Introduction:

In today’s world, a bank performs several general banking activities in line with its different internal departments. All the departments which are providing Foreign Remittance services are very much important while dealing with customers. Bank earns its operating profit through functional activities of Foreign Remittance. That is why; Foreign Remittance activities mean a lot for a bank. If a bank can figure out its outstanding performance in foreign remittance banking through satisfying its customer then it is possible for that particular bank to gain competitive advantage from the market.

The City Bank Limited performs several general banking activities through its existing branches throughout the country. In most of the branches there are deposit section, loan and advances section, accounts section, foreign exchange section cash section and foreign remittance section. CBL performs its different types of day to day general banking activities with the help of these sections. I tried my best to learn several activities while doing my internship in The City Bank Limited by working in Foreign Remittance banking.

This study is done to evaluate the foreign remittance activities of CBL. Findings of this study may benefit the organization itself to take strategic decision on its future plan to enhance the foreign remittance performance of the bank. This study contains a lot of learning materials that I have gained through my internship, thus I think that the result and recommendation of this study will be very much helpful for the maintenance of operational activities under foreign remittance division.

The report is on “Foreign Remittance Activities and Financial Performance of The City Bank Limited”. I studied on this topic because I was assigned to know about all the activities under the foreign remittance wing of the branch. In the organization part, I have presented the company in details so that the report presents the whole company, its activities, goals and objectives and its commitment towards the society. In the learning part it is been discussed that what I have studied while I worked in the bank. I have discussed the departmental activities that I have observed while working. I have presented the details view of activities of NRB Division of the bank.

Actually, I set some well-defined objectives for my study on this topic. Then following some specific methodology and analysis method I have worked out some findings of the study and recommended for the problems that had identified in my study. Finally, I have concluded with some comments on how it much be better performing bank in near future and how it can contribute towards the economic development of the country.

For globalization and the financial needs and transaction rapidly banking sector are emerge to meet up the challenges of modern days. The banking activities operated to satisfy customer needs with modern trends the bank needs efficient executives. To keep pace with the trend, banks need executives with modem knowledge. The course practical orientation in Banks is an indispensable part of the BBA program. Under this course the students are sent to gather practical knowledge about banks and others organization environment and activities. This practical knowledge and environment build up a working attitude, responsibility, sincerity and norms to build up a future career to the Present world is changing rapidly to face the challenge of competitive free market students. The students also have to submit a report on practical orientation in institution. Gazi Mohammad Hasan Jamil, Assistant Professor of Finance Department, Dhaka University authorized and supervised me to do the practical orientation at origin of the report. I have completed my practical orientation course at The City Bank Ltd. in Principal office of NRB and submitted this report to BBA program office on January1, 2011.

Origin of the Report:

Through the internship in Principal office of NRB, The City Bank Limited I tried to bridge the gap between the theoretical knowledge and real life experience as part of Bachelor of Business Administration (BBA) program. This Internship report has been designed to have a practical experience through the theoretical understanding.

This Internship is essential for every student of Business Administration which helps the students to know the real life situation of corporate life. That is why; a student takes the Internship program at the end of the BBA program as the requirement to Bachelors degree.

This Internship report titled “Foreign Remittance Activities and Financial Performance of The City Bank Limited” is prepared to fulfill the degree requirement of BBA program. In this regard I had been assigned in Principal branch of The City Bank Limited just immediately after the completion of the course requirement of the program. I had been supervised there by the management of the bank to gather information which was necessary to prepare my report.

Objectives of the Report:

I start my work with some specified objectives. The objectives act as a bridge between the starting point and the goal of the study. The report on “Foreign Remittance Activities and Financial Performance of The City Bank Ltd.” has been written as a partial requirement for obtaining the Degree of Bachelor of Business Administration. The basic objective of the report is to be acquainted with the practical aspects of the dealings of The City Bank Ltd. Thus the report has been prepared for serving the academic purposes only, and not for taking decisions by the City Bank’s Management or any other organization. However, I have an objective regarding why I started my work on such topic.

General Objectives :

The broad objective is to evaluate and analysis of “Foreign Remittance activities and Financial Performance of The City Bank Ltd.”

To have a specific idea about the foreign remittance activities of CBL and to scrutinize its financial and operational performance of CBL in today’s banking industry of Bangladesh.

Specific Objectives

To be familiar with the history and operations of CBL in Bangladesh.

To figure out the operational performance of CBL in recent years.

To gather knowledge about the function of different sections under foreign remittance activities.

To understand the financial status of the bank.

To find out the sector in which CBL provides credit.

To identify the problems related to remittance operations of The City Bank Limited.

To make some recommendations to overcome the problems.

Rationale of the Study:

Private Banks have of course a vital role in promoting and accelerating the economic development process as per the demand of time through the implementation of finance for industrial and agricultural project, domestic and foreign trade and allocating the fund to various off-farm employment and self-employment generation projects. Focusing the light and considering the every pros and cons on available statistical data it has been apparently accepted that The City Bank Ltd. continued to register its steady progress in the field of deposits, advances, foreign exchange and foreign remittance business. In view of the sluggish nature of the economic activities over the years the deposit performance of The City Bank Ltd is more or less satisfactory. The City Bank Ltd. gain advantages for foreign remittance related business.

The low rate of economic growth, high rate of unemployment, illiteracy, growth rate of population, low rate of recovery etc. are the impediment factor of economic development of a country.

Inspired of the above obligations rather in a most favorable situation City Bank Ltd have been flourishing efficient and endeavoring to the maximum of efficiency of its capacity to catch up with slow growing development of our country.

Scope of the Study :

The City Bank Ltd. is one of the largest private commercial bank, which provides its services through almost 97 branches all over in Bangladesh. This bank is a reputed and leading one in our banking sector for its performance. I am assigned to learn practical knowledge about the remittance processing system through CBL and how much customer satisfaction level toward CBL through remittance department of NRB, Principal Branch.

Methodology of the Report :

The report has been prepared mainly based on secondary data, famishing by The City Bank officials have also been incorporated in the report wherever it was considered necessary to maintain the singleness and lucidity of the report. This report has been prepared on the basis of experience gathered during the period of two months internship. Personal experience gained by visiting different desks during internship period. The collected data are taken from various sources which are mentioned in the below:

Research Design:

This is an “Exploratory Research”, which briefly reveals the overall activity of The City Bank Ltd. and also analyzes “Foreign Remittance activities and Financial Performance of The City Bank Ltd.”. Data have been collected from both primary and secondary sources.

Data Collection Method:

Personal Interview – Face-to-face conversation and in depth interview with the respective officers & clients of the branch.

Personal observation – Observing the procedure of banking activities followed by foreign remittance department.

Practical work exposures of the branch.

Data Sources

Primary Sources

Practical experience of banking.

Conversation, exchange of ideas and views with senior officials of bank.

Related files, books study provided by the officers concerned.

Secondary Sources:

Annual report of The City Bank Ltd.

Periodicals Published by Bangladesh Bank.

Different publications regarding Banking functions & foreign remittance operation.

Internet used as a theoretical source of information.

Websites and Newsletters used as major sources.

Different text books.

Data Analysis Method:

Both the qualitative and quantitative (such as Trend analysis, Regression analysis, t- Test, CAMELS Rating) tools are used to analyze the gathered data. I have used different charts and diagrams such as Pie-chart, Scatter diagram and Bar diagram for the analysis of data. I have also used financial and operational information of the Bank to evaluate its performance and to compare its performance with other banks.

Duration of observation:

8 weeks within the period of two months internship program.

Limitations of the Report:

It may agree to by the readers of the report that of such a report especially to enrich with empirical findings, wherever necessary, is a time to consuming matter. As the report prepared with a short span of time, the report could not be made comprehensive and conclusive. Mainly the report could be made descriptive. Some usual constraints I did face during the course of my investigation. These are as follows:

The main limitation of the study is availability of literature and data and in many cases the up-to date information is not yet published. Even the Annual Report of CBL, 2010 is not yet published.

Time constraints impede me to make in depth study.

Relevant paper and documents were not available sufficiently which writing this paper.

Due to some legal obligation and business secrecy banks are reluctant to provide data. For this reason, the study limits only on the available published data and certain degree of formal and informal interview.

The bankers are very busy with their jobs, which lead a little time to consult with.

