The main objective of the report is to explore the corporate governance of eastern bank limited. Other objectives are explain market scenario of banking sector and the current position of eastern bank Limited. Report also discuss about the overall banking activity. Finally identify the problem and weakness of the banking system of Eastern Bank Limited and suggest necessary measures for the development of the bank.

Introduction

The emergence of Eastern Bank Limited in the private sector is an important event in the banking industry of Bangladesh. Eastern Bank Limited started its business as a public limited company on August 08, 1992 with the primary objectives to carry on all kinds of banking business in and outside of Bangladesh and also with a view to safeguard the interest of the depositors of erstwhile BCCI [Bank of Credit and Commerce International (Overseas)] under the Reconstruction Scheme, 1992, framed by Bangladesh Bank.

In 19991, when BCCI had collapsed internationally, the operation of this bank had been closed in Bangladesh. After a long discussion with the BCCI employees and taking into consideration the depositors’ interest, Bangladesh Bank then gave the permission to form a bank named Eastern Bank Limited which would take over all the assets, cash and liabilities of erstwhile BCCI in Bangladesh, with effect from August 16, 1992. So, it can be said the EBL is a successor of BCCI.

EBL started its business as a scheduled bank with only four branches, which included Principal Branch, Dhaka; Motijheel Branch, Dhaka; Agrabad Branch, Chittagong and Khulna Branch. EBL started its business with motto to grow as a leader in the banking arena of Bangladesh through better counseling and efficient service to clients. EBL resumed its operational activities initially with an authorized capital of Tk. 1000 million, divided into 10 million shares of Tk. 100 each and paid up capital of Tk. 310 million. The initial shareholders were the NCBs, various govt. agencies, and some of the depositors who had agreed to accept shares in the new bank in lieu of their deposits. The first Board of Directors of EBL constituted under govt. supervision, consisted of 7 directors from various business and professions. Eastern Bank Limited was under government control until the end of 2000 and therefore, there were lots of deficiencies in the Bank’s management. In 2001, the board of directors brought in new professional management from various foreign banks who have been trying to modernize the bank ever since.

Objectives of Eastern Bank Limited

Maximization of profit along with the benefits of employees is the main objective of the bank. In addition, the other objectives are:

- To be one of the leading banks of Bangladesh in terms of ROE and ROE

- To be the market leader in high quality banking products and services

- Achieve excellence in customer service through providing the most modern and advanced state-art technological in the different spheres of banking

- Cater to a broader and differentiated segment of retail and wholesale customers.

- To grow its credit extension service to the commercials as well industrial sector;

- To increase its diversification of loan portfolio and geographical coverage

- To curd present operating expenses further so as to increase earnings before tax

- To reduce the burden of nonperforming assets

Historical Review and Different Milestones of EBL

In the year of 1992 EBL started their banking operation in the country. Within these 15 years EBL became one of the successful banks in Bangladesh. They are able to gain this huge success because of their employee’s honesty, integration and hard work.

EBL dreams to be the bank of choice of the general public which includes both the consumer and the corporate clients. It has adopted the tag line “simple math”, the philosophy of Easy Banking while celebrating the 10th anniversary in 2002, EBL’s logo was changed to reflect the restricting and the transformations it is going through; the colors of the new logo signify the vibrant green of mother earth, a blue sky full of possibilities and a yellow rising sun of hope.

In order to achieve superior growth and financial performance for its shareholders, EBL is radically transforming the way it dies business .The bank has already restructured from the traditional geographic matrix (branch based banking) to business unit matrix. The bank is also centralizing most of the business functions in the head office to ensure greater control and efficiency.

EBL wanted to stand up in the crowd. For moving out of the ramshackle, EBL management under the dynamic leadership of the honorable Directors of the Board switched over to a centralized platform using a world renowned banking software (Flexcube) which was the no one most popular software in the world for the year 2003. The bank also centralizing most of the business functions in the head office to ensure greater control and efficiency. The result has been incredible.

