1.1 ORIGIN OF THE REPORT:

The BBA program conducted by IBAIS University, Dhaka was already introduced in order to provide number of graduates in business sector. This program has been designed to facilitate the students and the executive to provide basic theoretical knowledge and practical in the job activities in the context of Bangladesh. Since the BBA Program is an integrated, practical and theoretical method of learning, the students of this program are required to have practical exposure in any kind of business organization last term of this course.

This report will be a requirement of the internship program for my BBA degree. The organization attachment started on August 20, 2008 and will end on November 20, 2008. My Organizational Supervisor Mr. Syed Fayzul Alam (Executive officer & Accounts In – Charge), Jamuna Bank Limited, Dilkusha Branch, Dhaka, assigned me the topic of my report. And My Academic Supervisor Dr. Md. ASIF KAMAL, Department of Business Administration, IBAIS University, Dhaka. The reason behind choosing this topic is that, to illustrate the activity of the host organization JAMUNA Bank Limited. This Bank has given emphasis on better customer service and more customer satisfaction and thus the customer service officer wants to get an idea of the current level of customer satisfaction at JBL.

1.2 OVERVIEW OF JAMUNA BANK LIMITED (JBL):

Jamuna Bank Limited (JBL) is a Banking registered under the Companies Act, 1994 with its Head office establisheded at Chini Shilpa Bhaban, 3, Dilkusha Commercial Area, Dhaka – 1000. The Bank started its operation from 3rd June 2001. The permission of the Central Bank converted in a full-fledged schedule for Jamuna Bank Ltd. in June 2001 with starting The Authorized Capital Tk.1600.00 million and Paid Up Capital of Tk. 390.00 million to serve the nation from a broader platform.

Banking system of Bangladesh has gone through three phases of development- nationalization, privatization and lastly financial sector reform. The Jamuna Bank Limited (JBL) is a highly generated operation with the rising Authorized Capital and Paid – Up Capital of Tk. 4,000.00 million and Tk. 1225.71 million respectively as of December, 2007. The company operated up to 2008 with Thirty – Six (35) branches (Including five Rural Branches & Two Islamic Banking Branches). And few branches are planned to be opened soon.

JBL undertakes all types of Banking transactions to support the development of trade and commerce of the country. JBL’s services are also available for the entrepreneurs to set up new ventures and BMRE of industrial units.

1.3 OBJECTIVE OF THE REPORT:

Objectively, obtaining the knowledge oriented with practical working level is obvious to be efficient. The report’s objective is to gather practical knowledge about general banking systems in Bangladesh. By Internship period, my target is to set an effective knowledge about “General Banking Activities of Jamuna Bank Limited” in my mind to help to complete my report. There are also some specific objectives for this report as follows:

- To appraise the General Banking function of The Jamuna Bank Ltd.

- To illustrate Financial Performance of the host organization (loan and advances, Deposit & Deposit Mix, Risk Management, Import & Export, Product & Services and also Foreign Remittance/ Exchange Operation).

1.4 METHODOLOGY OF THE REPORT:

In order to make the Report more meaningful and presentable, two sources of data and information have been used widely. The data collection method of this study consisted of both primary and secondary sources. Majority of the information was collected from secondary sources.

Data Sources:

- Primary sources: The primary sources include interviews with the concerned officers of the bank and also informal contact with the respective clients and customers..

- Secondary sources: The secondary sources of data are the annual reports, general reports, and official documents of the bank from the year 2007 & 2008.

1.4.1 The Primary Sources are as follows:

- Face-to-face conversation with respective officers and staffs of the bank who are giving the support to complete the report.

- Informal conversation with respective clients, whose are take the facility and how they act and behave with bank’s facility, help to finish the report.

- Practical work exposures form the different departments of the Branch covered.

- Relevant file study as provided by the officers concerned.

1.4.2 The Secondary Sources of data and information are:

- Annual Report (2007) of JAMUNA Bank.

- Periodicals published by Bangladesh Bank.

- Various book, articles, compilations etc. Regarding general banking functions, foreign exchange operations and credit policies.

1.5 SCOPE:

I have been already assigned in the Dilkusha Branch of JAMUNA Bank Limited. I have had an opportunity to gather experience by working in almost all departments under command of Executive officers and In – charge of all departments in the branch. The concerted area of concentration of this report is confined in investigating different aspects of the banking area as well as problems and prospects and by this way an endeavor is made to give recommendations for removing the problems.

The presentation of the organizational structure and policy of JBL and investigating the strategies applied by it provide the scope of this report. An infrastructure of the organization has been detailed, accompanied by a global perspective and look into the future. The scope of this report is limited to the overall description of the company, its services, and its position in the industry and its strategies. The scope of the study is limited to organizational setup, functions, and performances.

While preparing this report, l had a great opportunity to have an in depth knowledge of all the divisional work practiced by The Jamuna Bank Ltd. It also helped me to acquire a first hand perspective of a leading private bank in Bangladesh. The managers, Supervisors and employers are provided information to make this report. However, my topic is a broad and in reality it is hard to assess an organization, but I believed that without help of The JBL management I could not prepared this report. The JBL is the Leading private Bank in Bangladesh, is trying to reach better quality and minimize discrepancies.

1.6 LIMITATION:

The present study was not free from limitations. I was very fortune that I was given a lot of liberty to carry of my most of the everyday jobs. It helps me to prepare this report. However, it is a competitive market, the company was quite liberal in disclosing the confidential information to me for my report but it was expected of me to keep the confidential things at my discretion and at the same time, render as much information in the report as required. So, it is important to note that these limitations have somehow contributed in developing this report. The limitations are discussed briefly below:

- Respondents were reluctant to fill the questionnaire, which has impeded the preparation of the report.

- Validity of the report is subject to the reply of the respondent.

- In case of the secondary data collection, there were very few secondary information were available. There were few supporting books, reports, journals, etc. Moreover the branch office had very little of these information that is why, the bulk of it had to be gathered from the head office.

- Poor conception of the discussed group was another severe problem that created a lot of confusing regarding verification of the conceptual data. In some cases more than one person were interviewed to clarify each concept.

- Limitations of time were another one of the most important factors that influenced the present study. Due to time limitations many of the aspects could not be discussed in the report.

As the officers were very busy with their day-to-day work including myself, we could not discuss about The Jamuna Bank’s freely.

2.1 DEFINITION OF BANK:

“What is a Bank?” The answer to the questing might seem quite simple in reality; however, the answer is rather complicated, A bank offers various type of deposits account including the saving account to its customers and makes a variety of loans. It might argue then that a bank is an organization.

Two problems immediately come to mind with such a definition. Fist, organization other than commercial banks also provide these services. Like savings and loan association, savings bank and credit unions provide deposit and loan services that are virtually identical to those of commercial bank, and money funds and investment brokers such as Merrill Lynch also provide similar services. Second, banks do many things that are not included in the functions of offering deposits and loan services. They provide trust services, arrange merges and acquisition, and guarantee payment from one party to another through letters of credit and other devices.

Perhaps the best definition of a bank is the following, “A bank is an organization that has been given banking powers either by the state or the federal government”. Commercial bank has for many centuries played a vital role in the financial system. That vital role continued today, although, as with other financial institutions, the functions of commercial bank have changed as the needs of the economy have changed.

In this regard, imagine the entire range of financial services that exists in a modern economy. These services would certainly number in the hundreds, perhaps in the thousands. At a give time, government will allow banks to provide some of those services just because of the depositor’s safeties. As a result, we can conclude that commercial bank is an organization that ate giving loans from collecting funds to the depositions and earned interest form the loan that will be regulated by the central bank or either by permission of the central bank.

Involvement of the banking sector in different financial events is increasing day by day. At the same time banking process is becoming faster, easier and the banking arena is becoming wider. As the demand for better service increases the banking organizations are coming with innovative ideas. In order to survive in the competitive field of banking sector, all banking organizations are looking for better service opportunities to provide to those clients. As a result, it has become essential for every person to have some idea on the bank and banking procedure.

A student takes the internship program when S/he is at last leg of the bachelor’s degree; internship program brings a student closer to the real life situation and thereby helps to launch career with experience.

