Dyeing projects /companies, continued its support to its existing 31 CNG refueling station projects.

Credit card:

Very stiff competition prevails in credit card market .Many player’s have entered the market and competition is growing .Prime Bank limited started credit card operation in 1999 by introducing Master Card and is nor a principal member of both worldwide accepted plastic money network i.e. Master card and VISA thus positioned itself with strong footing within the industry .It expends various services to the credit card customers viz issuance of supplementary card ,free insurance coverage ,longer interest free period ,etc. The bank provides 24 hours services to the credit card customers.

\In 2009 PBL has successfully upgraded Card pro version 5 from version 3.3 to provide better services to the customers .The bank introduced “Birthday Gift “during anniversary an service month and launched “Eid discounts Campaign “for the first time for the customers .PBL also reintroduced co –branded credit card with one reputed foreign bank in Bangladesh

Term Loan:

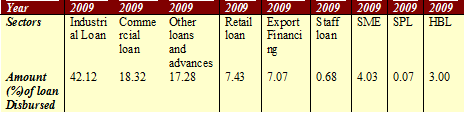

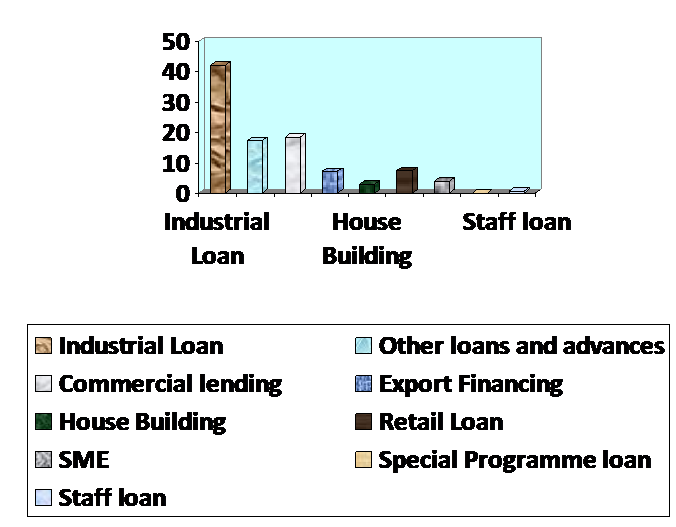

The followings are PBL provides last year in different sectors:

Source: Prime bank Limited, Annual Report 2009

The above graph shows that, the Prime bank Limited has disbursed the highest amount in industrial sector and minimum in Staff loan in the year of 2009.

3.10 Year wise Credit Disbursement:

The above graph indicates that in 2006 the credit disbursement is above 150 crore but decreased in 2007 and then it is gradually increased and crossed200 crore in 2010 up to may.

3.11 The user of corporate credit:

The Corporate Credit is a credit which is given to the user at a large scale .So the user of the corporate credit must be the corporate body and corporate organization.

1. The person of corporate firm.

2. The Developing company

3. The Transportation company

4. The Poultry Industry

5. The garments industry

6. The Medicine Industry

7. Electronics Machinery Industry

8. Any other industry Except Tobacco Industry.

There are two types of industry on the basis of performance is called performing and non performing credit.

Performing Credit:

The Performing Credit is the credit in which the installments are collected within the due time of payment. If the loan Installments is collected on the day of installments at every period is called performing Credit or performing loan.

Non -performing Credit:

The non- performing credit is the credit which is not collected within the due time of payment at every period is called non performing credit. And if any body’s amount shows the overdue is called non -performing credit.

Table:

| Steps | Duration | Category |

| MSA(Special Mention A/C) | More than 3 Months | Non performing |

| SS(Substandard) | More than 6 Months | Non performing |

| DF(Doubtful) | More than 12 Months | Non performing |

| BD(Bad &Loss) | More than 18 Months | Non performing |

Source: Credit Department, Prime Bank Limited (Mouchak).

3.13 Consumer credit/Retail Credit:

A bank like Prime Bank Limited that goes with superior brand equity and a unique brand tag line “a bank with a difference”, putting supreme emphases on retail business has an untapped potential to generate value. This potential of retail banking can be traced while thinking about the lines of business in an innovative way. An effort by retail banking to explore the untapped may help induce those, who wait to save money to buy their desired life-style at a future time to come and avail the retail banking services. Retail banking can play a very significant role in this respect by expanding the principles of opportunity cost, marginal and incremental and time value of money against the utility of the desired house –holds.

In view of the potentials of Retail Banking in Bangladesh, PBL is focusing on expansion of retail Loan /Consumer credit during last couple of years.PBL achieved a very strong growth of 46.89 percent during the year 2009.there are number of products for the customers viz.home loan (Swapna neer),Consumer loan(House hold Durables),Car loan Doctors Loan ,Loan against Salary etc.

3.14 Types of consumer credit/Retail credit:

Like other types of banks the PBL has provide a numerous number of retail credit or loan to their valued customer.

