Background of the Study:

Financial infrastructure refers to the systems for payment and settlement of transactions among financial institutions and the links between these systems. Having a safe and efficient financial infrastructure is vital to an international financial centre like Australia. Yet these systems are not well-understood by the general public and their importance is often overlooked. This booklet introduces, in non-technical language, the workings of these systems and the efforts devoted to maintaining them to the highest standards.

Financial Infrastructure Australia is the fourth of a series of Australia MA Background Briefs designed to explain the workings of Australian monetary and banking systems. Other Background Briefs in the series cover monetary, bankig.

Importance of financial infrastructure:

Financial infrastructure allows money to flow through the economy by serving as a platform for financial transactions. The following examples illustrate some of the financial processes that an efficient financial infrastructuremakes possible:

Funds can be transferred within Australia from Bank A to Bank B as soon as Bank A enters the payment instruction in the interbank payment system.

In a foreign exchange transaction, a party can be credited with the currency it is buying instantaneously when it delivers the currency it is

selling.

A member of the debt securities clearing and settlement system can be credited with securities as soon as the corresponding payment is debited from its bank account in a paperless transaction with no time lag.

A bank in Australia can settle debt securities lodged with an overseas debt securities settlement system through its account with Hong Kong’s debt securities settlement system.

All these processes involve the flow of money in one way or another. While these flows can be achieved without elaborate financial infrastructure(for example, by the physical exchange of cash for paper certificates of debt securities in the third example), the modern business world now demands a much higher level of safety and efficiency. To stay competitive, an economy must have a robust financial infrastructure to support increasingly sophisticated financial activities.

Methodology of the Report:

For carrying out this report first, I have visited many web sites to show the financial infrastructure & stability of USA, UK, Australia, Malisya, & Bangladesh.The following methodology was followed throughout the study .The study is based on both secondary data. Data regarding the organization profile collected in the following ways:

Secondary Sources of Data:

1.Annual Report on financial infrastructure of Australia, Bangladesh, USA, UK, & Malisya.

2. From Different Websites.

3. Different circulars, manuals and files

4. Journals and relevant books.

5. Different publications on financial infrastructure & stability.

6. Other relevant written materials.

Specially,

Most of the secondary data were collected by the review and study of relevant reports and documents.

Limitation of the study:

Despite all out co-ordination among the different countries, the report has some limitations.

Some of these limitations are as under:

Learning all the accounting tasks within just 7 days was really tough.

Financial infrastructure of all the countries are not same so data is changeable

In case of stability analysis secondary data are used.

This study completely depended on policy of the different Countries.

To prepare an analytical report need financial assistance. The financial assistance provided by the department is insufficient. In perspective of lack sufficient money, various types of analysis did not become possible

Financial Infrastructure of Bangladesh:

The financial system of Bangladesh consists of Bangladesh Bank (BB) as the central bank, 4 state-owned commercial banks, 4 government-owned specialized banks, 30 domestic private commercial banks, 9 foreign commercial banks and 29 non-bank financial institutions. The financial system also embraces Investment Corporation of Bangladesh (ICB), House Building Finance Corporation (HBFC), Securities and Exchange Commission (SEC) as the regulator of the capital markets, 2 stock exchanges, insurance companies, micro-credit organizations and co-operative banks. The banking sector is the dominant sector in the financial system of Bangladesh. The regulatory and supervisory arrangements for these entities are well defined, with strong legal underpinnings.There were no significant changes in the structure of the financial system of Bangladeshduring CY10. However, 2 specialized commercial banks named Bangladesh Shilpa Rin Shangstha (BSRS) and Bangladesh Shilpa Bank (BSB) merged and started functioning as

Bangladesh Development Bank Limited (BDBL) from January 2010. Underpinned by the strong macroeconomic fundamentals, the banking sector balance sheet size grew by 23.47 percent compared with end-2009 and reached to BDT 4855.04 billion as of end-2010. The growth was broad-based as most of the income earning assets registered positive growth.