2.2 DOMESTIC ECONOMY OF BANGLADESH:

In the last couple of years there were macroeconomic stability and maintenance of positive trends of development in the country owing to governments’ efforts made in that direction. Bangladesh experienced remarkable reduction of poverty for expansion of micro credit all over the country. The micro credit system has already been replicated in around 150 countries across the world. Of 31 large developing countries Bangladesh has been identified by the World Bank as one of the most rapidly growing economies. Bangladesh has also been ranked above India and Vietnam in having conducive environment for doing business by World Bank in its report titled “Ease of doing Business”. Higher growth in industrial and service sectors contributed to the growth GDP of the country to 6.51 percent during FY 2006-07. Ongoing implementation of economic reform programs is likely to help the country maintain its growth. In FY 2006-07 per capita incomes was US $482 as against US $ 447 in the preceding financial year. Domestic resource to ADP was 56.47 percent during FY 2006-07 as compared to 50.23 percent in 2005-06 registering a slight rise. The govt. revenue income was estimated to be tk. 494720 million during FY 2006-07 in the revised budget which was Tk. 448680 million in the preceding financial year showing an increase of 10.26 percent. The growth in agricultural sector in 2006-07 is decline to 3.17 percent from 4.94 percent in the preceding financial year. The lowest estimate shows that there will be 1 (one) percent increase in production of food grains in 2006-07 over that of FY 20055 – 06. Share of agriculture, forestry and fisheries stood at 18.87 percent in 2006-07. In 2006-07, industrial and service sector contributed to GDP at the rate of 28.55 percent and 52.59 percent respectively. Within industry the contribution of manufacturing and construction sectors stood at 17.95 percent and 8.15 percent respectively in FY 2006-07. The proportions of domestic savings to GDP and investment to GDP were projected to be 20.46 and 24.33 percent in FY 2006-07 respectively against 20.25 percent and 24.65 percent in preceding financial year.

A number of measures have been taken by Bangladesh Bank for removing bottlenecks in sending remittances by wage earners from abroad. Steps have also been taken for facilitating remittance from major migrating countries through electronic fund transfer system. Different banks of the country have opened foreign remittance monitoring cell with a view to tracking inflows of remittances and removing hindrances to smooth flow of remittances. Tightening of AML campaign is helping to reduce money transfer through hundi and unofficial channel. Wage earners’ remittance increased to US $ 5987.47 million in 2006-07 from US $ 4801.88 million in the previous year, which accounts for 8.77 percent of GDP.

Price hike of a number of essential commodities persisted over the past few years causing higher inflation. The average inflation rate in 2006-07, was 7.2 percent as against 7.16 percent in the preceding year. Forex Reserve could be kept at Satisfactory Level during 2006-07 due to favorable growth of exports earnings and remarkable rise in remittance from expatriate Bangladeshis.

2.3 BANKS IN BANGLADESH:

| Sl.no | Name of banks | Inland branch | Abroad |

| A | Nationalized Commercial Bank | ||

| 1 | Sonali Bank Limited | 1313 | 7 |

| 2 | Janata Bank Limited | 897 | 4 |

| 3 | Agrani Bank Limited | 978 | — |

| B | Specialized Bank | ||

| 1 | Bangladesh Krishi Bank | 836 | — |

| 2 | Rajshahi Krishi Unnayan Bank | 300 | — |

| 3 | Bangladesh Shilpa Bank(Industrial) | 15 | — |

| 4 | Bangladesh Shilpa Rin Sangstha | 5 | — |

| 5 | Grameen Bank | 1110 | — |

| C | Private Commercial Bank | ||

| 1 | The City Bank Ltd | 84 | |

| 2 | Rupali Bank Ltd | 515 | 1 |

| 3 | Pubali Bank Ltd | 351 | — |

| 4 | Uttara Bank Ltd | 198 | — |

| 5 | Jamuna Bank Limted | 35 | — |

| 6 | Islami Bank Bangladesh Ltd | 100 | |

| 7 | National Bank Ltd | 66 | 1 |

| 8 | IFIC | 55 | 2 |

| 9 | United commercial Bank Ltd | 79 | — |

| 10 | Oriental Bank Ltd (ICB) | 33 | — |

| 11 | Prime Bank Ltd | 26 | — |

| 12 | Dhaka Bank Ltd | 15 | — |

| 13 | Al-Arafah Bank Ltd | 20 | — |

| 14 | South East Bank Ltd | 16 | — |

| 15 | Bank Of Small Inds & Commerce | 21 | — |

| 16 | Eastern Bank Ltd | 21 | — |

| 17 | National Credit & Commerce Bank | 27 | — |

| 18 | Social Investment Bank Ltd. | 8 | — |

| 19 | Dutch Bangla Bank Ltd | 38 | — |

| 20 | AB Bank Ltd | 68 | 2 |

| 21 | One Bank | ||

| 22 | BRAC Bank | ||

| 23 | Bank Asia | ||

| D | Foreign Commercial Bank | ||

| 1 | American Express bank | 2 | |

| 2 | Bank Of Cyelon | 2 | |

| 3 | Standard Chartered Bank | 15 | |

| 4 | Habib Bank Ltd | 3 | |

| 6 | State Bank Of India | 3 | |

| 7 | Muslim Commercial Bank | 2 | |

| 8 | Citi Bank NA | 6 | |

| 9 | ICICI | 4 | |

| 10 | Hanil Bank | 1 | |

| 11 | National Bank Of Pakistan | 1 | |

| 12 | HSBC | 6 | |

| 13 | Habib Bank AG Zurich | 1 |

Source: www.bangladesh-bank.org

2.4 CENTRAL BANK OF BANGLADESH.

Bangladesh bank is the Central Bank of Bangladesh. It was established on 16th December 1971 under the Bangladesh Bank (Temporary) Order No.1971 (subsequently substituted by the Presidential Order No.127 of 1972). The powers and functions of Bangladesh Bank are governed by Bangladesh Bank Order 1972 and Banking Companies Act1991.This central bank gives permission (also called license) to start operation of private sector Banking. Those banks need to another permission to operate foreign exchange business.

The function of the central bank classified into traditional and non-traditional functions:

Traditional Functions:

1. Issuance of Bank Notes. Coin 5/ Taka 5 to Taka500.

2. Act as a banker of the Government.

3. Acts as Banker’s Bank.

4. Policy Maker and Holder.

5. Bank Rate.

6. Open market operation.

7. Variable Reserve Requirements.

8. Controller of Foreign Exchange.

9. Auditor of the Banker.

10. Clearing Agent of the schedule Banks.

Non-Traditional Functions:

1. Socio-economic developer.

2. More Employment opportunity maker.

2.5 APPROVAL OF NEW BANKS:

Opening of the recently permitted new banks, without implementation of the needed reforms, could lead to unethical competition and horse-trading in the country’s troubled banking sector, according to the bankers.

Entry of new banks in the market under the present situation will lead to unethical competition and horse-trading in the banking sector. The problems like non-performing loans in the sector may also worst. The size of the market and the present state of economic activity did not provide adequate scope for business for a large number of banks with poor management and outdated operating systems.

Mr. Dr. Fakruddin Ahmed, Ex-governorBangladesh Bank echoed his views and said “Allowing the new banks, without restoring discipline and resolving their numerous problems, will create unhealthy atmosphere and unethical banking in the whole country.” The banks would obviously resort to unethical means of capturing or retaining business, such as undercutting interest or bribing official to attract government deposits. These would vitiate the atmosphere of the banking sector.

The International Monetary Fund (IMF) and the World Bank earlier asked the government to reconsider its decision to permit new banks without restoring discipline in the sector, crippled by huge amount of bad debts.

3.1 THE BANK:

Jamuna Bank Limited (JBL) is a Banking Company registered under the Companies Act, 1994 with its Head Office at Chini Shilpa Bhaban, 3, Dilkusha C/A, Dhaka-1000. The Bank started its operation from 3rd June 2001. Jamuna Bank Limited is a highly capitalized new generation Bank with an Authorized Capital and Paid-up Capital of Tk.1600.00 million and Tk.390.00 million respectively. The Paid-up Capital has been raised to 429.00 million and the total equity of the bank stands at 725.00 million as on June 30, 2005. Banking system of Bangladesh has gone through three phases of development- nationalization, privatization and lastly financial sector reform. The Jamuna Bank Limited (JBL) is a highly generated operation with the rising Authorized Capital and Paid – Up Capital of Tk. 4,000.00 million and Tk. 1225.71 million respectively as of December, 2007. Currently the Bank has 39 (Thirty Nine) branches 16 in Dhaka, 7 in Chittagong, 3 in Sylhet, 2 in Gazipur, 1 in Bogra, 2 in Naogaon, 1 in Munshigang, 1 in Shirajganj, 1 in Rajshahi and 1 in Narayanganj, 1 in Comilla (including 9 Rural Branches and 2 Islami Banking Branches).