I had to base on secondary data for preparing this report.

Historical Background of The City Bank Limited:

City Bank is one of the oldest private Commercial Banks operating in Bangladesh. It is a top bank among the oldest five Commercial Banks in the country which started their operations in 1983. The Bank started its journey on 27th March 1983 through opening its first branch at B. B. Avenue Branch in the capital, Dhaka city. It was the visionary entrepreneurship of around 13 local businessmen who braved the immense uncertainties and risks with courage and zeal that made the establishment & forward march of the bank possible. Those sponsor directors commenced the journey with only Taka 3.4 crore worth of Capital, which now is a respectable Taka 330.77 crore as capital & reserve. City Bank is among the very few local banks which do not follow the traditional, decentralized, geographically managed, branch based business or profit model.

Under a real-time online banking platform, 4 business divisions are supported at the back by a robust service delivery or operations setup and also a smart IT Backbone. Such centralized business segment based business & operating model ensure specialized treatment and services to the bank’s different customer segments.

The bank currently has 87 online branches and 10 SME service centers spread across the length & breadth of the country that include a fully fledged Islami Banking branch. Besides these traditional delivery points, the bank is also very active in the alternative delivery area. It currently has 46 ATMs of its own; and ATM sharing arrangement with a partner bank that has more than 550 ATMs in place; SMS Banking; Interest Banking and so on. It already started its Customer Call Center operation. The bank has a plan to end the current year with 100 own ATMs.

City Bank is the first bank in Bangladesh to have issued Dual Currency Credit Card. The bank is a principal member of VISA international and it issues both Local Currency (Taka) & Foreign Currency (US Dollar) card limits in a single plastic. VISA Debit Card is another popular product which the bank is pushing hard in order to ease out the queues at the branch created by its astounding base of some 400,000 retail customers. The launch of VISA Prepaid Card for the travel sector is currently underway.

City Bank has launched American Express Credit Card and American Express Gold Credit card in November 2009. City Bank is the local caretaker of the brand and is responsible for all operations supporting the issuing of the new credit cards, including billing and accounting, customer service, credit management and charge authorizations, as well as marketing the cards in Bangladesh. Both cards are international cards and accepted by the millions of merchants operating on the American Express global merchant network in over 200 countries and territories including Bangladesh. City Bank also introduced exclusive privileges for the card members under the American Express Selects program in Bangladesh. This will entitled any American Express card members to enjoy fantastic savings on retail and dining at some of the finest establishment in Bangladesh. It also provides incredible privileges all over the globe.

City Bank is one of the largest corporate banks in the country with a current business model that heavily encourages and supports the growth of the bank in Retail and SME Banking. The bank is very much on its way to opening many independent SME centers across the country within a short time. The bank is also very active in the workers’ foreign remittance business. It has strong tie-ups with major exchange companies in the Middle East, Europe, Far East & USA, from where thousands of individual remittances come to the country every month for disbursements through the bank’s large network of 97 online branches.

The current senior management leaders of the bank consist of mostly people from the multinational banks with superior management skills and knowledge in their respective “specialized” areas. The newly launched logo and the pay-off line of the bank are just one initial step towards reaching that point.

City Bank prides itself in offering a very personalized and friendly customer service. It has in place a customized service excellence model called GAP (Graceful-Appropriate-Pleasing) that focuses on ensuring happy customers through setting benchmarks for the bank’s employees’ attitude, behavior, readiness level, accuracy and timelines of service quality.

The City Bank Limited was one of the 12 Banks of Bangladesh among the 500 Bank in Asia for its asset, deposit & profit as evaluated by “Asia Week” in the year 2000. Other than that, The City Bank Limited received the “Top Ten Company” award from the prime minister of the People’s Republic of Bangladesh.

Mission, Vision and Objectives of CBL

Corporate Mission of CBL

To contribute to the socioeconomic development of the country

To attain the highest level of customer satisfaction through extension of services by dedicated and motivated team of professional

To maintain continuous growth of market share ensuring Quality

To maximize bank’s profits by ensuring its steady growth

To maintain the high moral and ethical standards

To ensure participative management system and empowerment of Human Resources

To nurture an enabling environment where innovativeness and performance is rewarded.

Corporate Vision of CBL:

To be the leading bank in the country with best practices and highest social commitment.

Objectives of CBL

Despite extreme competition among banks operating in Bangladesh, both local and international The City Bank Limited made a remarkable progress practically in every sphere of its functions. The active of the CBL are very implicit and vast comparing to that of other banks in the country today. The theme of the bank is “For Relationship Banking”. The prime objectives of the CBL are to create a strong capital base, to earn good profit and pay satisfactory dividend to honorable shareholders with proper social commitments. To achieve the objectives the management is continuously working for the improvement of bank’s assets quality by identifying potential depositors and good borrowers. Because it believes “The line of excellence never ends”. The strategic plans and business will be its strength in this very competitive environment.

Source: Annual Report – 2009

Line of Business of CBL:

CBL manages its business and operation vertically from the head office through 4 distinct business divisions namely

Corporate & Investment Banking;

Retail Banking (including Cards);

SME Banking; &

Treasury & Market Risks.

Three major functions of the Bank-

Taking Deposit

Extending Loans & Advances

Foreign Exchange Business

Deposits are often called the lifeblood of commercial banks. No commercial banks can be thought of without deposits. In fact modern commercial banking starts with deposits from the public followed by lending or financing trade, commerce and trade. Deposits are treated as:

Deposits as the major source of fund

Deposit as basis of lending

Deposit as source of income

Deposit and credit creation

Under the umbrella of Foreign exchange business there are three main functions as follows:

Export Business

Import Business

Foreign remittance

So in simple words, Banking means taking deposit, extending loan and advances and doing foreign exchange business in order to attain profit & contribute to GDP.

Form the above discussion we can say that Bank as a financial intermediaries collects deposit form surplus areas and provides loans and advances to deficit areas (where needed) and also engaged itself in foreign exchange business, the sum-up of all these activities is known as Banking.

The City Bank Limited is the first private sector Bank in Bangladesh. The Bank established in March 27, 1983 with an authorized capital of Tk. 1.75 Billion under the entrepreneurship of twelve prominent & leading businessman of the country. Today The City Bank serves its customers at home & abroad with 83 branches spread over the country & about three hundred oversea correspondences covering all the major cities and business center of the world.

Current Functions of CBL:

a) Description of Services Offered by CBL: The Services offered by CBL are discussed below:

1. Service of CBL

The CBL concentrates the following categories of banking services:

General Banking

Retail Banking

Loans and Advances

SME

Corporate

International Trade and Foreign Exchange-

Export

Import

Remittance

Online Banking Services-

Debit Card and Duel Currency Credit Card Facilities & The American Express Cards.

One of the most remarkable success stories of last 50 years Banking Industry globally has been the conceptualization and innovative execution of banking with individual customers, their friends and families. The industry has termed it as Retail Banking or Personal Banking or Consumer Banking. The City Bank limited recently started its journey in Retail Banking. More than 700 staffs have been trained so far on the vital concepts of service excellence and sales. In the product side ATM fleet has been launched, Debit card has been issued, SMS Banking has been offered, 3 new deposit products have come up and our communications in media has been increased, manifold in the endeavor to build a Retail Banking brand namely “City Retail Happiness Counts”. Retail Banking includes:

Deposit

Loan

Debit Card

Credit Card

NRB

Considering the potential growth and demand situation the City Bank Limited has extended credit facilities to small and medium enterprises through SME Banking in the year 2006 and 2007. A separate division has established in the Head Office with collaboration of all branches to process and handle loans under SME for attaining a respectable market share and successful operation of the scheme. The Bank has organized several training program for development of adequate human resources.

Following services are provided by SME Banking-

City Muldhan

City Sheba

City Shulov

City Nokshi

In the year 2007, major initiatives have been taken to re-launch SME Banking. Organization and processes are being restructured with focus to enhance business. SME asset size in 2007 went up to BDT 2,000 million and the number of borrowers in SME was 3,000.The bank ha s also taken measures to provide complete banking solution to SME by devising both cash and non-cash based product appropriate and fit to support the requirements of the concerned business. Small enterprise will have a better opportunity to avail PPG based funded product. The needs of medium sized enterprises are also being fulfilled through multiple products offering in the conventional manner. The City Bank SME launched “City Nokshi”. “City Nokshi” is a 10 percent rate per annum as per the guidelines of Bangladesh Bank and is available only for the women entrepreneur of the country.