The loan which is given to the small customer or enterprise is shown below:

1. Home loan (Swapna Neer)

2. Consumer loan (House Hold Durables),

3. Doctors Loan

4. Loan against salary

5. Education Loan

6. Marriage Loan

7. CNG Conversion Loan

8. Hospitalization Loan

9. Any purpose Loan

10. Travel loan

11. HouseBuilding Deposit Scheme

Main Product under Consumer Credit:

Home loan (Swapna Neer):

. Household loan is sanctioned for household durables to purchase. The maximum loan limit sanctioned for this purpose is Tk.500000. The age limit of the borrower must be between 21-60 year (at the time of repayment). Maximum Loan Period is four years. Down payment is 10%.

3. Doctors Loan:

If you have minimum graduation in allopathic medical science/dentistry then you are eligible to apply.

Loan Limit: Up to tk.10, 00,000.

Loan period: Maximum 5 Years.

Easy Repayment: Equal monthly installments within the loan period.

4. Loan against salary:

PBL has introduced Loan against salary. The maximum loan limit sanctioned for this purpose is Tk.300000. If the eligible applicant is a bank holder of PBL then he will get eight times higher of his/her take total take home salary per month at a maximum. The age limit of the borrower must be between 21-65 year (at the time of repayment). Maximum Loan Period is three years.

5. Education Loan:

Prime bank offers the education Loan for higher education. To be eligible the applicant should have a bank account in any bank with in Bangladesh and should have satisfactory transaction. The age limit of the applicant must be between 25-60 year (at the time of repayment). Maximum loan sanctioned for this purpose is 5 lac. Maximum loan period is 4 year.

6. Marriage Loan:

Prime Bank’s marriage loan enables people to organize and celebrate the marriage in style. . The eligible applicant’s monthly income must be between Tk.10000-Tk. 25000. Besides, the age limit of the borrower must be between 25-65 year (at the time of repayment). The maximum Loan Period is three years.

7. CNG Conversion Loan:

The age limit of the borrower must be between 21-65 year.(at the time of repayment)Eligibility borrower can avail the facility to purchase more than one article but the amount of total loan shall not exceed the maximum limit fixed by Head office from time to time. Further loan may be allowed to the same borrower if 50% of the previous loan is recovered from him but the same shall not exceed the maximum limit. Like car loan, its down payment is also 10%. The loan is sanctioned for one and half year at a maximum.

8. Hospitalization Loan:

Prime bank, provide quick and convenient Hospitalization Loan for all medical emergency. With easy repayment option through equal Monthly Installments, money wills never a casualty in crises.

Eligible Criteria:

1. Age limit between 25-60 years.

2. Salaried person i.e.

Loan Limit:

90% of the estimated treatment cost up to a maximum of tk.5, 00,000.

Loan Period:

Maximum 2 Years.

9. Any purpose Loan:

Any purpose includes the type of loan which cannot be classified to any other category. . To become eligible for availing the facility the applicant’s monthly income must be minimum Tk.10000-12000. . The age limit of the borrower must be between 25-65 year. (at the time of repayment). Maximum loan sanctioned for this purpose is 3 lac. Only this loan is sanctioned in cash. Maximum loan period is 3 year.

10. Travel loan:

. This loan is to facilitate for those who loves to travel. For travel purpose, any self employed or service holder can apply for this loan scheme. . The eligible applicant’s monthly income must be between Tk.10000-Tk. 25000. The age limit of the borrower must be between 25-65 year (at the time of Repayment). The maximum loan limit sanctioned for this purpose is Tk.200000. Maximum Loan Period is three years.

12. Car Loan:

. If the applicant is a service holder then the applicant’s monthly income must be at least Tk.20000 and if the applicant is a business man then the income must be at least TK.40000. The age limit of the borrower must be between 25-60 years. The down payment of the loan must be 10%. Car Loan only sanctioned for the cars manufactured in Japan. . The loan is sanctioned for six years at a maximum.

Here the maximum in provides for car prupose, then any purpose loan, the minimum loan is disbursed for the purpose of Travel and Marriage.

3.17 Year wise loan Disbursement:

Amount in crore:

Source: PBL, Annual Report 2009.

The above graph shows that the disbursement of corporate credit in the year 2006 is over 20 crore and it increased gradually from 2006-2010(May).and it peaks up to 120 crore and above,

3.18 Documentation

3.19 Types of Documentation:

Documents related to securing loans and advances are classified into the following 2 (Two) categories:

Charge documents are preformatted and printed required to create charge on securities against loans and advances and the documents are provided by the Bank to the client for execution.

Legal documents are legal papers provided by the client certifying the legal status of the borrower, borrowing power, title to goods and property; legal deeds and power of attorney related to creation of charge on securities.