The Bank undertakes all types of banking transactions to support the development of trade and commerce of the country. JBL’s services are also available for the entrepreneurs to set up new ventures and BMRE of industrial units. Jamuna Bank Ltd., the only Bengali named new generation private commercial bank was established by a group of winning local entrepreneurs conceiving an idea of creating a model banking institution with different outlook to offer the valued customers, a comprehensive range of financial services and innovative products for sustainable mutual growth and prosperity. The sponsors are reputed personalities in the filed of trade, commerce and industries.

The operation hour of the Bank is 9:00 A.M. To 5:00 P.M. from Sunday to Thursday with transaction hour from 9:00 A.M. to 3:00 P.M. The Bank remains closed at Friday and Saturday including government holidays.

3.2: VISION:

To become a leading banking institution and to play a pivotal role in the development of the country.

3.3 MISSION:

The Bank is committed to satisfying diverse needs of its customers through an array of products at a competitive price by using appropriate technology and providing timely service so that a sustainable growth, reasonable return and contribution to the development of the country can be ensured with a motivated and professional work-force.

3.4 CORPORATE SLOGANS:

Your Partner for Mutual Growth.

3.5 JBL CORPORATE CULTURE:

Employees of JBL share certain common values, which help create a JBL culture:

- The client comes first.

- Search for professional excellence.

- Openness to new ideas and new methods to encourage crativity

- Quick decision making

- Flexibility and prompt response

- A sense of professional ethics

3.6 OBJECTIVE:

- To earn and maintain CAMEL Rating ‘Strong’

- To establish relationship banking and improve service quality through development of Strategic Marketing Plans.

- To remain one of the best banks in Bangladesh in terms of profitability and assets quality.

- To introduce fully automated systems through integration of information technology.

- To ensure an adequate rate of return on investment

- To keep risk position at an acceptable range (including any off balance sheet risk).

- To maintain adequate liquidity to meet maturing obligations and commitments.

- To maintain a healthy growth of business with desired image.

- To maintain adequate control systems and transparency in procedures.

- To develop and retain a quality work-force through an effective human Resources Management System.

- To ensure optimum utilization of all available resources

- To pursue an effective system of management by ensuring compliance to ethical norms, transparency and accountability at all levels.

3.7 STRATEGIES:

¨ To raise up Paid up capital and Statutory Reserve Fund i.e. Regulatory Capital up to Tk. 2000.00 million by June 2009.

¨ To manage and operate the Bank in the most efficient manner to enhance financial performance and to control cost of fund

¨ To strive for customer satisfaction through quality control and delivery of timely services

¨ To identify customers’ credit and other banking needs and monitor their perception towards our performance in meeting those requirements

¨ To review and update policies, procedures and practices to enhance the ability to extend better service to customers

¨ To train and develop all employees and provide them adequate resources so that customers’ needs can be reasonably addressed.

¨ To promote organizational effectiveness by openly communicating company plans, policies, practices and procedures to employees in a timely fashion

¨ To cultivate a working environment that fosters positive motivation for improved performance

¨ To diversify portfolio both in the retail and wholesale market

¨ To increase direct contact with customers in order to cultivate a closer relationship between the bank and its customers.

3.8 SPONSORS:

The sponsors of Jamuna Bank limited are successful leading entrepreneurs of the country having stakes in different segment of the national economy. They are eminent industrialist and businessman having wide business reputation both at home and abroad.

3.9 MANAGEMENT:

The Bank is being managed and operated by a group of highly educated and professional team As Mr. Md. Motior Rahaman (Managing Director), Mr. M.A. Salam (Additional Managing Director) & also Mr. Md. Alauddin Al – Azad (Deputy Managing Director) with diversified experience in finance and banking. The Management of the bank constantly focuses on understanding and anticipating customers needs. The scenario of banking business is changing day by day, so the bank’s responsibility is to device strategy and new products to cope with the changing environment. Jamuna Bank Ltd. has already achieved tremendous progress within only Seven years. The bank has already ranked at top of the quality service providers & is known for its reputation.

3.10 INTERNAL CONTROL SYSTEM:

With a view of reviewing and evaluating internal control system the bank has an internal Control & Compliance Division managed by experienced and efficient personnel. There are three departments under the division namely Audit & Inspection Dept., Compliance Dept. & Monitoring Dept. In order to have an effective internal control system the audit & Inspection Department conducts internal audit of branches once in a year and special and snap audits at periodical intervals. The Compliance department ensures compliances with regulatory instructions and policies of the bank. The Audit Committee of the Board of Directors reviews and evaluates the reports of Internal Control and Compliance Division Periodically and suggests measures to be taken for ensuring effective internal control system. Branches are also send Quarterly Operations reports to the Management on time which are reviewed and scrutinized by the Internal Control and Compliance Division.

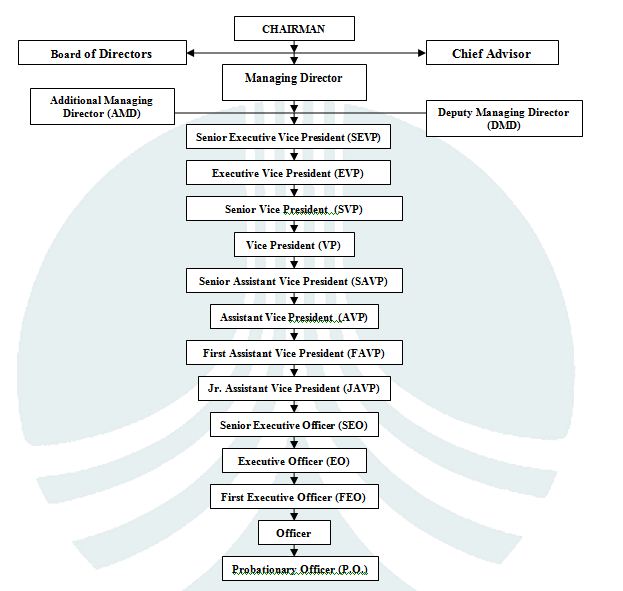

3.11 MANAGEMENT STRUCTURE OF JBL:

3.12 HUMAN RESOURCE MANAGEMENT & DEVELOPMENT:

JBL recognize the importance of employee participation in the maintenance of standards and general well being of the organization. Success of a bank depends on its employees working together as a team for the interests of banks. JBL’s banking strategy is to provide excellent service to it clientele through a highly motivated and engaged people. The management believes in having a strong and vivacious workforce to take a bank the path of shining progress. JBL draws from the best available training programs and faculty both international and domestic to meet its training and environment needs and establish globally benchmarked skills and capabilities. JBL’s human resources policy and practice are designed to secure the goodwill, motivation, commitment and contribution of all employees to achieve mission and objectives of the bank. The bank has an established and well recognized policy of encouraging employee involvement through communications and consultation on a wide range of uses. Wherever possible, employees are invited to participate in multi disciplinary quality and process improvement activities. The bank has already allocated a space to establish a well recognized Training Institute, where internal or external trainers will conduct bank’s in house training programs and such programs will designed to continuously upgrade itself within the latest development in the banking as well as information technology (IT).

JBL always have the view to hiring the best people both from local and foreign banks and to recruit talents through competitive exams and implementing programs to develop and retain high quality human resources. JBL has well thought policies for the welfare of its employees, like provident fund, gratuity fund, superannuation fund, car loan, house building loan etc. JBL’s Human resources management policy is to identify the right combination of skills, knowledge, behavior and values and divert them from the welfare of the Bank, themselves and the country as whole. The training Institute started its journey from September, 2006. It has imparted training to about 529 officers of different levels of the bank in year 2007.