Corporate and Investment Banking:

As part of its commitment to provide global quality service. The City Bank Ltd, one of the largest local Banks, has launched its Corporate & Investment Banking Division recently. This shift , from branch banking model to business driven matrix, is the first step of the banks plan to revitalize its way of doing business in 2008. The C&I Division will comprise of a number of relationship teams centered in Dhaka and Chittagong to provide who will act as one stop contact point for the customers of the bank. This model has been successfully globally to provide better service and create increased customer satisfaction. The relationship teams have been staffed mainly through internal quality resources. The C& I relationship teams have already taken over the existing large accounts and servicing the customers to their satisfaction. Total new booking in last few months is more than BDT 3,000 million. The C&I Division will also have product teams i.e. structured finance, Islamic finance, Leasing, Cash management who will meet the specialized product needs of the corporate customers. The time ahead is going to be very challenging for C&I. The major challenges shall be to increase the quality of the portfolio keeping in mind the business targets and also ensure quality services in this transaction phases with timely formation and support from other departments i.e. centralized credit administration, operations.

Following services are provided by Corporate Banking:

Working Capital Finance

Trade Finance

Short/mid-Term Finance

Project Finance

Islamic Finance

Structured Finance

Cash Management

Investment Banking

Schedule of Charges

Interest Rate on Lending

Dual Currency Credit Card:

Today’s customer wants services and information to be provided at all times and places. This has become possible by ATMs and POS terminals and helped banks in achieving “Anytime, Anywhere Banking”. Therefore there is a need for an automated system that will connect the branches through online to provide better services to the customers. The most modern technology based bank product for making hassle free financial transactions and drawing of cash money all over the world is given by Credit Card. The City Bank Ltd is the first among domestic banks to introduce a unique dual currency CITY CARD under the logo of VISA International in Bangladesh. After obtaining principle membership of VISA on 19th February, 2003 the bank is pleasing its commitment to be leader as card issuer in the arena. Tremendous responses are there from the market for this plastic money. Up to March, 2008 the number of CITYCARD is 10,215.

Computerization and Online Service:

With computerization the bank had gone another step ahead towards providing pragmatic, safe and prompt banking services. All 84 branches including Islamic Banking Branch are brought under computerized net. Bank has implemented online real time banking through an agreement with Info sys Technologies Limited for supply of world reputed banking software “FINACLE”. Within March, 2008 real time banking facilities have been introduced in 37 branches of CBL. Under this system, client will be able to do the following type of transactions:

Easy to withdraw or deposit from any online branch

Fund transfer with one click, no need TT/DD

Customer can easily tell which payments have cleared.

Islamic Banking:

The City Bank Limited started its Islamic Banking operation by opening its first Islamic Banking Branch at 9/H, Motijheel, Dhaka. Islamic Banking Branch has just completed 5 year of its operation. Islamic Branch is also rendering sales and service to a good number of broker houses including DSE’s central trade account in the capital market. The salient features of Islamic Banking are as follows:

To conduct all its activities as per Islamic Shariah

To conduct its monetary matters free of interest

To establish banker-customer relationship on the basis of partnership

To follow Islamic principle in all its investment port-folio

To develop living standard of the poor incoming group

To render excellent services to the clients cordially

To conduct welfare related activities to the people.

SWIFT Banking (Since 2000):

The City Bank Ltd. is one of the first few Bangladeshi Bank who has become member of SWIFT (Society for Worldwide Inter-Bank Financial Telecommunication) in 1983. SWIFT is members owned co-operative, which provides a fast and accurate communication network for financial transactions such as letters of Credit, Fund transfer etc. By becoming a member of SWIFT, the bank has opened up possibilities for uninterrupted connectivity with over 5,700 user institution in 150 countries around the world.

SMS Banking:

City SMS gives you 24-hour access to the key financial information of our customers City Bank Account. It is the simplest way of finding out customers account’s daily / month – end balance. With City SMS , a customer neither have to wait for his or her statement to arrive through mail nor have to make a phone call at branches to inquire about his or her balances and last few transactions. Once a customer becomes a member of SMS banking, he or she will enjoy 24-hour access it the key financial information.

Facility:

Through City SMS Banking you will be able to access his or her account information like balance; transaction and a range of other financial information by typing a presently following functionality are available through City SMS Banking

Corporate Governance:

The bank recognizes the importance of Corporate Governance and is committed to maintain highest standard. A team of experienced professionals maintains the following committees to run the Bank efficiently:

Management Authority

Administration and Disciplinary Action Authority

Technical and Audit Authority

Credit committee

Procurement and purchase Committee

Asset and liability Committee

Training Program:

The City Bank Limited has launched a huge training program for its staff as part of its restructuring plan. So far, 774 staffs have received training on Customer Service and face to Face Sales; 65 staff received training on departmental operating Instructions and 268 staff received training on Orientation to Credit. Apart from these regular training are going on with BBIM, BIM, and CRISL etc. City Bank Management gives top priority to its peoples leasing and development issues. That’s why the current training project of City Bank is given a name “Learning & Development making the winning moves”.

Functional Division of CBL: The Bank accomplishes its functions through different functional divisions/departments along with their major functions are listed below:

1. Financial Division:

Financial Planning , budget preparation and monitoring

Payment of salary

Controlling inter-branch transaction

Disbursement of bills

Preparation / Review of returns and statement

Preparation of financial reports and annual reports

Maintenance of Provident Fund, Gratuity, Superannuation Fund

Reconciliation

2. Credit and risk management:

Loan administration

Loan disbursement

Project evaluation

Processing and approving credit proposals of the branches

Documentation, CIB (Credit Information Bureau) report etc

Arranging different credit facilities

Providing related statements to the Bangladesh Bank and other department

3. Human Resource Division (HRD

Recruiting

Training and development

Compensation, employee benefit, leave and service rules program and purgation

Placement and performance appraisal of employees

Preparing related reports

Reporting to the Executive Committee/Board on related matters

Promotional camping and press release

4. Information Technology (IT) department

Software development

Network management and expansion

Member banks reconciliation

Date entry and processing

Procurement of hardware and maintenance

5. Branch control & Inspection Division

Controlling different function of the branches and search for expansion

Conducting internal audit and inspection both regularly and suddenly

Ensuring compliance with Bangladesh Bank(BB), monitoring BB’s inspection and external audit reports

6. Retail Division

ATM card, Credit and system operation and maintenance

SWIFT operation

Credit Card Operation (Proposed)

Customer and vendor relationship

7. City Bank Treasury and Market Risk Division:

City Bank Limited has a dedicated Treasury team who is capable of providing all treasury Solutions. Through business partners CBL is providing a wide range of Treasury products. In CBL Treasury, there are various teams who are specialized in their own area to ensure the best possible solution to our customer obligation. Such as:

Foreign Exchange

Money Market

Corporate Sales

ATM and Market Research

Strategy of CBL:

CBL believes in the practice of Market-Oriented Strategic Planning , developing and maintaining a viable fit between the organization’s objectives, skills and resources, The aim of such approach is to shape and reshape the bank’s businesses and service so that they yield target profit and growth. The strategic planning of CBL consists of two organizational levels, which are:

a) Location Based Strategy

b) Business Level Strategy

a) Location Based Strategy:

Since the growth and profit of banking business largely depends upon the location of branches where large connection of other businessman and industries are involved, CBL Main Strength is its location based strategy. The 83 branches of CBL are divided into five different regions, which are:

Dhaka Division, comprises 37 branches

Chittagong Division , comprising 15 branches

Comilla Division , comprising 5 branches

Sylhet Division , comprising 9 branches

Bogra Division , comprising 10 branches

Khulna Division , comprising 7 branches

The concentration of business and lifestyles of the people are not the same in these five areas. So, the strategies of the five areas differ from one another, but they are designed with distinctive local touch. Head office constantly monitors the progresses of all the five areas. At present, The bank is not interested in launching more branches. Currently CBL is focusing in strengthening the existing branches

b) Business Level Strategy:

The business strategy of the Bank is to strengthen its retail business, following a conservative leading approach. But the Bank’s major portion of the profit generates from its Retail banking and SME banking.