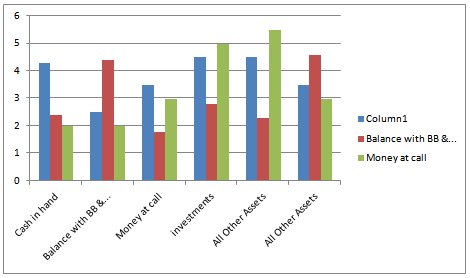

The share of loans and advances, the largest share among asset items, increased by 2.47 percentage points in CY10. However, the share of investment in government and other securities decreased by 2.52 percentage points. The share of balance with BB and other banks & FIs decreased by 0.88 percentage points and the share of investment in call money market decreased by 0.35 percentage points at end-2010 compared with end-2009. Of the banking sector assets, 65.88 percent were deployed in loans and advances in CY10. The share of other assets increased by 0.63 percentage points, implying new investments in IT infrastructure and branch expansion & renovation during CY10

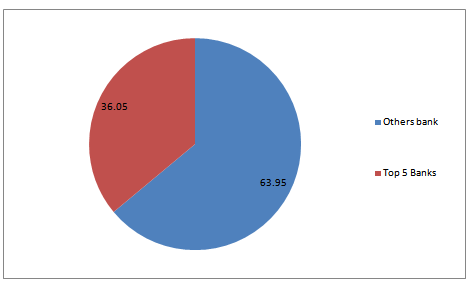

Top 5 banks based on asset size of the banking sector

Sources: (www.bangladesh-bank.org)

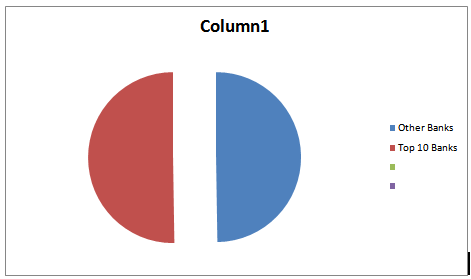

Top 10 banks based on asset size of the banking sector

Compared with other countries, the banking sector is not concentrated, which contributes to financial sector stability. The concentration ratios of the top 5 banks and top 10 banks within the total assets were only 36.05 percent and 50.24 percent respectively at end-2010

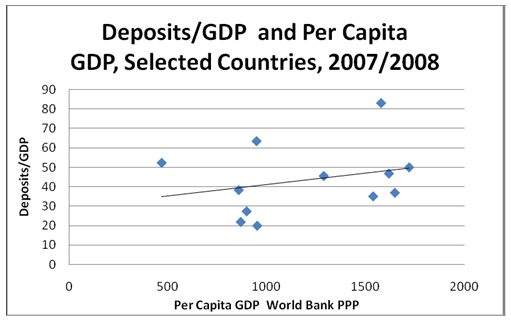

Figure 1. Asia: Deposits/GDP in Selected Countries

Financial stability in Bangladesh:

Stability of the financial sector of Bangladesh has over the years proven to be quite robust, amid episodes of regional and global crises, like the East Asian currency crisis of mid-nineteen nineties and the recent global financial crisis of 2008-2009. In both crises the financial sector in Bangladesh remained solvent and liquid, well in position to help out sectors in real economy impacted adversely. The key to this insulation from external turmoil is in the limited openness to short term external capital flows. In a steady sequence of steps opening up Bangladesh economy to the outside world, Bangladesh Taka is now freely convertible in the current account, the capital account is also virtually fully open to inflows and outflows of non-resident owned equity and longer term debt funds; but the capital account remains restricted for resident owned investment abroad, as also for non-resident owned short term capital flows (so-called ‘hot money’). This limited regulated external exposure of Bangladesh’s financial sector kept it free of toxic assets and contagion from external crises. Conservatively prescribed and closely monitored open exchange position limits for banks keep their exchange rate risk exposures within safe margins. Episodes of adverse developments in the domestic front also amply demonstrate the robustness of financial sector stability in Bangladesh. The sector includes private and government owned banks and financial institutions, local, joint venture and wholly foreign owned. Over years, competition has brought down the past dominance of four government-owned commercial banks. Today the institutional sizes are much less disparate; with no excessive mutual interdependence to pose systemic risk. In four decades since liberation, there were sporadic events of a foreign bank branch, a joint venture private bank, and two non-bank finance companies running into asset quality and solvency problems, needing central bank supervised restructuring. None of these events raised systemic concerns, because exposures of other banks/financial institutions to the stricken ones were not large. Fallouts from two episodes of stock market price bubble collapse in 1995 and 2010 were likewise limited and easily contained.