A brief of the programs and workshops conducted in 2007 by the Training Institute is given Next Page:

SL No. | SUBJECTS | No of Participants |

| 01 | Orientation of Banking Operations | 66 |

| 02 | Credit Monitoring & Supervision & Recovery | 40 |

| 03 | Training on New Version of FLORA BANKING SOFTWARE | 45 |

| 04 | Credit Operation And Management | 16 |

| 05 | Relationship Management in Marketing | 16 |

| 06 | Foreign remittance Rules & Procedures | 14 |

| 07 | Financial Analysis for Credit Officers | 36 |

| 08 | Basel II Capital Accord | 35 |

| 09 | Anti Money Laundering Campaign | 100 |

| 10 | International trade finance & Foreign Exchange Operation | 16 |

| 11 | Credit Risk Grading System | 18 |

| 12 | Law Practice of Banking | 14 |

| 13 | Loan Documentation and Allied Issues | 33 |

| 14 | UCPDC600 | 30 |

| 15 | Basic of Banking Operations (General Banking) | 50 |

| TOTAL | 529 |

3.13 RATINGS:

Credit Rating Information and Services limited (CRISL) upgrades the rating of Jamuna Bank Limited (JBL) to “A” and reaffirms short term rating to ST – 3. The above rating has been done on the basis of the bank’s good fundamentals such as capital adequacy, superior asset quality, introduction of real time online banking, moderate profitability, comfortable liquidity position and limited market share. The above rating is moderated to some extent by increase in NPL, high cost of fund, corporate governance, dependency on term deposit etc.

CRISL has submitted their report as under:

| LONG TERM | SHORT TERM | |

| Current Rating 2008 | A | ST – 3 |

| Previous Rating 2007 | BBB+ | ST – 3 |

| Outlook | STABLE | |

| Date of Rating | 30 JUNE, | 2008 |

Financial Institution rated in this category is adjudged to offer adequate safety of timely repayment of financial obligation. This level of rating indicates a corporate entity with an adequate credit profile. Risk factors are more variable and greater in periods of economic stress than those rated in the higher categories. The Short term rating indicates good certainty of timely payment. Liquidity factors and company fundamentals are sound. Although ongoing funding needs may enlarge total financing requirements, access to capital markets is good. Risk factors are small.

3.14 PRODUCT & SERVICE:

Jamuna Bank offers different types of Corporate and Personal Banking Services involving all segments of the society within the purview of rules and regulations laid down by the Central Bank and other regulatory authorities. Alongside traditional Banking products and services the Bank has some tailor made product in liability and asset sides. Of those mentionable are Monthly Savings Scheme, Monthly Benefit Scheme, Double Growth Deposit Scheme, Triple Growth Deposit Scheme, Marriage Saving scheme, Education Saving Scheme, Lacpati Deposit Scheme, Kotipati Deposit Scheme, Millionaire Deposit Scheme and also for deposit mobilization in one hand and Consumer Credit Scheme, lease Finance, personal loan for women, Shop Finance, SME Finance etc.

The bank already introduces some new product for the respective customers in October, 2008. The bank expands their product in a very short time with some extra ordinary deposit schemes. The Product lines are as follows: Pension Deposit Scheme, Haazz Deposit Scheme, Abashon Deposit Scheme, Car Deposit Scheme, Rural Deposit scheme, Households Durable Deposit Scheme, Small Savings Scheme and also Travel deposit Scheme etc.

◘ Services Of JBL

►Corporate Banking:

The motto of JBL’s Corporate Banking services is to provide a personalized solution to our customers. The Bank distinguishes and identifies corporate customers’ need and designs tailored solutions accordingly. Jamuna Bank Ltd. offers a complete range of advisory, financing and operational services to its corporate client groups combining trade, treasury, investment and transactional banking activities in one package. Whether it is project finance, term loan, import or export deal, a working capital requirement or a forward cover for a foreign currency transaction, our Corporate Banking Managers will offer you the accurate solution. Our corporate Banking specialists will render high class service for speedy approvals and efficient processing to satisfy customer needs.

►Personal Banking

Personal Banking of Jamuna Bank offers wide-ranging products and services matching the requirement of every customer. Transactional accounts, savings schemes or loan facilities from Jamuna Bank Ltd. make available to all a unique mixture of easy and consummate service quality. They make every endeavor to ensure their clients’ satisfaction. Their cooperative & friendly professionals working in the branches will make your visit and enjoyable experience.

3.15 INFORMATION TECHNOLOGY(IT):

Use of technology for providing prompt service to customer is inevitable for a service industry like Bank. This Bank has a strong conviction of applying information technology in their operation for ensuring prompt but accurate service to their customers. All its branches are connected on – line. The Bank gives the ATM facility to its customers. The bank has become a principal member of Visa International. This bank already introduced Debit card, Credit Card and also the Tele Banking. They are contemplating to introduce Internet Banking, SMS Banking, in wide range with in a short period, which are running in limited areas. It helps the management to belief that, these would take this organization to a newer height in auto banking services.

3.16 CORPORATE GOVERNANCE:

It is so much difficult to have self assessment of the status of corporate governance when there is no code of conduct and principles of business in place. But this Bank strive to practice and follow standard principles for ensuring corporate governance and we are in constant efforts for adhering to the rules, regulations and guidelines of regulatory authorities like SEC and Bangladesh Bank. It’s external auditors have been given absolute freedom in the process of audit and to verify compliance. It’s Board Members have participated in different workshops and seminars at home and abroad on corporate governance. They always try to give adequate disclosure in their Financial Statement and Reports so that the customers and investors are in a position to informed decision on borrowing and investment. Stakeholders’ interest is taken care of

3.17 CORPORATE SOCIAL RESPONSIBILITY:

In Jamuna Bank Limited, it’s always committed to the cause of humanity and fulfilling the social responsibilities. As a part of this commitment JBL contributed, Tk.0.50 million to AtishDipankerUniversity. Also, in winter season distributed more than 30 (thirty) thousands new blankets amounting to Tk. 4.35 million among the distress people, which is another example of the bank for serving the mankind. The bank already established “Jamuna Bank Foundation” and with foundation it will carry out more corporate social responsibilities. Besides, the Bank donated Tk. 5 million to the Chief Advisor’s Relief Fund for flood affected people and Tk. 2.5 million to the Army Chief of staff’s Fund for helping the SIDR affected people. The whole organization stood besides distressed people by way of distributing the relief materials to the flood affected & SIDR hit people from the funds raised by donating a part of our employees’ salary.

3.18 ISLAMIC BANKING BRANCH:

Along with conventional banking JBL carries on Islamic banking operation through two branhes one at Nayabazar, Dhaka and the other at Jubilee road, Chittagong. Islamic shariah principles as followed in carrying out banking operation through these branches and their operations are supervised through suggestions and guidance of the Shariah Board. The accounts of Islamic Banking Branches are separated from conventional branches.

JBL shariah Board consist of 06 (six) members, who are eminent Fakih, economist and bankers. In the meetings of Shariah Board all aspects of Islamic banking branches operation are discussed and directions are issued for compliance. Besides, Muraquib of the Bank monitors the activities of Islamic Banking branches. To provide professional service to our customers, the bank regularly provides training on Islamic banking to its employees.

3.19 RISK MANAGEMENT:

As a regulatory body Bangladesh Bank wants all bank to take effective measures for implementation of risk management in banking operations covering the major risks in asset – liability management, credit risk management, foreign exchange risk management, Internal control and compliance and Money Laundering Prevention. As these risks are integral parts of banking business JBL has put highest priority of such risk with intense monitoring of credit portfolios. We believe these will improve our operational and financial performance along with meeting the regulatory requirements. The bank is constant efforts to establish superior monitoring of credit risks and returns. For bringing harmonious matching between assets and liabilities ALCO reviews these on a regular basis for keeping risk in this area to an acceptable level. The bank pursues an effective internal control system by establishing systems and procedures for scrutinizing the transactions periodically, encompassing key back up supports and commissioning regular contingency plans.

3.20 CORRESPONDENT RELATIONSHIP (INTERNATIONAL):

JBL has so far established relationship with most leading international banks in107 countries through 715 correspondents to cover all important financial centers of the world. The bank endeavors to increase its network of correspondent relationship with more overseas banks, financial institutions to cater to the needs of customers globally. Drawing arrangements with overseas exchange house have already been established for bringing in home remittances through banking channel. Efforts are underway to expand correspondent relationship further to facilitate the bank’s growing foreign trade transactions.

3.21 ONLINE BANKING:

Banking business now in modern days has become a competitive in respect of line of products and quality of service. In JBL, they realize that if they do not adopt the latest technology in operation and adapt to the atmosphere arising out of technological development they would lag behind. Having in mind a far-reaching vision for improving their services and bringing in excellence in operation and satisfy customers’ need in better manner. By set up “FLORA BANK ON-LINE BANKING SOFTWARE”, switching software, servers, ATM, data storage system and other hardware to setup equipped data center in Computer Divisions bears testimony of their commitment to adoption of latest technology. The customers of JBL are in a position avail of world class banking services locally at are reasonable cost through fully automated on-line banking system.