Retail Banking Strategy

SME Banking Strategy

Retail Banking Strategy:

The City Bank Ltd. recently has started its journey in Retail Banking. More than 700 staffs have been trained so far on the vital concepts of service excellence and sales. In the product side ATM fleet has been launched , Debit card and credit ha s been issued, SMS Banking has been offered, 3 new deposit products have been introduced, manifold in the endeavor to build a Retail Banking brand namely “City Retail Happiness Counts”.

SME Banking Strategy:

Considering the potential growth and demand situation The City Bank Limited extended credit facilities to small and medium enterprises through SME Banking in the year 2006 and 2007. A separate division has been established in the Head Office with collaboration of all branches to process and handle loans under SME for attaining a respectable market share and successful operation of the scheme. The bank organized several training program for the development of adequate human resources.

Foreign Remittance:

Fund transfer from one country to another country goes through a process which is known as remitting process.

Suppose a local bank has 200 domestic branches and has the corresponding relationship with a foreign bank say-“X”, maintaining “Nostro Account” in US$ with the bank. Bangladeshi expatriates are sending foreign remittance to their local beneficiary, through that account. Now, when the Bangladeshi expatriates through other banks of different countries remit the fund to their “Nostro Account” with “X”, then the local bank’s Head office international division will receive telex message and the remittance section will record the advice and generate the advice letter to the respective branch of the bank. The branch will first decode the test, verify signature and check the account number and name of the beneficiary. After full satisfaction, the branch transfers the amount to the account of the beneficiary and intimates the beneficiary accordingly. But sometimes complexity arises, if the respective local bank has no branch where the beneficiary maintains his account. Then the local bank has to take help of a third bank who has branch there.

oreign Remittance of CBL:

By your side – all the way

The City Bank Ltd. is the Authorized Dealer (AD) to deal in foreign exchange business, as an authorized dealer, bank must provide some services to the clients regarding foreign exchange and this department provides the service of remitting foreign currencies from one country to another country. In the process of providing this remittance service it sells and buys foreign currency, the conversation of one currency into another takes place at an agreed rate of exchange , which than Banker quote one for buying and another for selling.

The City Bank’s Foreign Remittance unit meets growing customer needs for fast, secure & easy money transfers to an extensive range of destinations. Being a committed bank to its customers, they go all the lengths to remit customer’s hard earned money safely to their loved ones. With us, apart from a range of high-class modem remittance solutions, customer’s will get peace of mind which they believe counts to most.

Facility:

City Bank Limited has 83 online branches across the country; besides, the Bank has a strong remittance network with other major banks of the country. Therefore, wherever your account is, we are able to send your money instantly.

If you are a City Bank account holder, then please visit any of our branches. Our Foreign remittance service personnel will be there to help you out. If you are not an account holder, then please open an account of your choice with us to receive your remittance at earliest convenience.

CBL understands the value of your precious time. That’s why have made the payment procedure simple & easy. You have the privilege of enchasing the remitted money instantly from your branch counter without going through any hassle. That is to say, if you are an account holder of City Bank, we can instantly credit the money to your account or pay cash to the receiver.

So, place your trust with City Foreign Remittance Service. Send your money to your loved ones & experience peace of mind.

Foreign Currency Remitting Procedures:

There are two types of remittance:

Inward Remittance:

Inward remittance covers purchase of foreign currency in the form of foreign Telegraphic Transfer (T.T), Demand Draft (DD) and Bills & Travelers Cheque, Export Bill etc. sent from abroad favoring a beneficiary in Bangladesh, purchase of foreign exchange is to be reported to Exchange Control Department of Bangladesh Bank on from – letter of Credit (L/C). Basically, these are the formal channels of receiving inward remittance. A local bank also receives indenting commission of local firm also comes under purview of inward remittance.

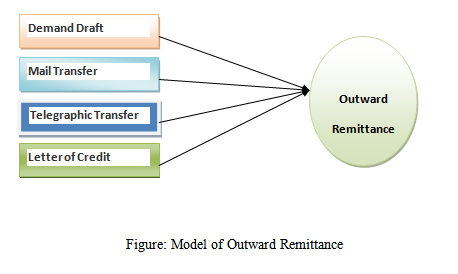

Outward Remittance:

Outward remittance covers sales of foreign Currency by Authorized Dealer (AD) or Formal Channel through issuing foreign Telegraphic Transfer (T.T), Demand Drafts (D.D), Traveler’s Cheque etc. as well as sell of foreign exchange under L/C and against Import Bills retired. The Authorized Dealers have to demonstrate utmost caution to ensure that foreign currencies remitted or released by them are used only for the purposes for which they are released. Most outward remittance is approved by the authorized dealer on behalf of Bangladesh Bank.

Modes of Foreign Remittance:

CBL Remittance facilities to its customer is to enable them to avoid risk rising out of profit or loss in cash carrying cash money to one place to another or making payment to someone in another places. Banks take this risk remit the fund on behalf of the customers to save them from any awkward happening through the network of their branches and ensure payment to the beneficiary in exchange of a little bit benefit known as commission. There are modes of remitting money from one place to another.

Pay Order Issue (PO):

Following procedure is maintained for the issuance of pay order (PO):

Customer is given a PO form.

After filling the form carefully, the customer is pays the money in casher cheque.

The concerned teller then issue PO on its specific block. This block has three parts, one for bank and another two for customer. “A/C payee” crossing its sealed on all PO issued by the bank. The teller then writes down the name and address of the beneficiary on the main part of the PO block. In other two part name and address of the customer is written.

The teller gives an entry to the registry book and maintains the same number of PO block.

Two authorized officer signed the PO block.

At the end customer is provided with the two parts of the PO block after signing of the backs of bank’s part.

Demand Draft Issue (DD):

Customer is supplied with DD form.

Customer fill up the form, which includes the name of the drawer, name of the payee, amount of money to be sent, commission, name of the drawer branch, signature and address of the drawer.

The customer may pay in cash or by cheque from his accounts (if any).

After the money is paid and the form is sealed and signed accordingly it is given to the DD issuing desk.

Upon block have two parts one for bank and another for customer.

Bank part contains issuing date, drawer’s name, payee’s name and some of the money and name of the drawer branch.

After finishing all the required information entry of the DD is given in the DD issuing register and at the same time bank issues a DD confirmation slip is entered into the DD advice issue register and a number is put on the confirmation slip form the same register. Later the bank mails this advice to the drawer branch.

Telegraphic Transfer (TT):

In this process the sender’s bank send a SWIFT message to the receiver’s bank. The SWIFT message received by the head office international division then the head office transfers the message to the respective branches. After getting message by the respective branches, the bank credited the beneficiary’s account. A beneficiary must have an account to receive the money.

Since the SWIFT message can be transfer from bank to bank, no exchange house can participate in this process. Exchange can take the advantage of the process with the help of a correspondent bank.

Some features of (TT) are given below

Since SWIFT has been used in the transaction process it is very much a secured.

Sending and receiving time is very much minimum.

The process is also hassle free. The remittance directly deposited to the beneficiary’s account.

The process is frequently used.

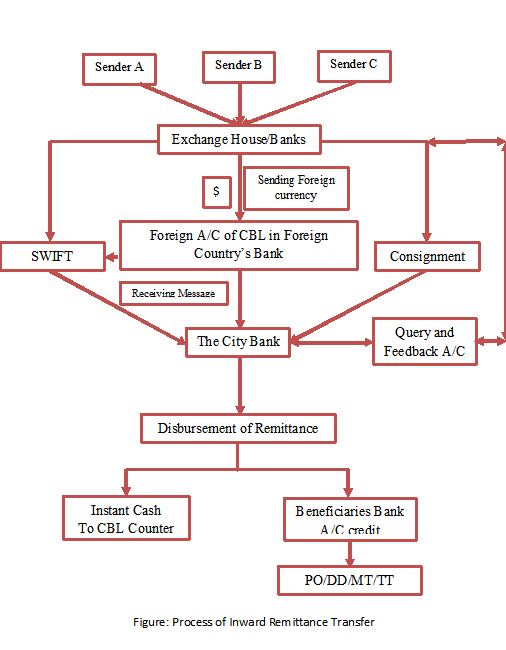

Foreign Remittance Process Diagram:

Mail Transfer (MT):

Mail Transfer means instructions of payment issued by one Bank to other bank. In other words, M.T. is an instrument issued by a remitting bank to the paying bank advising in writing to make payment of a certain amount to the specific beneficiary.