Financial Infrastructure & Stability of USA:

COUNTRY BACKGROUND:

The Republic of Armenia (RA) is a country on the southern side of the Caucasus region at the crossroads of Europe and Asia. The neighbouring countries are: Turkey to the west, Georgia to the north, Azerbaijan to the east, and Iran to the south. The territory of the Republic of Armenia is 29.8 thousands sq. m. The Capital – Yerevan, founded in 782 BC. Religion – Christianity adopted in 301.

OVERVIEW OF INTERNATIONAL TRADE FLOWS:

After the collapse of the Soviet Union, trade links between Armenia and the former Soviet Republics were disrupted and trade decreased dramatically. New trade links emerged, particularly with members of the EU, the Middle East, and the United States. Armenia’s major exports are diamonds, machinery and equipment, copper ore, brandy and other products of agro-processing. Major export trading partners are Belgium, Russian Federation, Israel, Great Britain, USA, some other EU countries, etc. Its major import trading p Results of Socio-Economic Development of RA in January-December, 2000; RA National Statistical Service, p.11, artners are Russian Federation, Belgium, Israel, Iran, USA, Great Britain, etc. Major imports are natural gas, petroleum, diamonds, tobacco products, foodstuffs. As a relatively small country with a limited national market, Armenia must necessarily look to international markets to stimulate its economic growth. However, as a small country, the opportunity for economies of scale and efficiency in production have to date, been limited and thus, international competitiveness has been constrained. In addition, as a land-locked sources..(www.unescap.org) Results of Socio-Economic Development of RA in January-December, 2000; RA National Statistical Service, p.11,

According to statistical data of the Ministry of Trade and Economic Development of RA4, in 2002 the total export from Armenia was $507.2 million (21% of GDP), while import amounted to $991.1 million (42% of GDP). Total trade turnover amounted to $1,498.3 million with trade balance deficit of $ 483.9 million.

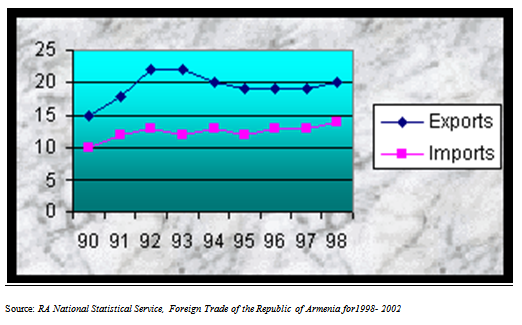

Graph 1 Foreign Trade of Armenia for 1998-2002 (in thous. USD)

OVERVIEW OF ARMENIAN BANKING SYSTEM:

The Banking system of the Republic of Armenia is one of the most important parts of country economy. Following the collapse of USSR the Armenian banking system faced significant problems, of which major one was lack of confidence among population. To remedy the situation in terms of strengthening and making more flexible the existing legal basis, a set of laws and rules has been adopted by the National Assembly of the RA in 1996, namely: “Law on the Central Bank of Armenia”, “Law on Banks and Banking Activities”,