The Main features of JBL on-line banking are as follows:

Centralized Database

Internet Banking Interface

Platform Independent

ATM Interface

Real Time any Branch Banking

Corporate MIS Facility

Delivery Channel of JBL On-Line Banking as follows:

¨ Branch Network

¨ ATM Network

¨ Tele-Banking Network

¨ SMS Banking Network

¨ Internet Banking Network

¨ POS (Point Of Sales) Network

The Bank offering Q-Cash, Omnibus (BRAC), DBBL (Dutch Bangla), VISA enable ATM for ensuring 24 hours banking service. Customers can transact round the clock through ATMs and any Point of Sales located in the country.

The Features of ATM are:

¨ 24 hours banking

¨ Account Transfer

¨ Balance Inquiry

¨ Cash Withdrawal

¨ Utility Bill Payment

Retail Purchase By the POS(Point of Sales) Network

3.22 CHALLENGE & STRATEGY:

JBL see themselves as a compliant but effective player in the country’s financial system. They contemplate to shift their exposure to SME and Retail Lending to significant extent for diversifying their Loan portfolio. Its strategy to grow in areas of core competence will remain and alongside we would expand our activities in SME and Micro-Finance. For furtherance of Inflow of foreign currency they would continue their endeavor for mobilization of wage earners’ remittances by their overseas presence through reputed exchange houses. They have already introduced VISA card as an extension to the existing debit card, credit card, SME and remittance services. The growth of the banking industry poses challenges for this sector. In order to face the ensuing challenges, the Bank will industrialize corporate governance together with culture, sound risk management policies and stringent monitoring procedure.

3.23. FUTURE THRUST OF JBL:

- Full on-line banking.

- Introducing more innovative products and services.

- Opening new branches including Islami banking branch.

- Dealing Room Service for Corporate Customers and high net worth individuals.

- Expansion of business network at home and abroad.

3.24.1. Important Information About Dilkusha Branch:

- Establishment: Dilkusha Branch was established at 14th February, 2002, in Shadharon Bima Corporation Building. 33 Dilkusha Commercial Area (Ground Floor & 1st Floor.)

- In Dilkusha branch Account Opening, Cash, Clearing, Remittance department are in ground floor and Dispatch, Accounts, Credit and Foreign Exchange departments are in 1st floor.

- Number of Employees: This branch is maintained by about 48 officers.

- Name :Key Persons of the Dilkusha Branch are given below:

MANGER : Mr.Md. Safiqur Rahaman (S.E.V.P)

2nd MANAGER : Mr.Md. Nazmul Hossain (S.V.P)

Credit Incharge : Mr. Engr. Md. Anisuzzaman (SAVP)

Import Incharge : Mr. Md. Kamaluddin (SAVP)

Export Incharge : Mr. Syed Md. Abu Yusuf (FAVP)

GBD Incharge : Mr. Mominul Abedin (AVP)

Export : Mr. Humayun Kabir (JAVP)

Clearing Incharge : Mr. A.M. Arifur Rahman (JAVP)

Accounts Incharge : Mr. Syed fayzul Alam (EO)

Cash Incharge : Mr. Md. Soruar Jahan (SEO)

3.24.2 Performance of Dilkusha Branch: As On 30th November, 2008

| Total deposit | Tk. 226,41,40,520.79 |

| Investment (Loan & Advances) | Tk. 199,40,02,092.53 |

| Total Fixed Assets | Tk. 1,11,32,922.87 |

| Income | Tk. 29,77,50,918.41 |

| Expenditure | Tk. 22,77,91,735.50 |

| Total Assets | Tk. 356,10,76,918.41 |

| Total Liabilities | Tk. 356,10,76,918.41 |

Total Number of Deposited Accounts in Dilkusha Branch – 8973 as on 30th November, 2008.

Total Number of Accounts in Dilkusha Branch- 9533 as on 30th November, 2008

3.25 LIST OF JAMUNA BANK’S BRANCHES WITH CODE NUMBER & ALSO GIVEN THE HEAD OFFICE CODE:

Code | Name of Branch |

0999 | Head Office |

0001 | Mohakhali Branch |

0002 | Sonargaon Road Branch |

0003 | Moulvi Bazar Branch |

0004 | Goala Bazar Branch |

0005 | Agrabad Branch |

0006 | Dilkusha Branch |

0007 | Beani Bazar Branch |

0008 | Sylhet Branch |

0009 | Shantinagar Branch |

0010 | Gulshan Branch |

0011 | Dhanmondi Branch |

0012 | Nayabazar Islami Banking Branch |

0013 | Mohadevpur Branch |

0014 | Naogaon Branch |

0015 | Khatungonj Branch |

0016 | Konabari Branch |

0017 | Bhatiyari Branch |

0018 | Foreign Exchange Branch |

0019 | Jubliee Road Islami Banking Branch |

0020 | Chistia Market Branch |

0021 | Bogra Branch |

0022 | Baligaon Bazar Branch |

0023 | Narayangonj Branch |

0024 | Motijheel Branch |

0025 | Rajshahi Branch |

0026 | Basurhat Branch |

0027 | Dholaikhal Branch |

0028 | Bahaddarhat Branch |

0029 | Sirajgonj Branch |

0030 | Banani Branch |

0031 | Ashulia Branch |

0032 | Mawna Branch |

0033 | Dinajpur Branch |

0034 | Kushtia Branch |

0035 | Kadamtali Branch |

0036 | Aaganagar Branch, Keranigonj |

0037 | Uttara Branch |

0038 | Comilla Branch |

0039 | Azadi Bazar, Fotikchori, Chittagong |

4.0. GENERAL BANKING ACTIVITIES:

General banking of any commercial bank deals primarily with accumulating the deposits which are recognized as the heat of banks. Along with fund accumulation, banks do invest the funds in different sectors of the economy and ensure the circulation of the same from the surplus unit to the deficit unit of the economy. General Banking is the heart of Banking. Most of the important task is done here. Here money collection procedure occurs. There are mainly five parts in General banking activities.

The general banking of JAMUNA Bank Ltd. can be visualized with the help of the following diagram:

These are –

- Account Opening section.

- Cash Section.

- Clearing and Transferring Section

- Remittance Section

- Accounts Section.

4.1. ACCOUNT OPENING:

Account opening is one of the foremost important activities of a commercial bank. By opening an account a person become a customer of the same bank. It is a legal contract with the bank and the customer and the account opening form is the document representing the rights and responsibilities of both the parties. This section of the bank can be considered as the door of the banking system. Deposit is life-blood of a commercial bank. Since commercial banks deal with public money, without business there is no business for the bank and so does the case of JAMUNA Bank. The various accounts of the bank are described bellow:

Individual/ joint

¨ Account opening form as applicable duly filled in.

¨ Specimen Signature Card.

¨ Two photographs duly attested by introducer.

¨ Nominee Form (if nomination given by the account holder).

¨ Mandate or Authority Form (if a third person is authorized to operate the account).

Proprietorship Firm

¨ Account Opening Form.

¨ Specimen Signature Card.

¨ Copy of Trade License

¨ Two photographs duly attested by introducer.

¨ Proprietorship Rubber Stamp against all signatures of the proprietor.

Partnership Concern

¨ Account Opening Form.

¨ Specimen Signature Card.

¨ Copy of Trade License

¨ Partnerships Deed

¨ Two photographs of each partner duly attested by introducer.

¨ Partnership Rubber Stamp against all signatures of partners operating the accounts.

¨ Partnership letter.

Private Limited Company

¨ Account Opening Form.

¨ Specimen Signature Card.

¨ Copy of Trade License.

¨ Copy of Memorandum and Articles of Association duly attested by the Managing Director/ Chairman of the Co.

¨ Certificate of Incorporation.

¨ List of Director as per return of Joint Stock Company with signature.

¨ Resolution of the Board for opening account with the bank.

¨ Photographs of each of the authorized signatories.

Public Limited Company

¨ Account Opening Form.

¨ Specimen Signature Card.

¨ Copy of Trade License.

¨ Photograph of Directors and account operators other than Director.

¨ Certified copy of Memorandum and Articles of Association.

¨ Certificate of commencement of business.

¨ List of Directors as per returns of Joint Stock Company with their signature.

¨ Resolution of the Board for opening account with the Bank.

¨ Certification of incorporation.

Corporation/ Autonomous Bodies/ Govt. Organization

¨ Account Opening Form as applicable.

¨ Specimen Signature Card.