Current Profile of EBL

At present, the bank has 32 branches throughout the country with about 850 employees. The existing Board of Members is 12. Mr. A. Q. I. Chowdhury, OBE is the Chairman of Board and Mr. Ali Reza Md. Iftekhar is the Managing Director & CEO. EBL is currently going through a restructuring stage where the traditional ‘Branch Banking System` is gradually discarded and being replaced by a Centralized System till 2000. The bank has been restructured into five main businesses which is responsible for earning the revenues of the bank. These are:

- Corporate Banking

- Consumer Banking

- SME Banking

- Treasury

- Cards

All other departments of the bank act as support for these five units and help them in every possible way. Under this arrangement, the responsibilities and functions of those branches have been reduced dramatically. Many of the activities like credit evaluation and approval, monitoring of loans, trade services activities etc. are now centralized in the Head Office. The branches of the bank are now termed as the “Sales & Service Centers” which are solely concentrated on delivering services to the corporate and consumer clients and maintain relationship with them.

2006, last year was another year of continued success of EBL across all the business units. The Bank has made an Operating Profit growth of 28.6% to BDT 1,358 million during the year but suffered a decline of Profit after Tax by 6.1% to BDT 513 million mainly due to increased general provisioning requirement by BB and disallowance of specific provision in tax computation. Therefore EPS dropped to BDT 61.98 in 2006 against BDT 66.00.

Corporate Banking remains the major bread earner with largest volume of loan portfolio and fees income. Adding 3 more branches at strategic locations, Consumer Banking supplied the major part of funding assets of corporate and SME, one of the potential business segments. EBL Treasury has passed a superb year 2006 by achieving an extraordinary growth of FX income by 130% to the tune of BDT 434 million by exploiting market volatility. Investment income also grew by 47.48% due to govts increased borrowing at higher rates.

Current Banking Scenario of BD and EBL’s Position in the Market

From the beginning of the year 2004, the entire banking industry in Bangladesh started facing stiff competition to procure business, under the changed circumstances of the policy of BB to lower the rates of interest in lending and to go for syndication against large loan portfolios with the objective to ensure better operation and control of all functions of the bank.

Despite such situation the year was a remarkable on for EBL when the bank finally completed the introduction of a state-of-the art IT technology platform of Flex Cube, a world class banking software. All of bank’s 25 branches were connected to this IT platform giving an enviable opportunity to all the EBL customers to obtain the most coveted services that no other bank could offer them yet.

Customers of new century are self-motivated, vigilant and informed about the market conditions, further more development of information technology and telecommunication systems created an environment whereby customers demand convenience, reasonable priced better quality financial products and personalized services. Customer demand together with technological advancement created new challenges and opportunities in the banking sector in Bangladesh. Adapting realistic and timely business policies, investments in IT are now prejudicing to stay at the edge of this assertive and competitive banking business of the country. Invention of new financial products and services and introduction of new delivery methods are the key concern of staying close to customers.

To cope with the status quo, Eastern Bank Limited welcomed these developments and restructured the bank to meet the challenges in future. The branches of the bank are now termed as the “Sales & Services Center” which are solely concentrated providing service to the corporate and consumer clients and maintain relationship with them.

2006, last year was another year of continued success of EBL across all the business units. The Bank has made an Operating Profit growth of 28.6% to BDT 1,358 million during the year but suffered a decline of Profit after Tax by 6.1% to BDT 513 million mainly due to increased general provisioning requirement by BB and disallowance of specific provision in tax computation. Therefore EPS dropped to BDT 61.98 in 2006 against BDT 66.00.

Corporate Banking remains the major bread earner with largest volume of loan portfolio and fees income. Adding 3 more branches at strategic locations, Consumer Banking supplied the major part of funding assets of corporate and SME, one of the potential business segments. EBL Treasury has passed a superb year 2006 by achieving an extraordinary growth of FX income by 130% to the tune of BDT 434 million by exploiting market volatility. Investment income also grew by 47.48% due to govts increased borrowing at higher rates.