Law on Bank Secrecy”, “Law on Bank Bankruptcy”, “Law on Payment Order Transfers”, “Law on Companies”. of banking reforms. The improvement process of banking regulations and supervision mechanisms was continued, which was a serious and significant input in ensuring a sound activity of the banking system sector. Along with developed legal, accounting and judicial infrastructures mainly crucial for promoting foreign capital inflows, foreign business circles have gradually improved their attitude toward Armenian banking systems. Capital adequacy principles were among most prioritized issues stipulated by bank regulations. The minimum capital requirements have been considerably strengthening from USD 600,000 in 1998 to USD 2 million in July 2003. Further requirement insists the Banks to have 5 million of capital by July 1, 2005.

Banking activities are specifically regulated by “Law on Banks and banking activities”. It defines clearly concepts of “Bank” and “banking activities”, and incorporates inter-alia, rules and regulations on registration, licensing, suspending or termination and merging of alreadyacting banks in Armenia, including local and foreign subsidiaries, branches, representations,

etc.

Trade Finance Infrastructure Development in Armenia, by Alexander Babayan

Financial Infrastructure & Stability of UK:

Finance, Industrial Growth and Infrastructure in the

UK:

The production of signicant pieces of infrastructure required a greater financial outlay than was feasible for most firms alone. As such, in the absence of public investments, the emergence of _financial intermediation of some form { through informal coalitions of firms, bank finance, or the creation of joint stock companies {was thus inevitable. Such intermediation was, of course, itself not costless: Mapping the path of infrastructure required coordination among firms; legal specialists needed to be hired in order to obtain Parliamentary assent; potential wider investors needed to be sought out; banks needed to be negotiated with; and so on. On top of this, at the onset of the industrial revolution many new infrastructural technologies had yet to be proven and the industrial centers had yet to emerge. The costs of relaying information about the virtues of any given project, especially dur-

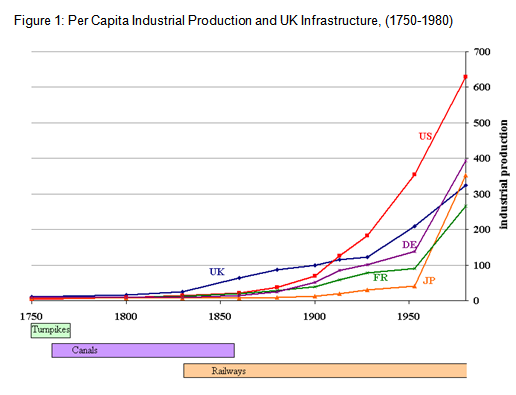

(Even what we might think of to be a large _xed cost in manufacturing, the factory premises constructed to house workers and machines, were often rented in arrears from more wealthy individuals, with multiple tenancy, subletting and power-sharing prevalent (see Hudson, 2002). 5See Hulten (1996), Calderon and Serven (2004), Keller and Shiue (2008) and Atack et al. (2008). ing times of speculation, were crucial determinants of the intermediary structuresthat resulted. For reference, Figure 1 depicts the phases of each of the main forms of transport infrastructure in the UK next to data for the per capita volume of industrial production, using the data in Bairoch (1982).

The industrial revolution saw a gradual standardization of the way in which infrastructure finance was regulated through Parliament. The Bubble Act of 1720 necessitated that joint-stock companies be authorized by royal charter. Thus, the construction of any piece of infrastructure required a Bill to be passed in Parliament. Further, from 1794, requirements for an infrastructure Bill included the need to deposit a map of landholdings in the vicinity of the project, reference books (linked to the map of landholdings) of landowners and occupiers as well as their support or opposition to the plan, and a list of proposed financial supporters. Most of the evidence cited in this Section is based on analysis of these deposits.