¨ Copy of the Act or Ordinance Showing authority to open account.

¨ Letter from the authorized persons in absence of the Board.

g. Power Of Attorney:

A copy of power of attorney will be taken and entered in the Power of Attorney Register in serial order. The Serial number is to be noted along with Banks name on the Power of Attorney. Original may be returned and the copy to be attached with A/C opening form.

4.1.1 Procedures of Opening An Account:.

Proper introduction serves as a precaution against fraud and forgeries and safeguard against inadvertent overdraft to bank. Obtaining proper introduction may absolve the banker from the charges of negligence for conversion. So, while opening a new account, emphasis would be given without exception to introductory reference and inquiry. The following instruction to be followed while opening account: –

For opening a bank account of individual either singly or jointly, passports and identity cards may be accepted for introduction, but subsequently proper introduction may be obtained.

Introduction of account by members of the staff may be allowed but shall be discouraged as far as possible.

An Account shall preferably be introduced by another Current Account holder acceptable to bank.

Introduction of Account holder of other branch may be accepted with caution. In that case the introducer’s signature must be verified by authorized officer of that branch and authenticated by a forwarding letter.

Photographs of account holder must be attested by the introducer.

Letter of thanks be issued to introducer in Bank’s standard specimen.

4.1.2. Deposits:

Types of Deposit Accounts:

The branches may accept deposits from the public in the following accounts:

A. Current Deposits

B. Savings Bank Deposits

C. Fixed Deposits (Term Deposit)

D. Short Term Deposits

E. Monthly Term Deposits

4.1.2. A. CURRENT DEPOSIT ACCOUNT (CD):

a) Current Deposit Account:

JBL opens current accounts for its clients to facilitate their day-to-day operations. The amount deposited in the current account can be withdrawn at any time. No interest is given on the current account. In certain cases, however, interest is available at an agreed rate where withdrawals are subject to a written notice for a specified period. The minimum balance requirement for this account is Tk. 1000/- and Tk. 250/- is deducted from the account in case of closing the current account.

4.1.2. B. SAVINGS BANK DEPOSIT ACCOUNT (SB):

The bank provides savings account services for the case of its clients. It offers both personal and corporate savings accounts to its clients in every branch. The current rate on the deposit amount is 6% and minimum balance requirement is Tk. 500/=.

Rules and regulation for opening Savings Account:

- Account may be opened in the name of any audit individual or jointly who is/are mentally sound and also jointly in the names of two or more persons payable to either or both or all of them or to the survivor or survivors.

- Savings Bank Account may be opened in the name of a minor also.

- A suitable introduction is required for opening the A/C.

- Account opening formalities like Current Account should be followed.

- Savings Bank Account should not be allowed to be operated like Current Account

- Bank shall provide monthly-computerized statement of accounts to account holders instead of passbook.

4.1.2. C. SHORT TERM DEPOSIT ACCOUNT (STD):

Deposits held in this account are payable on short notice. Normally corporate bodies, bank and financial organizations invest their funds temporarily. Now-a-days, private individuals having sound financial means also open this type of deposit accounts. Short term deposit account interest is calculated at daises and its interest rate is 7.00 %.

Documents required for opening short term deposit:

- Two copies of pass port size photo.

- TIN number

- An introducer who has an account in JBL, Dilkusha branch.

- Trade license.

- Ward commissioner or chairman certificate.

Every day, authorized officer check out which (MSS,FDR, STD) account interest has to pay. He credit voucher for interest excise duty. On every (MSS, FDR, STD) account holder has to paid 105 govt. tax, another interest. Here authorized officer issued one debit voucher and one credit voucher

4.1.2. D. FIXED DEPOSIT ACCOUNT (FDR):

Fixed term deposit (FDR) application form has been used both for application form and as a credit voucher for the bank. In case of FDR specimen signature card used and client give three signatures on the specimen card. In the case of FDR it is clearly mention that when this amount will be withdrew account holder receive principle amount plus interest. FDR account holder gets a FDR slip that is provided by the JBL officer. FDR slip contains name of account holder, deposited amount, And interest, and time of maturity. If depositor withdrew his money before maturity date he does not get any interest. If account holder lost FDR slip then indemnity bond is required to issue a duplicate FDR slip. FDR account can be open by individually or joint name, In the case of FDR holder death, his nominee will get the amount.

| Duration | Interest Rate | |

| For 1 month, less than 3 month | 10% | |

| For 3 months | 12.50% | |

| From 6 months up to 1 year | 12.50% | |

| 1 year | 12.50% | |

| 2 years and Above | 12.50% |

4.1.2. E. MONTHLY TERM DEPOSITS: Schemes offered by Jamuna bBank Limited:

- lakhpati Deposit Scheme (LDS)

- Kotipati Deposit Scheme (KDS)

- Monthly Benefit Scheme (MBS)

- Monthly Savings Scheme (MSS)

- Education Savings Scheme (ESS)

- Millionaire Deposit Scheme (MDS)

- Marriage Deposit Scheme.

- Double Growth Deposit Scheme (DGDS)

- Triple Growth Deposit Scheme (TGDS)

- Pension Deposit Scheme (PDS)

- Haazz Deposit Scheme(HDS)

- Abashon Deposit Scheme (ADS)

- Car Deposit Scheme (CDS)

- Rural Deposit scheme(RDS)

- Households Durable Deposit Scheme (HDDS)

- Small Savings Scheme (SSS) and also

- Travel deposit Scheme (TDS).

4.1.3. CHEQUE BOOK:

A cheque is a bill of exchange drawn of a specified banker and not expressed to be payable otherwise than on demand. It uses withdrawals and payments to third party by the customer. It contains 10 – 20 leaves for savings account while for current account is 25/50 or 100 leaves. A cheque book issuing register is maintained in this regard. This register contains the cheque book number, leaf number, issuing date. After giving these entries to this register, information are send to the computer department for taking necessary steps to pass the cheques during withdrawal.

Issuance of Cheque Book:

- The cheque book also contains requisition slip, which is used by the customer to obtain new cheque book. When all the leaves are used, the customer to obtain new cheque book when all the leaves are used, the customer submits this slip to the ban k. A senior official then issues a new cheque book and subsequent entries are given in the register and in computer.

- When a cheque book is required by the new customer, the cheque requisition slip posted on top of each cheque book is to be signed by GB In-charge. The officer also responsible for verified the signature with the application form and also the Signature Card which signed by the customer and also authorized by the respective officers.

- The requisition slips also send to the Computer Terminal for posting in favor of respective Account number.

- In case of Dormant Account, the party will call the manager personally for identification purpose. The Manager on being satisfied about the bonafides of the applicant will allow issuance of a new cheque.

- When the book is issued through bearer , his signature must be attested by the a/c holder on the request letter. The requisition will however be filled and signed by the a/c holder.

If the cheque book is lost then the customer must inform the police and should take a copy of general diary (GD). The customer then fills an indemnity from guarantying that the cheque is lost. When the banks are convinced with having the above documents bank gives the customer a new cheque book.

Dishonor of Cheque:

Cheque is dishonor for following reasons which are identified below: -

– Drawer signature differs.

– Insufficient Balance in Account

– Cheque is post dated.

– Amount in ward and figures differs.

– Cheque crossed “Account payee only”.

– If crossed cheque does not presented through.

– Payment stopped by drawer.

– Validity date (with in 6 months)

– Over writing

– Signature required.

4.1.4. CLOSING OF AN ACCOUNT

The closing of an account may happen for different reasons. The account holder(s) may request for closure of his/ their account with the bank. On receipt of such letter of request for closure of account, the Manager should ascertain the reasons to satisfy himself that the constituent is not severing his relations for grievance from the bank which may possibly be redressed. If for genuine reason the account holder(s) approach for closure of his/their account, the following steps shall be taken:

If the customer is desirous to close the account.

If JBL finds that the account is inoperative for a long duration.

If garnishee order is issued by the court on JBL.

The Manager shall approve closure of the account and ascertain liability position (if any) and closing charges at prescribed rate to be recovered

After closure of the account, “Account Closed” Stamp shall be affixed on the account opening form, S.S. Card and in the Account Opened and Closed Register with date under signature of an authorized officer.

To close the account, the cheque book is to be returned to the bank, JBL takes all the charges by debiting the account and the remaining balance is then paid to the customer. Necessary entries are given to the account closing register and computer.