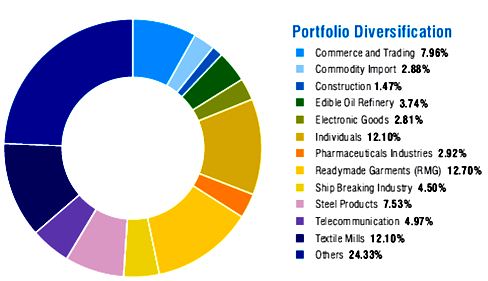

Credit Risk Management [Portfolio Diversification]

Comprehensive risk management is a core competence of EBL. EBL take a prudent and conservative approach to risk that is fully aligned with their long-term strategy. The risk framework combines centralized policy setting with board oversight supported by risk execution and monitoring. It provides management with the ability to oversee the bank’s large and highly diversified portfolio effectively and efficiently.

EBL’s risk management systems are designed to identify and analyze risks management processes by establishing a credit risk management policy, credit underwriting standards, and credit risk rating methodology. It also established a Credit Risk Management Division, which is independent from relationship management units to ensure proper controls on its lending.

Departments and Divisions of EBL

These are the main divisions; the structures and functions of each of these divisions are given below:

| Serial No | Name of Departments |

| 1 | Audit & Compliance Division |

| 2 | Finance & Accounts Division |

| 3 | Human Resources Department |

| 4 | Corporate Banking Division |

| 5 | Treasury Department |

| 6 | Consumer Banking Division |

| 7 | Brand Management Division |

| 8 | SME Banking Division |

| 9 | Credit Risk Management Division |

| 10 | Credit Administration Department |

| 11 | Operations |

| 12 | International Division |

| 13 | Information Technology Division |

Products and Services of Eastern Bank Ltd.

Consumer Products

Loan Products

- EBL Jibandhara Loan

- EBL Utshab Loan

- EBL Home Loan

- EBL FastCash

- EBL FastLoan

- EBL Executive Loan

- EBL Auto Loan

- EBL TraveLoan

- EBL Parseloan

- Education Finance Pack

Deposit Products

- Interesting Account

- Campus Account

- High Performance

- EBL Repeat

- EBL Confidence

- EBL Just Double

Cards Products

- Simple Credit Card

- LifeStyle Card

- Cool Car

SME Banking Products

Loan Products

- EBL Agrim

- EBL Uddog

- EBL Asha

- EBL Puji

- EBL Banijjo

- EBL Mukti

Deposit Products

- EBL Subidha

Corporate Governance of Eastern Bank Limited

Corporate Governance is based on several critical principles. They include an independent, active and engaged Board of Directors which has the skill to properly evaluate and oversee the business process, business and financial performance, internal control and compliance structure and direct management on strategic and policy issues. On the other hand, the Board has to ensure that the management headed by Chief Executive Officer (CEO) fully discharge their day to day administrative responsibilities prescribed by BB and the Board itself and necessarily refrain themselves from micro management of the management affairs. Eastern Bank Ltd. recognizes the importance of good corporate governance as a major factor in enhancing the efficiency of the organization. The Bank therefore seeks to encourage the conduct of its business to be in line with the principles of good corporate governance, which form a basis for sustainable growth.

Eastern Bank Limited Corporate Governance

In absence of any specific, integrated and mandatory Corporate Governance instructions, various rules and guidelines by different regulatory bodies constitute an informal structure of Corporate Governance. EBL understands that all these rules and guidelines aim at establishing and maintaining a delicate balance of authority and responsibility conferred on the Board, the collective representatives of shareholders, and the management to safeguard the interest of key stakeholders i.e. depositors and shareholders. Two very important pillars of a good corporate governance structure are “Transparency” and “Accountability” backed by strong Internal Control and Compliance Structure and MIS capabilities.