Financial Infrastructure & Stability of Australia:

A descriptive approach to financial crises:

One alternative to the econometric approach is to rely on a descriptive analysis of financial crises or a ‘case study’ approach. Here, the exact comparability of data is less of a restriction and a much richer set of financial crises can be considered by going further back in time. The approach can also incorporate indicators, which because of their nature or lack of data are difficult to quantify, but nonetheless may be crucial to financial system stability.

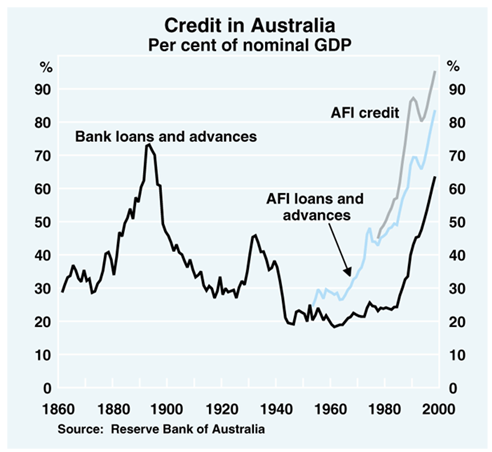

The descriptive approach can be illustrated by tracing the history of credit in Australia over the past 140 years. Movements in the ratio of credit to nominal GDP are shown in Graph 1. The early years lack data on non-bank financial institutions (NBFIs), but in more recent years the figures incorporate loans and advances by banks and NBFIs, and credit provided through the issue of bank bills.

There are four turning points in credit – during the depressions of the early 1890s and early 1930s, and the recessions of the mid 1970s and the early 1990s. Each of these turning points was associated with financial distress (Kent and Lowe 1998; Fisher and Kent 1999).

During the 1890s, a substantial proportion of the financial system collapsed, extending the decline in the Australian economy for some years. Many finance companies and building societies failed, over half of the trading banks were forced to close their doors for a period, and bank deposits and credit fell dramatically. In contrast, the financial problems of the 1930s were relatively mild, with only three institutions suspending payment and a more moderate decline in bank deposits and credit. This difference in performance occurred despite the fact that the initial negative shock to real GDP was at least as large in the first year of the 1930s depression as it was during the 1890s depression.

Conclusion:

Over the years, Australia, USA, UK, Malisya has developed a sound financial infrastructure expediting economic transactions and financial intermediation in the region. However, to maintain Hong Kong’s monetary and financial stability and its competitiveness as an international financial centre, the present financial infrastructure must be further developed into a robust and comprehensive multi-currency, multi-dimensional platform covering the major currencies transacted in the region, and with diversified channels for financial intermediation.

Reference:

1.http://www.bnm.gov.my/files/publication/fsps/en/2010/cp00_004_exec_summary.pdf

2. http://www.imf.org/external/pubs/ft/gfsr/2011/01/pdf/summary.pdf

3. http://www.hkma.gov.hk/eng/publications-and-research/hkma-background-briefs/fihk.shtml

4. http://www.hkma.gov.hk/eng/publications-and-research/hkma-background-briefs/fihk.shtml

5. http://www.divergingmarkets.com/wp-content/uploads/2012/05/Latin-America-Infrastructure-project-finance-by-country.jpg

6. http://benchmarks.rockefeller.edu/assets/finance_graph_lg.gif

7. http://www.unescap.org/tid/projects/tfarm03_dev.pdf

8. http://www.colombiaemb.org/sites/default/files/Trade%20graph.jpg?1336657712

9. For reference, Figure 1 depicts the phases of each of the main forms of transport

infrastructure in the UK next to data for the per capita volume of industrial

production, using the data in Bairoch (1982).

10. http://i.telegraph.co.uk/multimedia/archive/02004/debtgraph_2004525b.jpg

11. http://www.rba.gov.au/speeches/1999/images/sp-ag-010999-graph1.gif

12. http://www.imf.org/external/pubs/ft/scr/2010/cr1038.pdf

13. http://www.bangladesh-bank.org/pub/annual/fsr/final_stability_report2010.pdf