4.2. CASH

Cash is treated to be the most sensitive and vital issue particularly in a bank. Of all the functions undertaken by the staff members and officers of a bank, the handling of cash is regarded as the most risky and calls for strict protection and supervision. The place where cash is kept in a bank is known as STRONG ROOM or VOLT. The withdrawal and deposit from in the bank will be entered to the cash book, the entire being cheeked and balanced initialed by both head cashier and the supervising official.

Generally financial intuitions like commercial Banks pool fund form people in form deposit and invests these fun in other economic activities by the extending credit to different manufacturers and trading organizations which are properly known as loans.

4.2.1 Cash Received:

Cash may be deposited either by deposit Slips for SB/ CD/ CC accounts or by other credit voucher like single credit voucher, pay order/ Draft/ T.T. application forms. Branches shall ensure the following:

Cash receiving officer shall check the deposit slip/ credit voucher/ application form as to its title of account, number and amount in words and figures.

The cash currency notes shall be counted physically /by cash counting machine as per denominations of the currency notes on the back of the voucher /deposit slip. The officer will enter the particulars in the cash Receiving Register and sign on the related deposit slip/voucher and affix “Cash Received” Stamp with date. He/she shall write the amount in words and figures in red ink across the deposit slip/voucher/ application form in token of receipt of the money. He /She shall send the register along with the deposit slip/voucher for signing on the same and authenticating the receipt in the register by the in-charge of the department.

The officer in-charge shall retain the original of deposit Slip and other vouchers and send them to respective desk for postings/actions. The duplicate voucher (counter foil) shall be handed over to the depositor/client.

At the close of business the cash receiving officer shall add all the entries in the register and if agreed with the actual cash received by him, shall hand over the register for checking by officer-in-charge.

Receiving Cash officer will hand over the cash to the entire cash in-charge duly checked by him.

4.2.2 Payment of Cash:

Cheques, Cash Debit Vouchers, Fixed Deposit Receipts, Monthly Term Deposit Receipts, Bearer Certificates of Deposit, Demand Drafts, may be placed for payment at the counter by clients, beneficiaries and various departments for encashment. Branches shall ensure the following:

- The instrument is checked for any apparent discrepancy and evidence of posting and cancellation.

- Specimen Signature of cancellation officer shall be available with cash paying officer for convenience of payment.

- On being satisfied, the cash paying officer shall count cash for payment and the denominations of notes are written on the reverse of the instrument invariably.

- Signature of the bearer is obtained on the reverse of the instrument and compared with the signature already obtained from the bearer while presenting the instrument.

- If the presenter is found to be the same person, cash is handed over to the bearer/presenter.

- “Cash Paid” Stamp is affixed on the face of the instrument and signed by the cash paying officer.

- Particulars of the instrument are entered in the cash payment register.

- Paid instruments are preserved with the cash paying officer.

- At the close of bank hour, the amounts entered in the cash payment register are totaled. The total must agree with the totals of cash paid.

- The total is written in the cash payment register in words and figures.

- The officer-in-charge of cash department shall check the entries and instruments to ascertain that the payment has been made correctly and shall release the instruments from cash payment register by his initials against each entry in the cash payment register.

- The officer-in-charge also checks and signs the entries.

- The cheques/instruments are sent to accounts department for stitching and preservation.

4.2.3. Cancellation of Cheques:

I. The cancellation officer should be an authorized officer of the bank/ branch.

II. He/ She shall keep all Specimen Signature Card under his effective control during transaction hours.

III. The cancellation officer shall retain only the signature cards admitted by the authorized officer in serial order.

IV. Before passing any cheque, the signature of the drawer must be verified. In case, signature of the drawer differs, cheques shall not be passed unless the drawer’s confirmation is obtained or a reference is made to Manager for his instruction.

V. The cancellation officer shall not pass any cheque unless cheque is posted in the computer system.

VI. He/ she should check the irregularities of the cheque if any.

VII. The cheque series number with Prefix should be checked to safeguard fraud and forgeries.

VIII. The cancellation shall be done by drawing a redline across the signature of the drawer of the cheque. He/ She shall sign in full in red ink near the drawer’s signature.

IX. Cheques over Tk.50, 000/- shall be cancelled by two authorized officers jointly. Branch must issue office order regarding cheque passing schedule according to its size and volume of work load. The cancellation officer shall follow the schedule in variably.

X. In case of cash payment cheque a “Pay Cash” stamp shall be affixed on the cheque and signed by the cancellation officer.

4.3.1 CLEARING:

Clearing Department plays a vital role in General Banking. The instruments of this department are posted in the ‘NIKASH’ Computer. After posting those instruments, are separated from the deposit slips and seal it by “CLEARING” with the following dated and also sealed by the “Account Payee Credited” or “Our Branch Endorsement” Seal. These cheques are segmented by the bank wise. 16 (Sixteen) separate branches of JBL with in Dhaka sent instruments to the Dilkusha Branch which is Known as LOCAL BRANCH/ PRINCIPAL BRANCH of JBL and also situated in distance of 2 Kilometer Area from Bangladesh Bank. All branches of Jamuna Bank Limited are computerized and operate in Clearing House with computer Floppy. All clearing items will first be sorted out bank-wise and then entered in a computer printed slip prescribed for the purpose. These Schedules/Slips are in fact list of cheques etc. delivered by Jamuna Bank Limited to other banks through the clearing House. This Branch always collection along with the floppy disk in which particulars of the instruments are described from rest of 16 branches. Then the authorized officer of the local branch accumulates all information in a floppy and the instruments of fourteen branches (including the local branch) are segmented bank wise. After that, all instruments are ready for collection at the 1st clearing house. As soon as cash is received the amount is deposited in the clients account and crossed it carefully. Collection of Cheque, drafts etc. on behalf of its customers is one of the basic functions of commercial bank. Clearing sends for mutual settlement of claims made in between members banks at an agreed time and placed in respect of instruments drawn on each other.

Negotiable instrument law provides protection to a banker who collects a Cheque or a draft if the banker fulfills the following conditions:

- Banks collects the instrument for customer.

- The instrument should be crossed.

- The acts in good faith and without any negligence.

There are two types of House:

- 1st Clearing House and

- Same-day clearing House

Conditions for Same-Day Clearing:

- The Instrument’s value must be over Tk.5 lac.

- The respective branch of the bank must be with in 2 K.M of Bangladesh Bank.

4.3.2 TYPE OF CLEARING:

Outward clearing:

Outward clearing means when a particular branch receives instruments drawn on other bank within the clearing zone and those instruments for collection through the clearing arrangement is considered as outward clearing for that particular branch. All cheques, demand drafts and other credit instruments tendered for the credit of customers account will be delivered by the depositor at the clearing counter. Any deposits received by post will also be sent over to the clearing counter.

The counter officer shall at the time of receipt examine such deposits carefully to ensure that:

- The name of the account is very clearly written on the Deposit slips.

- The particulars of deposits such as cheque numbers, names of bank etc. are properly entered on the deposit slip.

- The depositor has signed the Deposit Slip.

- All these slips are summarized in a bigger computer print out which reflects in details the instruments etc. presented by the bank to Clearing House and contains the names and account number to which the credits will be posted. These sheets serve the purpose of a Clearing House Register.

- Bank also prepare, another summery sheet (Validation Sheet) from computer which contain the total a number of cheques etc. delivered to different banks in the Clearing House and cheques received from different banks with correct total of amount.

- The Credit vouchers should then be released for posting in the computer. It will be the responsibility of Deposit Department, however, not to allow any drawings against such items before the fate is definitely known. Reversal entries for any clearing item returned unpaid should invariably be made by a separate debit voucher.

- All clearing item will be passed through the bank’s Local Office/Main Branch’s Account with Bangladesh Bank.

- Entries to be passed by Local office/ Main Branch.

- Other branches of JBL routing their Clearing Instruments shall send a Clearing House Floppy to Local Office/Main Branch supported by IBDA (Intra Bank Debit Advice) for the total amount.

- Local Office/ Main Branch shall respond the IBDA to the debit of their account with Bangladesh Bank/Sonali Bank in a consolidated manner.

- In case of return of cheques unpaid in the Clearing House, Local Office /Main Branch shall issue IBDA on the branch which lodged the cheques in clearing to reconcile the accounts.

Inward clearing:

The bank provides the instruments to other bank through clearing house, which have been collected different clients. It performs this kind of service for its clients without any charge or the remittance.