Objectives Corporate Governance

For excellence in Corporate Governance, the most important processes one has to concentrate on are:

- Strategy Process, which provides: – A link between Strategy & Operations, – Sets up a mechanism for Strategy Review

- People Process, which provides: – A link between People & Operations

- Operations Process, which provides: – A link between Strategy & People The link between Core Objectives of Corporate Governance and the important processes is the structure of the corporate & the systems through which the activities are organized and executed.

Analysis Corporate Governance of Eastern Bank Limited

The only guideline regarding Corporate Governance so far issued by Securities & Exchange Commission (SEC) vide letter no SEC/CFD/246/2006-2378 dated January 26, 2006 is currently being followed by Banks, although not mandatory yet.

Reporting of anything having material financial impact to the Commission

If the Audit Committee has reported to the Board of Directors about anything which has material impact on the financial condition and results of operation and has discussed with the Board of Directors and the management that any rectification is necessary and if the Audit Committee finds that such rectification has been unreasonably ignored, the Audit Committee should report such finding to the Commission, upon reporting of such matters to the Board of Directors for three times or completion of a period of 9 (nine) months from the date of first reporting to the Board of Directors, whichever is earlier.

The Audit Committee holds meetings at least once every three months to scrutinize matters as assigned by the Board of Directors. The Audit Committee held 5 (Five) Meetings in 2007 as per following dates:

- 16th meeting held on 4th April, 2007

- 17th meeting held on 26th July, 2007

- 18th meeting held on 2nd August, 2007

- 19th meeting held on 29th August, 2007

- 20th meeting held on 1st November, 2007

Reporting of activities to the shareholders and general investors

Report on activities carried out by the Audit Committee, including any report made to the Board of Directors under condition 3.3.1 (ii) above during the year, signed by the Chairman of the Audit Committee and disclosed in the annual report of the issuer company.

External/Statutory Auditors:

The Hoda Vasi Chowdhury Co. not to perform the following services of the Eastern Bank Limited (EBL); namely:-

Appraisal or valuation services or fairness opinions

Such as they are not related with the assets revaluation.

Financial information systems design and implementation.

They are not related any kind of system design operation.

Book-keeping or other services related to the accounting records or financial statements

They not engage themselves with the any kind of Book Keeping and Finance related activities with the EBL

Broker-dealer services

Such as share or right share activities.

Actuarial services;

Such as gratuity activities

Internal audit services; and

External auditor not related with the internal auditor activities.

Any other service that the Audit Committee determines

EBL not engage them any special activities. Other person or company engaged for such activities.

Findings

Some systematic problems of corporate governance all over the world Eastern Bank Limited is not different then other company.

Systemic problems of corporate governance

Demand for information:

A barrier to shareholders using good information is the cost of processing it, especially to a small shareholder. The traditional answer to this problem is the efficient market hypothesis (in finance, the efficient market hypothesis (EMH) asserts that financial markets are efficient), which suggests that the small shareholder will free ride on the judgments of larger professional investors.

Monitoring costs:

In order to influence the directors, the shareholders must combine with others to form a significant voting group which can pose a real threat of carrying resolutions or appointing directors at a general meeting.

Supply of accounting information:

Financial accounts form a crucial link in enabling providers of finance to monitor directors. Imperfections in the financial reporting process will cause imperfections in the effectiveness of corporate governance. This should, ideally, be corrected by the working of the external auditing process.

To maintain some principles for corporate governance

Rights and equitable treatment of shareholders:

Organizations should respect the rights of shareholders and help shareholders to exercise those rights. They can help shareholders exercise their rights by effectively communicating information that is understandable and accessible and encouraging shareholders to participate in general meetings.

Interests of other stakeholders:

Organizations should recognize that they have legal and other obligations to all legitimate stakeholders.

Role and responsibilities of the board:

The board needs a range of skills and understanding to be able to deal with various business issues and have the ability to review and challenge management performance. It needs to be of sufficient size and have an appropriate level of commitment to fulfill its responsibilities and duties. There are issues about the appropriate mix of executive and non-executive directors.