Charge Documents:

a) Demand Promissory Note

b) Borrowing Resolutions

c) Letter of hypothecation

d) Power of Attorney

e) Letter of Arrangement

f) Letter of Revival

g) Trust Receipt

h) Counter Guarantee

CHAPTER: 5

PROBLEM, RECOMMENDATIONS&CONCLUSION

4.1 Problems regarding credit:

Customer’s perspective:

The customers are always wants to get a loan high loan with minimum cost of capital or with a minimum rate of interest. But besides the customer are not always repay their installments in due time of every period. Sometimes they are failed to repay the installments at fixed time so the relationship between the Banker and customer are suspended.

Market perspective:

The Corporate credit is the large amount of credit. So the Disbursement of the credit is less frequent when the money market is not in a sound position .i.e. when the market faces financial crises. the money market are not always stable so on the time of sanctioned loan the bank cant increase or decrease the rate of interest instantly. So the problem is arising.

Competitor’s perspective:

The problem is also raised within the competitors when a Bank decrease the interest rate without the prior consents of the scheduled another bank. The customers are in confusion when the interest rate is different from one Bank to another Bank .So the problem is consists within the competitors.

Legal perspective:

The credits are given on the basis of some criteria of the government. So anybody who is interested to take a loan from the Bank, are to face some legal problems. The problems arise when the Banks wants a bank Guarantee from the user of the credit.

A lump sum amount is to pay to purchase a Government authorized Stump in which the rules and regulations are mentioned. It’s a contract between t banker and the customer. If the customer doesn’t pay the money back the bank can sued against the customer on the basis of Stumps signature.

4.2 Recommendations:

As I have gone through some departments, I have come up with some points, which can improve the efficiency as well as quality of the work. The points are as below;

Setting proper planning for each and every work as well as for the whole department.

Increase the remuneration package for the employee.

Reduce the service charge for account and other service charge.

Designing jobs on priority basis.

Assigning necessary manpower for every job.

Proper Credit Planning and Management.

Monitor the loan sanction process carefully.

Proper maintenance of files and necessary files and documents on daily basis.

Proper managerial observation and cooperation.

Avoiding duplication through accuracy and efficiency.

Developing motivational program and training program.

Borrower Selection carefully.

Follow Five Cs in Borrower Selection.

Appropriate Financial Analysis of Borrower’s Business.

4.3 Conclusion:

This report is an effort to reflect a clear idea about the strategies, activities and difference performances of Prime Bank Ltd. regarding its commercial activities with a special reference to Credit management or Business. The researcher was assigned it in the Mouchak Branch of Prime Bank Limited (PBL) as an intern. I present this report on the basis of the knowledge and experience gained during the internship period of twelve weeks. Throughout the report my objective is to seek and find out the main reasons of this prosperity / success of Prime Bank Limited. Lending is a heart of a commercial Bank. It has two types of loans and advances. Both of them are profitable assets for a bank to competitive in the market. But the condition is that loan or advances must have the quality and quantity. It is therefore, indispensable for a Bank to have a well thought policy for executive to perform its lending operation. This report contains the overall policy and various stages of Corporate and Consumer Credit Operation

To identify the success of any organization it is required to give keen sight in each section of the work place. In any Bank there are three sectors these are general banking, credit section and foreign exchange. Of them the most important sector is credit and the main task is credit operation and credit management. The global success or failure of the Bank as a whole depends on it. Also with this general banking has got special importance, because without sufficient deposits no bank will be able to sanction the credit facility to its various clients and earning profits. General banking consists of customer services and deposits collection and credit section consists of utilizing this huge amount of deposits properly. Credit section has gone several frequent steps. These are: Credit Planning, Borrower Selection, Financial Analysis of Borrower’s Business, Scoring, Sanction of Credit, Monitoring, Classification, and Provision. With other things the main important part of credit operation is borrower selection. There are five important factors to select the borrower. These are known ad five Cs. These are Capital, Character, Collateral, Capacity, and condition of the borrower. The financial viability of the customer has got significant importance. That’s why different techniques are used to justify the borrower’s financial position.

Prime Bank is an emerging bank. The bank has only completed a decade of banking services. At the initial stage of business, every institution has to go through the difficult path of survival. To achieve the confidence of the customers, the bank must execute some improvements in its marketing and operational areas – Prime Bank Ltd should try to win customers faith by providing them efficient and dependable services, credit facility and updating with user friendly modern technologies. The bank should redesign all sorts of banking procedures to be more user-friendly, attractive and impressive.

Prime Bank limited started with a vision to be the most efficient financial intermediary in the country and it believes that the day is not far off when it will reach its desired goal. Prime Bank Limited looks forward to a new horizon with a distinctive mission to become a highly competitive modern and transparent institution comparable to any of its kind at home and abroad.

![Report on Overall activity on AB Bank ltd [part-1]](https://assignmentpoint.com/wp-content/uploads/2013/04/ab-bank2-200x100.jpg)