Electronic Fund Transfer (EFT):

Electronic fund transfer refers to the computer-based systems used to perform financial transactions electronically.Electronic fund transfer getting more popular in these days due to quickness of its operation.

Some features of EFT:

Electronic fund transfer is a very fast service.

It requires some formalities, as beneficiary does not need to maintain an account with the bank.

The use of EFT is increasing very fast.

Sometimes it may not be secured.

Private FC Account:

(i) Without prior approved of the Bangladesh Bank open foreign currency accounts may be opened with CBL in the names of:

(a) Bangladesh Nationals residing abroad.

(b) Foreign nationals residing abroad or in Bangladesh or in Bangladesh and also foreign firms registered abroad and operating in Bangladesh or aboard.

(c) Foreign missions and their expatriate employees.

Foreign exchange earned through business done or services rendered in Bangladesh cannot be put into these accounts.

(ii) On the above foreign currency accounts maintained with CBL under this authority they can pay interest or such accounts provided the accounts are maintained in the form of term deposits for a minimum period of 90 days. Rates of interest payable on such accounts should normally be comparable with the rates available on similar accounts maintained abroad.

Bangladesh nationals working and earning abroad intending self-employed Bangladeshi migrants proceeding abroad on employment may open foreign currency accounts even without initial deposits. They may open foreign currency accounts with CBL even without initial deposits. They may operate the accounts themselves or nominate other persons in Bangladesh for this purpose. The account can be opened either in Pound Starling US Dollar, Deutsche Mark or Japanese Yen or the option of the prospective account holder and maintained as long as the account holder desires.

Foreign currency accounts in the names of the Diplomatic Bonded Warehouse (duty free shops) licensed by the Custom Authorities may be opened by us without prior approval of the Bangladesh Bank or following conditions:

(a) Convertible foreign currency (traveler’s Cheques, Drafts, Cheques or credit card settlements) received only on account of sale of merchandise may be credited to these accounts.

(b) Foreign exchange may be remitted abroad only for the purpose of import of merchandise by bonded warehouses

(c) Monthly statement of purchase, sale and foreign exchange transaction related thereto along with Bank certificate concerning encashment in Taka shall be submitted to the Bangladesh Bank in prescribed form

Foreign currency accounts in the name of local and joint venture contracting firms employed to execute projects by foreign donor/international donor agencies may also be opened by us as per terms of the approved contract without prior permission of the Bangladesh Bank. Only foreign exchange received from the donors/donor agencies to meet expenses in foreign of the project can be credited to these accounts. All expenses in foreign exchange as per relevant contract may be met from these accounts. These accounts should be closed as soon as the transactions relating to the project are concluded.

Foreign nationals residing in Bangladesh are allowed to maintain and operate their foreign currency accounts abroad.

Foreign currency accounts may be opened in the names of resident Bangladesh nationals working with the foreign/international organizations operating in Bangladesh provided salary is paid in foreign currency.

Resident Forcing Currency Deposit (RFCD):

Persons ordinarily resident in Bangladesh may open and maintain with CBL Resident Forcing Currency Deposit (RFCD) accounts with forcing exchange brought in at the time of their return from travel abroad. Any amount brought in with declaration to Custom authorities in up to us $ 5000 brought in without any declaration, can be credited to such accounts. However, proceeds of export of goods or services in Bangladesh or commission arising from business deals in Bangladesh shall not be credited to such accounts.

Balances in these accounts shall be freely transferable abroad. Fund from these accounts may also be issued to account holders for the purpose of their foreign travels in the usual manner (i.e. with endorsement in Passport and Ticket up to USD 300/- in the form of Cash currency notes and the remained in the form of TC). These accounts may be opener in us Dollar, Pound, Staling, DM or Japanese Yen and may be maintained as long as the account holder’s desire.

Interest in foreign exchange shall be payable on balances in such accounts. if the deposits are for a term of not less than one month and the balance is not less than USD 1000/- or $ 500/- or its equivalent. The rate of interest shall be 0.25 present less than the rate at which interest is paid on balance of back in their foreign currency clearing accounts maintained with the Bangladesh.

Wage Earner Bonds:

Non-resident Bangladesh nationals can remit their surplus earnings in foreign currency to their home country for investment in the 5 years term Wage Earners Development Bond in BD Taka. Such Bonds can be purchased in denomination of Tk.1, 000/=, Tk. 5,000/=,

Tk10, 000/=, Tk.25, 000/=, Tk.50, 000/=, and Tk.1, 00,000/=. These Bonds are renewable and attractive rate of interest is allowed on this investment in BD Taka, present rate of interest is 12% p.a. and rate of interest to be utilized in Bangladesh. For premature encashment of the Bonds reduced rate of interest is applied. Death risk insurance benefit is allowed on the Bonds of value Tk.25.000/= and above.

Principal amount of the investment under this scheme can be frilly repatriated in FC in foreign country. Interest earned on the Wage Earners Development Bond is Tax Free in Bangladesh. Remittance may be sent from abroad by way of TT/MT/DD which has already been explained above. A remitter abroad simply has to approach a bank branch there with certain amount to be deposited beneficiary in Bangladesh either in foreign currency or in equivalent Taka currency. The Branch so approached abroad usually should have agency arrangement with the paying banks in Bangladesh. However, in the absence of any such agency arrangement, remittance may also be made by transferring cover value of the remittance to the paying bank’s account abroad by the remitting bank.

Payment of Traveler’s cheques:

Traveler’s cheques may be paid at the counter of bank on presentation on obtaining signature on the T.C. after verifying the signature of the holder with the signature already on the T.C. The payment will be effected in local currency at the prevailing conversion rate fixed by the rate committee. The T.C. may also be deposited in foreign currency account T.C.’s are being issued by some reputed banks & Co.’s of the world such as:-

The American Express Bank.

The City Bank

The National West Minister Bank

The Barclays’ Bank

The Bank of Oman

The Saudi Travelers Cheque Co.

T.C. is bought & sold by banks with which arrangements have been made by the issuing banks. T.C.’s are being paid at the T.T. clean buying rate. The traveler’s cheques bought by the bank have to be sent to their foreign correspondents with the instruction to credit the proceeds on collection to their NOSTRO account with them.

Payment of Foreign Currency Notes:

Authorized branches of the bank are to make payment of F.C. notes in equivalent Taka currency at the prevailing rate (T.T. clean buying rate). Generally, two foreign currencies namely U.S. Dollar & Britain Pound Sterling is being bought and sold along with two other currencies like K.S.A. Riyal & Kuwaiti Diner.

These above currency notes are normally disposed of in the following ways:-

By selling them to travelers abroad. In this case, endorsement has to be made in the passport of the Travelers.

By sending them to foreign correspondent/agent for depositing to Bank’s NOSTRO account. But in this particular case, approval of Bangladesh Bank is required & customs clearance has to be obtained.

By selling them to another Authorized Dealers. (FET Schedule is not required while transacting in each foreign currency).

Authorized dealer’s power:

Authorized Dealers can issue foreign currency remittance in respect of the following:

Travel quota per year:

SAARC Countries: By Road=USD500/- & BY AIR=USD1000/-

Other than SAARC Countries: USD 3000/-

Minor will get half of the above mentioned amount.

AD can issue USD 200/- for SAARC Countries & USD2 50/- for other Countries per dime allowance to attend seminar, conference and workshop arranged by recognized bodies.

For medical treatment abroad, USD.10, 000/- can be issued as expenses.

Examination fees, foreign education fee & evaluation fee for immigration at actual amount.

A.D. can remit membership fees, annual fees, and registration fees of international Bodies.

A.D. can remit foreign currency required for current expenses of Foreign Offices of Bangladesh Biman, Bangladesh shipping Corp.

A.D. can remit consular fees of foreign Embassies, Pre-shipment Inspection fees & genuine export claims up to 10% of the proceeds realized.

A.D. can remit cost of ships bought in private sector.

Commercial remittance.