Integrity and ethical behavior:

Ethical and responsible decision making is not only important for public relations, but it is also a necessary element in risk management and avoiding lawsuits. Organizations should develop a code of conduct for their directors and executives that promotes ethical and responsible decision making. It is important to understand, though, that reliance by a company on the integrity and ethics of individuals is bound to eventual failure. Because of this, many organizations establish Compliance and Ethics Programs to minimize the risk that the firm steps outside of ethical and legal boundaries.

Disclosure and transparency:

Organizations should clarify and make publicly known the roles and responsibilities of board and management to provide shareholders with a level of accountability. They should also implement procedures to independently verify and safeguard the integrity of the company’s financial reporting. Disclosure of material matters concerning the organization should be timely and balanced to ensure that all investors have access to clear, factual information.

Issues involving corporate governance principles include:

- Internal controls and the independence of the entity’s auditors.

- Oversight and management of risk

- Oversight of the preparation of the entity’s financial statements

- Review of the compensation arrangements for the chief executive officer and other senior executives

- The resources made available to directors in carrying out their duties

- The way in which individuals are nominated for positions on the board

Recommendations

Internal corporate governance controls

Monitoring by the board of directors:

The board of directors, with its legal authority to hire, fire and compensate top management, safeguards invested capital. Regular board meetings allow potential problems to be identified, discussed and avoided. Whilst non-executive directors are thought to be more independent, they may not always result in more effective corporate governance and may not increase performance. Different board structures are optimal for different firms. Moreover, the ability of the board to monitor the firm’s executives is a function of its access to information. Executive directors possess superior knowledge of the decision-making process and therefore evaluate top management on the basis of the quality of its decisions that lead to financial performance outcomes, ex ante. It could be argued, therefore, that executive directors look beyond the financial criteria.

Balance of power:

The simplest balance of power is very common; require that the President be a different person from the Treasurer. This application of separation of power is further developed in companies where separate divisions check and balance each other’s actions. One group may propose company-wide administrative changes, another group review and can veto the changes, and a third group check that the interests of people (customers, shareholders, employees) outside the three groups are being met.

Remuneration:

Performance-based remuneration is designed to relate some proportion of salary to individual performance. It may be in the form of cash or non-cash payments such as shares and share options, superannuation or other benefits. Such incentive schemes, however, are reactive in the sense that they provide no mechanism for preventing mistakes or opportunistic behavior, and can elicit myopic behavior

External corporate governance controls

External corporate governance controls encompass the controls external stakeholders exercise over the organization. Some Examples include

- Competition

- debt covenants

- demand for and assessment of performance information (especially financial statements)

- government regulations

- managerial labor market

- media pressure

- Takeovers.

Conclusions

Since the banking service especially the private Banks are doing good business, so it is clear that the modern people are more concerned about the securing their valuable assets and get high quality and timely services. For this reason lot of new commercial banks has been established in last few years and these banks have made this banking sector very competitive, so now banks have to organize their operation and do thir operations according to the need of the market. Banking sectors no more depends on the traditional method of banking. In this competitive world this sector has trenched its wings wide enough to cover any kind of financial services anywhere in this world. The major task for banks, to survive in this competitive environment is by managing its assets and liabilities in an efficient way.

The study was conducted on the proceeding of the activities carried out by Eastern Bank Limited (EBL) corporate governance. As the study was concentrated towards the management efficiency and the stakeholder and investors services. Therefore few limitations occurred while conducting the study. In spite of having many challenges, adverse economic conditions and market pattern during the years, the bank tried to maintain its growth trend through the indicators like strong management efficiency, proper corporate governance and their timely services to their clients.

On the basis convincing reasons, Eastern Bank Limited (EBL) management believes that in the coming years the bank will try it s level best to sustain good corporate governance and maintain rest of the years. With the current performance of the bank and they will certainly make Eastern Bank Limited (EBL) one of the best private bank in Bangladesh.