Local Office/Main Branch shall receive cheques etc drawn on Jamuna Bank Limited branches from the Clearing House. On receipt of the cheque etc. they shall segregate the same branch-wise and issue IBDA on branches against total amount of cheque etc. and shall arrange delivery of the IBDA together with the cheques etc. within Clearing House time schedule.

Branches shall send the cheques dishonored by them supported by IBDA issued on Local Office/Main Branch, within Clearing House time schedule for enabling Local Office/ Main Branch to return these instruments in the 2nd Clearing House (Return House).

OBC (Outward bill for collection) & IBC (Inward Bill collection):

It a party gives a Cheque to a branch of JBL to collect money from a branch of other bank, which is not situated in the clearing house then JBL collects money through OBC. Incase of OBC two ways exist to collect money from another bank.

- In the 1st way, the receiving branch of JBL sends the Cheque with forwarding letter to the branch of another bank which name is introduced in the Cheque. That is called IBC (Inward Bill collection). After receiving the Cheque that branch of the bank sends a DD to other branch of their bank, which is situated, in the same clearinghouse of payee’s branch of JBL. After that they issue pay order to the name of payee’s branch name and send the Cheque to the clearing house and JBL collects the Cheque through clearing house and credit the payee’s account.

- In the 2nd way, JBL payee’s branch sends the Cheque to another branch of JBL, which is situated in the same area of another bank’s branch (which name is included in the Cheque). Then the receiving branch of JBL collects the amount of Cheque through outward clearing by clearinghouse of those areas and issues a credit advice to the payee’s branch. After that payee’s branch credit the payee’s account.

4.3.3 DISHONOR/ RETURN OF CHEQUES OR INSTRUMENTS:

A banker is not under statutory obligation to give a written answer to on a dishonored cheque. It’s an incumbent upon the bankers to proceed with caution in matter of dishonoring cheque drawn on them. But as per practice, as well as agreement of Banker’s Clearing House a banker should return it with Return Memo giving the appropriate reason for the dishonor. If the cheque is dishonor by the banker, it happens through inadvertence they may pay the damage for wrongful dishonors.

While giving actual reason behind the return of cheque or instruments, it should be taken to the credit of the customer is not damaged by unwanted /exaggerated answer. It should be ensured that actual fact does not mislead the payee. In the event or circumstances of dishonoring a cheque it must be entered in the cheque returned registered and the authorized officer must sign it and also return the memo.

Some reasons of generally used for returning Cheque& Instruments:

- Insufficient Funds

- Effects not Cleared, May be presented again

- Not arrange for

- Exceeds arrangements

- Full Cover not received

- Payment stopped by drawer

- Payees endorsement required

- Payees endorsement irregular

- Payees endorsement illegible

- Required Bank’s Confirmation

- Drawer’s signature differs/required

- Alternations in date/ figures/requires drawer’s full signature

- Amount in words and figure differs

- Crossed cheque must be presented through a Bank

- Cheque is out of Date

- Cheque crossed “Account Payee Only”

- Collecting Bank discharge irregular / required.

- Not drawn on us

- Addition to Bank discharge should be authenticated

- Clearing stamp required /requires cancellation

4.3.4. CLEARING CHEQUES

In case of clearing cheque, it is checked that: –

I. Collecting Bank’s Clearing Stamp bearing correct date is affixed on the face of the cheque and the cheque is presented in the 1st or 2nd clearing as stamped.

II. The collecting bank’s discharge is correct.

III. Other points similar to those as explained above are followers.

4.4 REMITTANCE, BILLS AND ENDORSEMENTS:

REMITTANCE:

Remittance is one of the main components of banking. The main activities of remittance section are:

●Telegraphic Transfer (TT)

●Demand Draft (DD)

●Payment of Pay order

4.4.1 PAYMENT OF TELEGRAPHIC TRANSFER:

Receipt of Message and Payment:

- i. The in-charge and the manager verify the test message.

- ii. If the test-number, payees A/C number and title of the A/C does not agree a telex is sent to the branch concern asking them to rectify the message with correct test number and other particulars.

- iii. If the test-number agrees and all other information is correct, test agreed seal is affixed on the message and signed by the officers.

Where the payee does not have any account in the drawee branch a Pay Order/ Pay Slip is issued in favour of the payee a delivered to his banker on the same day.

4.4.2. PAYMENT OF PAY-ORDER

Payment in cash: When pay-order is presented for encashment similar procedure is adopted as explained in the foregoing for payment of Demand Draft in cash. It also paid by clearing /transfer delivery /cash transfer Procedure is similar to that explained in paras of Payment of DD through clearing transfer delivery and cash transfer.

4. 4.3 ISSUE OF DUPLICATE DEMAND DRAFT

- On receipt of application from the purchaser of the draft regarding its loss and issue of duplicate one, the signature of the applicant is verified from the original application.

- Head Office is informed of the loss of DD immediately and the drawee branch is informed of the loss of draft number and requested to exercise caution by letter or telex. The telex charges if incurred are recovered from customer.

- On receipt of confirmation from the drawee branch that the draft is still outstanding in their books and that caution is being exercised by them, a duplicate draft is issued to the purchaser after obtaining an Indemnity Bond in Bank’s prescribed format.

- The draft is issued marked “DUPLICATE” in red ink, repeating the original printed number, striking out the present printed number and giving the original controlling number.

- A note to this effect is made on the original application form and the Drafts Issued Register.

- Drawee branch is advised regarding issuance of the duplicate draft.

- The indemnity bonds are kept in “Indemnity Bonds for duplicate instruments issued File.”

4.4.4 CANCELLATION OF INSTRUMENTS

4.4.4.1 Cancellation Of Pay-Order:

- I. On receipt of application along with pay-order for its cancellation, the signature of applicant is verified from the original application form.

- II. Before the pay-order is cancelled it is ascertained that no duplicate pay-order has been issued. The pay-order is cancelled and kept with the debit voucher.

4.4.4.2 Cancellation Of Demand Draft:

I. On receipt of application along with the Demand Draft for its cancellation the signature of the applicant is verified from the original application form and the genuineness of the Demand Draft is examined.

II. Before the draft is cancelled it is ascertained that no duplicate draft has been issued.

4.5 ACCOUNTS

4.5.1 ACCOUNTING SYSTEM:

The branches of the bank operate as independent accounting unit. They submit statement of affairs and other prescribed returns direct to Head Office where these are consolidated in the form of a statement showing assets and liabilities of whole Bank as at the close of month at the last working day of each month.

The system of transactions of the bank is essentially double entry system of book keeping. But for quick and accurate recording as well as for arriving at daily financial position specialized form of double entry system book keeping, named slip system under self-balancing method is followed by the bank. The golden principle of debiting or crediting is the same as those of double entry system. In the bank, instead of recording transactions in a journal initially, these are directly recorded and posted in the ledger (computer) separating the debits and credits by slips or voucher system.

Accounts Section performs the following tasks:-

- Collection of clearing cheque from Client and send to the main branch to present clearing house for collection without any charge.

- Computer entry of clearing cheque and credit posting.

- Voucher sorting and reconciliation with supplementary summary.

- Voucher arrangement and preparation of voucher cover.

- Preserve daily cash book position and trial balance.

- To prepare salary sheet and record all the stationary cost.

- To provide solvency certificates.

- If the supplementary summary and voucher are not same his/her duty to find out the discrepancies. And other works demanded by the authority.

- They also prepared SBS Sheet for the previous month and send it to the Head office by instant of 10.

5.0: CREDIT FINANCING BEHAVIOR OF JBL

The main focus of Jamuna Bank Ltd. Credit Line/Program is financing business, trade and industrial activities through an effective delivery system. Jamuna Bank Ltd. offers credit to almost all sectors of commercial activities having productive purpose. Loan is provided to the rural people for agricultural production and other off-farm activities.

- Loan pricing system is customer friendly.

- Prime customers enjoy prime rate in lending and other services.

- Quick appreciation, appraisal, decision and disbursement are ensured.

- Credit facilities are extended as per guidelines of Bangladesh Bank (Central Bank of Bangladesh) and operational procedures of the Bank.

- Interest is calculated on daily product basis but charged and accounted for quarterly on accrual basis. Interest on classified loans is kept in interest suspense account as per Bangladesh Bank guidelines and such interest is not accounted for as income until realized from borrowers. Interests are not charged on bad / loss loans as per instructions of Bangladesh Bank. Advances are stated at gross value.

Here there is a table of Interest rate of provision on credit:

| Particulars | Rate |

| General Provision on unclassified loan and advances | 1%

|