Payment of rent of hiring foreign ship/Aircraft by local branch/agent.

Appointment of agent by Bangladeshi firm.

Advertisement in foreign News paper by Bangladeshi Firm etc.

Prior approval of Bangladesh Bank is required on the following:-

Family Remittance facility

Other private remittance.

While applying for Bangladesh bank permission for outward remittances along with others, the following prescribed forms are used.

IMP form (Remittance for Import)

T/M Form (Traveling & Miscellaneous).

Cancellation of M.T. / D.D.:-

The above instruments may be cancelled & payment may be made to the applicant by cancellation after observing all existing formalities. Bangladesh Bank should also be reported about the cancellation of the outward remittance as inward remittance.

Online Remittance:

Online Remittance is the process of sending money or transferring using the Internet, and is usually done by an expert back to his/her home country. According to the World Bank, remittances are an important source of income for the receiving country, usually developing and emerging market countries.

Money Gram:

It is mentionable that The City Bank Ltd. is one of the Bangladeshi Bank, which has a membership of Money Gram network. CBL is a member of Money Gram and SWIFT networks. Using the services of these global network, nonresident Bangladesh nationals can send money from abroad to their home country within a few minutes without any risk, Besides Money Gram, they have also arrangement with foreign money exchange companies like U.S.E. Exchange Co. Redha-al-Ansari Co. etc. through which Bangladeshi expatriates can remit these money to their relatives in home country very easily and safely using SWIFT network. Money Gram and SWIFT mechanism ensure 100% secured and quickest possible mode of money transfers from abroad tour country and Bangladeshi money receivers are enjoying these facilities through us. CBL is rendering exceptional services to its clients by arranging such private remittance of money from foreign countries to Bangladesh.

The City Bank Limited is very happy to announce to have joined hands with Money Gram Payment Systems to serve expatriates to send money back home quickly from anywhere in the world. Moreover, money can also be sent quickly through Money Gram from Bangladesh to other parts of the world as is done through the banking channel. At the moment we are concentrating on home remittances being sent by the expatriates.

Money Gram Payment system is a non-back provider of electronic money transfer service. Money Gram is providing its customers a service of an unsurpassed quality and superior value. Money Gram has over 80,000 Agent locations throughout the world. Persons anywhere require transferring cash quickly, reliably, conveniently and at attractive prices to more than 180 countries can depend Money Gram agents for the service.

CBL continuous commitment to serve the country’s economy in a better way we have made agreement with Money Gram Payment Services Company to facilitate transfer flow money from abroad. The best benefit of the service can be derived by our expatriates who are living in many countries of the world.

The major problem being faced by CBL expatriated in many countries in not having bank accounts. Many banks do not entertain customers for remitting money without having accounts. Moreover many of our expatriates cannot get acquainted with banking formalities immediately on reaching abroad. It is not necessary to have a bank account to use Money Gram Service. Our expatriates can visit any Money Gram agent when they want to send money, which gives very easy and convenient transfer.

Money Gram is represented in over 180 countries and is available at more than 80,000 locations worldwide. In the USA alone Money Gram is available at more than 15,000 locations. Besides in the UK Money Gram is available through 1700 Postal Branches and 500 Thomas Cook travel shops making it the UK’s largest money transfer network.

Sender completes a “Send” form and gets a Receipt. Money Gram Agent gives a Ref. No. which has to be passed to the Receiver. Recipient goes to CBL Branch in Bangladesh. Fills out a “Receive” form and show proper identification. CBL Bank makers and inquiry on the Money Gram computer network to obtain authorization to pay Recipient and Recipient receives the fund.

Money Gram is one of the fastest ways to transfer money. Customers using Money Gram can send or receive money usually within 10 minutes from anywhere in the world. At The City Bank provide the Recipients immediate attention and made it a point to pay the Recipient within minutes. The Recipients need not require having a bank account. The City bank does not levy any extra charge. We give a better exchange rate to the Recipient. The Recipient can approach any for the CBL branches at his convenience for payment.

Procedures of Remittance Payment:

Passport (not expired).

Driving License.

Ration Card.

Voter ID.

Pan Card.

Refugee Card.

Student ID (Nationalized University and College).

Bank Passport (CBL).

Army Card.

Post office loyalty card, Govt. employee ID card, local (W/C) ID Card.

All ID are valid only if they have a photograph and the ID verifies the person’s signature.

Reporting To Bangladesh Bank:

At the end each month, transactions on outward remittance have to be reported to Bangladesh Bank similar to foreign inward remittance through the statements S-1, S-2, S-4 & S-6 along with schedules. Finally, one has to remember that foreign inward remittance has no restriction to our in while foreign outward remittance should have to be made in accordance with the Bangladesh Bank’s Guidelines for foreign exchange transactions & latest circulars of Bangladesh Bank. Last but not the last, we must keep in mind that all types of transaction involving foreign remittance.

The CAMELS Rating is a US supervisory rating of the bank’s overall condition used to classify the nation’s fewer than 8,000 banks. This rating is based on financial statements of the bank and on-site examination by regulators like the Fed, the OCC and FDIC. The scale is from 1 to 5 with 1 being strongest and 5 being weakest. These ratings are not released to the public but only to the top management of the banking company to prevent a bank run on a bank which has a bad CAMELS rating.

Performance indicators of the banking industry depict a trend similar to that of the state-owned banks, which is understandable due to their predominant market share. CAMELS ratings indicate that financial performance of the PCBs and FCBs in general has been better than that of the industry average. Any bank rated 4 or 5 i.e., ‘Marginal’ or ‘Unsatisfactory’ under composite CAMELS rating is generally identified as a Problem Bank. Activities of the problem banks are closely monitored by the Central Bank. Bangladesh Bank issues directives from time to time to the problem banks to bring them in good shape. After the assessment under CAMELS rating, The City bank Limited is rated 3 or Fair.

The components of a bank’s condition that are assessed:

(C) Capital adequacy

(A) Asset quality

(M) Management

(E) Earnings

(L) Liquidity

(S) Sensitivity to market risk

Capital Adequacy:

Capital adequacy is a bank regulation, which sets a framework on how banks and depository institutions must handle their capital. The categorization of assets and capital is highly standardized so that it can be risk weighted. Internationally, the Basel Committee on Banking Supervision housed at the Bank for International Settlements influence each country’s banking capital requirements. In 1988, the Committee decided to introduce a capital measurement system commonly referred to as the Basel Accord. This framework is now being replaced by a new and significantly more complex capital adequacy framework commonly known as Basel II. While Basel II significantly alters the calculation of the risk weights, it leaves alone the calculation of the capital. The capital ratio is the percentage of a bank’s capital to its risk-weighted assets. Weights are defined by risk-sensitivity ratios whose calculation is dictated under the relevant Accord.

To be adequately capitalized under federal bank regulatory agency definitions, a bank holding company must have a Tier 1 capital ratio of at least 4%, a combined Tier 1 and Tier 2 capital ratio of at least 8%, and a leverage ratio of at least 4%, and not be subject to a directive, order, or written agreement to meet and maintain specific capital levels.

Elements of Capital Adequacy:

- 1. Regulatory Capital

Tier 1 (Core) Capital

Tier 2 (Supplementary) Capital

Undisclosed Reserves

Revaluation Reserves

General Provisions

Subordinated Term Debt

Common Capital Ratios

Capital Adequacy of The City Bank Ltd (CBL) is given below:

| Particulars Amount In Crore Amount of regulatory capital to meet unforeseen Capital:

|

The Capital Condition of CBL 🙁 Figure in Crore)

Particulars | 2009 Taka | 2008 Taka | |

| Tier-1 (Core Capital) | |||

| Paid up Capital Statutory reserve General Reserve Retained earnings as per profit and loss a/c | 157.11 137.74 1.14 57.52 | 136.62 109.98 1.14 23.34 | |

353.51 | 271.08 | ||

| Tier-II (Supplementary Capital) | |||

| General Provision against UC loan General Provision against Off-B/S items Asset revaluation reserve Exchange equalization account Revaluation reserve for HTM securities | 79.92 10.92 69.18 1.69 0.75 | 42.02 10.92 69.46 1.69 0.18 | |

162.46 | 124.27 | ||

A. Total Capital | 515.97 | 395.35 | |

B. Total Risk Weighted Assets | 4571.45 | 3591.89 | |

| C. Required Capital based on Risk Weighted Assets (10% of B) | 457.15 | 359.19 | |

D. Surplus (A-C) | 58.83 | 36.16 | |

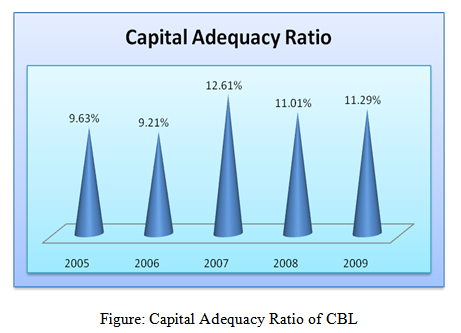

The Capital adequacy Ratio of CBL:

| Required | Actual | |||

2009 | 2008 | |||

| On Core Capital (Tier-I) On Supplementary Capital(Tier-II) | 5.00% 5.00% | 7.73% 3.56% | 7.55% 3.46% | |

| On Total Capital | 10.0% | 11.29% | 11.01% | |

The Graphical Presentation is given below:

Asset quality:

It is related to the left-hand side of the bank balance sheet. Bank managers are concerned with the quality of their loans since that provides earnings for the bank. Loan quality and asset quality are two terms with basically the same meaning.

Government bonds and T-bills are considered as good quality loans whereas junk bonds, corporate credits to low credit score firms etc. are bad quality loans. A bad quality loan has a higher probability of becoming a non-performing loan with no return. The ratio of non-performing loans in Japan is expected to be as high as 25% of the overall bank assets.

Bank management components are:

Asset management

Liquidity management

Liability management

Capital adequacy management

Risk management

The Asset Quality of CBL:

| Particulars | 2009 Taka | 2008 Taka |

| Classification of loans and advances / investments | ||

| Unclassified Standard including staff loan Special Mention Accounts (SMA) | 40,054,822,803 1,314,637,000 | 31,745,159,980 505,977,000 |

41,369,459,803 | 32,251,136,980 | |

| Classified Sub-standard Doubtful Bad/Loss | 231,832,000 400,577,000 1,484,553,000 | 286,730,000 461,788,000 1,421,290,000 |

2,116,962,000 | 2,169,808,000 | |

| Total | 43,486,421,803 | 34,420,944,980 |

Management:

Management in all business areas and organizational activities are the acts of getting people together to accomplish desired goals and objectives. Management comprises planning, organizing, staffing, leading or directing, and controlling an organization (a group of one or more people or entities) or effort for the purpose of accomplishing a goal. Resourcing encompasses the deployment and manipulation of human resources, financial resources, technological resources, and natural resources.

Because organizations can be viewed as systems, management can also be defined as human action, including design, to facilitate the production of useful outcomes from a system. This view opens the opportunity to ‘manage’ oneself, a pre-requisite to attempting to manage others. Management can also refer to the person or people who perform the act(s) of management. In CBL, the Board of Directors has been conceived as the sources of all power headed by its Chairman. It is a legislative body of the Bank. Board can delegate its power and authority to professionals but cannot delegate, relinquish or avoid their responsibilities.

Board of Directors

| Aziz Al Kaiser | Chairman |

| Hossain Mehmood | Vice Chairman |

| Rubel Aziz | Director |

| Evana Fahmida Mohammad | Director |

| Hossain Khaled Saifullah | Director |

| Rajibul Huq Chowdhury | Director |

| Ahmed Rajeeb Samdani | Director |

| Tabassum Kaiser | Director |

| Rafiqul Islam Khan | Director |

| Meherun Haque | Director |

| Mobarak Ali | Director |

| K Mahmood Sattar | Managing Director & CEO |

So we can see that the top management of CBL is full of so much experience person in banking sector and they can eligible enough to fulfill the top-level management duties.

In CBL, The Board delegates its functional responsibilities of the professional management team headed by managing Director. He is an ex-officio of the Board of Directors and has to take the full load of carrying out of the guidelines, rules and regulations and Directors given by the Board of Directors time to time and provide all vital information to this Board for their knowledge and effective decision-making.

Year | No of Employees |

2005 | 1,829 |

2006 | 1,989 |

2007 | 1,991 |

2008 | 2,134 |

2009 | 2,424 |

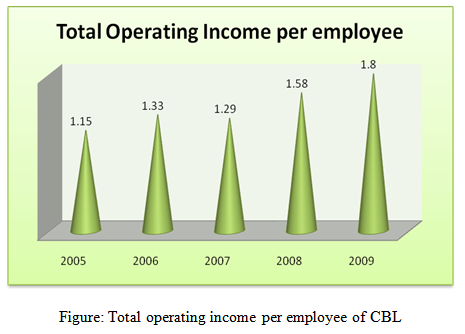

| Particulars | 2005 | 2006 | 2007 | 2008 | 2009 | |

| Operating profit per employee | 0.68 | 0.75 | 0.63 | 0.82 | 0.93 |

The Graphical Presentation is given below:

Income or Earnings:

Income is the consumption and savings opportunity gained by an entity within a specified time frame, which is generally expressed in monetary terms. However, for households and individuals, income is the sum of all the wages, salaries, profits, interests’ payments, rents and other forms of earnings received in a given period of time. For firms, income generally refers to net-profit, what remains of revenue after expenses have been subtracted. In the field of public economics, it may refer to the accumulation of both monetary and non-monetary consumption ability, the former being used as a proxy for total income.

Economic definitions:

In economics, factor income is the flow of revenue accruing to a person or nation from labor services and from ownership of land and capital. In consumer theory ‘income’ is another name for the “budget constraint,” an amount Y to be spent on different goods x and y in quantities x and y at prices Px and Py.

This equation implies two things. First buying one more unit of good x implies buying less units of good y. So, is the relative price of a unit of x as to the number of units given up in y. Second, if the price of x falls for a fixed Y, then its relative price falls. The usual hypothesis is that the quantity demanded of x would increase at the lower price, the law of demand. The generalization to more than two goods consists of modeling y as a composite good.

The theoretical generalization to more than one period is a multi-period wealth and income constraint. For example the same person can gain more productive skills or acquire more productive income-earning assets to earn a higher income. In the multi-period case, something might also happen to the economy beyond the control of the individual to reduce (or increase) the flow of income. Changing measured income and its relation to consumption over time might be modeled accordingly, such as in the permanent income hypothesis.

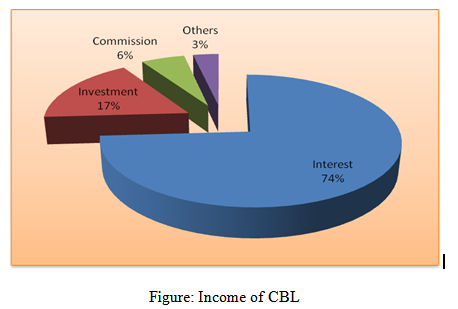

Various income of CBL in 2009 is shown below (Amounts in million)

Besides, some other income of CBL is shown below:

| Particulars | 2009 | 2008 |

Million | Million | |

| Return on Assets (ROA) Earnings per Share (EPS) Net Assets Value Per Share Price Earnings Ratio (Times) | 1.23% 52.11 373.25 14.00 | 0.75% 25.34 308.70 17.82 |

Market liquidity:

In business, economics or investment, market liquidity is an asset’s ability to be sold without causing a significant movement in the price and with minimum loss of value. Money, or cash on hand, is the most liquid asset. An act of exchange of a less liquid asset with a more liquid asset is called liquidation. Liquidity also refers both to a business’s ability to meet its payment obligations, in terms of possessing sufficient liquid assets, and to such assets themselves.

In Banking:

In banking, liquidity is the ability to meet obligations when they come due without incurring unacceptable losses. Managing liquidity is a daily process requiring bankers to monitor and project cash flows to ensure adequate liquidity is maintained. Maintaining a balance between short-term assets and short-term liabilities is critical. For an individual bank, clients’ deposits are its primary liabilities, whereas reserves and loans are its primary assets . The investment portfolio represents a smaller portion of assets, and serves as the primary source of liquidity. Investment securities can be liquidated to satisfy deposit withdrawals and increased loan demand. Banks have several additional options for generating liquidity, such as selling loans, borrowing from other banks, borrowing from a central bank, such as the US Federal Reserve bank, and raising additional capital. In a worst case scenario, depositors may demand their funds when the bank is unable to generate adequate cash without incurring substantial financial losses. In severe cases, this may result in a bank run. Most banks are subject to legally-mandated requirements intended to help banks avoid a liquidity crisis.

Cash Reserve Requirement (CRR) and Statutory Liquidity Ratio (SLR) of CBL:

Cash Reserve Requirement and Statutory Liquidity Ratio have been calculated and maintained in accordance with section 33 of Bank Companies Act, 1991 and as per BRPD circular no. 11 and 12, dated August 25, 2005 and DOS circular no. 6 dated October 05, 2005.

The Cash Reserve Requirement on the Bank’s time and demand liabilities at the rate of 5% has been calculated and maintained with Bangladesh Bank in current account and 18% Statutory Liquidity Ratio, including CRR, on the same liabilities has also been maintained in the form of treasury bills, bonds & debentures including FC balance with Bangladesh Bank. Both the reserve maintained by CBL is in excess of the statutory requirements, as shown below:

Liquidity Condition of CBL:

a. Cash Reserve Requirement

| Particulars | 2009 (Taka) | 2008 (Taka) |

| Required Reserve (5% of average time and demand liabilities) Actual Average maintained | 2,688,313,000 2,849,674,000 | 2,284,419,000 2,321,252,000 |

| Surplus/ (Deficit) | 161,361,000 | 36,833,000 |

b. Statutory Liquidity Ratio

| Particulars | 2009 (Taka) | 2008 (Taka) |

| Required Reserve (18% of average time and demand liabilities) Actual Average maintained (including CRR) | 9,664,264,000 13,050,517,000 | 8,210,229,000 10,312,595,000 |

| Surplus/ (Deficit) | 3,386,271,000 | 2,102,366,000 |

Liquidity Statement of CBL:

Liquidity Statement

As at 31st December 2009 (Figure in BDT)

| Particulars | Total |

| ASSETS Cash in hand Balance with BB and agent Balance with other bank Money at call and short Investments Loans and Advances Fixed Assets Other Assets Non-banking assets Total Assets |

746,634,507 4,396,026,055 9,850,784,094 299,779,167 10,586,452,613 43,486,421,803 2,788,065,869 4,312,637,456 – 76,466,801,564 |

| LIABILITIES Borrowing from other Bank Deposits and other accounts Other liabilities Total Liabilities |

992,651,503 62,384,280,002 7,225,635,781 70,602,567,286 |

| Net Liquidity Gap | 5,864,234,278 |

Sensitivity to market risk:

Market risk is defined as a current or prospective threat to the Bank’s earnings and capital due to movements in market prices, i.e. prices of securities, commodities, interest rates & foreign exchange rates.

CBL addresses Market Risk through standardized approach as per direction of Bangladesh bank. It is the risk that the value of on and off-balance sheet positions will be adversely affected movements in market rates or prices such as interest rates, foreign exchange rates, equity prices, credit spreads and commodity prices resulting in a loss to earnings and capital.

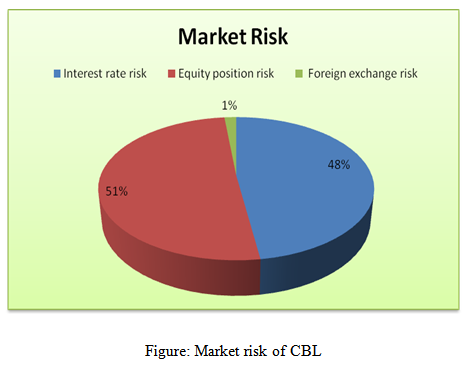

CBL calculates market risk for three components, namely interest rate risk, equity position risk and foreign exchange risk. CBL does not deal with commodity. Under standardized approach both specific and general market risk are calculated for interest rate related instruments and equity holding. Presently CBL does not deal with SWAP or derivative instruments.

Interest Rate Risk: Interest rate risk arises when there is a mismatch between positions, which are subject to interest rate adjustment within a specific period. CBL has developed VAR and Stress Testing to assess and manage the interest rate risk and its adverse impact on balance sheet as well as on profitability.

Foreign Rate Risk: It is the current or prospective risk to earnings and capital arising from adverse movements in currency exchange rates. It refers to the impact of adverse movement in currency exchange rates on the value of open foreign currency position. To manage the risk, CBL has taken the following initiatives:

CBL has formed Asset Liability Committee (ALCO)

Separated Back office and Front office

Hire expect dealing officers

Measures risk to NII regularly

Measures risk to economic of value

Earning at Risk and

Value at Risk (VAR)

Equity Price Risk: It is risk to earnings or capital that results from adverse changes in the value of equity related portfolios of a financial institution. CBL has deployed a team to manage equity position risk. Beside these, CBL use VAR and Stress Test for measuring the impact of market movement of stock price as well as capital adequacy of CBL.

| The Capital Requirements for Market Risk

| BDT in million

237.10 252.10 8.20 |

The Graphical Presentation is given below:

Findings:

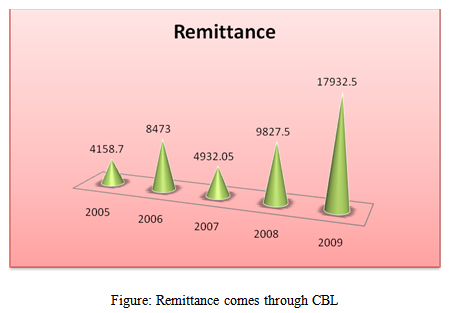

Remittance generates remarkable benefits for the home country’s economy in terms of macro and microeconomic impacts. Now-a-days CBL renders a stable support to the national Foreign Remittance Business. Although the foreign Remittance business of CBL widening day by day, but there are also some obstacles around it. After analyzing “Foreign Remittance Activities and Financial Performance of The City Bank Limited”, it has been observed some shortcomings regarding operational and other aspects of their banking. They are as per observations:

The entire department is well informed regarding their goals and objectives. It is essential to execute company objectives into individual target.

There is a clear allocation of responsibilities authority and accountability.

CBL has already achieved a high growth rate accompanied by an impressive profit growth in 2009. The number of deposit and investment are also increasing rapidly.

CBL management information system and financial information system have been restructured over the recent years to keep speed with the process of development.

The branches regular report about the customer’s feedback can help to the CBL policy makers to overcome the errors.

Trend of remittance inflow in Bangladesh is increasing day by day. The amount of remittances in terms of GDP and export earnings has also increased over the years.

During the last two years, the bank signed money transfer agreement with overseas exchange companies. As a result, remittance flow has increased significantly.

Income of foreign remittance of CBL is more than some of the other same type of banks in recent year.

Export & import business is not good.

Despite of some limitation at present CBL has 97 branches all over the country covering a satisfactory area for creating a proper channel of remittance.

CBL Capital adequacy ratio is over the required rate. Asset quality condition is also satisfactory.

Operating income per employee is increasing over the years.

The main income of CBL comes from interest income which is 74%

CRR and SLR maintained by CBL are in excess of the statutory requirements.

CBL has positive net liquidity gap.

CBL has developed VAR and Stress Testing to assess and manage the market risk.

Conclusion:

As an organization The City Bank Limited has earned the reputation of top banking operation in Bangladesh. It is relentless in pursuit of business innovation and improvement. It has a reputation as a partner of consumer growth. The City Bank Ltd. makes a strong position through its various activities. Its number of clients, amount of deposit and investment money increases day by day.

This report tries to figure out most of the indicators of problems and strengths of foreign remittance department of The City Bank Limited as a valid pretender in the competitive banking sector of Bangladesh. Foreign remittance business of CBL is satisfactory and day by day increase the remittance volume.

Banks have a key role to develop the foreign remittance business in our country. Commercial banks provide foreign remittance services to their customers. Though foreign remittance business is challenging, it offers an excellent opportunity to accelerate the growth of the bank’s own business. The City Bank Ltd. is one of the major players in the foreign remittance business. It has been enjoying an escalating growth in foreign remittance business. Income from the foreign remittance business has a large contribution to CBL overall profit. Thus foreign remittance business has become one of the major sources of revenue for the bank.